Mutual Fund

Mutual fund is a most viable investment options through which fund pooled in from various investors and this fund invested in equities, bonds, money market instruments and other securities with the help of well qualified & professional fund managers.

Type of Mutual Funds

In order to make money by investing in mutual funds, it is important to know the types of Mutual Fund Investment. There is a wide range of mutual funds in India that are categorized on the basis of Investment Objective, Asset class & Structure.

Categories of Schemes, Scheme Characteristics and Type of Scheme

The Schemes would be broadly classified in the following groups:

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution Oriented Schemes

- Other Schemes

A. Equity Schemes

| S.NO | Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

|---|---|---|---|

| 1. | Multi Cap Fund | Minimum investment in equity & equity related instruments- 65% of total assets | Multi Cap Fund- An open ended equity scheme investing across large cap, mid cap,small cap stocks |

| 2. | Flexi Cap Fund | Minimum 65% investments in equity & equity related instruments | |

| 3. | Large Cap Fund | Minimum investment in equity & equity related instruments of large cap companies- 80% of total assets | Large Cap Fund – An open ended equity scheme predominantly investing inlarge cap stocks |

| 4. | Large & Mid Cap Fund | Minimum investment in equity & equity related instruments of large cap companies- 35% of total assets Minimum investment in equity & equity related instruments of mid cap stocks- 35% of total assets | Large & Mid Cap Fund – An open ended equity scheme investing in both large cap and mid cap stocks |

| 5. | Mid Cap Fund | Minimum investment in equity & equity related instruments of mid cap companies- 65% of total assets | Mid Cap Fund- An open ended equity scheme predominantly investing in mid cap stocks |

| 6. | Small cap Fund | Minimum investment in equity & equity related instruments of small cap companies- 65% of total assets | Small Cap Fund – An open ended equity scheme predominantly investing in small cap stocks |

| 7. | Dividend Yield Fund | Scheme should predominantly invest in dividend yielding stocks.Minimum investment in equity- 65% of total assets | An open ended equity scheme predominantly investing in dividend yielding stocks |

| 8 a. | Value Fund* | Scheme should follow a value investment strategy.Minimum investment in equity & equity related instruments – 65% of total assets | Scheme should follow a contrarian investment strategy.Minimum investment in equity & equity related instruments – 65% of total assets |

| 8 b. | Contra Fund* | Scheme should follow a contrarian investment strategy.Minimum investment in equity & equity related instruments – 65% of total assets | An open ended equity scheme following contrarian investment strategy |

| 9. | Focused Fund | A scheme focused on the number of stocks (maximum 30) Minimum investment in equity & equity related instruments – 65% of total assets | An open ended equity scheme investing in maximum 30 stocks (mention where the scheme intends to focus, viz.,multi cap,large cap, mid cap,small cap) |

| 10. | Sectoral/ Thematic | Minimum investment in equity & equity related instruments of a particular sector/ particular theme- 80% of total assets | An open ended equity scheme investing in sector (mention the sector)/An open ended equity scheme following theme (mention the theme) |

| 11. | ELSS | Minimum investment in equity & equity related instruments – 80% of total assets (in accordance with Equity Linked Saving Scheme,2005 notified by Ministry of Finance) | An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit |

B. Debt Schemes

| S.NO | Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

|---|---|---|---|

| 1. | Overnight Fund** | Investment in overnight securities having maturity of 1 day | An open ended debt scheme investing in overnight securities |

| 2. | Liquid Fund $ ** | Investment in Debt and money market securities with maturity of upto 91 days only | An open ended liquid scheme |

| 3. | Ultra Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 months – 6 months | An open ended ultra-short term debt scheme investing in instruments with Macaulay duration between 3 months and 6 months. |

| 4. | Low Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months- 12 months | An open ended low duration debt scheme investing in instruments with Macaulay duration between 6 months and 12 months. |

| 5. | Money Market Fund | Investment in Money Market instruments having maturity upto 1 year | An open ended debt scheme investing in money market instruments |

| 6. | Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 1 year – 3 years | An open ended short term debt scheme investing in instruments with Macaulay duration between 1 year and 3 years |

| 7. | Medium Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 years – 4 years | An open ended medium term debt scheme investing in instruments with Macaulay duration between 3 years and 4 years. |

| 8. | Medium to Long Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 4 – 7 years | An open ended medium term debt scheme investing in instruments with Macaulay duration between 4 years and 7 years. |

| 9. | Long Duration Fund | Investment in Debt & Money Market Instruments such that the Macaulay duration of the portfolio is greater than 7 years | An open ended debt scheme investing in instruments with Macaulay duration greater than 7 years. |

| 10. | Dynamic Bond | Investment across duration | An open ended dynamic debt scheme investing acrossduration |

| 11. | Corporate Bond Fund | Minimum investment in corporate bonds- 80% of total assets (only in highest rated instruments) | An open ended debt scheme predominantly investing in highest rated corporate bonds |

| 12. | Credit Risk Fund^ | Minimum investment in corporate bonds- 65% of total assets (investment in below highest rated instruments) | An open ended debt scheme investing in below highest rated corporate bonds |

| 13. | Banking and PSU Fund | Minimum investment in Debt instruments of banks, Public Sector Undertakings , Public Financial Institutions- 80% of total assets | An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions |

| 14. | Gilt Fund | Minimum investment in Gsecs- 80% of total assets (across maturity) | An open ended debt scheme investing in government securities across maturity |

| 15. | Gilt Fund with 10 year constant duration | Minimum investment in Gsecs- 80% of total assets such that the Macaulay duration of the portfolio is equal to 10 years | An open ended debt scheme investing in government securities having a constant maturity of 10 years |

| 16. | Floater Fund | Minimum investment in floating rate instruments- 65% of total assets | An open ended debt scheme predominantly investing in floating rate instruments |

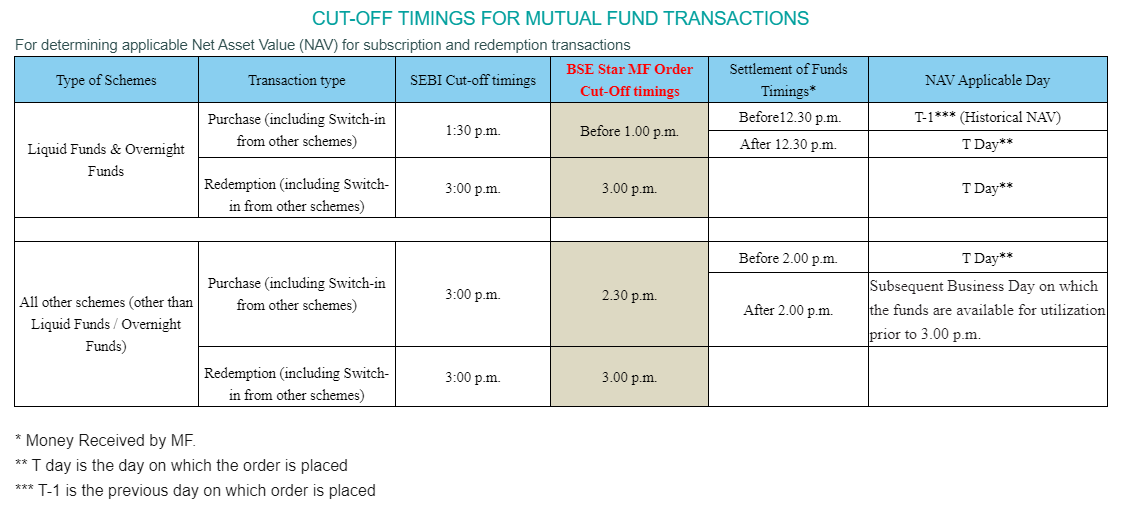

**Provisions of SEBI Circular No SEBI/IMD/DF/19/2010 dated November 26, 2010 shall be followed for Uniform cut-off timings for applicability of Net Asset Value in respect of Liquid Fund and Overnight Fund.

$ All provisions mentioned in SEBI circular SEBI/IMD/CIR No.13/150975/09 dated January 19, 2009 in respect of liquid schemes shall be applicable

# Please refer to the page number of the Offer Document on which the concept of Macaulay’s Duration has been explained

C. Hybrid Schemes

| S.NO | Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

|---|---|---|---|

| 1. | Conservative Hybrid Fund | Investment in equity & equity related instruments- between 10% and 25% of total assets; Investment in Debt instruments- between 75% and 90% of total assets | An open ended hybrid scheme investing predominantly in debt instruments |

| 2 a. | Balanced Hybrid Fund @ | Equity & Equity related instruments- between 40% and 60% of total assets;Debt instruments- between 40% and 60% of total assets No Arbitrage would be permitted in this scheme |

An open ended balanced scheme investing in equity and debt instruments |

| 2 b. | Aggressive Hybrid Fund @ | Equity & Equity related instruments- between 65% and 80% of total assets;Debt instruments- between 20% 35% of total assets | An open ended hybrid scheme investing predominantly in equity and equity related instruments |

| 3. | Dynamic Asset Allocation or Balanced | Investment in equity/ debt that is managed dynamically | An open ended dynamic asset allocation fund |

| 4. | Multi Asset Allocation | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes | An open ended scheme investing in , , (mention the three different asset classes) |

| 5. | Arbitrage Fund | Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments – 65% of total assets | An open ended scheme investing in , , (mention the three different asset classes) |

| 6. | Equity Savings | Minimum investment in equity & equity related instruments- 65% of total assets and minimum investment in debt- 10% of total assets Minimum hedged & unhedged to be stated in the SID.Asset Allocation under defensive considerations may also be stated in the Offer Document | An open ended scheme investing in equity, arbitrage and debt |

D. Solution Oriented Schemes

| S.NO | Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

|---|---|---|---|

| 1. | Retirement Fund | Scheme having a lock-in for at least 5 years or till retirement age whichever is earlier | An open ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier) |

| 2. | Children’s Fund | Scheme having a lock-in for at least 5 years or till the child attains age of majority whichever is earlier | An open ended fund for investment for children having a lock-in for at least 5 years or till the child attains age of majority (whichever is earlier) |

E. Other Schemes:

| S.NO | Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

|---|---|---|---|

| 1. | Index Funds/ ETFs | Minimum investment in securities of a particular index (which is being replicated/ tracked)- 95% of total assets | An open ended scheme replicating/ tracking _ index |

| 2. | FoFs (Overseas/ Domestic) | Minimum investment in the underlying fund- 95% of total assets | An open ended fund of fund scheme investing in fund (mention the underlying fund) |

Why Should Invest in Mutual Fund

Investment in mutual funds is the best way of creating wealth in the long-term as well as short term through Lumpsum and Systematic Investment Plan (SIP) with minimum investment amount of Rs 500. Investors can get the benefit of rupee cost averaging, compounding, and disciplined investing, and can beat the volatility of the stock markets.

Benefits of Mutual Fund Investment

Professional management

Qualified professionals manage your money,but they are not alone. They have a research team that continuously analyses the performance and prospects of companies. Fund managers are in a better position to manage your investments and get higher returns.

Diversification

Diversification lowers your risk of loss by spreading your money across various industries and geographic regions. It is a rare occasion when all stocks decline at the same time and in the same proportion.

Affordability

As a small investor, you may find that it is not possible to buy shares of larger corporations. Mutual funds generally buy and sell securities in large volumes which allow investors to benefit from lower trading costs. You can invest with a minimum of Rs.500 in a Systematic Investment Plan.

Transparency

The performance of a mutual fund is reviewed by various publications and rating agencies, making it easy for investors to compare funds. An investor is provided with regular updates, for example daily NAVs, as well as information on the fund’s holdings and the fund manager’s strategy.

More choice

Mutual funds offer a variety of schemes that will suit your needs over a lifetime. When you enter a new stage in your life, all you need to do is sit down with your financial advisor who will help you to rearrange your portfolio to suit your altered lifestyle.

Rupee-cost averaging

with rupee-cost averaging, you invest a specific rupee amount at regular intervals regardless of the investment’s unit price. As a result, your money buys more units when the price is low and fewer units when the price is high, which can mean a lower average cost per unit over time.

Online Mutual Fund Platform

How to Open Mutual Fund Account with Elite Wealth Click Here

List of AMC To Invest in Online Mutual Fund

- Axis Mutual Fund

- Birla Mutual Fund

- BNP Paribas Mutual Fund

- Canara Rebeco Mutual Fund

- Deutsche Mutual Fund

- DSP BlackRock Mutual Fund

- Edelweiss Mutual Fund

- Franklin. Temp. Mutual Fund

- HDFC Mutual Fund

- ICICI Mutual Fund

- IDBI Mutual Fund

- IDFC Mutual Fund

- Kotak Mutual Fund

- L&T Mutual Fund

- Mirae Asset Mutual Fund

For Any Query Regarding Mutual Fund Investment Click here

For Any Query Regarding Online Mutual Fund click here

To Need An Assistance, Submit your details below:

You can also call us on 011-42445800 / 9650901058 from 9:00 a.m. to 6:00 p.m. Further, you can also mail to us on contact@elitewealth.in