Exicom Tele-Systems IPO Company Details:

Exicom Tele-Systems Limited (ETL) is a power management solutions provider which operates under two distinct business segments. The critical power solutions business is its main line of business under which it is responsible for designing, producing, and maintaining DC power systems and Li-ion energy storage systems. The company offers comprehensive energy management solutions for international and Indian telecom installations. Its market shares in the critical power segment are 16% for DC power systems and 10% for Li-ion battery applications for the telecom industry. The company’s operations are located in India, Southeast Asia, and Africa. In FY19, ETL entered the Electric Vehicles Chargers business, which it currently leads with a 60% market share in India and a 25% market share in Southeast Asia. It also produces smart chargers that meet local standards like the Automotive Research Association of India (ARAI) and international standards like CE. As of September 2023, company has installed over 61,000 EV chargers at 400 locations in India. ETL’s clientele includes companies like Fortum Charge and Reliance BP Mobility; Fleet aggregator, such as Lithium Urban Technologies and BluSmart Mobility; Reputable OEMs including MG Motors, JBM Ltd., and Mahindra & Mahindra. The company’s three manufacturing facilities, located in Solan and Gurugram, have a combined yearly capacity of 1.34 lakh square feet and can produce 12,000 DC Power Systems and 44,400 AC and DC Chargers. ETL offers end-to-end vertically integrated product management services, encompassing concept, design, engineering, and prototype testing. Additionally, it has two Research & Development facilities located in Bangalore and Gurugram. These facilities focuses on developing battery packs, EV chargers, and battery management software. The R&D team in the critical power solutions industry is tasked with developing cutting-edge, economically viable Li-ion Battery & DC Power solutions that preserve technological leadership.

| IPO-Note | Exicom Tele-Systems Limited |

| Rs.135 – Rs.142 per Equity share | Recommendation: Subscribe |

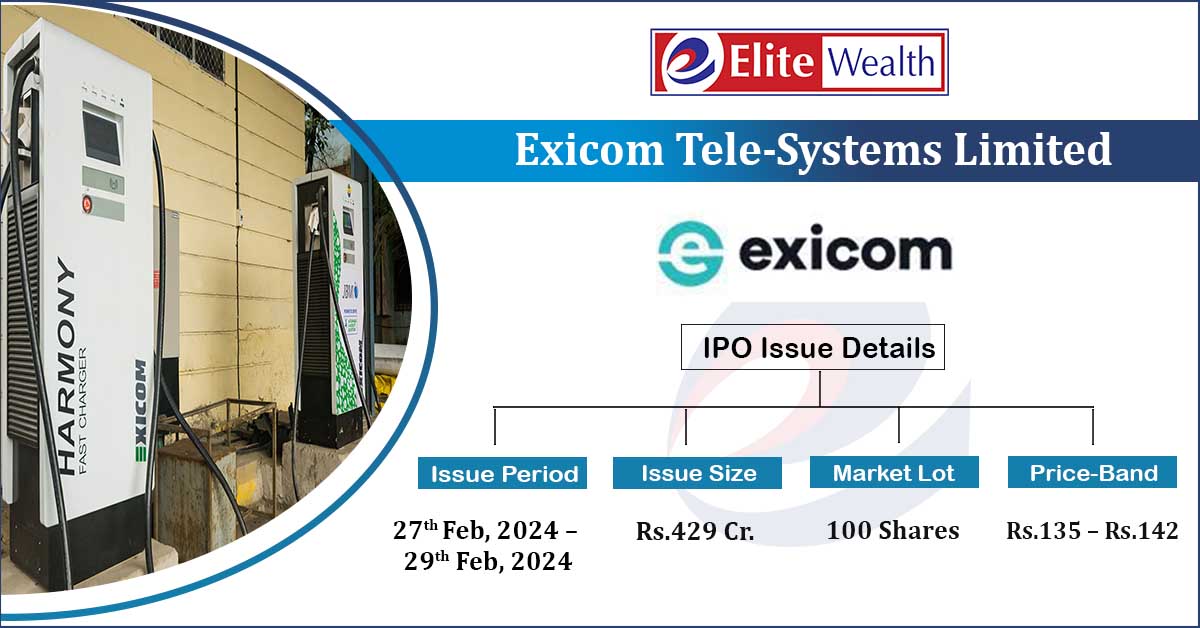

Exicom Tele-Systems IPO Details:

| Issue Details | |

| Objects of the issue | · To fund the finance cost of setting production/assembly lines

· To pay borrowings · To fund working capital borrowings |

| Issue Size | Total issue Size – Rs.429 Cr.

Fresh Issue – Rs.329 Cr. Offer for Sale – 100 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.135 – Rs.142 |

| Bid Lot | 100 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 27th Feb, 2024 – 29th Feb, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Exicom Tele-Systems IPO Strengths:

- ETL is able to gain a larger market share in the residential and public charging segments as it entered the EV charging industry early.

- The Company gains a competitive edge in terms of product knowledge by beginning as a critical power solutions supplier. Aside from this, having a talented R&D staff ensures that the business may always innovate.

- It has long standing relationship with its customers like BSNL, Jio-Infocom, and Indus Towers. The company also benefits from alliances with other well-known companies in the energy sector.

Exicom Tele-Systems IPO Risk Factors:

- The company is highly dependent on telecom providers such as BSNL, Jio, Indus Towers, etc. in the critical power market; which contribute ~50% of co.’s revenue. Loss of any of these customers may impact its business.

- Over 65% of the raw materials used by the company are imported. For Li-ion cells, battery packs, and semiconductors, it is dependent on nations like South Korea, Singapore, Hong Kong, and China.

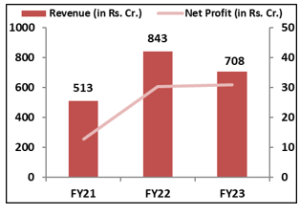

Exicom Tele-Systems IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Exicom Tele-Systems IPO Allotment Status

Exicom Tele-Systems IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Exicom Tele-Systems IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 93.28% | 69.57% |

| Others | 6.71% | 30.43% |

Source: RHP, EWL Research

Exicom Tele-Systems IPO Outlook:

ETL is an established player in the critical power solutions provider and has recently entered into EV charging business. The company has an early mover advantage in the new and evolving industry. It already exhibits 60% market share in the EV charging segment and is well positioned to benefit with the shift from conventional fuel to EV vehicles globally. The PE of ETL stands at 55x on the upper price band which seems fair when compared to its peer’s average of 147x. Considering the valuations, financials and future growth prospect we recommend investors to apply in the offering.

Exicom Tele-Systems IPO FAQ

Ans. Exicom Tele-Systems IPO is a main-board IPO of 30,211,214 equity shares of the face value of ₹10 aggregating up to ₹429.00 Crores. The issue is priced at ₹135 to ₹142 per share. The minimum order quantity is 100 Shares.

The IPO opens on February 27, 2024, and closes on February 29, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Exicom Tele-Systems IPO opens on February 27, 2024 and closes on February 29, 2024.

Ans. Exicom Tele-Systems IPO lot size is 100 Shares, and the minimum amount required is ₹14,200.

Ans. The Exicom Tele-Systems IPO listing date is not yet announced. The tentative date of Exicom Tele-Systems IPO listing is Tuesday, March 5, 2024.

Ans. The minimum lot size for this upcoming IPO is 100 shares.