JNK India IPO Company Details:

JNK India Limited (JIL) was incorporated in 2010 and is engaged in the design, manufacture, supply, installation, and commissioning of process-fired heaters, reformers and cracking furnaces. It has effectively finished projects in Andhra Pradesh, Assam, Bihar, Karnataka, Kerala, Maharashtra, Tamil Nadu, and West Bengal, among other Indian states. The company has worked on projects in Nigeria and Mexico, and it is now working on projects in Oman, Algeria, Lithuania, Gujarat, Odisha, Haryana, and Rajasthan in India. JIL has served clients in international markets by completing 17 projects for JNK Global. In Lagos, Nigeria, which is home to the Dangote Refinery, one of the biggest refineries in the world with an annual capacity of 32.7 million metric tonnes, JNK Global has installed process-fired heaters for a client.One of the company’s locations, at Mundra, Gujarat, is devoted to export fabrication and spans a multi-product special economic zone.

| IPO-Note | JNK India Limited |

| Rs.395 – Rs.415 per Equity share | Recommendation: Apply for Long-Term |

JNK India IPO Details :

| Issue Details | |

| Objects of the issue | · To fund working capital requirements

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.649.47 Cr.

Fress Issue – Rs.300 Cr. Offer for Sale – Rs.349.47 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.395 – Rs.415 |

| Bid Lot | 36 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 23rd April, 2024 – 25th April, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

JNK India IPO Strengths:

-

Company has a diverse clientele demonstrating a proven track record.

-

It is strategically positioned to seize opportunities driven by industry trends, leveraging its established capabilities.

-

JIL is Expanding its product range to serve a wide array of industries.

-

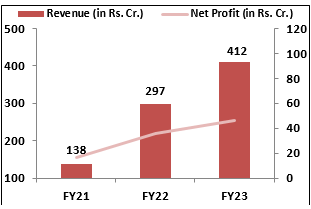

The company is exhibiting strong financial performance, as evidenced by a strong Order Book providing revenue clarity for the past three fiscal periods.

-

It has a competent and experienced team of promoters and management, supported by a dedicated workforce.

JNK India IPO Risk Factors:

-

The Company is bound by stringent performance criteria and must adhere to predetermined timelines; failure to meet these obligations could have adverse consequences.

-

The Company operates in a competitive industry, and its ability to compete effectively is crucial for its business sustainability.

-

Foreign exchange fluctuations pose a potential risk to the Company’s operational results.

-

A substantial portion of the Company’s revenue is generated from contracts with Contracting Customers; failure to secure new contracts may impact operational revenue.

-

The Company relies heavily on revenue from its Corporate Promoter, JNK Global.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check JNK India IPO Allotment Status

JNK India IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

JNK India IPO Financial Performance:

JNK India IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 94.56% | 63.13% |

| Others | 05.44% | 32.87% |

Source: RHP, EWL Research

JNK India IPO Outlook:

JIL is the subsidiary of a South-Korean company engaged in the manufacturing of critical heating equipment such as process-fired heaters, reformers and cracking furnaces for use in the oil and gas, petrochemicals and fertilisers industries. The company enjoys a sizable market share in the industry on the back of high entry barrier due to stringent policies and high switching costs. JIL also gets support from its promoter company i.e. JNK Global which holds 16% global market share. The company is well-positioned for significant development given the favorable outlook for the oil and gas and hydrogen industries in India, as well as its established financial track record, strong customer portfolio, and aggressive expansion plans. The PE of JIL stands at 49.8x on the upper price band which seems reasonable when compared to its peer’s average of 149x. Hence, we recommend investors to apply to the offering for the long term perspective.

JNK India IPO FAQ:

Ans. JNK India IPO is a main-board IPO of 16,015,988 equity shares of the face value of ₹2 aggregating up to ₹649.47 Crores. The issue is priced at ₹395 to ₹415 per share. The minimum order quantity is 36 Shares.

The IPO opens on April 23, 2024, and closes on April 25, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The JNK India IPO opens on April 23, 2024 and closes on April 25, 2024.

Ans. JNK India IPO lot size is 36 Shares, and the minimum amount required is ₹14,940.

Ans. The JNK India IPO listing date is not yet announced. The tentative date of JNK India IPO listing is Tuesday, April 30, 2024.

Ans. The minimum lot size for this upcoming IPO is 36 shares.