Rashi Peripherals IPO Company Details:

Rashi Peripherals Limited (RPL) is among the top value-added national distribution partners for global technology brands in India for information and communications technology (“ICT”) products in terms of revenues and distribution network in FY2022. The company is also one of the fastest growing national distribution partners for global technology brands in India in terms of revenue growth between Fiscal 2020 and Fiscal 2023. The company provides comprehensive value-added services, including pre-sale operations, technical support, solution design, marketing, credit solutions, and warranty management.

Business Verticals of the company:

-

Personal Computing, Enterprise, and Cloud Solutions (“PES”): The Company sells cloud computing, embedded designs and products, enterprise solutions, and personal computers under this sector.

-

Lifestyle and IT essentials (“LIT”): This covers the distribution of goods like: (i) motherboards, graphic cards, and central processing units (“CPUs”); (ii) storage and memory devices; (iii) peripherals and accessories for daily life, such as wearables, fitness trackers, webcams, keyboards, and mice; (iv) power tools, such as UPSs and inverters; and (v) networking and mobility devices.

| IPO-Note | Rashi Peripherals Limited |

| Rs.295 – Rs.311 per Equity share | Recommendation: Apply for Long Term |

Rashi Peripherals IPO Details:

| Issue Details | |

| Objects of the issue | · To pay the borrowings

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.600 Cr.

Fresh Issue – Rs.600 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.295 – Rs.311 |

| Bid Lot | 48 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 07th Feb, 2024 – 09th Feb, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer

|

Rashi Peripherals IPO Strengths:

-

RPL has distributes wide range of ICT products including personal computers, mobile devices, enterprise, embedded solutions, components, lifestyle, storage and memory devices, UPS, and accessories. It offers a wide range of products from international technology brands, which has enabled it to attain economies of scale and offer Channel Partners a centralized point of procurement.

-

It has maintained long-term relationships with key technology brands like Asus, Lenovo, HP, Dell, NVIDIA. Intel.

-

The company has scalable business model complemented by advance IT infrastructure.

Rashi Peripherals IPO Risk Factors:

-

RPL depends on a number of international technology brand vendors to distribute its products. Any delay or failure on part of such global technology brands to supply products may affect company’s business.

-

The company has very low gross margins; fluctuations in sales, operational expenses, bad debts, and interest expenditure can have a greater effect on company’s operating results.

-

It has witnessed negative cash flows in the past, with net cash used in operating activities of Rs. (115) Cr. in FY23 and Rs. (286) Cr. in September, 2023.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Rashi Peripherals IPO Allotment Status

Rashi Peripherals IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

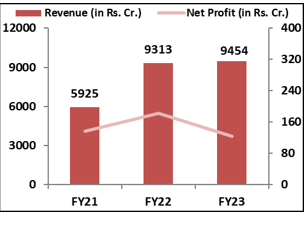

Rashi Peripherals IPO Financial Performance:

Rashi Peripherals IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 89.65% | 63.40% |

| Others | 10.35% | 36.60% |

Rashi Peripherals IPO Outlook:

RPL is a major distributor of global technological brands in India with strong relationship with major clients across world. It has a significant market share across a number of products and boasts a diverse product line. Furthermore, the company’s strength and ability to build long lasting relationships are highlighted by the fact that over 90% of its income comes from repeat clients. Industry’s future outlook is positive due to the increasing prevalence of technology, increasing data volumes, government focus on digitalization and e-governance, and the need for efficient supply chain solutions. Revenue growth of RPL has stabilized in the last 2 years; flat revenue in the latest quarter and rising expenses led to lower net profits. Despite tepid margins, attractive return on equity remains a positive. Due to the nature of the hardware retail business, where profits are derived from volumes rather than margins, the net profit margins have been relatively modest, averaging 1.3%. The PE of RPL stands at 16.62x on the upper price band which seems fairly priced when compared to its peer. Considering the valuations, future growth prospect and government support to the industry, we recommend investors to apply in the offering for long term perspective.

Rashi Peripherals IPO FAQ

Ans. Rashi Peripherals IPO is a main-board IPO of 19,292,604 equity shares of the face value of ₹5 aggregating up to ₹600.00 Crores. The issue is priced at ₹295 to ₹311 per share. The minimum order quantity is 48 Shares.

The IPO opens on February 7, 2024, and closes on February 9, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Rashi Peripherals IPO opens on February 7, 2024 and closes on February 9, 2024.

Ans. Rashi Peripherals IPO lot size is 48 Shares, and the minimum amount required is ₹14,928.

Ans. The Rashi Peripherals IPO listing date is not yet announced. The tentative date of Rashi Peripherals IPO listing is Wednesday, February 14, 2024.

Ans. The minimum lot size for this upcoming IPO is 48 shares.