Plaza Wires IPO Company Profile :

Plaza Wires Limited (PWL) an ISO-certified company, specializes in the manufacturing and sale of wires, LT aluminum cables, and fast-moving electrical goods (FMEG) under brands like “PLAZA CABLES,” “Action Wires,” and “PCG.” Their product range includes various wires, cables, electric fans, water heaters, switches, switchgears, PVC insulated electrical tape, and PVC conduit pipe & accessories. Core wire and cable products encompass building wires, flexible industrial cables, and cables for submersible pumps & motors. They collaborate with third-party manufacturers for additional wire and cable offerings. The company has a network of over 1249 authorized dealers, distributors, and C & F agents, primarily in states like Delhi, Uttar Pradesh, Haryana, Kerala, and Rajasthan as of March 31, 2023.

| IPO-Note | Plaza Wires Limited |

| Rs.51 – Rs.54 per Equity share | Recommendation: Aggressive Investors may Apply |

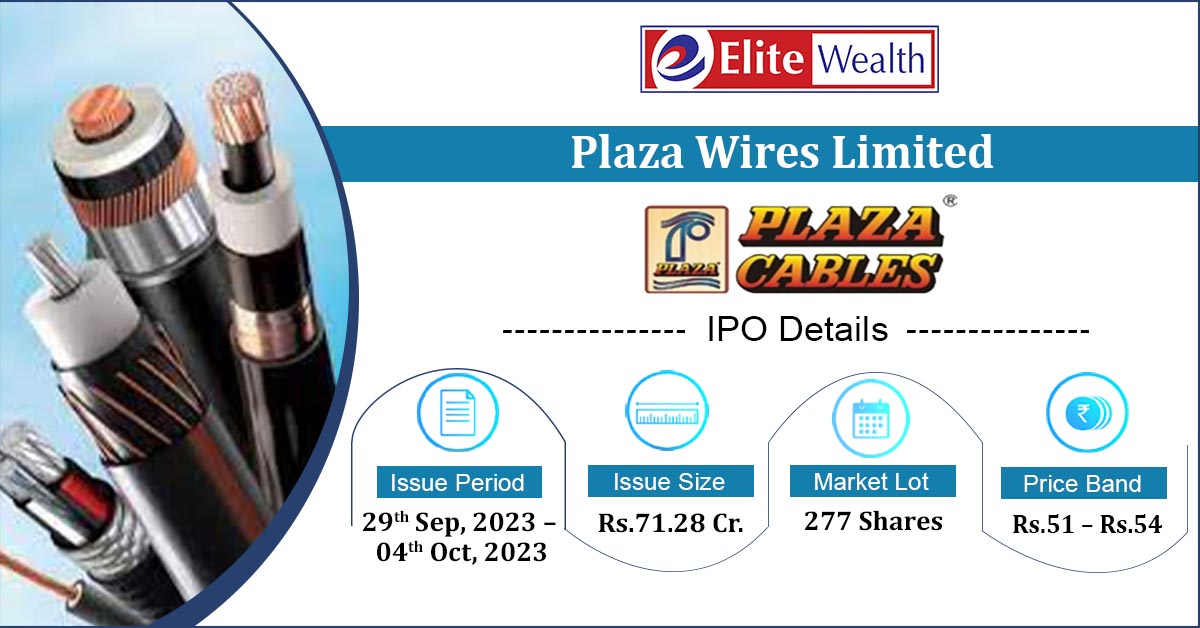

Plaza Wires IPO Details:

| Issue Details | |

| Objects of the issue | · To fund capital expenditure for setting up a manufacturing unit

· To fund working capital requirements |

| Issue Size | Total issue Size – Rs.71.28 Cr.

Fresh Issue – Rs.71.28 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.51 – Rs.54 |

| Bid Lot | 277 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 29th Sep, 2023 – 04th Oct, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Plaza Wires IPO Strengths:

-

PWL has wide product portfolio focused on various customer segment and markets.

-

Company has a repeat relationships with most of its key distributors & dealers. The market knowledge, financial resources and time required to develop such distribution network may present entry barrier for competition.

-

Company has experienced management team and dedicated employee base through which it has created value through operational growth, building brand recognition and loyalty.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Plaza Wires IPO Allotment Status

Plaza Wires IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Plaza Wires IPO Key Highlights:

-

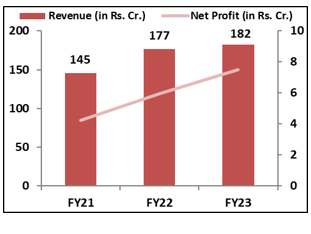

Revenue of the co. has increased from Rs.145 Cr. in FY21 to Rs.182 Cr. in FY23 with a CAGR of 7.9%; Net Profit also increased from Rs.4 Cr. in FY21 to Rs.8 Cr. in FY23 with a strong CAGR of 21%

-

Co’s EBITDA Margin & PAT Margin stands at 8.6% & 4.1% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratio of the co. is 15.57% and 14.15% respectively.

-

Debt to Equity ratio is decreasing over the years & currently stands at 0.75.

Plaza Wires IPO Financial Performance:

Plaza Wires IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 69.83% |

| Others | 0% | 30.17% |

Source: RHP, EWL Research

Plaza Wires IPO Risk Factors:

-

Company has not entered into any long-term agreements with any of its raw material or inputs suppliers and it purchase such raw materials and inputs on spot order basis. Any failure of its suppliers to deliver these raw materials in the necessary quantities would impact company’s operations.

-

PWL generates significant portion of sales from Delhi and Uttar Pradesh region. Any adverse developments affecting its operations in these regions could have an adverse impact on company’s revenue and results of operations.

-

Company’s existing and proposed manufacturing facilities are concentrated in a single region i.e., Himachal Pradesh. Any adverse development affecting continuing operations at its manufacturing facilities could result in significant loss due to an inability to meet customer contracts and production schedules.

Plaza Wires IPO Outlook:

PWL is a renowned player in the wires, cables, and FMEG sector; known for its flagship brand “PLAZA CABLES” and home brands like “Action Wires” and “PCG”. It generated ~94% of revenue from wires & cables segment, 1.57% from FMEG products and the rest ~4% from the PVC pipe, tape and others. Company is focusing on setting up the proposed manufacturing facility to increase its installed capacities to manufacture new products such as fire proof/ survival wires, LT aluminum cable and solar cable in addition to its existing products. PWL is offering the P/E of 31.46x compared to the industry average of 24.47x which looks slightly overpriced as the FMEG business is very small portion of the total business of the company and FMEG businesses typically have higher P/E ratios. While the company’s financials look good, it is uncertain whether its PAT margin will remain sustainable in the future. Considering all of these factors, we recommend that only aggressive investors apply to this offering.

Plaza Wires IPO FAQ

Ans. Plaza Wires IPO is a main-board IPO of 13,200,158 equity shares of the face value of ₹10 aggregating up to ₹71.28 Crores. The issue is priced at ₹51 to ₹54 per share. The minimum order quantity is 277 Shares.

The IPO opens on September 29, 2023, and closes on October 4, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Plaza Wires IPO opens on September 29, 2023 and closes on October 4, 2023.

Ans. Plaza Wires IPO lot size is 277 Shares, and the minimum amount required is ₹14,958.

Ans. The Plaza Wires IPO listing date is not yet announced. The tentative date of Plaza Wires IPO listing is Thursday, October 12, 2023.

Ans. The minimum lot size for this upcoming IPO is 277 shares.