JG Chemicals IPO Company Details:

JG Chemicals Limited, which was founded in 1975, is the biggest producer of zinc oxide in India in terms of both volume of production and revenue from the French process. Among the top ten zinc oxide producers in the world, the company provides a wide variety of more than 80 grades of zinc oxide. Numerous industries use its products, including rubber (tyres and other rubber products), ceramics, paints and coatings, batteries and electronics, pharmaceuticals and cosmetics, lubricants, specialty chemicals, agrochemicals and fertilizers, oil and gas, and animal feed. The business has effectively promoted and sold its goods to more than 200 domestic clients and more than 50 international clients spread across more than ten nations throughout the last three years.With three manufacturing facilities located in Jangalpur (Kolkata, West Bengal), Belur (Kolkata, West Bengal), and Naidupeta (Nellore District, Andhra Pradesh), the company’s total installed capacity as of December 31, 2023, is 77,040 MTPA. The main production location is the Naidupeta complex, which is owned and run by its Material Subsidiary. JGCL’s manufacturing facilities have all been accredited in accordance with ISO 9001:2015, ISO 45001:2018, and ISO 14001:2015 standards. Company generates over 90% of the revenue from the Rubber & Tyre industry, 7% from the Pharmaceuticals & Chemicals and 0.75% from the Agriculture Industry.

| IPO-Note | JG Chemicals Limited |

| Rs.210 – Rs.221 per Equity share | Recommendation: Apply for long term |

JG Chemicals IPO Details:

| Issue Details | |

| Objects of the issue |

· To invest in its subsidiary · To fund working capital requirements · To gain listing benefits |

| Issue Size | Total issue Size – Rs.251.19 Cr.

Fresh Issue – Rs.165 Cr. Offer for Sale – Rs.86.19 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.210 – Rs.221 |

| Bid Lot | 67 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 05th March, 2024 – 07th March, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

JG Chemicals IPO Strengths:

-

JGCL holds the leading market position with well diversified client base.

-

Company’s end use industries have significant entry barriers due to specific factors unique to such industries.

-

It has long standing relationship with customers & its suppliers along with strong supply chain; company has generated over 95% of its sales directly from its customers without any involvement of any intermediary/distributor, in the last three fiscals.

-

Company has well experienced promoter and management team.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check JG Chemicals IPO Allotment Status

JG Chemicals IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

JG Chemicals IPO Risk Factors:

-

Company is solely dependent on the sale of single product i.e. Zinc Oxide; any reduction in its demand could impact the business & financial performance.

-

~64% of the consolidated revenue comes from its subsidiary, i.e. BDJ Oxides Private Limited. Any decline in its material subsidiary’s performance could have a negative impact on the company’s operations and financials.

-

JGCL’s business is mostly dependent on the rubber & tyre industry and lacks diversification across other Application Industries.

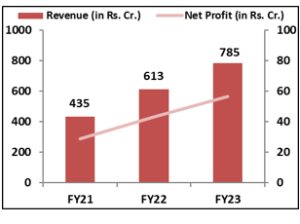

JG Chemicals IPO Financial Performance:

JG Chemicals IPO Shareholding Pattern:

JG Chemicals IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 70.99% |

| Others | 0% | 29.01% |

Source: RHP, EWL Research

JG Chemicals IPO Outlook:

JGCL is the biggest producer of zinc oxide in India and supplies nearly all of the world’s leading tyre manufacturers. Following increases in both its top and bottom lines from FY21 to FY23, it experienced degrowth in 9MFY24 due to a sharp decline in the price of zinc oxide on a worldwide scale. The company will soon be back on track as the trends seem to be reversing. The PE of JGCL stands at 15.25x on the upper price band which seems attractive when compared to its peer’s average of 31.48x. Considering its market position, financial performance, debt profile and peer comparison, we recommend investors to apply to the offering for long term horizon.

R K SWAMY IPO FAQ

Ans. JG Chemicals IPO is a main-board IPO of 11,366,063 equity shares of the face value of ₹10 aggregating up to ₹251.19 Crores. The issue is priced at ₹210 to ₹221 per share. The minimum order quantity is 67 Shares.

The IPO opens on March 5, 2024, and closes on March 7, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The JG Chemicals IPO opens on March 5, 2024 and closes on March 7, 2024.

Ans. JG Chemicals IPO lot size is 67 Shares, and the minimum amount required is ₹14,807.

Ans. The JG Chemicals IPO listing date is not yet announced. The tentative date of JG Chemicals IPO listing is Wednesday, March 13, 2024.

Ans. The minimum lot size for this upcoming IPO is 67 shares.