Juniper Hotels IPO Company Details:

Juniper Hotels Limited (JHL) was established in 1985 with the goal of becoming a leading developer and owner of luxurious hotels. Juniper Hotels Ltd. has seven hotels and serviced apartments with 1,836 rooms across all its locations in India. Two Seas Holdings Ltd., an affiliate of Hyatt Hotels Corporation, and Saraf Hotels Ltd. jointly control Juniper Hotels Ltd. This presents a singular strategic alliance between a global hotel chain such as the Hyatt group and a hotel developer. In Mumbai, Delhi, Ahmedabad, Lucknow, Raipur, and Hampi (in Karnataka), it has hotels and service flats. Hyatt establishments are regarded as some of the most upscale lodging and hospitality establishments in India and around the globe.

What is included in Juniper Hotels’ portfolio?

The Grand Hyatt Mumbai has 549 rooms and 116 serviced flats. At the ANDAZ Delhi, Juniper Hotels Ltd. offers 401 rooms, and at the Hyatt Delhi Residences, it offers 129 serviced apartments. Additionally, the Hyatt Regency Ahmedabad boasts 211 rooms, the Hyatt Regency Lucknow 206 rooms, the Hyatt Raipur 105 rooms, and the Hyatt Place, Hampi, a historic UNESCO-certified area in Karnataka, with 119 rooms. The CHPL Group and Juniper Hotels Ltd. together employ 1,993 people for the company. Among its 1,836 keys are 245 serviced units under the Hyatt group’s management and trademark.

| IPO-Note | Juniper Hotels Limited |

| Rs.342 – Rs.360 per Equity share | Recommendation: Avoid |

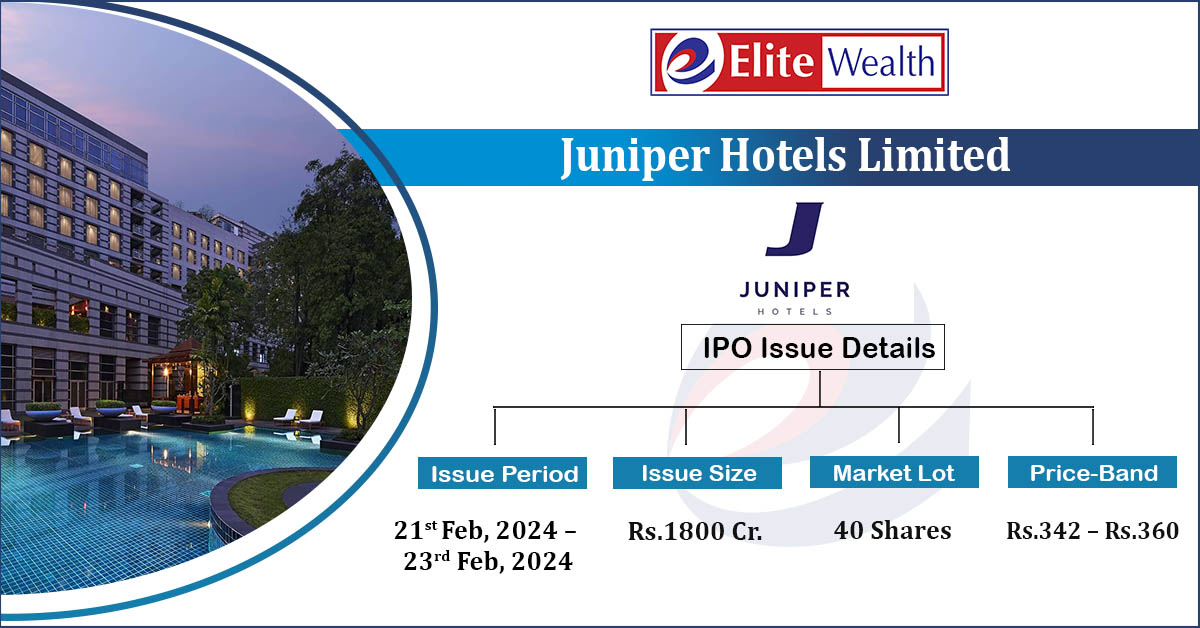

Juniper Hotels IPO Details:

| Issue Details | |

| Objects of the issue | · Repayment/ prepayment/ redemption, in full or in part, of certain outstanding borrowings

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.1800 Cr.

Fresh Issue – Rs.1800 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.342 – Rs.360 |

| Bid Lot | 40 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 21st Feb, 2024 – 23rd Feb, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Juniper Hotels IPO Strengths:

-

JHL has developed its hotels at locations with high barriers to entry. For example, according to the Horwath Report, the land parcels for hotels of the scale of Grand Hyatt Mumbai Hotel and Residences and Andaz Delhi, are difficult to obtain, and carry high cost and associated development risks.

-

Decades-long partnership between Saraf Group & Hyatt (since 1982’s 1st India Hyatt) has fostered deep alignment on goals, values & culture, fueling their success and high EBITDA margins.

-

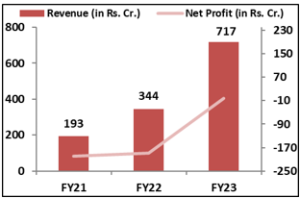

Over the past two years, the company’s top line revenues have grown significantly. In fact, during the past two years, Juniper Hotels’ revenues have increased by about four times as a result of the company’s increased business traction, improved key capacity utilization, and improved fixed cost absorption.

Juniper Hotels IPO Risk Factors:

-

JHL has substantial indebtedness which requires significant cash flows to service, and limits its ability to operate freely.

-

A significant portion of its revenue from operations (90.48% in the six months ended September 30, 2023) is derived from three hotels/serviced apartments in Mumbai (Maharashtra) and New Delhi out of the portfolio of four hotels/serviced apartments and any adverse developments affecting these hotels/serviced apartments or the regions in which they operate could harm its business

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Juniper Hotels IPO Allotment Status

Juniper Hotels IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Juniper Hotels IPO Financial Performance:

Juniper Hotels IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100.00% | 77.53% |

| Others | 0.00% | 22.47% |

Source: RHP, EWL Research

Juniper Hotels IPOOutlook:

Over the years, Juniper Hotels has shown to be a high-caliber and elegant property manager for the hotel industry. In the future, this should increase operating efficiency. Juniper Hotels Ltd.’s business strategy combines asset ownership on the back end with a worldwide brand like Hyatt on the front end. Even though the fixed cost absorption has significantly increased, the business is still losing money. Therefore, conventional P/E-based valuation metrics might not be applicable in this situation. The net loss in the final year between FY22 and FY23 decreased from Rs188 crore to just Rs1.50 crore, which is a positive indicator for the company. But in the first half of FY24, the losses have increased while sales have stabilised. Hence we recommend to avoid the offer for now.

Juniper Hotels IPO FAQ

Ans. Juniper Hotels IPO is a main-board IPO of 50,000,000 equity shares of the face value of ₹10 aggregating up to ₹1,800.00 Crores. The issue is priced at ₹342 to ₹360 per share. The minimum order quantity is 40 Shares.

The IPO opens on February 21, 2024, and closes on February 23, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Juniper Hotels IPO opens on February 21, 2024 and closes on February 23, 2024.

Ans. Juniper Hotels IPO lot size is 40 Shares, and the minimum amount required is ₹14,400.

Ans. The Juniper Hotels IPO listing date is not yet announced. The tentative date of Juniper Hotels IPO listing is Wednesday, February 28, 2024.

Ans. The minimum lot size for this upcoming IPO is 40 shares.