Valiant Laboratories IPO Company Profile :

Valiant Laboratories Limited (VLL) is an Active Pharmaceutical Ingredient (“API”) / Bulk Drug manufacturing company having focuses on the manufacturing of Paracetamol. Bulk drugs/Active Pharmaceutical Ingredients (API) serve as raw materials for manufacturing finished dosage forms or formulations. Paracetamol is one of the most commonly taken analgesics worldwide and is recommended as the first-line therapy in pain conditions by the World Health Organization (WHO). Paracetamol has several applications such as usage in the treatment of headaches, muscle aches, arthritis, backaches, toothaches, colds, and fever. The company manufactures Paracetamol in various grades such as IP/BP/EP/USP, as per the pharmacopeia requirements of its customers. Paracetamol is often found combined with other drugs in many over-the-counter (“OTC”) allergy medications, cold medications, sleep medications, pain relievers, and other products. The company was originally formed in year 1980 as a partnership firm under the Indian Partnership Act, 1932 under the name and style of “M/s. Bharat Chemicals” and gradually, commenced manufacturing of Paracetamol by late 1982. In August 2021, the partnership firm was converted into a public limited company registered under the Companies Act.

| IPO-Note | Valiant Laboratories Limited |

| Rs.133 – Rs.140 per Equity share | Recommendation: Aggressive investors may Subscribe |

Valiant Laboratories IPO Details:

| Issue Details | |

| Objects of the issue | · Funding capital expenditure and working capital for Valiant Advanced Sciences Private Limited (VASPL) |

| Issue Size | Total issue Size – Rs.152.46 Cr.

Fresh Issue – Rs.152.46 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.133 – Rs.140 |

| Bid Lot | 105 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 27th Sep, 2023 – 03rd Oct, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Valiant Laboratories IPO Strengths:

-

VLL is reducing dependence on the import of raw materials by purchasing the same through its promoter group company i.e. Valiant Organics Limited which leads to better coordination, competitive pricing, eliminating hefty transportation, and reduced delivery transit time.

-

The paracetamol API industry is expected to clock a CAGR of 5-7% between fiscal 2023 and fiscal 2027, largely driven by the demand from domestic formulation manufacturers as well as export markets.

-

VLL’s manufacturing facility is strategically located approximately 110 km. from its registered office in Mulund West, Mumbai, Maharashtra, and approximately 150 km. from JNPT Port, Navi Mumbai, Maharashtra. This ensures that the company has ready access to port facilities and is able to import and export its products quickly, giving the company a financial and logistical advantage.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Valiant Laboratories IPO Allotment Status

Valiant Laboratories IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Valiant Laboratories IPO Key Highlights:

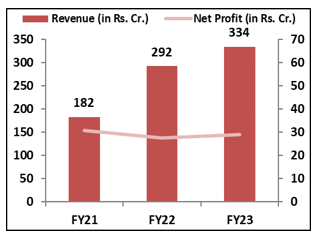

- VLL has (on a consolidated basis) posted a total income/net profit of Rs. 182.27 cr. / Rs. 30.59 cr. (FY21), Rs. 291.52 cr. / Rs. 27.49 cr. (FY22), and Rs. 333.91 cr. / Rs. 28.99 cr. (FY23).

- VLL’S ROCE for Fiscals 2023, 2022, and 2021 is 22.76%, 35.75% and 70.86%, respectively.

- VLL’s net profit margins for Fiscals 2023, 2022, and 2021 are 8.56%, 9.37% and 16.65%, respectively.

Valiant Laboratories IPO Financial Performance:

Valiant Laboratories IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100.00% | 74.94% |

| Others | 0.00% | 25.06% |

Source: RHP, EWL Research

Valiant Laboratories IPO Risk Factors:

- VLL is a single-product manufacturing company and any changes to the paracetamol API industry or its product demand will adversely affect the company’s revenues, financials, and profitability.

- Pricing pressure from customers may affect the company’s gross margin, profitability, and ability to increase its prices.

Valiant Laboratories IPO Outlook :

Valiant Laboratories Limited (VLL) is an API / Bulk Drug manufacturing company focusing on the manufacturing of Paracetamol. Within the company’s Manufacturing Facility located at Tarapur Industrial Area, Palghar, Maharashtra it also has an in-house R&D infrastructure. Shantilal Shivji Vora, Promoter and Non-Executive Director of the Company has rich experience of over 45 years in the chemical and pharmaceutical industry. However company main focus on only one product makes it vulnerable to its competition and various other external factors. P/E of the VLL stands at 20.98x on the upper price band compared to the industry average of 40.48x; which seems fairly priced against listed peers. Hence we recommend aggressive Investors may subscribe and park money for medium- to long-term. gains.

Valiant Laboratories IPO FAQ

Ans. Valiant Laboratories IPO is a main-board IPO of 10,890,000 equity shares of the face value of ₹10 aggregating up to ₹152.46 Crores. The issue is priced at ₹133 to ₹140 per share. The minimum order quantity is 105 Shares.

The IPO opens on September 27, 2023, and closes on October 3, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Valiant Laboratories IPO opens on September 27, 2023 and closes on October 3, 2023.

Ans. Valiant Laboratories IPO lot size is 105 Shares, and the minimum amount required is ₹14,700.

Ans. The Valiant Laboratories IPO listing date is not yet announced. The tentative date of Valiant Laboratories IPO listing is Monday, October 9, 2023.

Ans. The minimum lot size for this upcoming IPO is 105 shares.