Zaggle Prepaid Ocean Services IPO Company Profile:

Zaggle Prepaid Ocean Services Limited (“ZPOSL”) is a top player in spend management, with a distinctive value proposition and diversified user base. The company operates in a market where it interacts and interfaces with customers and end users (i.e., employees), and it is one of a select group of players that are in a unique position with a diverse offering of financial technology (“fintech”) products and services. It also has one of the largest numbers of issued prepaid cards in India in partnership with some of its banking partners, accounting for 12.7% of the country’s total prepaid transaction value as of March 31, 2022. Additionally it has a diversified portfolio of software as a service (“SaaS”), including tax and payroll software, and a wide touchpoint reach. ZPOSL serves a wide range of industries including banking, technology, healthcare, manufacturing, and more. Well-known companies like TATA Steel, Persistent Systems, Vitech, Inox, Pitney Bowes, Wockhardt, MAZDA, PCBL (RP – Sanjiv Goenka Group), Hiranandani group, Cotiviti, and Greenply Industries are among its corporate customers.

| IPO-Note | Zaggle Prepaid Ocean Services Limited |

| Rs.156 – Rs.164 per Equity share | Recommendation: Avoid |

Zaggle Prepaid Ocean Services IPO Details:

| Issue Details | |

| Objects of the issue | · To expend towards customer acquisition and retention

· To expend in technological development and products · To pay borrowings · To gain listing benefits |

| Issue Size | Total issue Size – Rs.563.38 Cr.

Fresh Issue – Rs.392 Cr. Offer for Sale – Rs.171.38 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.156 – Rs.164 |

| Bid Lot | 90 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 14th Sep, 2023 – 18th Sep, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Zaggle Prepaid Ocean Services IPO Strengths:

-

ZPOSL stands out as a diversified fintech player with a significant no. of prepaid cards issued through banking partners, strong profitability, a varied SaaS service portfolio (including tax and payroll), and an extensive touchpoint network.

-

Co’s model focuses on acquiring large user bases through corporate and SMB customers, allowing it to minimize user acquisition costs compared to other B2C/retail players.

-

It has a strong customer retention ability with the churn rate for Customers terminating contracts with it being consistently low at 1.54%, 0.37%, 1.17% in FY23, FY22 and FY21, respectively.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Zaggle Prepaid Ocean Services IPO Allotment Status

Go Zaggle Prepaid Ocean Services IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Zaggle Prepaid Ocean Services IPO Key Highlights:

-

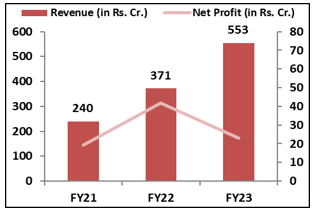

Revenue of the co. has increased from Rs.240 Cr. in FY21 to Rs.553 Cr. in FY23 with a CAGR of 32%; Net Profit also increased from Rs.19 Cr. in FY21 to Rs.23 Cr. in FY23 with a CAGR of 5.8%

-

Co’s EBITDA Margin & PAT Margin stands at 8.7% & 4.1% respectively in FY23.

-

As of March, 2023, ROE ratio is at 46.98% and Debt to Equity ratio at 2.48 times.

Zaggle Prepaid Ocean Services IPO Financial Performance:

Zaggle Prepaid Ocean Services IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 57.91% | 38.02% |

| Others | 42.09% | 61.98% |

Source: RHP, EWL Research

Zaggle Prepaid Ocean Services IPO Risk Factors:

-

ZPOSL earns a significant portion of its revenue from Program Fees through partnerships with banks. Since its banking partners’ businesses are regulated by the RBI, any shifts in RBI policies or regulations could potentially impact ZPOSL’s business, cash flow, financial results, and overall financial health.

-

It may be unable to retain existing customers, attract new customers, and convert customers using the beta or trial versions into paying customers.

-

recognizes revenue over contract terms so sales downturns may not impact operating results until one or more quarters following the actual decrease.

Zaggle Prepaid Ocean Services IPO Outlook:

ZPOSL is a leading fintech co., specialized in prepaid cards, spend management SaaS solutions, and customer engagement systems. With a diverse clients across various industries, it is emerging as a key player in India’s fintech sector, prioritizing growth and customer retention through cross-selling and ecosystem-driven approaches. Co. generates its revenue through propel platform/gift cards, program fee and platform fee/ SaaS fee/ service fee. In FY23 these segments contributed 64%, 30.7% & 4.4% to the co.’s total revenue, respectively. P/E of ZPOSL stands at 87.4x on the upper price band; which seems highly overpriced. There are no comparable businesses in India or worldwide. So peer comparison is impossible. The co. is relatively new in the market and faces competition from other fintech companies. The evolving fintech industry also poses risk to the co.’s future prospects on the back of changing market dynamics and regulatory shifts. Considering all the factors we recommend investors to avoid the offering.

Zaggle Prepaid Ocean Services IPO FAQ

Ans. Zaggle Prepaid Ocean Services IPO is a main-board IPO of 34,352,255 equity shares of the face value of ₹1 aggregating up to ₹563.38 Crores. The issue is priced at ₹156 to ₹164 per share. The minimum order quantity is 90 Shares.

The IPO opens on September 14, 2023, and closes on September 18, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Zaggle Prepaid Ocean Services IPO opens on September 14, 2023 and closes on September 18, 2023.

Ans. Zaggle Prepaid Ocean Services IPO lot size is 90 Shares, and the minimum amount required is ₹14,760.

Ans. The Zaggle Prepaid Ocean Services IPO listing date is not yet announced. The tentative date of Zaggle Prepaid Ocean Services IPO listing is Wednesday, September 27, 2023.

Ans. The minimum lot size for this upcoming IPO is 90 shares.