Bharti Hexacom IPO Company Details:

Bharti Hexacom Limited (BHL) offers technical and consulting services with expertise in telecom & IT sectors to developing nations worldwide. Currently, the company provides its consumers with communication services under the Airtel brand in a synergistic way. Enhanced consumer interaction and personalized family plans are among the offerings offered by Airtel Black. The company uses a combination of leased and owned assets to run a strong network infrastructure. The Company held 5092 of the 24,874 network towers it operated as at December 31, 2023. It also features a spectrum portfolio with mid-band spectrum architecture in the MHz bands of 1800, 2100, and 2300. Because these towers are built in a non-standalone manner, the same architecture may be applied to both 4G and 5G networks. This makes it possible for the infrastructure to be deployed across the nation more quickly and at a reduced cost of ownership. The telecom sector is fiercely competitive and capital-intensive. In order to not only survive but also to advance technologically, increase client base size, and broaden product variety, players engage in mergers and acquisitions (M&As).

| IPO-Note | Bharti Hexacom Limited |

| Rs.542 – Rs.570 per Equity share | Recommendation: Avoid |

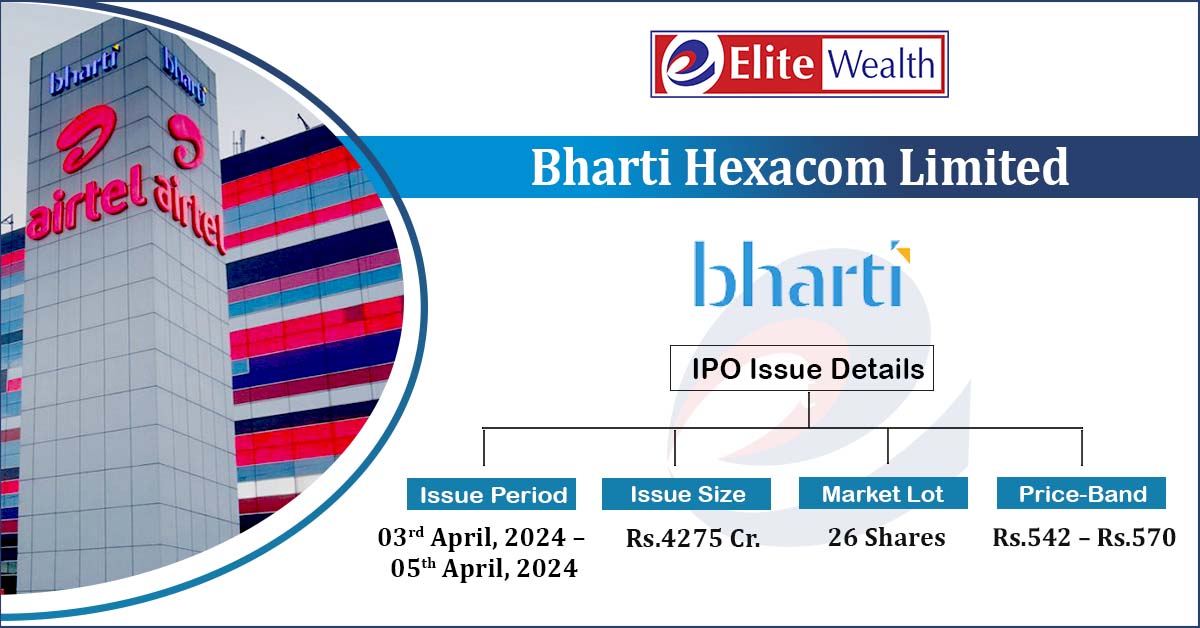

Bharti Hexacom IPO Details :

| Issue Details | |

| Objects of the issue | · To gain listing benefits |

| Issue Size | Total issue Size – Rs.4275 Cr.

Offer for Sale – Rs.4275 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.542 – Rs.570 |

| Bid Lot | 26 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 03rd April, 2024 – 05th April, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Bharti Hexacom IPO Strengths:

-

BHL has a substantial customer base and a well-established leadership in Rajasthan and other Northeastern Indian states. As of December 31, 2023, the Company has 2.7 Cr customers altogether and is present in 486 census localities.

-

The tele densities in Rajasthan and North Eastern India are just 79.5% and 79.7%, respectively. In Rajasthan’s rural areas, the teledensity is as low as 57%. The Company now has a fantastic opportunity to further improve its connectivity in these locations.

-

Wide-ranging distribution and servicing network: The Company has 75 stores and 616 distributors in the North Eastern and Rajasthan regions. Via the “Mitra App,” these partners offer Airtel goods and services for sale. Customers in this area can benefit greatly from Airtel’s India-wide, seamlessly integrated offerings.

Bharti Hexacom IPO Risk Factors:

-

Geographic Concentration Risk: The Company’s services sales in Rajasthan and Northeastern India provide all of its revenue. If anything goes wrong in the corresponding marketplaces, it can have a big effect on the firm.

-

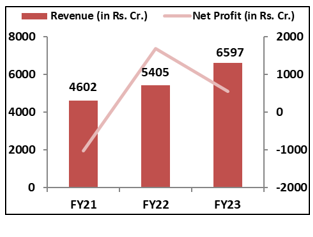

Unreliable profitability: BHL’s revenue has increased steadily, but its profitability have not followed suit. Unusual profits and losses occurred in both FY21 and FY22, distorting the figures from normalized earnings.

-

High Debt Concerns: The total amount of outstanding debt as of December 31, 2023, was around Rs. 3,772 Cr. Its debt-to-equity ratio stands at 1.48x as of FY23 and 1.41x as of December 31, 2023.

Bharti Hexacom IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Bharti Hexacom IPOAllotment Status

Bharti Hexacom IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Bharti Hexacom IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 70.00% | 55.00% |

| Others | 30.00% | 45.00% |

Source: RHP, EWL Research

Bharti Hexacom IPO Outlook:

BHL has a large customer base in its operating regions of Rajasthan and North-Eastern India and a strong parentage with Bharti Airtel, a well-established brand presence. However, it faces a number of serious risks and weaknesses like high geographic concentration risk, which exposes it to the dynamics of local markets. Its profitability have been inconsistent, and in recent years, the financials have been distorted by extraordinary gains and losses. Furthermore, by declaring losses in FY21, the company violated SEBI laws in the past. While debt levels have steadily decreased since FY21, they nonetheless remain rather high at the moment. The PE of BHL stands at 52x on the upper price band which seems high when compared to its peer’s average of 40x. Considering its business, current financial status and valuation we recommend investors to avoid the offering.

Bharti Hexacom IPO FAQ

Ans. Bharti Hexacom IPO is a main-board IPO of 75,000,000 equity shares of the face value of ₹5 aggregating up to ₹4,275.00 Crores. The issue is priced at ₹542 to ₹570 per share. The minimum order quantity is 26 Shares.

The IPO opens on April 3, 2024, and closes on April 5, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Bharti Hexacom IPO opens on April 3, 2024 and closes on April 5, 2024.

Ans. Bharti Hexacom IPO lot size is 26 Shares, and the minimum amount required is ₹14,820.

Ans. The Bharti Hexacom IPO listing date is not yet announced. The tentative date of Bharti Hexacom IPO listing is Friday, April 12, 2024.

Ans. The minimum lot size for this upcoming IPO is 26 shares.