Krystal Integrated Services IPO Company Details:

Krystal Integrated Services Limited (KISL), a leading provider of integrated facilities management services in India, with a focus on industries including healthcare, education, public administration, airports, railways and metro infrastructure, and retail. The company provides staffing solutions, payroll administration, manned guarding services, private security, and catering services to its clients. It had extended its services to 35 hospitals and medical institutions, 228 schools and colleges, one airport, four railway stations, and thirty metro stations, in addition to providing catering services on specific trains and routes by September, 2023. In the six months that concluded on September 30, 2023, and the fiscal years 2021, 2022, and 2023, the company served 262, 277, 326, and 309 clients, respectively. KISL supplied 1,962 customer locations as of March 31, 2021; this figure increased to 2,240 as of March 31, 2022; it then increased to 2,427 as of March 31, 2023; finally, it settled at 2,160 as of September 30, 2023. In the six months that concluded on September 30, 2023, and the fiscal years 2021, 2022, and 2023, the company acquired 76, 70, 89, and 57 new clients, respectively. It boasts a nationwide network of 21 branch offices as of September 30, 2023, and operates in 16 states and two union territories in India. Company generates ~37% from Healthcare sector, ~20% from Education sector and ~7% from the Airport, Railways and Metro infrastructure sector. It generates ~60% revenue from integrated facility management services, ~25% from Staffing & Payroll management, ~13% from private security & manguarding and ~1% from the catering business.

| IPO-Note | Krystal Integrated Services Limited |

| Rs.680 – Rs.715 per Equity share | Recommendation: Aggressive Investors may apply |

Krystal Integrated Services IPO Details :

| Issue Details | |

| Objects of the issue | · To pay borrowings

· To fund working capital requirements · To gain listing benefits |

| Issue Size | Total issue Size – Rs.300.13 Cr.

Fresh Issue – Rs.175 Cr. Offer for Sale – Rs.125.13 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.680 – Rs.715 |

| Bid Lot | 20 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 14th March, 2024 – 18th March, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Krystal Integrated Services IPO Strengths:

-

The company offers an extensive array of services to provide clients a one-stop solution.

-

It is using a targeted business strategy that is well-positioned to take advantage of favorable industry conditions.

-

KISL maintains long-term relationship with its clients which benefits it with recurring business.

-

Company has demonstrated consistent history of strong financial performance led by an adaptable, efficient, and scalable business approach.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Krystal Integrated Services IPO Allotment Status

Krystal Integrated Services IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Krystal Integrated Services IPO Risk Factors:

-

KISL’s revenue from operations is heavily reliant on a limited number of customers which signifies client concentration risk of the company.

-

~74% of the company’s revenue comes from government contracts secured through competitive bidding; failure to secure these contracts could adversely affect its financials.

-

The company works in highly competitive industries witch could impact its operations.

-

There are ongoing legal proceedings involving the company, its promoters, subsidiaries, and directors. Any adverse decision in these cases may impact the company’s performance.

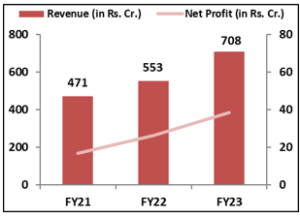

Krystal Integrated Services IPO Financial Performance:

Krystal Integrated Services IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 69.96% |

| Others | 0% | 30.04% |

Source: RHP, EWL Research

Krystal Integrated Services IPO Outlook:

KISL is a prominent player in the India’s integrated facilities management services, well-known for its longstanding client relationships and stable financial performance. However, the business’s growth prospects appear generally bleak as they are entirely dependent on the expansion of the industry as a whole, which is now expanding very slowly. The PE of KISL stands at 26x on the upper price band which seems fully priced in when compared to its peer’s average of 39x. Considering its business model, market position, financials and industry prospects, we recommend only aggressive investors to apply in the offering.

Krystal Integrated Services IPO FAQ

Ans. Krystal Integrated Services IPO is a main-board IPO of 4,197,552 equity shares of the face value of ₹10 aggregating up to ₹300.13 Crores. The issue is priced at ₹680 to ₹715 per share. The minimum order quantity is 20 Shares.

The IPO opens on March 14, 2024, and closes on March 18, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Krystal Integrated Services IPO opens on March 14, 2024 and closes on March 18, 2024.

Ans. Krystal Integrated Services IPO lot size is 20 Shares, and the minimum amount required is ₹14,300.

Ans. The Krystal Integrated Services IPO listing date is not yet announced. The tentative date of Krystal Integrated Services IPO listing is Thursday, March 21, 2024.

Ans. The minimum lot size for this upcoming IPO is 20 shares.