PKH Ventures IPO Company Details:

PKH Ventures Limited is a construction and hospitality company with a focus on government projects. Company’s subsidiary, Garuda Construction, executes the civil construction business. The hospitality vertical owns, manages, and operates hotels, restaurants, QSRs, spas, and sells food products. It owns and manages two hotels under its renowned brand, Golden Chariot. It also owns and operates various other restaurants, including Casablanca, Mumbai Salsa, Balaji, Hardy’s Burger, and Zebra Crossing. The company has recently completed the construction of Delhi Police Headquarters building, which involved the construction of two 17-story towers with a glass façade and steel bridge. It is proposing to develop new projects in Amritsar, Mumbai, Jalore, Indore, and Chiplun.

| IPO-Note | PKH Ventures Limited |

| Rs.140 – Rs.148 per Equity share | Recommendation: Avoid |

PKH Ventures IPO Details:

| Issue Details | |

| Objects of the issue | · To invest in subsidiaries

· To acquire businesses · To gain listing benefits |

| Issue Size | Total issue Size – Rs.379 Cr.

Fresh Issue – Rs.270.22 Cr. Offer for Sale – Rs.109.13 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.140 – Rs.148 |

| Bid Lot | 100 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 30th June, 2023 – 04th July, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

PKH Ventures IPO Strengths:

-

PKH Ventures has 15+ years of experience of managing and operating restaurants, QSRs, lounges & other catering services at various airports in the country. This experience has enabled it to venture into owning, managing, and operating hotels, restaurants, and QSRs.

-

The co. has grown significantly over the past year, backed by an increase in orders and government projects in both the construction and hospitality sectors.

-

It uses an asset-light business model for its civil construction business. This means that it does not own its own equipment or labor, but instead relies on third-party suppliers to provide these services. This strategy helps to reduce the company’s fixed costs, which can lead to higher profit margins.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check PKH Ventures IPO Allotment Status

Go PKH Ventures IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

PKH Ventures IPO Key Highlights:

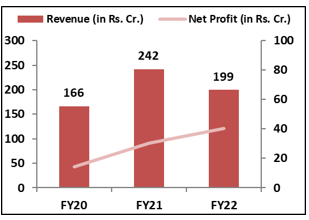

- Revenue of the co. has increased from Rs.166 Cr. in FY20 to Rs.199 Cr. in FY22 with a CAGR of 6.3% and the Net Profit has increased from Rs.14 Cr. in FY20 to Rs.41 Cr. in FY22 with a strong CAGR of 42%.

- ’s EBITDA Margin & PAT Margin stands at 49% & 20% respectively in FY22.

- As of March, 2022, ROCE and ROE ratio of the co. is 15% and 12.38% respectively. And Debt to Equity ratio is 0.30 times.

- The order book of the co. has increased from Rs.212.7 cr. in FY21 to Rs.546.8 cr. in FY22, which is 2.75x of the revenue generated in FY22.

PKH Ventures IPO Financial Performance:

PKH Ventures IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 79.82% |

| Others | 0% | 20.18% |

Source: RHP, EWL Research

PKH Ventures IPO Risk Factors:

- The co. has generated 61% of revenue from construction & development vertical as of Dec, 2022. Any reduction in the contracts or projects in this segment may adversely affect co.’s financials.

- The co. has been experiencing negative cash flows in the past. If this continues, it could be bad for its long-term financial health.

- The company has experience in the construction and hospitality industries, but it lacks experience developing hydropower plants.

PKH Ventures IPO Outlook:

PKH Ventures is a diversified company that operates in three business verticals: Construction & Development, Hospitality, and Management Services; and it generated 61.24%, 30.66% and 7.29% respectively from these segments as of Dec.22. The co. has been awarded with two Govt. hydro power projects and three Govt. hotel development projects. The co. is going to further develop projects including real estate development, an agro-processing cluster, cold storage park/facilities, and a wellness centre and resort. PKH Ventures is a well-positioned co. with a strong track record and is expected to benefit from the ongoing growth in the construction & hospitality sectors in India. But the lack of focus on one business segment is key risk for the business going forward. Based on FY22 earnings, PKH Ventures is offering the PE of 25.9x on the upper price band and it does not have any peer in the listed space. We suggest investors to avoid the offering as there are other fundamentally sound companies in the same segments available in the market with better valuations.

PKH Ventures IPO FAQ

Ans. PKH Ventures IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The PKH Ventures IPO opens on Jun 30, 2023 and closes on Jul 4, 2023.

Ans. PKH Ventures IPO lot size is 100 Shares and the minimum order quantity is .

Ans. The PKH Ventures IPO listing date is not yet announced. The tentative date of PKH Ventures IPO listing is Wednesday, 12 July 2023.

Ans. The minimum lot size for this upcoming IPO is 100 shares.