Avalon Technologies IPO Company Profile:

Avalon Technologies Limited (ATL) is one of the leading fully integrated Electronic Manufacturing Services (“EMS”) companies with end-to-end capabilities in delivering box-build solutions in India, with a focus on high-value precision-engineered products. The company provides a full stack product and solution suite, right from printed circuit board (“PCB”) design and assembly to the manufacture of complete electronic systems (“Box Build”), to certain global original equipment manufacturers (“OEMs”), including OEMs located in the United States, China, Netherlands, and Japan. It is well diversified and is present in virtually every major industry vertical, including clean energy, mobility, industrial, aerospace, defence, communication and medical. This diversified industry presence hedges against global market and industry cycle volatilities. Company has also penetrated sunrise industries such as clean energy with a presence in the solar, hydrogen, and electric vehicles industries. In FY-2022, clean energy accounted for 20.28% of its sales.

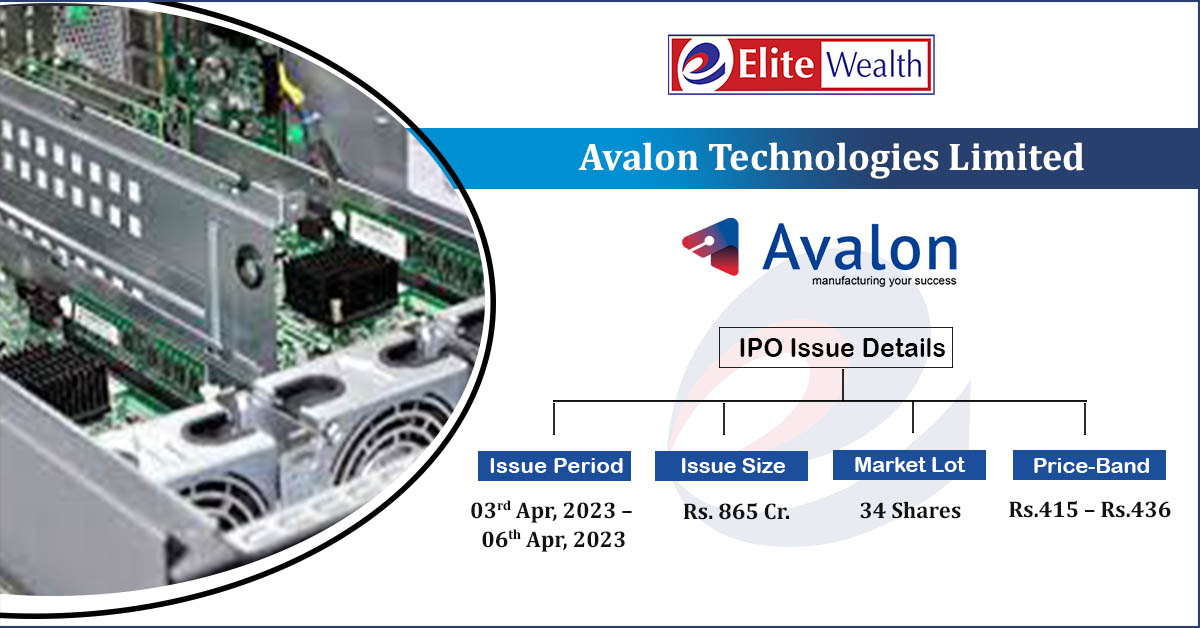

| IPO-Note | Avalon Technologies Limited |

| Rs.415 – Rs.436 per Equity share | Recommendation: Aggressive Investors May Apply |

Avalon Technologies IPO details:

| Issue Details | |

| Objects of the issue | · To prepay/repay borrowings

· To gain listing benefits |

| Issue Size | Total issue Size – Rs. 865 Cr.

Fresh Issue – Rs. 320 Cr. Offer For Sale – Rs. 545 Cr. |

| Face value | Rs. 2.00 Per Equity Share |

| Issue Price | Rs.415 – Rs.436 |

| Bid Lot | 34 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 03rd Apr, 2023 – 06th Apr, 2023 |

| QIB | 75% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Avalon Technologies IPO Financial Performance:

Avalon Technologies IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 70.75% | 43.65% |

| Others | 29.25% | 56.35% |

Source: DRHP, EWL Research

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Avalon Technologies IPO Allotment Status

Go Avalon Technologies IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Avalon Technologies IPO Strengths:

- The company is an end-to-end integrated solution provider for electronics and electro-mechanical design and manufacturing services.

- It has well-diversified business leading to strong growth lines.

- The company has strong and growing customer base and it has established long term relationship with these client base.

Avalon Technologies IPO Key Highlights:

-

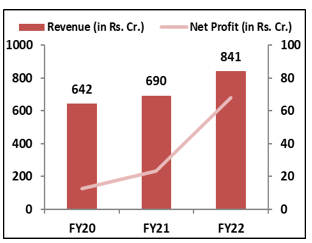

Revenue of ATL has increased from Rs.642 Cr. in FY20 to Rs.841 Cr. in FY22 with a CAGR of 9.4% while Net Profit has increased from Rs.12 Cr. in FY20 to Rs.68 Cr. in FY22 with a huge CAGR of 77% majorly due to decrease in finance costs.

-

Company has EBITDA margin and Net Profit margin of 11.6% and 8.1% respectively for the FY22.

-

ROCE & ROE of the company stands at 27.41% and 85.86% respectively for FY22.

-

Net Debt of the company has increased over the years and is currently at Rs.304.5 Cr. as of Nov.22 from Rs.222 cr. in FY22.

Avalon Technologies IPO Risk Factors:

-

The company imports average 44.64% of its raw materials, any shortages or delay in the supply of key raw materials and components may impact the business operations.

-

Top 5 customers of the company contribute to average 46% of the total revenue. Loss of any such customers may have an adverse effect on the profitability and results of operations of the company.

-

It faces significant competitive pressures in the business as there are lot of key competitors present in the Indian as well as Global market.

Avalon Technologies IPO Outlook:

ATL is an integrated EMS provider in India serving to various major industries such as clean energy, mobility, communication, industrial, defence etc. The company generates average 48%, 33% and 9% of revenue by offering Box build, Printed Circuit Boards and Cables respectively. These products are sold to customers primarily in the US and India and contributes to 62% and 38% respectively in the total revenue. It has strong order book of Rs.1,190 cr. as of Nov.2022, which is 1.4x of the total revenue of FY22 and is focusing to high growing industry such as clean energy and emerging communication technologies. The global electronics industry is expected to grow at a CAGR of 4.9% by CY2026 driving by the growth of increasing disposable income, higher internet penetration, inclination of the youth towards next generation technologies, the emergence of e-commerce etc. The financials of ATL looks promising; however high borrowings is a key risk for the company. On the basis of FY22 earnings, ATL is offering the PE of 41.76 times on the upper price band against the industry average of 76.39. In the current scenario IPO looks bit overpriced. Hence, we recommend only aggressive investors to apply for the offering.

Avalon Technologies IPO FAQ

Ans. Avalon Technologies IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The Avalon Technologies IPO opens on Apr 3, 2023 and closes on Apr 6, 2023.

Ans. Avalon Technologies IPO lot size is 34 Shares and the minimum order quantity is .

Ans. The Avalon Technologies IPO listing date is not yet announced. The tentative date of Avalon Technologies IPO listing is Apr 18, 2023.

Ans. The minimum lot size for this upcoming IPO is 34 shares.