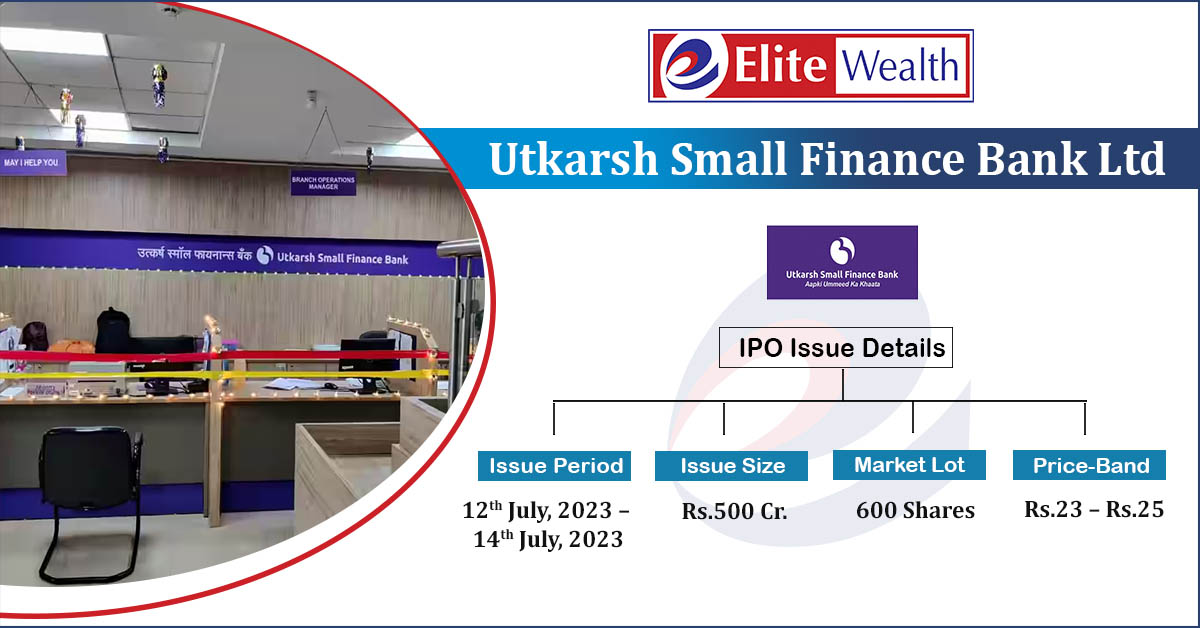

Utkarsh Small Finance Bank IPO Details:

Utkarsh Small Finance Bank Ltd. (USFB) is a small finance bank which operates in 26 states and Union Territories. Its range of financial products includes Micro banking loans, retail loans, wholesale lending, housing loans, loans for commercial vehicles and construction equipment, as well as gold loans. Additionally, the bank provides various savings accounts, current accounts, term and recurring deposit accounts. It also offers non-credit services such as ATM-cum-debit cards, bill payment systems, third-party point-of-sales terminals, mutual funds, and insurance products. As of March’23, USFB has a network of over 830 branches and 287 ATMs across India.

| IPO-Note | Utkarsh Small Finance Bank Limited |

| Rs.23 – Rs.25 per Equity share | Recommendation: Subscribe |

Utkarsh Small Finance Bank IPO Details:

| Issue Details | |

| Objects of the issue | · To increase tier-1 capital |

| Issue Size | Total issue Size – Rs.500 Cr.

Fresh Issue – Rs.500 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.23 – Rs.25 |

| Bid Lot | 600 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 12th July, 2023 – 14th July, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Utkarsh Small Finance Bank IPO Strengths:

-

The bank has a solid grasp of the microfinance sector and a strong presence in rural and semi-urban regions.

-

It has a varied distribution network with substantial potential for cross-selling.

-

USFB has a stable growth with cost efficient operational performance. Among small finance banks (SFBs) with a Gross Loan Portfolio exceeding ₹60 billion, bank has achieved the third highest CAGR of 31.0% between FY19 and FY 23.

Utkarsh Small Finance Bank IPO Key Highlights:

-

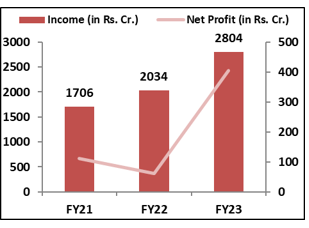

Total income of the bank has increased from Rs.1,706 Cr. in FY21 to Rs.2,804 Cr. in FY23 with a CAGR of 18% and the Net Profit has increased from Rs.112 Cr. to Rs.405 Cr. during the same period with a strong CAGR of 53.5%.

-

Total deposits of the bank has grown from Rs.7,508 cr. in FY21 to Rs.13,710 cr. in FY23. During same period total advances has grown from Rs.8,217 cr. to Rs.13,068 cr.

-

In FY23 bank’s CASA ratio stands at 20.89% while capital adequacy ratio stands at 20.64%.

-

Asset quality of the bank is stable and as of March, 2023, GNPA and NNPA ratio stands at 3.23% and 0.39%.

Utkarsh Small Finance Bank IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Utkarsh Small Finance Bank IPO Allotment Status

Go Utkarsh Small Finance Bank IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Utkarsh Small Finance Bank IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 84.75% | 69.28% |

| Others | 15.25% | 30.72% |

Source: RHP, EWL Research

Utkarsh Small Finance Bank IPO Risk Factors:

-

A significant proportion of bank’s loans in the micro banking sector are allocated to customers residing in Bihar and Uttar Pradesh states. Any unfavorable developments affecting these regions can have a negative impact on the bank’s business.

-

As of March, 23, USFB’s top 20 depositors contributed to 21.04% in the total deposits. Any decline in the number of these depositors may impact the bank’s business and performance.

-

92% of bank’s loans, including micro banking loan portfolio, lack collateral or any form of security. Inability to recover these loans may have an adverse impact on the asset quality of the bank.

Utkarsh Small Finance Bank IPO Outlook:

USFB is one of the fastest growing Small Finance Bank (SMF) based in the Varanasi district of Uttar Pradesh. Its operations primarily target rural and semi-urban areas, serving a customer base of 3.59 million (both deposit and credit). The majority of these customers are located in Bihar and Uttar Pradesh, states that displayed strong asset quality but have lower credit penetration in Fiscal 2022. As of March 31, 2023, Bihar constituted 30.88% and Uttar Pradesh constituted 25.98% of the total Gross Loan Portfolio. Additionally, USFB aims to expand its presence in new regions alongside existing states. To achieve this, bank has established partnerships with 13 business correspondents (BCs) and 321 direct selling agents (DSAs) as of March 31, 2023, to acquire customers and expand its asset portfolio. The lower financial inclusion in rural areas compared to urban areas, coupled with less competition for banking services, creates substantial growth prospects for the USFB in rural regions. Based on FY23 earnings, USFB is offering the PE of 6.77x on the upper price band against the industry average of 67.78x. And we recommend investors to apply to the offering.

Utkarsh Small Finance Bank IPO FAQ:

Ans.

Utkarsh Small Finance Bank IPO is a main-board IPO of 200,000,000 equity shares of the face value of ₹10 aggregating up to ₹500.00 Crores. The issue is priced at ₹23 to ₹25 per share. The minimum order quantity is 600 Shares.

The IPO opens on Jul 12, 2023, and closes on Jul 14, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Utkarsh Small Finance Bank IPO opens on Jul 12, 2023 and closes on Jul 14, 2023.

Ans. Utkarsh Small Finance Bank IPO lot size is 600 Shares and the minimum order quantity is .

Ans. The Utkarsh Small Finance Bank IPO listing date is not yet announced. The tentative date of Utkarsh Small Finance Bank IPO listing is Monday, 24 July 2023.

Ans. The minimum lot size for this upcoming IPO is 600 shares.