Vishnu Prakash R Punglia Limited IPO Company Details:

Vishnu Prakash R Punglia Limited is an ISO certified integrated engineering, procurement and construction (“EPC”) company with experience in design and construction of various infrastructure projects for the Central and State Government, autonomous bodies, and private bodies across 9 States and 1 Union territory in India. The company takes on projects using an EPC model, either with or without operation and maintenance (“O&M”) services. The range of its services includes project engineering in detail, the acquisition of necessary materials, project execution on the job sites, and overall project management up until the projects are put into service. In accordance with its contractual obligations, it takes on project operation and maintenance. The company executes a variety of projects on a turnkey basis because of its strong engineering ability, fleet of equipment, and staff resources.

| IPO-Note | Vishnu Prakash R Punglia Limited |

| Rs.94 – Rs.99 per Equity share | Recommendation: Subscribe |

Vishnu Prakash R Punglia Limited IPO Business Offerings:

-

Water Supply Projects (“WSP”) – Survey, design, construction, , operation, maintenance, and management of water supply projects (WSPs) including supply, laying and testing of pipelines; construction of water tanks, reservoirs, water treatment plants, pumping stations, etc

-

Railway Projects – Laying of railway tracks, construction of platforms, major & minor bridges, station buildings, staff quarters, signal and telecommunication building.

-

Road Projects – Construction and strengthening of roads and highways on EPC mode, including major & minor bridges, culverts.

-

Irrigation Network Projects – Survey, design, construction, operation, maintenance, and management of irrigation network including construction of tunnels, canals, raw water reservoirs, pumping stations, pressurized piping system, sewerage treatment plants etc.

Vishnu Prakash R Punglia Limited is accredited with various registrations as a contractor with various departments and agencies viz. Jodhpur Development Authority, Public Health Engineering Department, Water Resources Department, Rajasthan (Class AA), roads and Building Department, Gujarat (Class AA), South Western Command, Military Engineering Services (MES), Jaipur (Class ‘S’), Public Works Department, Chhattisgarh (Class A), Madhya Pradesh, Bhopal (Civil works), pursuant to which the company is also eligible to participate and undertake projects awarded by various other departments and agencies. In 2021, company was awarded a WSP by the Public Health Engineering Department (“PHED”), Manipur worth ₹433.29 cr as against a WSP awarded to it (as a partnership firm) by PHED, Rajasthan in 2002 of ₹1.98 cr.

Vishnu Prakash R Punglia Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To fund capital expenditure

· To fund the working capital requirements |

| Issue Size | Total issue Size – Rs.308.88 Cr.

Fresh Issue – Rs.308.88 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.94 – Rs.99 |

| Bid Lot | 150 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 24th Aug, 2023 – 28th Aug, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Vishnu Prakash R Punglia Limited IPO Allotment Status

Vishnu Prakash R Punglia Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Vishnu Prakash R Punglia Limited IPO Financial Analysis :

| Particulars | 9M of FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from Operations | 712.70 | 785.61 | 485.73 | 373.15 | 45.1% |

| Other Income | 1.57 | 1.77 | 1.94 | 2.24 | |

| Cost of Goods Sold | -142.26 | -71.48 | -3.70 | -18.39 | |

| Purchase Cost | 330.01 | 345.62 | 147.40 | 121.50 | |

| Employee Cost | 18.58 | 14.97 | 10.09 | 9.54 | |

| Construction Expenses | 404.51 | 400.13 | 278.67 | 215.40 | |

| Other expenses | 9.63 | 9.50 | 7.91 | 7.16 | |

| EBITDA | 93.80 | 88.64 | 47.32 | 40.18 | 48.5% |

| EBITDA margin% | 13.16% | 11.28% | 9.74% | 10.77% | |

| Depreciation | 4.89 | 4.19 | 4.10 | 4.17 | |

| Interest | 20.48 | 24.07 | 17.54 | 17.65 | |

| Profit / (loss) before tax | 68.43 | 60.38 | 25.68 | 18.36 | 81.4% |

| Total tax | 17.70 | 15.53 | 6.70 | 5.70 | |

| Profit / (loss) After tax | 50.74 | 44.85 | 18.98 | 12.66 | 88.3% |

| Profit / (loss) After tax margin% | 7.12% | 5.71% | 3.91% | 3.39% |

Vishnu Prakash R Punglia Limited IPO Revenue from Operations:

| Segment | 9M of FY-23(in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | CAGR |

| Revenue from Contracts with Customers | |||||||||

| Sale of Services | |||||||||

| Work Contract Services | 706.563 | 99.14% | 781.556 | 99.48% | 484.449 | 99.74% | 372.093 | 99.72% | 44.9% |

| Sale of Products | 5.638 | 0.79% | 3.654 | 0.47% | 1.282 | 0.26% | 1.058 | 0.28% | 85.8% |

| Other Operating Revenues | 0 | 0 | 0 | ||||||

| Technical & Professional Services | 0.5 | 0.07% | 0.403 | 0.05% | 0 | 0.00% | 0 | 0.00% | |

| Total | 712.70 | 100% | 785.61 | 100% | 485.73 | 100% | 373.15 | 100% | 45.1% |

Vishnu Prakash R Punglia Limited IPO Major Shareholders :

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 90.45% | 67.81% |

| Others | 9.55% | 32.19% |

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1. | Vishnu Prakash Punglia | 13,125,000 | 14.05 |

| 2. | Ajay Pungalia | 9,600,000 | 10.27 |

| 3. | Kamal Kishor Pungalia | 8,400,000 | 8.99 |

| 4. | Sanjay Kumar Punglia | 8,310,000 | 8.89 |

| 5. | Manohar Lal Punglia | 8,220,000 | 8.8 |

| 6. | Vijay Punglia | 8,190,000 | 8.76 |

| 7. | Anil Punglia | 8,100,000 | 8.67 |

| 8. | Pushpa Pungalia | 7,590,000 | 8.12 |

| 9. | Pushpa Devi Pungalia | 7,110,000 | 7.61 |

| 10. | Mamta Pungaliya | 1,500,000 | 1.61 |

| 11. | Nitu Punglia | 1,500,000 | 1.61 |

| 12. | Pooja Punglia | 1,500,000 | 1.61 |

| TOTAL | 83,145,000 | 88.98 |

Vishnu Prakash R Punglia Limited IPO Strengths:

-

Vishnu Prakash R Punglia Limited is a focused player in WSPs. The company has over thirty-six years of experience in executing WSPs and has executed more than fifty WSPs and developed financial strength and managerial capabilities, thereby motivating it to venture into new segments like railways, roads and various other segments.

-

As on December 31, 2022, Vishnu Prakash R Punglia Limited has on-going projects aggregating ₹56,53.43 cr, of which ₹18,16.8 cr worth of work has been executed and balance ₹38,36.2 cr form part of its Order Book. The company has been able to achieve and maintain such Order Book positions due to continued focus on its core areas and ability to successfully bid and win new projects across multiple segments and this would provide it with sustainable growth and ability to enhance shareholders’ value in the future.

-

The company’s in-house integrated model ensures that products and services required for development and construction of a project meet quality standards and are delivered in a timely manner, thereby reducing contractual risks associated with third party suppliers.

-

Vishnu Prakash R Punglia Limited has established long lasting relationships with marquee client base. This has been made possible by virtue of its adaptability to changing client needs and its ability to successfully execute projects.

-

Vishnu Prakash R Punglia Limited benefits from its Promoters’ vision and leadership. It has a diversified Board of Directors, which is supplemented by a management team with experience in the EPC sector and a proven track record of performance.

- VPRPL has over 36 years of expertise and has successfully completed more than 50 WSPs. Its strong managerial and financial capabilities have enabled it to diversify into new verticals including railways, road and others.

- ’s in-house integrated model ensures that products and services required for development and construction of a project meet quality standards and are delivered in a timely manner, thereby reducing contractual risks associated with third party suppliers.

- The business has established long-term relationships with marquee clients by adjusting to changing customer needs and efficiently completing projects.

Vishnu Prakash R Punglia Limited IPO Risk Factors:

- There are certain outstanding litigations involving Vishnu Prakash R Punglia Limited, its business operations and reputation could be impacted if these litigations yield unfavourable outcomes.

- Vishnu Prakash R Punglia Limited derives a significant portion of its revenues from its top 5 clients. The loss of any significant clients may have an adverse effect on its business, financial condition, results of operations, and prospect.

- Vishnu Prakash R Punglia Limited is working capital intensive involving relatively long implementation periods which require substantial financing for its business operations. The company indebtedness and the conditions and restrictions imposed on by its financing arrangements could adversely affect its ability to conduct its business.

- There are certain outstanding litigations involving VPRPL, its business operations and reputation could be impacted if these litigations yield unfavorable outcomes.

- The co.’s business is mostly focused in Rajasthan; comprised 61.5% of its revenue as of 15th July, 2023. If the company fails to mitigate the concentration risk, it may not be able to develop its business effectively.

Vishnu Prakash R Punglia Limited IPO Key Highlights:

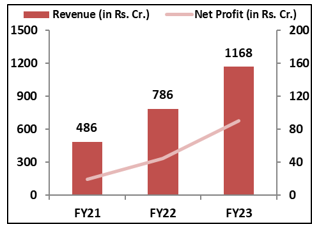

- Revenue of the co. has increased from Rs.486 Cr. in FY21 to Rs.1,168 Cr. in FY23 with a CAGR of 34% and the Net Profit has increased from Rs.19 Cr. to Rs.91 Cr. during the same period with a CAGR of 68.4%.

- Cash flow from operating activities has decreased from Rs.34.8 cr. in FY21 to negative Rs.8.4 cr. in FY23.

- ’s EBITDA Margin & PAT Margin stands at 13.7% & 7.8% respectively in FY23.

- As of March, 2023, ROCE and ROE ratio of the co. is 33.7% and 38.3%.

- Debt to Equity of the co. has decreased from 0.98 in FY21 to 0.80 in FY23.

- As of 15th July 2023, co.’s order book stands at Rs.3,799.53 cr.

Vishnu Prakash R Punglia Limited IPO OBJECTS OF THE ISSUE:

Vishnu Prakash R Punglia Limited proposes to utilize the Net Proceeds towards funding the following objects:

1.Funding capital expenditure requirements for the purchase of equipment/machineries

2.Funding the working capital requirements of company

3.General corporate purposes.

Vishnu Prakash R Punglia Limited IPO Outlook:

VPRPL is a dynamic infrastructure development company specializing in road, railway, irrigation, and water supply projects. They offer end-to-end services from project engineering to execution and management, often on a turnkey basis due to their robust engineering, equipment, and staffing capabilities. As of 15th July, 2023, the co.’s order book majorly consists WSPs accounting for 77.89%, followed by railway projects at 10.05%, ~8% for road projects & remaining 4% allocated to sewerage and other projects. VPRPL is offering the P/E of 13.6x on the upper price band compared to the industry average of 17.22x, which seems attractive. The Indian infrastructure sector, a key driver of the economy, offers the co. significant growth prospects. Additionally, government initiatives in infrastructure, waste management, road and railway projects outlined in the Union budget 2023-24 will likely benefit the company. Given its diverse business segments, strong financials, numerous growth opportunities, and a healthy order book, we recommend subscribing to the issue.

Vishnu Prakash R Punglia Limited IPO FAQ

Ans. Vishnu Prakash R Punglia IPO is a main-board IPO of 31,200,000 equity shares of the face value of ₹10 aggregating up to ₹308.88 Crores. The issue is priced at ₹94 to ₹99 per share. The minimum order quantity is 150 Shares.

The IPO opens on Aug 24, 2023, and closes on Aug 28, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Vishnu Prakash R Punglia IPO opens on Aug 24, 2023 and closes on Aug 28, 2023.

Ans. Vishnu Prakash R Punglia IPO lot size is 150 Shares, and the minimum amount required is ₹14,850.

Ans. The Vishnu Prakash R Punglia IPO listing date is not yet announced. The tentative date of Vishnu Prakash R Punglia IPO listing is Tuesday, 5 September 2023.

Ans. The minimum lot size for this upcoming IPO is 150 shares.