Gopal Snacks IPO Company Details:

Gopal Snacks Limited, a well-known FMCG company, was founded in 1999 and distributes a variety of different items, along with ethnic and western snacks, throughout 10 Indian states and two union territories. Under the ‘Gopal’ brand, the company sells a wide range of savory products. These include western snacks like wafers, extruded snacks, and snack pellets as well as traditional treats like namkeen and gathiya. Fast-moving consumer items such papad, spices, besan (gram flour), noodles, rusk, and soan papdi are also offered. with a broad range of products, comprising 276 SKUs in 84 distinct categories. With 5.33 locations in India, Gopal Snacks sells 8.01 million packets a day, catering to a diverse range of tastes and preferences. As of September 30, 2023, its strong distribution network included three depots and 617 distributors, all of whom were backed by a committed team of 741 sales and marketing personnel. To help with distribution, the corporation keeps a fleet of 263 logistical vans. Six manufacturing sites are run by Gopal Snacks: three main sites are in Nagpur, Maharashtra; Rajkot, Gujarat; and Modasa, Gujarat; three subsidiary sites are in Rajkot, Gujarat; and one is in Modasa, Gujarat.

| IPO-Note | Gopal Snacks Limited |

| Rs.381 – Rs.401 per Equity share | Recommendation: Apply for Listing Gains |

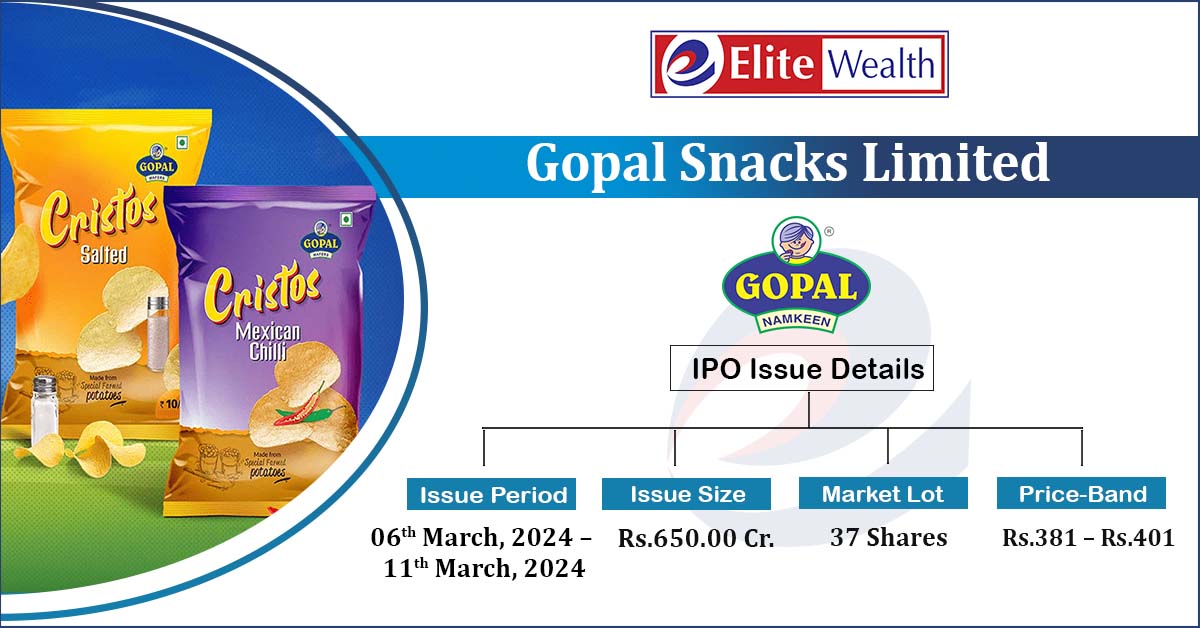

Gopal Snacks IPO Details:

| Issue Details | |

| Objects of the issue | · Funding working capital requirements

· Investment in the Associate, viz. Ento Proteins Private Limited, for funding its working capital requirements |

| Issue Size | Total issue Size – Rs.650.00 Cr.

Offer For Sale – Rs.650.00 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.381 – Rs.401 |

| Bid Lot | 37 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 06th Mar, 2024 – 11th Mar, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Gopal Snacks IPO Strengths:

-

-

A well-known participant in the Indian snack food industry with a focus on ethnic savory foods and a solid presence in Gujarat that enhances brand recognition with high-quality and varied products.

-

With a varied range of products, the company is well-positioned to take advantage of the growing Indian snack industry.

-

Having established itself as one of India’s top producers of gathiya, the company is taking advantage of the growing market for these snacks to look for new growth opportunities.

-

Manufacturing facilities that are positioned strategically to maximize productivity. Vertically integrated company operations guaranteeing superior product quality and efficient, low-cost procedures.

-

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Gopal Snacks IPO Allotment Status

Gopal Snacks IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Gopal Snacks IPO Risk Factors:

-

Eight notices under the Food Safety and Standards Act of 2006 have been sent to the company. Seasonality affects business operations; fewer revenues are anticipated outside of holidays and during summer breaks from school, which could have an effect on the performance of the organization.

-

Because the company operates in a competitive market, any rise in competition could be detrimental to it.

-

A number of causes could cause revenue from operations, EBITDA, EBITDA margins, PAT, and PAT margins to decrease in the future.

-

A number of legal and regulatory processes engage or may involve the Company, its Promoters, and its Directors. Noncompliance with food safety rules, environmental regulations, and other relevant requirements pertaining to industrial facilities may have an adverse effect on the enterprise.

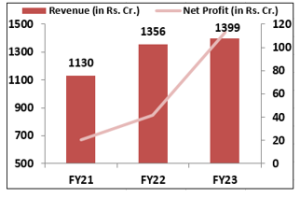

Gopal Snacks IPO Financial Performance:

Gopal Snacks IPO Shareholding Pattern:

Gopal Snacks IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 93.5% | 80.49% |

| Others | 6.5% | 19.51% |

Source: RHP, EWL Research

Gopal Snacks IPO Outlook:

Prominent FMCG brand Gopal Snacks Limited has a sizable customer base, a robust distribution network, and a varied product line. The business has shown that its financial performance is good. Notwithstanding these advantages, prospective investors are urged to thoroughly consider all pertinent considerations, including the issue price. To guarantee the best possible outcomes, a comprehensive evaluation is advised prior to taking part in the IPO.

Company is looking good valuation wise as it is priced at a P/E of 44.14 whereas the competitors are at a higher P/E which averages around 121.27. And we recommend investors to apply for listing gains.

Gopal Snacks IPO FAQ

Ans. Gopal Namkeen IPO is a main-board IPO of 16,209,476 equity shares of the face value of ₹1 aggregating up to ₹650.00 Crores. The issue is priced at ₹381 to ₹401 per share. The minimum order quantity is 37 Shares.

The IPO opens on March 6, 2024, and closes on March 11, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Gopal Namkeen IPO opens on March 6, 2024 and closes on March 11, 2024.

Ans. Gopal Namkeen IPO lot size is 37 Shares, and the minimum amount required is ₹14,837.

Ans. The Gopal Namkeen IPO listing date is not yet announced. The tentative date of Gopal Namkeen IPO listing is Thursday, March 14, 2024.

Ans. The minimum lot size for this upcoming IPO is 37 shares.