Happy Forgings Limited IPO Company Details:

Happy Forgings Limited (HFL) ranks fourth in India among engineering-led manufacturers of heavy forged, highly precision machined, complex, and safety-critical components (Source: Ricardo Report). The company is involved in engineering, process design, testing, manufacture, and delivery of a range of margin-accretive and value-added components through its vertically integrated businesses. It mainly serves domestic and international original equipment manufacturers (“OEMs”) that produce commercial vehicles for the automotive industry. In the non-automotive industry, company serves producers of farm equipment, off-highway vehicles, industrial equipment, and machinery for the power generation, wind turbine, oil and gas, and railroad sectors. In terms of market share, HFL provides all five of the top Indian OEMs in the medium- and heavy-commercial vehicle market and four of the top five Indian OEMs in the farm equipment market in FY23. Some of its customers are Ashok Leyland, SML ISUZU Limited, Swaraj Engines and JCB India.

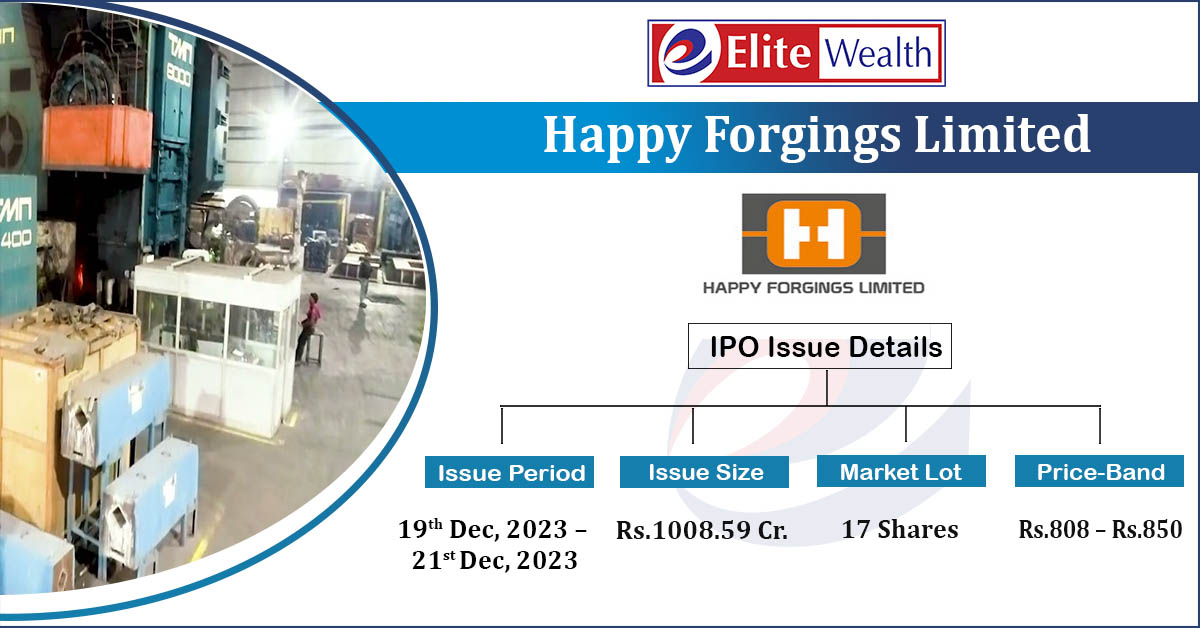

Happy Forgings Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To purchase equipment, plant & machinery · To pay borrowings · To gain the listing benefits |

| Issue Size | Total issue Size – Rs.1008.59 Cr.

Fresh Issue – Rs.400 Cr. Offer for Sale – Rs.608.59 Cr. |

| Face value |

Rs.2 |

| Issue Price | Rs.808 – Rs.850 |

| Bid Lot | 17 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 19th Dec, 2023 – 21st Dec, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Happy Forgings Limited IPO Strengths:

- HFL is Fourth largest engineering led manufacturer of complex and safety critical, heavy forged and high precision machined components in India.

- The business model of the company is diversified, positioning it to capitalize on potential advances in alternative engine technology.

- Company has Long-standing relationships with key customers across industries.

- It has strong track record of consistently building capabilities and infrastructure, with focus on capital efficiency.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Happy Forgings Limited IPO Allotment Status

Muthoot Happy Forgings Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Happy Forgings Limited IPO Key Highlights:

-

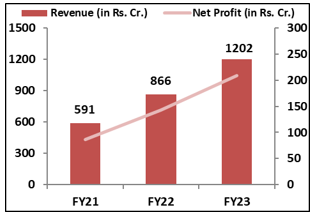

Revenue of the co. has increased from Rs.591 Cr. in FY21 to Rs.1202 Cr. in FY23 with a strong CAGR of 26.7%; while its profits have grown from Rs.86 cr. in FY21 to Rs.209 cr. in FY23 with a CAGR of 34%.

-

Co’s EBITDA Margin & PAT Margin are promising and stand at 28.4% & 17.4% respectively in FY23.

-

As of FY23, ROCE & ROE ratios are healthy at 24.24% and 21.12% respectively.

-

As of 30th Sep, 2023, debt to equity of the co. stands at comfortable level of 0.2x.

Happy Forgings Limited IPO Risk Factors:

-

Top 10 customers of the co. generate ~70% of their revenue, loss of any such customers would impact the business of the co.

-

HFL depends on a few number of supplier for the supply of steel, its primary raw material. Also it doesn’t have any supply agreements with such suppliers. Any interruption in the supply of steel could impact co.’s business operations.

-

derives 45% of revenue from the sale of crankshafts, loss or reduction in sales could affects its financials and business.

Happy Forgings Limited IPO Financial Performance:

Happy Forgings Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 88.24% | 76.23% |

| Others | 11.76% | 23.77% |

Source: RHP, EWL Research

Happy Forgings Limited IPO Outlook:

HFL has established itself as a major player in the domestic crankshaft manufacturing market with the second largest production capacity for commercial vehicle and high horse power industrial crankshafts in India. HFL has over 40 years of experience manufacturing and supplying quality and complex components according to customer specifications. Company has diversified product portfolio, strong market position along with key customers. However, it currently doesn’t cater to rapidly growing EV market which can be a setback for the company in the future. The company is focusing on foraying into lightweight forging and machining and expanding its manufacturing facilities. Leveraging in-house engineering and product development capabilities to grow its product portfolio and tapping growing business opportunities in the industrial markets are also among its strategies. HFL is offering the P/E of 38.37x on the upper price band which seems very reasonable compared to the industry average of 70.37x. Considering its strong fundamentals, leadership position and potential for future growth, we recommend investors to consider applying in the offering.

Happy Forgings Limited IPO FAQ

Ans. Happy Forgings IPO is a main-board IPO of [.] equity shares of the face value of ₹2 aggregating up to ₹1,008.59 Crores. The issue is priced at ₹808 to ₹850 per share. The minimum order quantity is 17 Shares.

The IPO opens on December 19, 2023, and closes on December 21, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Happy Forgings IPO opens on December 19, 2023 and closes on December 21, 2023.

Ans. Happy Forgings IPO lot size is 17 Shares, and the minimum amount required is ₹14,450.

Ans. The Happy Forgings IPO listing date is not yet announced. The tentative date of Happy Forgings IPO listing is Wednesday, December 27, 2023.

Ans. The minimum lot size for this upcoming IPO is 17 shares.