RR Kabel IPO Details:

RR Kabel Limited (RRKL) is one of the leading and fastest growing companies in the Indian consumer electrical industry (comprising wires and cables and fast-moving electrical goods (“FMEG”)), with an operating history of over 20 years in India. It is growing at a CAGR of 43.4% between Fiscal 2021 and Fiscal 2023. It is the fifth largest player in the wires & cables market and branded wires & cables in India, representing approximately 5% and 7% market share respectively by value as of March 31, 2023. Co. sell products across two broad segments – i) wires and cables including house wires, industrial wires, power cables and special cables; and (ii) FMEG including fans, lighting, switches and appliances. In FY20, co. amalgamated the business from one of its group companies, Ram Ratna Electricals Limited (“RREL”), also acquired the light emitting diode (“LED”) lights and related hardware business (“LED Lights Business”) of Arraystorm Lighting Private Limited (“Arraystorm”). In May 2022, it acquired the corresponding home electrical business (“HEB”) of Luminous Power Technologies Private Limited (“Luminous”) and obtained a limited and exclusive license to use the ‘Luminous Fans and Lights brand for fan and light products including a portfolio of lights and premium fans, to strengthen its FMEG portfolio.

| IPO-Note | RR Kabel Limited |

| Rs.983 – Rs.1035 per Equity share | Recommendation: Aggressive investors may apply |

RR Kabel IPO Business Offerings:

- Wires and cables including house wires, industrial wires, power cables, and special cables.

- FMEG including fans, lighting, switches, and appliances.

- Professional and trade lighting products.

RR Kabel Limited has actively diversified and expanded its product portfolio. In Fiscal 2020, the company amalgamated the business from one of its group companies, Ram Ratna Electricals Limited (“RREL”), also acquired the light emitting diode (“LED”) lights and related hardware business (“LED Lights Business”) of Arraystorm Lighting Private Limited (“Arraystorm”). In May 2022, it acquired the corresponding home electrical business (“HEB”) of Luminous Power Technologies Private Limited (“Luminous”) and obtained a limited and exclusive license to use the ‘Luminous Fans and Lights brand for fan and light products including a portfolio of lights and premium fans, to strengthen its FMEG portfolio.

RR Kabel IPO Details:

| Issue Details | |

| Objects of the issue | · To pay borrowings

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.1964.01 Cr.

Fresh Issue – Rs.180 Cr. Offer for Sale – Rs.1784.01 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.983 – Rs.1035 |

| Bid Lot | 14 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 13th Sep, 2023 – 15th Sep, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check RR Kabel IPO Allotment Status

Go RR Kabel IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

RR Kabel IPO Financial Analysis :

| Particulars | 9M FY-23 (in cr.) | 9M FY-22(in cr.) | FY-22

(in cr.) |

FY-21 (in cr.) | FY-20

(in cr.) |

CAGR |

| Revenue from Operations | 4082.68 | 2988.54 | 4385.94 | 2723.94 | 2478.52 | 33.0% |

| Other Income | 20.60 | 30.12 | 46.28 | 22.00 | 27.02 | |

| Cost of Goods Sold | 3351.91 | 2448.11 | 3607.98 | 2149.22 | 1925.26 | 36.9% |

| Employee Cost | 192.95 | 136.05 | 188.85 | 148.35 | 135.77 | |

| Other expenses | 315.89 | 178.12 | 285.85 | 196.23 | 212.71 | |

| EBITDA | 242.53 | 256.39 | 349.53 | 252.14 | 231.80 | 22.8% |

| EBITDA margin% | 5.94% | 8.58% | 7.97% | 9.26% | 9.35% | |

| Depreciation | 45.97 | 34.19 | 46.08 | 44.75 | 38.80 | |

| Interest | 29.14 | 17.85 | 23.28 | 27.06 | 35.25 | |

| Share of profit/(loss) of joint venture net of tax | 0.28 | 2.89 | 4.20 | 1.10 | -0.08 | |

| Profit / (loss) before tax | 167.70 | 207.24 | 284.36 | 181.43 | 157.68 | 34.3% |

| Total tax | 43.12 | 51.21 | 70.42 | 46.04 | 35.28 | |

| Profit / (loss) After tax | 124.58 | 156.03 | 213.94 | 135.40 | 122.40 | 32.2% |

| Profit / (loss) After tax margin% | 3.05% | 5.22% | 4.88% | 4.97% | 4.94% |

RR Kabel IPO Revenue from Operations:

| Segment | 9M FY-23(in cr.) | % | 9M FY-22(in cr.) | % | FY-22 (in cr.) | % | FY-21 (in cr.) | % | FY-20 (in cr.) | % | CAGR |

| Revenue from contract with customers | |||||||||||

| Sales of products | |||||||||||

| Finished goods | 3704.783 | 90.74% | 2589.15 | 86.64% | 4108.203 | 93.67% | 2521.07 | 92.55% | 2303.159 | 92.92% | 33.6% |

| Traded goods | 332.879 | 8.15% | 349.078 | 11.68% | 211.099 | 4.81% | 152.261 | 5.59% | 133.382 | 5.38% | 25.8% |

| Other operating revenues : | |||||||||||

| Sale of scrap | 44.369 | 1.09% | 50.124 | 1.68% | 66.38 | 1.51% | 44.213 | 1.62% | 33.506 | 1.35% | 40.8% |

| Processing charges | 0.207 | 0.01% | 0.185 | 0.01% | 0.254 | 0.01% | 0.217 | 0.01% | 0.268 | 0.01% | -2.6% |

| Export incentives | 0.442 | 0.01% | 0 | 0.00% | 0 | 0.00% | 6.18 | 0.23% | 8.204 | 0.33% | |

| Total | 4082.68 | 100% | 2988.54 | 100% | 4385.94 | 100% | 2723.94 | 100% | 2478.52 | 100% | 0.97 |

RR Kabel IPO Major Shareholders:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 66.42% | 50.12% |

| Others | 33.58% | 49.88% |

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1 | TPG Asia VII SF Pte. Ltd. | 23,333,072 | 21.00% |

| 2 | Mahendrakumar Rameshwarlal Kabra | 8,648,588 | 7.78% |

| 3 | Tribhuvanprasad Rameshwarlal Kabra | 6,896,889 | 6.21% |

| 4 | Hemant Mahendrakumar Kabra | 6,799,436 | 6.12% |

| 5 | Mahhesh Tribhuvanprasad Kabra | 5,872,077 | 5.28% |

| 6 | Kirtidevi Shreegopal Kabra | 5,656,308 | 5.09% |

| 7 | Sumeet Mahendrakumar Kabra | 5,537,324 | 4.98% |

| 8 | Ram Ratna Research and Holdings Private Limited | 5,078,464 | 4.57% |

| 9 | Sarita Jhawar | 4,779,881 | 4.30% |

| 10 | Vvidhi Mahhesh Kabra | 4,738,045 | 4.26% |

| 11 | Shreegopal Rameshwarlal Kabra | 4,629,232 | 4.17% |

| 12 | Rajesh Shreegopal Kabra | 4,101,812 | 3.69% |

| 13 | Kabra Shreegopal Rameshwarlal HUF | 3,961,160 | 3.56% |

| 14 | Asha Muchhal | 3,308,524 | 2.98% |

| 15 | Priti Amit Saboo | 2,684,524 | 2.42% |

| 16 | MEW Electricals Limited | 2,236,000 | 2.01% |

| 17 | Mamta Ashok Loya | 2,160,000 | 1.94% |

| 18 | Tribhuvanprasad Kabra HUF | 1,436,000 | 1.29% |

| 19 | Ram Ratna Wires Limited | 1,364,480 | 1.23% |

| 20 | Jag-Bid Finvest Private Limited | 1,344,000 | 1.21% |

| 21 | Monal Rajesh Kabra | 1,200,000 | 1.08% |

| 22 | Mahendra Kumar Kabra HUF | 1,154,208 | 1.04% |

| Total | 106,920,024 | 96.22% |

RR Kabel IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

|

| 1. | Mahendrakumar Rameshwarlal Kabra | 754,417 Equity Shares | |

| 2. | Hemant Mahendrakumar Kabra | 754,417 Equity Shares | |

| 3. | Sumeet Mahendrakumar Kabra | 754,417 Equity Shares | |

| 4. | Kabel Buildcon Solutions Private Limited | 707,200 Equity Shares | |

| 5. | Ram Ratna Wires Limited | 1,364,480 Equity Shares | |

| 6. | TPG Asia VII SF Pte. Ltd. | 12,901,877 Equity Shares | |

RR Kabel IPO Strengths:

-

RR Kabel Limited is well-positioned to capture a significant share of this industry’s growth due to its existing market share, its brand recognition, diversified product portfolio, ability to innovate, its scale of operations, its sizeable and certified manufacturing facilities, infrastructure, quality, and safety of its products and the reach of its distribution network.

-

RR Kabel Limited manufactures and sells a diverse portfolio of products across categories, giving it an opportunity to cross-sell its product. The company has been investing in global trends and has built capabilities to cater to the growing demand for such products as cables used by telecom operators which roll out electric vehicle (“EV”) charging cables, 5G capabilities, designer lights, and smart fans.

-

RR Kabel Limited’s distribution footprint encompasses both domestic sales and export sales. As on December 31, 2022, it has 33 warehouses across 19 states and union territories in India. It has a focused approach to expanding its geographical market share in India by identifying micro and nano markets for a specific product. As of 2021, it is the largest exporter of wires and cables from India, in terms of value, representing approximately 11% market share of the export market from India.

-

RR Kabel Limited is the fastest-growing consumer electrical company amongst its peers in India. Its focus on safety, quality, and continuous innovation, together with its distribution network, connection with electricians, and its digital and physical marketing efforts have enabled it to develop brand recognition in the consumer electrical industry.

-

RR Kabel Limited is a technologically advanced and integrated precision manufacturing facility. Its manufacturing facilities are subjected to rigorous quality control checks, accreditation requirements, and periodic inspections. Its manufacturing facilities and warehouses are strategically located to achieve a shorter time to market, greater cost competitiveness, and responsiveness of its inventory positions to changes in the portfolio market as a result of proximity, thereby allowing it to cater to domestic and international markets.

-

RRKL is India’s fastest-growing consumer electrical co., known for its safety, quality, innovation, and strong brand recognition, fostered by strong distribution network, electrician connections, and effective marketing efforts.

-

It is a technologically advanced precision manufacturer with strategically located facilities. It meets rigorous quality standards and caters to domestic and international markets.

RR Kabel IPOKey Highlights:

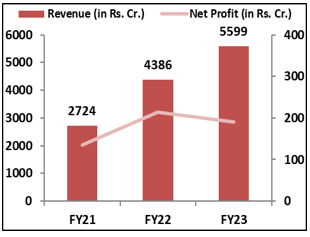

- Revenue of the co. has increased from Rs.2724 Cr. in FY21 to Rs.5599 Cr. in FY23 with a CAGR of 27%; Net Profit also increased from Rs.135 Cr. in FY21 to Rs.190 Cr. in FY23 with a CAGR of 11.9%

- ’s EBITDA Margin & PAT Margin stands at 6.4% & 3.4% respectively in FY23.

- As of March, 2023, ROCE and ROE ratio of the co. is 15.57% and 14.22%.

- Debt to Equity ratio is decreasing over the years & currently stands at 0.36.

RR Kabel IPO Risk Factors:

-

RR Kabel Limited’s operations are dependent upon the price and availability of the raw materials that it requires for the production of its wires and cables and FMEGs. The total cost of materials consumed amounted to ₹1,823.95 crores, ₹2,173.20 crores, ₹ 3,575.52 crores, ₹ 2,467.82 crores, and ₹ 3,117.46 crores, accounting for 77.69%, 84.71%, 86.11%, 87.69% and 79.21%, respectively, of its total expenses in Fiscals 2020, 2021 and 2022.

-

Operating risks at RR Kabel Limited’s manufacturing facilities include equipment breakdown or failure, disruption in power supply or processes, performance below expected levels of efficiency, obsolescence, industrial accidents, and the need to comply with relevant government authorities’ directives.

-

RR Kabel Limited is exposed to the concentration risk of relying on a few distributors for its distribution to overseas markets. In Fiscals 2020, 2021, and 2022, and nine months ended December 2021 and 2022, its top ten overseas distributors accounted for 86.19%, 92.95%, 92.67%, 90.73% and 85.35% of its revenue from operations from outside India. There can be no assurance that it can continue to enter into distribution agreement with its material overseas distributors on commercially favourable terms or at all.

-

RR Kabel Limited requires substantial power and fuel for its manufacturing facilities, and its energy costs represent a significant portion of the production costs for its operations. Power outages can also cause production shutdowns, increased expenses associated with restarting production, and the loss of work in progress.

- relies on a few distributors for overseas sales; any disagreement with these distributors would affect its overseas operations.

- RRKL generates average ~22.4% of revenues from exports. International operations are subject to risks that are specific to each country and region in which it operate.

RR Kabel IPO Outlook:

RRKL focuses on consumer electrical products for residential, commercial, industrial, and infrastructure applications, operating within two core segments: Wires and Cables, and FMEG (Fans, Lighting, Switches, and Appliances). The co. has domestic as well as international presence and in the three months leading up to June 30, 2023, it derived 71% of its revenue from the wires and cables segment, while a remarkable 97% of its revenue was generated through the FMEG segment, largely through the B2C channel. Co. focuses to strengthen its position as one of the leading consumer electrical brands in India and also grow its international business a by implementing various strategies. Consumer electrical sector revenue was $1.8 trillion in FY23 and is anticipated to increase by 10% CAGR to $2.7 trillion in FY27.P/E of the RKKL stands at 61.5x on the upper price band compared to the industry average of 57.57x; which seems a bit overpriced. Co. faces challenges such as raw material price volatility and supply chain risks. With its robust brand, diversified product portfolio, innovation, extensive operations, certified facilities, infrastructure, quality, safety standards, and broad distribution network, the co. is well-positioned to capture significant share of industry growth. Considering all these factors we recommend high risk taking investors to subscribe to the offering.

RR Kabel IPO FAQ

Ans. R R Kabel IPO is a main-board IPO of 18,975,939 equity shares of the face value of ₹5 aggregating up to ₹1,964.01 Crores. The issue is priced at ₹983 to ₹1035 per share. The minimum order quantity is 14 Shares.

The IPO opens on September 13, 2023, and closes on September 15, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The R R Kabel IPO opens on September 13, 2023 and closes on September 15, 2023.

Ans. R R Kabel IPO lot size is 14 Shares, and the minimum amount required is ₹14,490.

Ans. The R R Kabel IPO listing date is not yet announced. The tentative date of R R Kabel IPO listing is Tuesday, September 26, 2023.

Ans. The minimum lot size for this upcoming IPO is 14 shares.