Rishabh Instruments Limited IPO Company Details:

Rishabh Instruments Limited (RIL) is a global energy efficiency solution company specialized in manufacturing, designing, and developing Test and measuring instruments as well as Industrial Control Products. The co. has a wide range of offerings and are designed to measure, control, record, analyze, and improve energy and processes effectively. Additionally, it offers complete solutions for accurate aluminum high-pressure die casting, catering to clients in industries including precision flow meter automation and automobile compressors. The co. is a global leader in manufacturing and supply of analog panel meters, and is among the leading global companies in terms of manufacturing and supply of low voltage current transformers. It currently has 3 production facilities in India and supports both domestic and foreign customers with the help of over 150 dealers based in India and an additional 270 dealers located across 70 worldwide locations

| IPO-Note | Rishabh Instruments Limited |

| Rs.418 – Rs.441 per Equity share | Recommendation: Avoid |

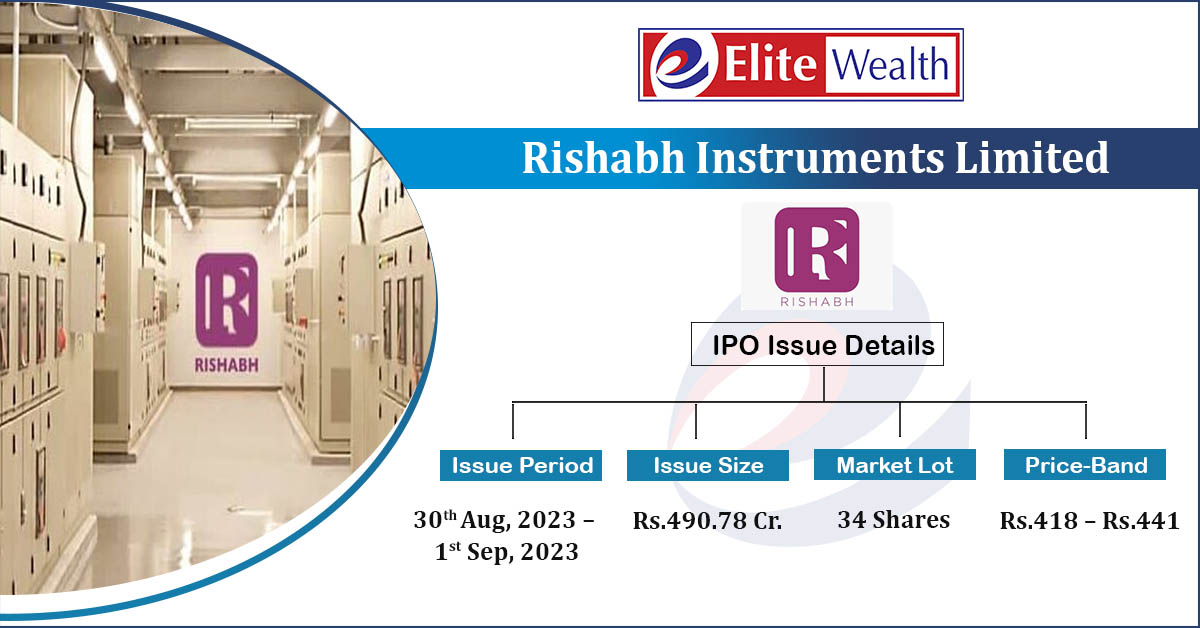

Rishabh Instruments Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To fund the expansion plan · To gain listing benefits |

| Issue Size | Total issue Size – Rs.490.78 Cr.

Fresh Issue – Rs.75 Cr. Offer for Sale – Rs.415.78 Cr. |

| Face value |

Rs.10 |

| Issue Price | Rs.418 – Rs.441 |

| Bid Lot | 34 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 30th Aug, 2023 – 1st Sep, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Rishabh Instruments Limited IPO Financial Analysis:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Rishabh Instruments Limited IPO Allotment Status

Rishabh Instruments Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Rishabh Instruments Limited IPO Strengths:

-

RIL is a global engineering solution provider operating in over 100 countries and is well positioned to benefit from the mega industrialization trends.

-

Co. is a technology and R&D focused enterprise which allows it to provide innovative and customizable solutions to its customers more efficiently.

-

It has a diversified product portfolio of over 145 product lines and a wide customer base in over 100 countries.

-

Its brands ‘Rishabh’, ‘Lumel’, ‘Sifam’ and ‘Tinsley’ are well recognized in multiple countries.

Rishabh Instruments Limited IPO Key Highlights:

-

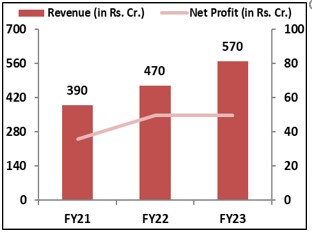

Revenue of the co. has increased from Rs.390 Cr. in FY21 to Rs.570 Cr. in FY23 with a CAGR of 13.5% and the Net Profit has increased from Rs.36 Cr. to Rs.50 Cr. during the same period with a CAGR of 11.4%.

-

Net Cash flow from operating activities has decreased from Rs.52.9 cr. in FY21 to Rs.27.5 cr. in FY23.

- Co.’s EBITDA Margin & PAT Margin stands at 15.2% & 8.7% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratio of the co. is 13.77% and 12.39%.

-

Debt to Equity of the co. has decreased from 0.31 in FY21 to 0.26 in FY23.

Rishabh Instruments Limited IPO Risk Factors:

-

- Co.’s Poland manufacturing facility aggregates 62.7% of the total units produced as of FY23. Any slowdown or shutdown in this manufacturing operations could have an adverse effect on co.’s business operation and financials.

- Co. do not commit long term contracts with most of its customers; any loss of these customers or cancellation of orders from these customers may affect co.’s business performance.

Rishabh Instruments Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 80.67% | 52.22% |

| Others | 19.33% | 47.78% |

Rishabh Instruments Limited IPO Outlook:

RIL is a vertically integrated player involved in designing, developing, manufacturing, and supplying i) Electrical Automation Devices, ii) Metering, Control, and Protection Devices, iii) Portable Test and Measuring Instruments and iv) Solar String Inverters. The co. serves more than 100 countries including India, Germany, US, UK & the middle east. In FY23, It generated ~34% & ~66% of the revenue from the Indian & overseas operations respectively. The co. had acquired Lumel Alucast in 2011, a non-ferrous pressure casting co. in Europe, which helped it to establish a strong foot in manufacturing and supply of low-voltage current transformers. Co. is further focusing in expanding its global footprint to other geographies through inorganic growth strategies. RIL is offering the P/E of 33.69x on the upper price band; co. has a diverse customer base and product line and is maintaining moderate margins that are poised to contribute positively to its future revenue. Co. operates as a global engineering solution provider in sizable markets & is strategically positioned to capitalize on significant industrialization trends in the longer run. However, a predicted downturn in major international markets could impact co.’s short-term performance. Thus, we advise investors to avoid this offering.