Concord Biotech IPO Company Profile :

Concord Biotech Limited (CBL) is a leading biopharma company based in India and is one of the world’s leading developers and manufacturers of fermentation-based APIs for cancer and immunosuppressants worldwide. The business serves more than 200 customers in over 70 countries throughout the world, including the USA, India, Europe, and Japan. In FY23, the company has two DSIR-approved R&D units with 148 members, including those with doctoral qualifications. Additionally, it operates three manufacturing facilities in Gujarat, consisting of API manufacturing units in Dholka and Limbasi, and a formulation manufacturing facility in Valthera. CBL manufactures its products mainly under immunosuppressants, anti-bacterial, oncology drugs and anti-fungal therapy areas.

| IPO-Note | Concord Biotech Limited |

| Rs.705 – Rs.741 per Equity share | Recommendation: Subscribe |

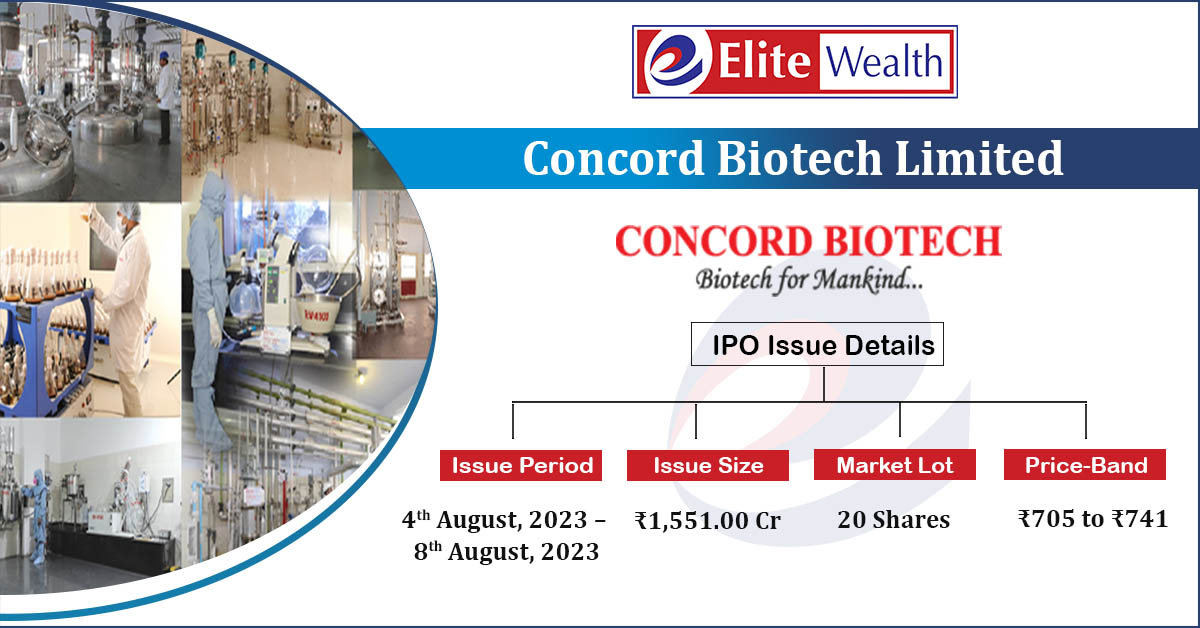

Concord Biotech IPO Details:

| Issue Details | |

| Objects of the issue | · To gain listing benefits |

| Issue Size | Total issue Size – Rs.1,551 Cr.

Offer for Sale – Rs.1,551 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.705 – Rs.741 |

| Bid Lot | 20 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 04th Aug, 2023 – 08th Aug, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Concord Biotech IPO Financial Performance:

Concord Biotech IPO Strengths:

-

The co. is a leading global developers and manufacturers of select fermentation-based APIs and commanded 20% market share by volume in 2022.

-

co.’s presence across the fermentation value chain demands specialized manufacturing expertise, intricate technological capabilities, and significant capital investment, making entry into the fermentation-based API industry a major challenge.

-

It has a diverse worldwide customer base with long-lasting relationships with key clients.

Concord Biotech IPO Key Highlights:

-

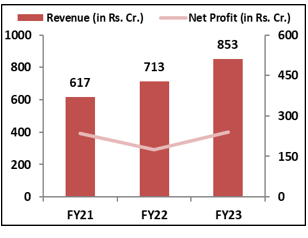

Revenue of the co. has increased from Rs.617 Cr. in FY21 to Rs.853 Cr. in FY23 with a CAGR of 11.4% and the Net Profit has marginally increased from Rs.235 Cr. to Rs.240 Cr. during the same period. Subdued profit growth was mainly due to the higher operating expense

-

CO’s EBITDA Margin & PAT Margin stands at 40.5% & 28% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratio of the co. is 24.27% and 20.06% respectively.

-

Current Debt to Equity ratio of the co. is 0.02 times.

Concord Biotech IPO Risk Factors:

-

Top 10 customers accounted ~44% of the total revenue in FY23, any loss of such customers may adversely affect company’s business.

-

The co. generates ~ 50% of its revenue from exports and is subject to significant risk of currency fluctuations.

-

The co.’s reliance on imported raw materials from China is a major risk factor for the business (Imported 32% of it from China in FY23). Any disruptions or restrictions to this supply could have a negative impact on the co.’s operations.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Concord Biotech IPOAllotment Status

Concord Biotech IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Concord Biotech IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 44.08% | 24.08% |

| Others | 55.92% | 75.92% |

Source: RHP, EWL Research

Concord Biotech IPO Outlook:

CBL is a significant player in the field of fermentation-based APIs for immunosuppressants and cancer in the global market. As of March 2023, its portfolio included six immunosuppressive APIs that were used in a wide range of markets. The company’s R&D capabilities have been essential in advancing technologies from research to commercialization. With the assistance of its 148-person R&D team, it has created and made 23 fermentation-based APIs available for purchase. CBL also provides contract research and manufacturing services to independent pharmaceutical firms. The small molecule fermentation-based APIs market is anticipated to grow at a CAGR of 3.6%. The Indian healthcare market is also expected to increase significantly between 2023 and 2026, with a CAGR of 8% to 10%. The co. has strong global presence with leadership in fermentation based APIs and is further focusing on increasing its API market share along with increasing the presence of its existing formulations and expanding into new formulations. CBL is offering the P/E of 32x on the upper price band compared to the industry average of 36x. The IPO is reasonably valued given its strong global presence and promising growth prospects in the pharma sector. Hence, we recommend investors to apply to the offering for longer term perspective.