SBFC Finance Limited IPO Company Profile :

SBFC Finance Limited is a systematically important, non-deposit taking non-banking finance company (“NBFC-ND-SI”) offering Secured MSME Loans and Loans against Gold, with a majority of its borrowers being entrepreneurs, small business owners, self-employed individuals, salaried and working-class individuals. Among MSME-focused NBFCs in India, SBFC Finance Limited has one of the highest assets under management (“AUM”) growth, at a CAGR of 40% in the period from Fiscal 2019 to Fiscal 2022. The company has also witnessed robust disbursement growth, at a CAGR of 39% between Fiscal 2019 and Fiscal 2022.

SBFC Finance Limited has a diversified pan-India presence, with an extensive network in the target customer segment. As of June 30, 2022, the company had an expansive footprint in 104 cities, spanning 16 Indian states and two union territories, with 135 branches. The geographically diverse distribution network, spread across the North, South, East, and West zones, allows the company to penetrate underbanked populations in tier II and tier III cities in India.

SBFC Finance Limited has set up stringent credit quality checks and customized operating procedures that exist at each stage for comprehensive risk management. The company primarily focuses on small enterprise borrowers, whose monthly income is up to ₹ 0.15 million, with a demonstrable track record of servicing loans such as gold loans, loans for two-wheeler vehicles and have a CIBIL score above 700 at the time of origination.

| IPO-Note | SBFC Finance Limited |

| Rs.54 – Rs.57 per Equity share | Recommendation: Apply for Listing Gains |

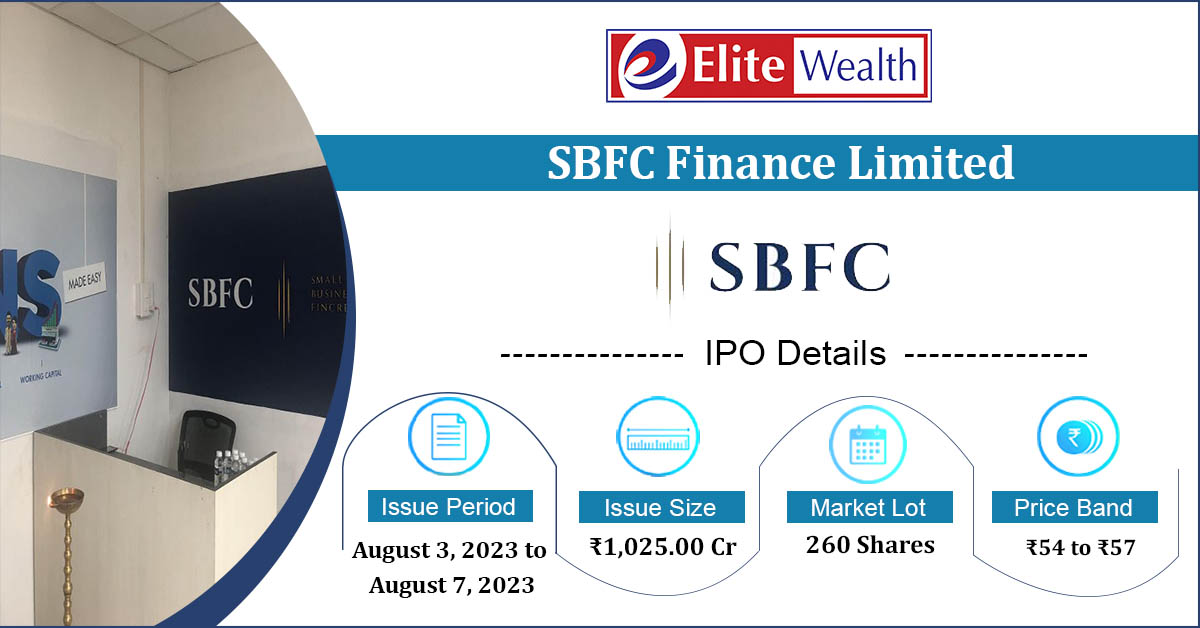

SBFC Finance Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To augment the capital base

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.1,025 Cr.

Fresh Issue – Rs.600 Cr. Offer for Sale – Rs.425 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.54 – Rs.57 |

| Bid Lot | 260 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 03rd Aug, 2023 – 07th Aug, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

SBFC Finance Limited IPO Financial Analysis:

| Particulars | Q1 FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Customers | 80073 | 72816 | 56587 | 40432 | 25.6% |

| AUM | 3628.26 | 3192.18 | 2221.32 | 1648.21 | 30.1% |

| Net Worth | 1571.88 | 1287.17 | 1205.11 | 1012.48 | 15.8% |

| PAT | 32.07 | 64.52 | 85.01 | 35.49 | 39.6% |

| ROE (%) | 2.24% | 5.18% | 7.67% | 3.75% | |

| Branches | 135 | 135 | 124 | 96 | 12.0% |

| Gross NPA ratio (%) | 2.68% | 2.74% | 3.16% | 2.28% | |

| Net NPA ratio (%) | 1.57% | 1.63% | 1.95% | 1.58% | |

| Average cost of borrowing (%) | 2.06% | 7.65% | 8.11% | 12.39% | |

| Provision Coverage Ratio (%) | 41.54% | 40.44% | 38.25% | 30.80% | |

| Average yield on Gross Loan Book (%) | 15.49% | 14.89% | 15.09% | 15.78% | |

| Net Interest Margin (%) | 9.40% | 9.39% | 11.73% | 11.69% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check SBFC Finance Limited IPOAllotment Status

SBFC Finance Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Pre-Offer shareholding of the Selling Shareholders:

| S. No. | Name of the Selling Shareholder | No. of Equity Shares

held |

Percentage of the pre-Offer paid

Up equity share capital (%) |

| 1. | SBFC Holdings Pte. Ltd. | 657,040,000 | 73.25% |

| 2. | Arpwood Partners Investment Advisors LLP | 122,217,177 | 13.62% |

| 3. | Arpwood Capital Private Limited | 29,995,300 | 3.34% |

| 4. | Eight45 Services LLP | 24,272,805 | 2.71% |

| Total | 833,525,282 | 92.92% |

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 80.48% | 65.51% |

| Others | 19.52% | 34.49% |

SBFC Finance Limited IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Maximum amount of Offered Shares( in ₹ crores) |

| 1. | SBFC Holdings Pte. Ltd. | Up to 275.00 |

| 2. | Arpwood Partners Investment Advisors LLP | Up to 398.19 |

| 3. | Arpwood Capital Private Limited | Up to 97.73 |

| 4. | Eight45 Services LLP | Up to 79.08 |

SBFC Finance Limited IPO Strengths:

-

SBFC Finance Limited has an expansive footprint in 104 cities, spanning 16 Indian states and two union territories, with 135 branches. This extent of the network allows the company to service its existing customers and attract new customers as a result of personal relationships cultivated through proximity and frequent interaction by the employees. This allows the company to expand its presence across the country more seamlessly than regional players

-

Most small businesses in India do not maintain documents such as income proof, business registration, GST registration, income tax filings, and bank statements, which makes access to credit challenging. SBFC Finance Limited believes that its understanding of the local characteristics of these markets and customers has allowed it to address the needs of low and middle-income customers and assisted it to penetrate deeper into such markets.

-

To ensure positive business outcomes, 100% of the loan portfolio has in-house origination, limiting the company’s reliance on direct selling agents or connectors in order to ensure a more direct, thorough understanding of the customer’s profile.

-

The company sources customers directly through our sales team of 1,594 personnel as of June 30, 2022, and has adopted a direct sourcing model through branch-led local marketing efforts, repeat customers, or walk-ins, which has helped the company maintain contact with its customers and establish strong relationships with them, high levels of customer satisfaction and increased loyalty. The AUM per employee has also increased from ₹ 14.29 million as of March 31, 2020, to ₹ 15.10 million as of March 31, 2021, to ₹ 15.59 million as of March 31, 2022, and was ₹ 15.26 million as of June 30, 2022.

-

SBFC Finance Limited’s risk management committee has developed risk management policies, addressing credit risk, market risk, liquidity risks, and operational risks. Leveraging significant operational experience, the company has set up stringent credit quality checks and customized operating procedures that exist at each stage for comprehensive risk management. The company’s focus is on the profile of the borrower, and as of June 30, 2022, 80.43% of the Secured MSME Loan customers have a CIBIL score above 700 at the time of origination, while 7.59% of the customers are new to the formal secured lending ecosystem.

-

Average yield on Gross Loan Book was 15.49%, with Secured MSME Loans and Loans against Gold accounting for 15.05% and 16.48%, respectively. The loan against Gold portfolio has grown from 25,862 customers as of March 31, 2020 to 42,931 customers, as of March 31, 2022 at a CAGR of 28.84%. The AUM has grown from ₹ 16,482.07 million as of March 31, 2020, to ₹ 31,921.81 million as of March 31, 2022 and was ₹ 36,282.62 million as of June 30, 2022, at a CAGR of 39.17% between Fiscal 2020 and Fiscal 2022

- The co. has a presence all across India, which enables it to serve its current clients and draw in new ones.

- The co. has also witnessed robust disbursement growth, at a CAGR of 39% between Fiscal 2019 and Fiscal 2022.

- The business uses a thorough framework for credit evaluation and risk management to recognise, track, and control operational risks.

SBFC Finance Limited IPO Key Highlights:

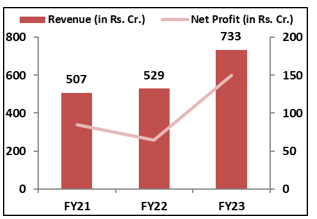

- Revenue of the co. has increased from Rs.507 Cr. in FY21 to Rs.733 Cr. in FY23 with a CAGR of 13% and the Net Profit has increased from Rs.85 Cr. to Rs.150 Cr. during the same period with a CAGR of 20.8%.

- ’s AUM has grown by avg. 44.5% during from FY21 to FY23 while credit cost to avg. AUM has declined to 0.79% from 1.74% during the same period.

- As of March, 2023, Net Interest Margin of the co. stand at 9.32%.

- Gross NPA and Net NPA of the co. is improving continuously and stands at 2.43% and 1.41% respectively at the end of FY23.

SBFC Finance Limited IPO Risk factors:

-

SBFC Finance Limited’s business is particularly vulnerable to interest rate risk, and volatility in interest rates for both lending and treasury operations could have an adverse effect on the net interest income and net interest margin, thereby affecting the results of operations and cash flows.

-

SBFC Finance Limited competes with Five-Star Business Finance Limited, Veritas Finance Private Limited, IIFL Finance, and Fedbank Financial Services Limited in the Secured MSME Loans segment, and Muthoot Finance, Manappuram Finance, IIFL Finance, Fedbank Financial Services Limited, and Shriram City Union Finance in the Loan against Gold segment. Many of these competitors may have greater financial resources, may be larger in terms of business volume, and may have significantly lower cost of funds compared to SBFC Finance Limited. Many of them may also have greater geographical reach, and long-standing partnerships and may offer their customers other forms of financing that SBFC Finance Limited may not be able to provide.

-

Some of the loans that the company provides are unsecured and are susceptible to certain operational and credit risks which may result in increased levels of NPAs, which may adversely affect the business, prospects, results of operations, and financial condition of the company.

- Majority of MSME loans sanctioned in FY23 went to self-employed customers, who are considered high-risk. A default by these customers could have a negative impact on the business

- The co.’s assessment of customer creditworthiness is based on information provided by customers and third parties. Any errors or inaccuracies in this information could impact the company’s ability to make accurate assessments.

SBFC Finance Limited IPO Outlook:

SBFCFL is a NBFC-ND-SI offering secured MSME loans and loans against gold to entrepreneurs, small business owners, self-employed and salaried individuals having presence across country. It focuses on underserved or unregistered MSMEs and small enterprise borrowers with CIBIL scores above 700 and demonstrable loan servicing track record to bridge the present credit gap. As of March, 2023, Co. has generated 79.31% from the Secured MSME loans and 17.48% from Loans against gold. SBFCFL is currently focusing to expand its pan-India network to deepen the penetration in its target customer segment also focusing to diversify the source of borrowings and improve the operational leverage. Co. has strong financial performance with consistent growth in total assets & revenue, increasing profitability & profit margins. It has a diversified pan-India presence, offering growth opportunities in untapped markets. The focus on secured MSME loans and loans against gold, positions it for the growing MSME sector. However, the valuation is high with P/E ratio of 40.5 compared to industry average of 30.44. There are risks of non-payment, collateral recovery uncertainties, and potential losses. Also, exposure to interest rate risk, regulatory compliance, and competitive pressures may pose challenges to the company. Hence, we recommend investors to apply for the listing gains.

SBFC Finance Limited IPO FAQ

Ans. SBFC Finance IPO is a main-board IPO of [.] equity shares of the face value of ₹10 aggregating up to ₹1,025.00 Crores. The issue is priced at ₹54 to ₹57 per share. The minimum order quantity is 260 Shares.

The IPO opens on Aug 3, 2023, and closes on Aug 7, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The SBFC Finance IPO opens on Aug 3, 2023 and closes on Aug 7, 2023.

Ans. SBFC Finance IPO lot size is 260 Shares, and the minimum amount required is ₹14,820.

Ans. The SBFC Finance IPO listing date is not yet announced. The tentative date of SBFC Finance IPO listing is Wednesday, 16 August 2023.

Ans. The minimum lot size for this upcoming IPO is 260 shares.