JSW Infrastructure IPO Company Profile :

JSW Infrastructure Limited (JIL) is the second-largest commercial port operator in India in terms of cargo handling capacity in fiscal 2023 and the port-related infrastructure company with the fastest growth in terms of installed cargo handling capacity and cargo volumes handled between fiscal 2021 and fiscal 2023. The company provides maritime related services including, cargo handling, storage solutions, logistics services and other value-added services to its customers, and are evolving into an end-to-end logistics solutions provider. The company develops and operate ports and port terminals pursuant to Port Concessions. The company is a part of the JSW Group, a multinational conglomerate with an international portfolio of diversified assets across various sectors, including steel, energy, infrastructure, cement, etc. Its operations have expanded from one Port Concession at Mormugao, Goa which was acquired by the JSW Group in 2002 and commenced operations in 2004, to nine Port Concessions as of June 30, 2023, across India, making it a diversified maritime ports company. In addition to its operations in India, it operates two port terminals under O&M agreements for a cargo handling capability of 41 MTPA in the UAE.

| IPO-Note | JSW Infrastructure Limited |

| Rs.113 – Rs.119 per Equity share | Recommendation: Subscribe |

JSW Infrastructure IPO Details:

| Issue Details | |

| Objects of the issue |

· Funding capital expenditure and working capital. · Repayment of Loans. |

| Issue Size | Total issue Size – Rs.2,800 Cr.

Fresh Issue – Rs.2,800 Cr. |

| Face value |

Rs.2 |

| Issue Price | Rs.113 – Rs.119 |

| Bid Lot | 126 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 25th Sep, 2023 – 27th Sep, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

JSW Infrastructure IPO Strengths:

-

JIL has diversified operations in terms of cargo profile, geography and assets. The breadth of these operations significantly reduces risks associated with dependence on any single asset or type of cargo or geography and enables the company to realize strong growth momentum.

-

JIL’s ports and port terminals typically have long concession periods ranging between 30 to 50 years, providing the company with long-term visibility of revenue streams.

-

JIL’s installed cargo handling capacity in India has grown at a CAGR of 15.27% from March 31, 2021 to March 31, 2023, and the volume of cargo handled by the company in India has grown at a CAGR of 42.76% between Fiscal 2021 and Fiscal 2023. The application of its operational expertise in running large ports and port terminals has contributed significantly towards this growth.

JSW Infrastructure IPO Key Highlights:

-

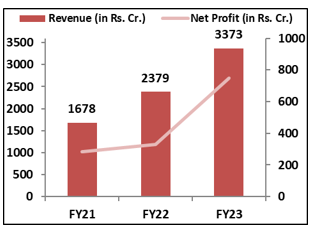

JIL has (on a consolidated basis) posted a total income/net profit of Rs. 1678.26 cr. / Rs. 284.62 cr. (FY21), Rs. 2378.74 cr. / Rs. 330.44 cr. (FY22), and Rs. 3372.85 cr. / Rs. 749.54 cr. (FY23). For Q1 of FY24, it earned a net profit of Rs. 322.20 cr. on a total income of Rs. 918.24 cr.

-

JIL’s ROCE which is not annualized for the three month period ended June 30, 2023 and June 30, 2022, is 5.68% and 4.98%, respectively, and for Fiscals 2023, 2022 and 2021 is 19.49%, 10.88% and 8.15%, respectively.

-

JIL has reported an average EPS of Rs. 2.88 and an average RoNW of 14.52%.

JSW Infrastructure IPO Risk Factors:

-

Depends on licencing and concession agreements with governmental and quasi-governmental agencies to run and expand the business.

-

JIL has a 49.81% capacity utilisation rate as of FY23. The company might suffer if present capacity utilisation cannot be maintained or increased.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check JSW Infrastructure IPO Allotment Status

Go JSW Infrastructure IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

JSW Infrastructure IPO Financial Performance:

JSW Infrastructure IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 96.42% | 85.61% |

| Others | 3.58% | 14.39% |

Source: RHP, EWL Research

JSW Infrastructure IPO Outlook:

JSW Infrastructure Ltd. (JIL) a part of the JSW Group, is the second-largest commercial port operator in India in terms of cargo handling capacity in Fiscal 2023 and the port infrastructure company with the fastest growth in terms of installed cargo handling capacity and cargo volumes handled during Fiscal 2021 to Fiscal 2023. After more than 13 years, JSW Group is reopening with an IPO. The group’s infrastructure division, JIL, has consistently increased both its top and bottom lines over the reporting periods. According to annualized earnings for FY24, the issue seems to be fairly priced. P/E of the JIL stands at 33.34x on the upper price band compared to the industry average of 35.95x; which seems fairly priced against listed peers. Hence we recommend Investors may subscribe and park money for medium- to long-term gains.

JSW Infrastructure IPO FAQ

Ans. JSW Infrastructure IPO is a main-board IPO of 235,294,118 equity shares of the face value of ₹2 aggregating up to ₹2,800.00 Crores. The issue is priced at ₹113 to ₹119 per share. The minimum order quantity is 126 Shares.

The IPO opens on September 25, 2023, and closes on September 27, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The JSW Infrastructure IPO opens on September 25, 2023 and closes on September 27, 2023.

Ans. JSW Infrastructure IPO lot size is 126 Shares, and the minimum amount required is ₹14,994.

Ans. The JSW Infrastructure IPO listing date is not yet announced. The tentative date of JSW Infrastructure IPO listing is Friday, October 6, 2023.

Ans. The minimum lot size for this upcoming IPO is 126 shares.