Credo Brands Marketing IPO Company Details:

Credo Brands Marketing Limited (CBML) is the parent company for the well-known menswear brand `Mufti’. The brand started out small in 1992 when founder Kamal Khushlani took a Rs. 10,000 loan to set up his fashion retail brand. Mufti brand provides Men’s western wear from the brand includes sweaters, cargo pants, jeans, sweatshirts, blazers, and cargo pants. The brand creates attire for athleisure, party wear, urban casuals, authentic daily casuals, and relaxed holiday wear. From having just one outlet in Mumbai, the company now operates in more than 591 cities. The company currently operates an online presence in addition to a Pan-India distribution network consisting of 89 Large Format Stores (LFS), 1305 Multi-Brand Outlets (MBOs), and 379 Exclusive Brand Outlets (EBOs) as of 31st May, 2023. With an approximate revenue contribution of 52% to 61%, the Company’s Exclusive Brand Outlets generate the majority of its revenue. Multi-brand outlets account for up to 27%–30% of revenue. Mufti’s revenue from its presence in large format stores is the lowest in FY23, coming in at just 3.16%.

Credo Brands Marketing IPO Details:

| Issue Details | |

| Objects of the issue | · To gain the listing benefits |

| Issue Size | Total issue Size – Rs.549.78 Cr.

Offer for Sale – Rs.549.78 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.266 – Rs.280 |

| Bid Lot | 53 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 19th Dec, 2023 – 21st Dec, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Credo Brands Marketing IPO Strengths:

-

CBML’s Mufti brand is a recognizable brand with presence over 25 years. It enjoys a high level of customer brand memory and enjoys enduring relationships with its production, supply, and distribution network partners.

-

Co’s business is a scalable asset-light model which allows it to optimize its costs, leading to sustained profitability with improving financial metrics.

-

It has a team of professional designers with rich experience of working in domestic and international markets.

Credo Brands Marketing IPO Key Highlights:

-

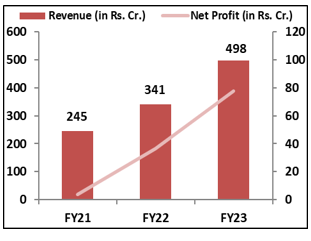

Revenue of the co. has increased from Rs.245 Cr. in FY21 to Rs.498 Cr. in FY23 with a strong CAGR of 26.7%; profits have grown tremendously from Rs.4 cr. in FY21 to Rs.78 cr. in FY23 with a huge CAGR of 170%.

-

Co’s EBITDA Margin & PAT Margin are promising and stand at 32.9% & 15.6% respectively in FY23.

-

As of FY23, ROCE & ROE ratios are healthy at 28.16% and 29.98% respectively.

-

As of 30th June, 2023, debt to equity of the co. stands at 0.72x

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Credo Brands Marketing IPO Allotment Status

Credo Brands Marketing IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Credo Brands Marketing IPO Risk Factors:

- The co. operates in a highly competitive market with numerous international brands. The key challenge for the company would be to stay on top of market trends or gain market share.

- CBML’s business is primarily concentrated on the sale of men’s casual western wear, any disruptions in the demand in this segment would affect its business.

- outsources manufacturing to third-party partners without exclusivity arrangements. Any issues in obtaining sufficient, timely, and quality apparel at acceptable prices or disruptions in partner operations could adversely impact the business.

Credo Brands Marketing IPO Financial Performance:

Credo Brands Marketing IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 68.82% | 38.28% |

| Others | 31.18% | 61.72% |

Credo Brands Marketing IPO Outlook:

CBML is an established wardrobe solution provider for men with wide range of products and pan-India multichannel distribution network. It is engaged in the retail sales of garments & accessories and does not manufacture it. Company is focusing on expanding its store network in existing and new cities. Along with this, it is focusing on expanding its product portfolio to make a men’s lifestyle brand. The men’s apparel market is expected to grow at a CAGR of 18% by FY27. Also the market share of organised player is expected to reach to 60% by FY27 from 45%. CBML is offering the P/E of 23x on the upper price band which seems attractive as compared to the industry average of 95.19x. Considering its strong presence, growing financials, and industry leading margins, we recommend investors to consider applying in the offering for longer horizon.

Credo Brands Marketing IPO FAQ

Ans. Credo Brands Marketing IPO is a main-board IPO of 19,634,960 equity shares of the face value of ₹2 aggregating up to ₹549.78 Crores. The issue is priced at ₹266 to ₹280 per share. The minimum order quantity is 53 Shares.

The IPO opens on December 19, 2023, and closes on December 21, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Credo Brands Marketing IPO opens on December 19, 2023 and closes on December 21, 2023.

Ans. Credo Brands Marketing IPO lot size is 53 Shares, and the minimum amount required is ₹14,840.

Ans. The Credo Brands Marketing IPO listing date is not yet announced. The tentative date of Mufti Menswear IPO listing is Wednesday, December 27, 2023.

Ans. The minimum lot size for this upcoming IPO is 53 shares.