Ratnaveer Precision Engineering IPO Company Details:

Ratnaveer Precision Engineering Limited (RPEL) specializes in a wide variety of stainless steel (SS) goods, such as finished sheets, washers, solar roofing hooks, pipes, and tubes. These products cater to a diverse spectrum of industries including automotive, solar, wind, power generation, industrial facilities, oil and gas, pharmaceuticals, sanitary and plumbing, instrumentation, electromechanics, architecture, building & construction, electrical appliances, transportation, kitchen appliances, chimney liners, and more. The company operates from four production facilities situated across Gujarat, India. These locations include Unit-III in Waghodia, Vadodara, Gujarat, Unit-IV in GIDC, Vatva, Ahmedabad, Gujarat, and two plants in GIDC, Savli, Vadodara, Gujarat. The company’s capacity to effectively serve its local and foreign customers is improved by this geographic spread, which maximizes production and distribution efficiency.

| IPO-Note | Ratnaveer Precision Engineering Limited |

| Rs.93 – Rs.98 per Equity share | Recommendation: Apply |

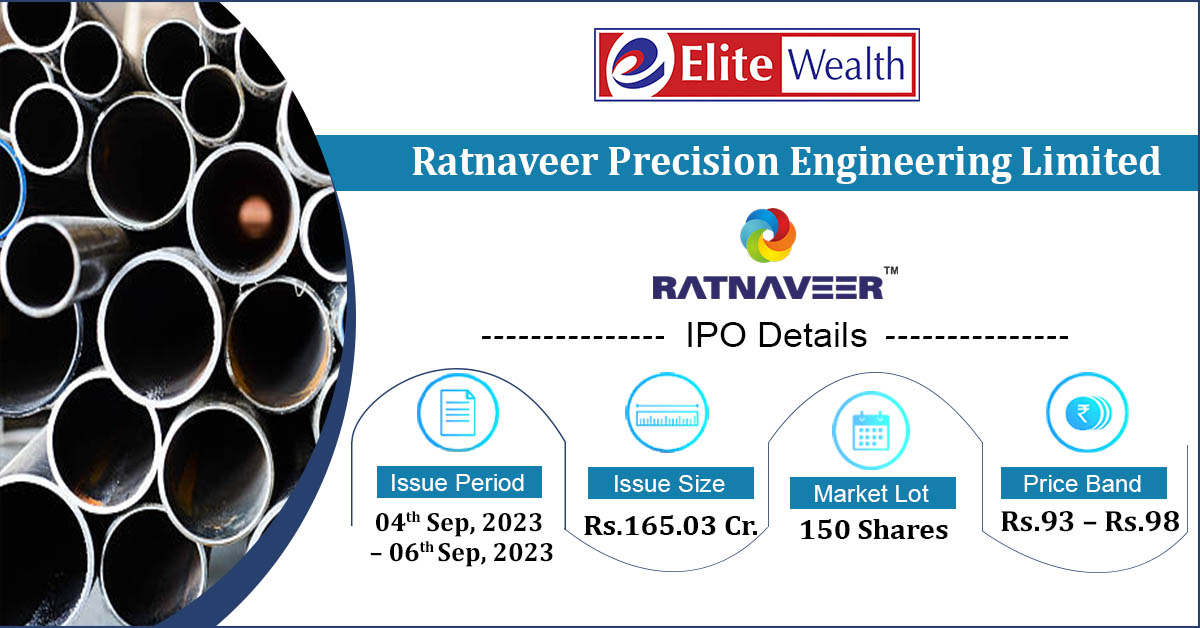

Ratnaveer Precision Engineering IPO Details:

| Issue Details | |

| Objects of the issue |

· To fund the working capital requirements · To gain listing benefits |

| Issue Size | Total issue Size – Rs.165.03 Cr.

Fresh Issue – Rs.135.24 Cr. Offer for Sale – Rs.29.79 Cr. |

| Face value |

Rs.10 |

| Issue Price | Rs.93 – Rs.98 |

| Bid Lot | 150 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 04th Sep, 2023 – 06th Sep, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Ratnaveer Precision Engineering IPO Financial Analysis:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Ratnaveer Precision Engineering IPOAllotment Status

Ratnaveer Precision Engineering IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Ratnaveer Precision Engineering IPO Strengths:

- RPEL uses backward integration system which turns waste from manufacturing into raw resources, improving efficiency, controlling costs, and lowering reliance on outside suppliers. This strategy boosts competitiveness and sustainability.

- ’s broad customer base protects it from industry and customer specific risks including shifting foreign relations, market volatility, and legislative changes.

- The co. has a competitive advantage over competitors due to its broad and diverse product offering, which enables it to adjust to changing customer preferences and market trends.

Ratnaveer Precision Engineering IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 86.30% | 76% |

| Others | 13.70% | 24% |

Source: RHP, EWL Research

Ratnaveer Precision Engineering IPO Key Highlights:

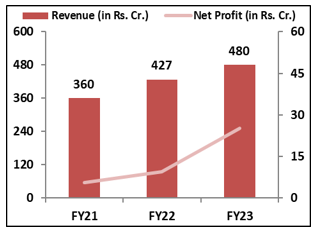

- Revenue of the co. has increased from Rs.360 Cr. in FY21 to Rs.480 Cr. in FY23 with a CAGR of 10% and the Net Profit has increased from Rs.5 Cr. to Rs.25 Cr. during the same period with a huge CAGR of 66%.

- Net Cash flow from operating activities has decreased from Rs.12.9 cr. in FY21 to negative Rs.14.3 cr. in FY23.

- ’s EBITDA Margin & PAT Margin stands at 9.8% & 5.2% respectively in FY23.

- As of March, 2023, ROCE and ROE ratio of the co. is 12.62% and 29.12%.

- Debt to Equity of the co. stands at 2.17 from 2.6 of FY21.

Ratnaveer Precision Engineering IPO Risk Factors:

- The co. does not have any long-term agreements with its raw material suppliers. An inability to procure the desired raw materials in a timely manner and at a reasonable cost can have a negative impact on co.’s business.

- operates in a highly competitive industry with easy entry for both established and new competitors, posing challenges to its success.

Ratnaveer Precision Engineering IPO Outlook:

RPEL specializes on producing stainless steel products, offering a broad range of products such as sheets, pipes, hooks, and tubes. The co. generates ~80% of its revenue from the domestic market, with the remaining 20% coming from exports to various countries, including Spain, Germany, the Netherlands, the United Kingdom, and others. It is one of the few companies who has a backward integration model which helped the co. to maximize its returns. It is focusing at consistent expansion of its product portfolio by developing new designs. Additionally, it is investing in technology integration and plant automation to enhance cost efficiency and productivity. The stainless steel market in India is experiencing robust growth, driven by rising demand for stainless steel products in various domestic and global sectors. This dynamic market presents opportunities for RPEL. Co.’s P/E of 13.85x on the upper price band compared to the industry average of 34.4x looks attractive. Over the years, co.’s financial performance has shown a constant upward trend. The business is well-positioned to take advantage of new opportunities and grow its market presence due to its broad product portfolio, diversified client base, and strong dedication to innovation. Hence, we advise investors to apply to the offering.

Ratnaveer Precision Engineering IPO FAQ

Ans. Ratnaveer Precision Engineering IPO is a main-board IPO of 16,840,000 equity shares of the face value of ₹10 aggregating up to ₹165.03 Crores. The issue is priced at ₹93 to ₹98 per share. The minimum order quantity is 150 Shares.

The IPO opens on September 4, 2023, and closes on September 6, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Ratnaveer Precision Engineering IPO opens on September 4, 2023 and closes on September 6, 2023.

Ans. The minimum lot size that investors can subscribe to is 150 shares.

Ans. The Ratnaveer Precision Engineering IPO listing date is not yet announced. The tentative date of Ratnaveer Precision Engineering IPO listing is Thursday, September 14, 2023.

Ans. The minimum lot size for this upcoming IPO is 150 shares.