Jyoti CNC Automation IPO Company Details:

Jyoti CNC Automation Limited (JCAL) is the third largest manufacturer of metal cutting computer numerical control (CNC) machines with 10% market share in India & 0.4% market share globally. The company is a leading manufacturer of 5-axis CNC machines, with more than 200 models available in 44 series. It offers a selection of turn-mill centers, vertical and horizontal machining centers, and CNC turning centers. With over 20 years of experience, JCAL has designed and manufactured tools for a variety of industries, including general engineering, auto components, aerospace, & defense and supplies to UK, Belgium, France, Poland, Romania, and Italy. Some of its key clients include Bharat Forge, Tata Advanced Systems, and Shakti Pumps (India) in the domestic markets. Foreign clients include Bosch Ltd, Turkish Aerospace, and Hawe Hydraulics among others. The company operates three manufacturing sites: one in Strasbourg, France, and two in Rajkot, Gujarat. There are separate research and development centers with 141 personnel each in the Gujarat and France facilities.

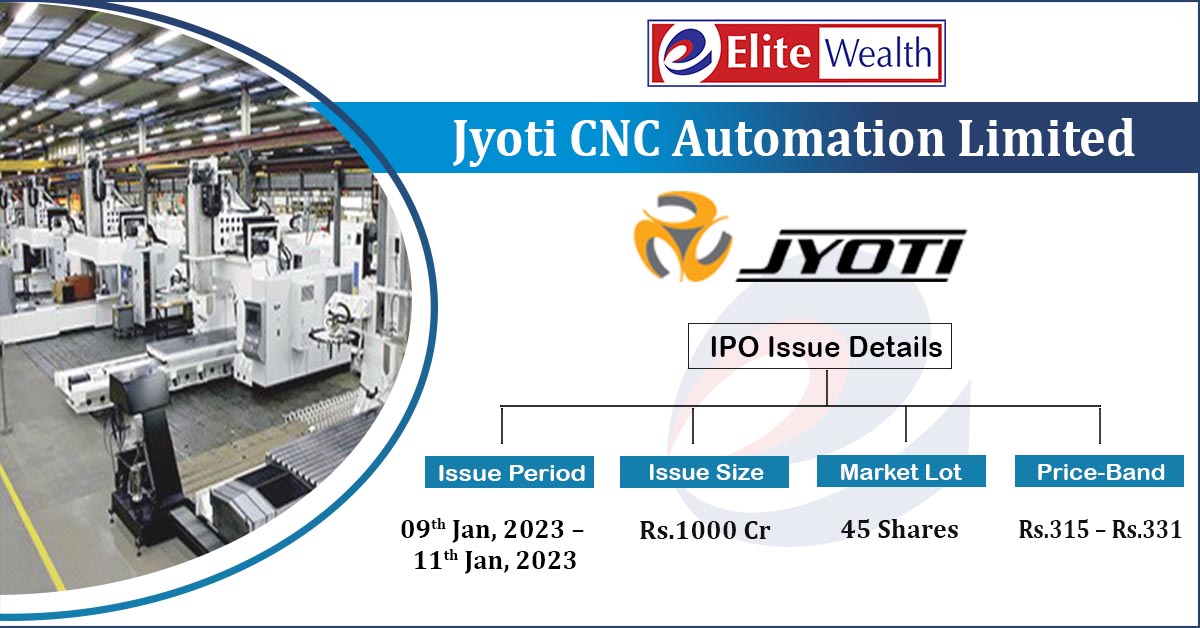

| IPO-Note | Jyoti CNC Automation Limited |

| Rs.315 – Rs.331 per Equity share | Recommendation: Avoid |

Jyoti CNC Automation IPO Details:

| Issue Details | |

| Objects of the issue | · To repay debts

· To fund long-term working capital requirements |

| Issue Size | Total issue Size – Rs.1000 Cr.

Offer for Sale – Rs.1000 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.315 – Rs.331 |

| Bid Lot | 45 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 09th Jan, 2023 – 11th Jan, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Jyoti CNC Automation IPO Strengths:

-

JCAL is one of the leading CNC machine manufacturers in India & globally, with a diverse range of products specialized for multiple industries.

-

Co has a wide diversified business segments comprising Aerospace, Automotive, general engineering, EMS & dies & molds.

-

As of Q2FY24, It has an order book of Rs.3,315 cr., out of which ~57% comes from Aerospace & Defence sector.

Jyoti CNC Automation IPO Key Highlights:

-

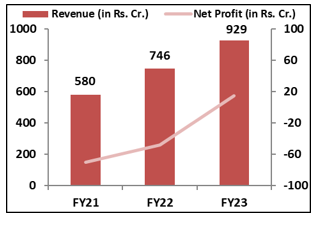

Revenue of the co. has grown from Rs.580 Cr. in FY21 to Rs.929 Cr. in FY23 with a CAGR of 26.7%; while it registered loss in FY21 & in FY22 and became profitable in FY23 registering profit of Rs.15 cr. because of the exceptional gains of Rs.30.5 cr.

-

Co’s EBITDA Margin & PAT Margin stand at 10.5% & 1.6% respectively in FY23.

-

As of FY23, ROCE & ROE ratios are at 9.5% and 18.35% respectively.

-

As of 30th September, 2023, debt to equity of the co. stands at 3.25x.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Jyoti CNC Automation IPOAllotment Status

Jyoti CNC Automation IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Jyoti CNC Automation IPO Financial Performance:

Jyoti CNC Automation IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 72.13% | 62.55% |

| Others | 27.87% | 37.45% |

Source: RHP, EWL Research

Jyoti CNC Automation IPO Risk Factors:

-

JCAL doesn’t have long-term agreements with suppliers for the input materials; any significant increase in the cost of, or a shortfall in the availability, or deterioration in the quality, of such input materials, could have an adverse effect on the business operations of the company.

-

The company has a high debt to equity ratio of 3.25x, inability to generate a sufficient amount of cash could impact the financial condition of the company.

-

50% of the Company’s total assets are stuck in inventory; It also has a very slow inventory turnover ratio.

-

The company, along with its promoters, directors, and subsidiaries, is currently involved in various legal proceedings, including criminal cases. An unfavorable outcome in these matters could impact the business of the company.

Jyoti CNC Automation IPO Outlook:

JCAL, one of the leader in India’s machine tool industry, crafts high-precision CNC machines for diverse industries. From its modest beginnings as a maker of gearboxes, the company has evolved into a leading innovator, creating sophisticated 5-axis machines in addition to CNC turning centers and vertical machining centers. It caters industries in the aerospace, car, and many other sectors, catering to both domestic and international customers with a commitment to quality and a focus on customization. JCAL is offering the P/E of 499x on the upper price band which appears exorbitantly priced. Considering its financials, risky debts & extremely high valuations, we recommend investors to avoid applying in the offering.

Jyoti CNC Automation IPO FAQ

Ans. Jyoti CNC Automation IPO is a main-board IPO of 30,211,480 equity shares of the face value of ₹2 aggregating up to ₹1,000.00 Crores. The issue is priced at ₹315 to ₹331 per share. The minimum order quantity is 45 Shares.

The IPO opens on January 9, 2024, and closes on January 11, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Jyoti CNC Automation IPO opens on January 9, 2024 and closes on January 11, 2024.

Ans. Jyoti CNC Automation IPO lot size is 45 Shares, and the minimum amount required is ₹14,895.

Ans. The Jyoti CNC Automation IPO listing date is not yet announced. The tentative date of Jyoti CNC Automation IPO listing is Tuesday, January 16, 2024.

Ans. The minimum lot size for this upcoming IPO is 45 shares.