Motisons Jewellers Limited IPO Company Profile :

Motisons Jewellers Limited is a Jewellery retail player with a history of more than 2 decades in the jewellery industry having experienced entrepreneurs as Promoters with more than 20 years of experience. The company’s jewellery business includes the sale of jewellery made of gold, diamond, kundan, and the sale of other jewellery products that include pearl, silver, platinum, precious, semi-precious stones and other metals. The other offerings of the company include gold and silver coins, utensils, and other artifacts.

Motisons Jewellers Limited started its jewellery business in 1997 with a single showroom in Jaipur, Rajasthan. The company’s first outlet, famously known as the ‘Traditional Store’ was set up amidst the famous lanes of the busiest Johri Bazaar, a renowned jewellery hub in the heart of the city. The company has expanded its network of showrooms and the product portfolio and currently operates 4 showrooms under the “Motisons” brand, located across the city of Jaipur. The flagship store of the company ‘Motisons Tower’ is located at the high street of Tonk Road, Jaipur.

Motisons Jewellers Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To pay borrowings availed by the company

· To fund the working capital requirements |

| Issue Size | Total issue Size – Rs.151.09 Cr.

Fresh Issue – Rs.151.09 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.52 – Rs.55 |

| Bid Lot | 250 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 18th Dec, 2023 – 20th Dec, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Motisons Jewellers Limited IPO Financial Analysis:

| Particulars | FY-22(in cr.) | FY-21(in cr.) | FY-20 (in cr.) | CAGR(FY-20 to FY-22) |

| Revenue from sale | 314.33 | 213.04 | 218.94 | 12.8% |

| Other Income | 0.14 | 0.02 | 0.05 | |

| Cost Of Goods Sold | 264.05 | 173.79 | 185.95 | |

| Employee Cost | 7.03 | 5.63 | 5.96 | |

| Other expenses | 4.65 | 2.52 | 3.44 | |

| EBITDA | 38.75 | 31.12 | 23.64 | 17.9% |

| EBITDA margin% | 12.33% | 14.61% | 10.80% | |

| Depreciation | 2.83 | 2.67 | 2.94 | |

| Interest | 15.93 | 15.39 | 16.47 | |

| PBT | 19.99 | 13.07 | 4.23 | 67.8% |

| Total tax | 5.24 | 3.39 | 1.07 | |

| PAT | 14.75 | 9.67 | 3.16 | 67.0% |

| PAT margin% | 4.69% | 4.54% | 1.44% | |

| Dep./revenue% | 0.90% | 1.25% | 1.34% | |

| Int./revenue% | 5.07% | 7.22% | 7.52% |

Revenue from Sale Of Products:

| Segment | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20 (in cr.) | % | CAGR |

| Sale of Gold & Silver Jewellery | 260.54 | 82.89% | 170.85 | 80.19% | 181.93 | 83.09% | 12.7% |

| Sales of Silver Articles & Jewellery | 24.12 | 7.67% | 18.76 | 8.80% | 17.42 | 7.96% | 11.5% |

| Gold Bullions | 29.17 | 9.28% | 24.75 | 11.62% | 21.58 | 9.86% | 10.6% |

| Exports & SEZ Sales | 2.10 | 0.67% | 0.29 | 0.14% | 0.00 | 0.00% | |

| Job Work | 0.00 | 0.00% | 0.04 | 0.02% | 0.00 | 0.00% | |

| Less: Sales Return | 1.61 | 0.51% | 1.64 | 0.77% | 1.98 | 0.91% | -6.8% |

| Total | 314.33 | 100.00% | 213.04 | 100.00% | 218.94 | 100.00% | 12.8% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Motisons Jewellers IPO Allotment Status

Motisons Jewellers IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Motisons Jewellers Limited IPO Strengths:

-

Motisons Jewellers Limited has a proven track record of approx. 25 years. Over the years, the company has grown significantly and has established its brand ‘Motisons’. The company’s strength lies in the wide variety of designs offered by jewellery designers wherein it develops its own creations and specialty designs according to the latest tastes and preferences of customers.

-

Jaipur, Rajasthan has been well-known for manufacturing traditional jewellery. To leverage this opportunity and tap the growing historical jewellery retail market, the company has rapidly expanded its retail network of strategically located stores in recent years across the city, which help it to achieve logistical convenience in inventory management

-

Motisons Jewellers Limited’s product portfolio comprises over 300,000+ jewellery designs, including a wide range of gold, diamond and other jewellery products across different price points. Over the years, the company has launched many creative collections in gold, silver and diamond jewellery. The company has introduced a range of jewellery collections, which are designed to cater to specific customer niches such as classic jewellery, contemporary jewellery and polki diamonds and precious stones jewellery. Each collection serves customers with different preferences and needs for different designs.

-

Motisons Jewellers Limited has established systems and procedures for various facets of its business and operations including inventory management, order management, human resource management, finance and controls, CRM, data analytics, management processes and risk management.

-

Most of the employees of the Company have been associated either since inception or have been serving for numerous years. The company’s major strength lies in retaining the employees once they are associated with the Company.

- MJL is well-known for its “Motisons” brand and has a solid 25-year track record. It specializes in distinctive designs created by in-house designers which helps the company to adapt the latest customer preferences.

- Its product portfolio comprises over 300,000 jewellery designs, including a wide range of gold, diamond & other jewellery products across different price points.

- Most of the employees of the Co. have been associated either since inception or have been serving for numerous years. The company’s major strength lies in retaining the employees once they are associated with the Company.

Motisons Jewellers Limited IPO Risk Factors:

-

All of Motisons Jewellers Limited’s showrooms are located in Jaipur, Rajasthan. Any adverse development affecting such region may have an adverse effect on the business, prospects, financial condition and results of operations of the company

-

The non-availability or high cost of quality gold bullion, diamonds and other precious and semi-precious stones may have an adverse effect on the business, results of operations and financial condition of the company.

-

Certain of the Promoters and members of the Promoter Group are involved in proceedings involving SEBI which could have an adverse impact on the business and reputation of the company

-

Motisons Jewellers Limited’s, Promoters and Directors are involved in certain legal proceedings. Any adverse decision in such proceedings may render them liable to liabilities/penalties and may adversely affect the business and results of operations of the company

-

Motisons Jewellers Limited’s Promoters, Mr. Sanjay Chhabra and Mr. Sandeep Chhabra, in past, were involved in proceedings initiated by the investigation agency in relation to betting in the cricket matches of the Indian Premier League. Though they have been duly discharged, any re-opening of the matter could have an adverse impact on the business and reputation of the company.

- All of MJL’s showrooms are located in Jaipur, Rajasthan. Any adverse development affecting such region may have an adverse effect on the business, prospects, financial condition and results of operations of the company.

- procures ~99.84% of goods sold from third party suppliers, inability to maintain arrangements with such third parties or any disruptions in their supply chain arrangements may have negative impact on business operations.

- Co’s Promoters and Directors are involved in certain legal proceedings. Any adverse decision in such proceedings may render them liable to liabilities/penalties and may adversely affect the business of the company.

Objects of the Issue:

Motisons Jewellers Limited proposes to utilize the Net Proceeds of the Fresh Issue towards funding the following objects:

- Pre-payments or scheduled repayment of a portion of the existing borrowing availed by the company.

- Funding the working capital requirements of the Company; and

- General corporate purposes.

Motisons Jewellers Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 91.55% | 8.45% |

| Others | 66% | 34% |

Source: RHP, EWL Research

Motisons Jewellers Limited IPO Key Highlights:

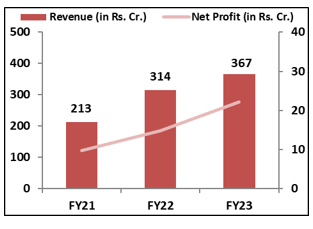

- Revenue of the co. has increased from Rs.213 Cr. in FY21 to Rs.367 Cr. in FY23 with a CAGR of 19.9%; and Net Profit also grew with strong CAGR of 31.9% from Rs.10 Cr. in FY21 to Rs.22 Cr. in FY23.

- Co’s EBITDA Margin & PAT Margin stands at 13.5% & 6.1% respectively in FY23.

- As of FY23, ROCE & ROE ratios are healthy at 30.04% and 17.56% respectively.

- As of March, 2023, debt to equity of the co. stands at 1.2x.

Motisons Jewellers Limited IPO Outlook:

MJL is a well-established player in the Indian Jewellery industry serving a broad customer base with a diverse collection of gold, diamond and kundan jewellery. It has a strong retail network coupled with growing online presence. In FY23, co. generated 74.57% from trading of gold jewellery, 9.23% from trading of diamond & gem stone jewellery and 7.50% from manufacturing of gold jewellery. Although the company’s sales are now restricted to Rajasthan, its varied product offering, planned growth in the historical jewelry retail industry, and proficiency in producing traditional jewelry could be intriguing traits that set it apart from competitors. MJL is offering the P/E of 24.39x on the upper price band which seems very reasonable compared to the industry average of 81.55x. Company has huge growth potential in the Indian market. Considering its strong financials and fundamentals, we recommend investors to consider applying in the offering.

Motisons Jewellers IPO FAQ

Ans. Motisons Jewellers IPO is a main-board IPO of 27,471,000 equity shares of the face value of ₹10 aggregating up to ₹151.09 Crores. The issue is priced at ₹52 to ₹55 per share. The minimum order quantity is 250 Shares.

The IPO opens on December 18, 2023, and closes on December 20, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Motisons Jewellers IPO opens on December 18, 2023 and closes on December 20, 2023.

Ans. Motisons Jewellers IPO lot size is 250 Shares, and the minimum amount required is ₹13,750.

Ans. The Motisons Jewellers IPO listing date is not yet announced. The tentative date of Motisons Jewellers IPO listing is Tuesday, December 26, 2023.

Ans. The minimum lot size for this upcoming IPO is 250 shares.