Samco Active Momentum Fund NFO Company Profile:

Samco Mutual Fund is a leading Indian asset management company with over 1.5 million investors and assets under management of ₹100 billion. It was founded in 1994 and is headquartered in Mumbai, Maharashtra. Samco Mutual Fund is a HexaShield Tested mutual fund, managed by Samco Asset Management Private Limited which is sponsored by one of India’s leading equity brokerage firms, Samco Securities Limited. Equity funds, debt funds, and hybrid funds are just a few of the many mutual fund products offered by Samco Mutual Fund. The business has a proven track record of success.

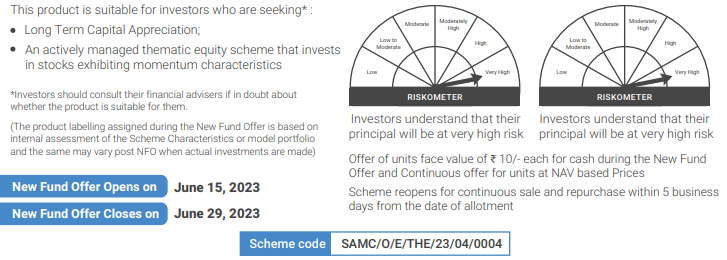

Samco Mutual Fund will shortly be launching the Samco Active Momentum Fund, an NFO scheme with the goal of generating long-term capital appreciation through investments in equities with significant momentum. Momentum stocks are those that show positive price momentum. They are based on the idea that stocks that have historically outperformed other stocks (winners) continue to outperform in the future, while companies that have historically underperformed (losers) continue to underperform. But there can be no assurance or guarantee that the scheme’s investment goal will be attained. The scheme opens on the 15th of June, 2023, and closes on the 29th of June, 2023.

Samco Active Momentum Fund NFO Details:

| Mutual Fund: | Samco Mutual Fund |

| Scheme Name: | Samco Active Momentum Fund |

| Objective of Scheme: | The investment objective of the Scheme is to seek to generate long-term capital appreciation by investing in stocks showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

| New Fund Launch Date: | 15th June 2023 |

| New Fund Offer Closure Date: | 29th June 2023 |

| Fund Managers: | Mr. Paras Matalia (C.A.) |

| Type of scheme: | An open-ended equity scheme following momentum theme |

| Plans: | Regular Plan – Growth & Direct Plan – Growth |

| Benchmark Index: | Nifty 500 Index TRI |

| Minimum Application Amount of scheme: | ₹5000 and in multiples of ₹1/- thereafter |

| Minimum Additional Application Amount: | ₹500 and in multiples of ₹1/- thereafter |

| Minimum SIP Amount: | ₹500 and in multiples of ₹1/- thereafter [Fresh SIPs restricted post NFO, until further notice] |

| Entry Load: | Not applicable |

| Exit Load | · 2.00% if the investment is redeemed or switched out on or before 365 days from the date of allotment of units

· 1.00% if the investment is redeemed or switched out after 365 days but on or before 730 days from date of allotment of units · No Exit Load will be charged if investment is redeemed or switched out after 730 days from the date of allotment of units |

Samco Active Momentum Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments of momentum theme | 80% | 100% | High to Very High |

| Equity and Equity related securities of other Companies | 0% | 20% | High to Very High |

| Debt and Money Market instruments | 0% | 20% | Low to Moderate |

Samco Active Momentum Fund NFO Conclusion:

Momentum investing is a strategy that seeks to profit from the tendency of stocks that have recently performed well to continue to perform well. Momentum investors believe that information about a stock’s performance spreads slowly from those who know it first (such as company insiders) to those who know it last (such as retail investors). As the information spreads, investors become more willing to buy the stock, which drives up its price. Momentum investors try to take advantage of this by buying stocks that have recently performed well and selling stocks that have recently performed poorly. It is important to note that momentum investing is not a guaranteed way to make money. The stock market is unpredictable and there is no guarantee that a momentum strategy will be successful in the future. However, momentum investing has been shown to be a profitable strategy over the long term. Investment in mutual fund units involves investment risks such as trading volumes, settlement risks, liquidity risks, and default risks including the possible loss of principal. Therefore, this product is suitable for investors who are seeking long-term capital appreciation and an actively managed thematic equity scheme that invests in stocks exhibiting momentum characteristics. Investors may consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.