Muthoot Microfin Limited IPO Company Details:

Muthoot Microfin Limited (MML) is a microfinance company focused on rural areas of India and offers microloans to women clients. As of March 31, 2023, it was the third-biggest NBFC-MFI in South India and the fifth-largest NBFC-MFI in terms of gross loan portfolio, the largest in Kerala in terms of MFI market share, and a significant participant in Tamil Nadu with 16% market share. The business model of the co. helps in driving financial inclusion, as it serves customers who belong to low-income groups. The company has built its branch network with an emphasis on under-served rural markets with growth potential, in order to ensure ease of access to customers. The company’s branches are connected to its IT networks and are primarily located in commercial spaces which are easily accessible by the customers. MML is a subsidiary of the Muthoot Pappachan Group, a business conglomerate with operations in the automotive, hospitality, real estate, information technology infrastructure, precious metals, and alternative energy sectors and has been in the financial services industry for more than 50 years. For the Financial Year 2023, it is the second-largest entity within the Muthoot Pappachan Group in terms of AUM.

Muthoot Microfin Limited IPO Business Offerings:

Muthoot Microfin Limited’s loan products comprise:

-

Group loans for livelihood solutions such as income generating loans, Pragathi loans (which are interim loans made to existing customers for working capital and income generating activities) and individual loans.

-

Life betterment solutions including mobile phones loans, solar lighting product loans and household appliances product loans.

-

Health and hygiene loans such as sanitation improvement loans.

-

Secured loans in the form of gold loans and its Muthoot Small & Growing Business (“MSGB”) loans.

-

The company also offers ‘e-clinic’ services by collaborating with M-Swasth Solutions Private Limited, a technology driven digital healthcare service provider. It provides its customers and up to five of their family members with video consultation with doctors at a nominal enrolment cost.

Muthoot Microfin Limited is a subsidiary of the Muthoot Pappachan Group, a business conglomerate with operations in the automotive, hospitality, real estate, information technology infrastructure, precious metals, and alternative energy sectors and has been in the financial services industry for more than 50 years. For the Financial Year 2023, it is the second-largest entity within the Muthoot Pappachan Group in terms of AUM.

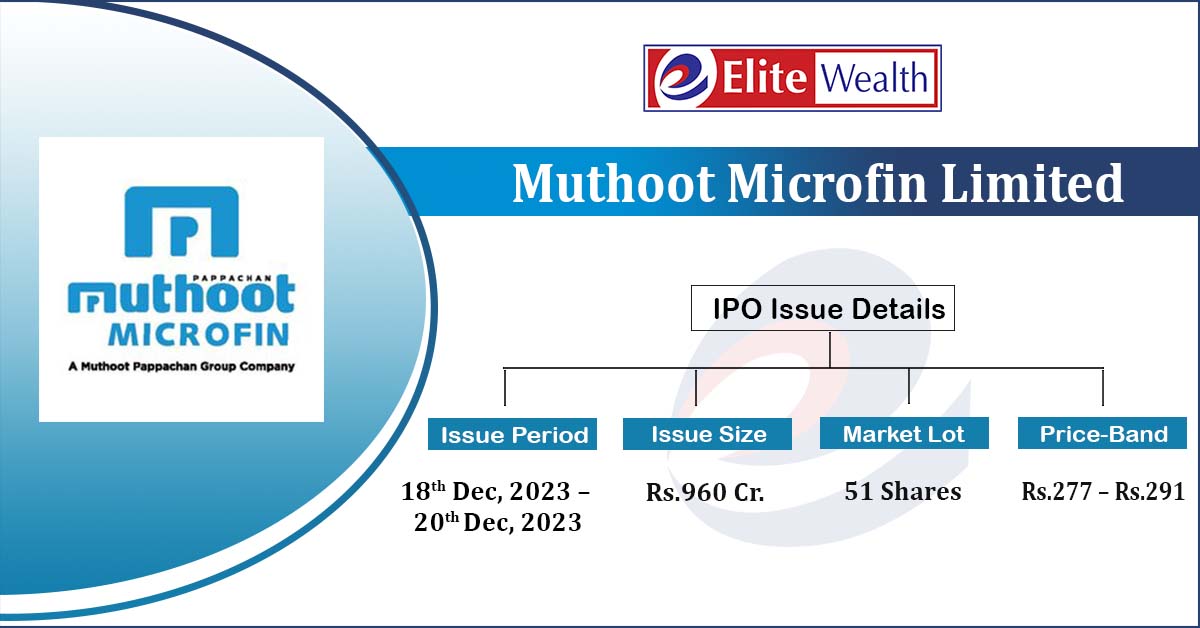

Muthoot Microfin Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To undertake existing business activities

· To undertake the activities proposed from net proceeds · To gain the listing benefits |

| Issue Size | Total issue Size – Rs.960 Cr.

Fresh Issue – Rs.760 Cr. Offer for Sale – Rs.200 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.277 – Rs.291 |

| Bid Lot | 51 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 18th Dec, 2023 – 20th Dec, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Muthoot Microfin Limited IPO Financial Analysis:

| Particulars | FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | CAGR |

| Revenue from Operations | 1428.76 | 832.51 | 684.17 | 44.5% |

| Other Income | 17.58 | 10.43 | 12.11 | |

| Fees and commission expenses | 27.54 | 17.85 | 9.74 | 68.2% |

| Impairment on financial instruments | 223.32 | 111.15 | 132.22 | 30.0% |

| Employee Cost | 322.56 | 237.08 | 187.09 | 31.3% |

| Other expenses | 84.44 | 51.20 | 40.02 | |

| EBITDA | 788.49 | 425.66 | 327.22 | 55.2% |

| EBITDA margin% | 55.19% | 51.13% | 47.83% | |

| Depreciation | 26.61 | 20.78 | 18.83 | |

| Interest | 549.01 | 340.16 | 299.33 | |

| Profit / (loss) before tax | 212.87 | 64.72 | 9.06 | 384.9% |

| Total tax | 48.98 | 17.32 | 2.00 | |

| Profit / (loss) After tax | 163.89 | 47.40 | 7.05 | 382.0% |

| Profit / (loss) After tax margin% | 11.47% | 5.69% | 1.03% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Muthoot Microfin Limited IPO Allotment Status

Muthoot Microfin Limited IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Muthoot Microfin Limited IPO Revenue from Operations:

| Segment | FY-23(in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | CAGR |

| Interest income | 1290.64 | 90.33% | 728.62 | 87.52% | 622.78 | 91.03% | 44.0% |

| Fees and commission income | 17.32 | 1.21% | 6.15 | 0.74% | 3.21 | 0.47% | 132.3% |

| Net gain on fair value changes | 111.53 | 7.81% | 91.03 | 10.93% | 40.92 | 5.98% | 65.1% |

| Income on investments | 8.33 | 0.58% | 5.82 | 0.70% | 16.99 | 2.48% | -30.0% |

| Sale of services | 0.92 | 0.06% | 0.86 | 0.10% | 0.25 | 0.04% | 91.6% |

| Total | 1428.76 | 100.00% | 832.51 | 100.00% | 684.17 | 100.00% | 44.5% |

Muthoot Microfin Limited IPO Major Shareholders:

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1. | Thomas John Muthoot | 51,456,049 | 26.56 |

| 2. | Thomas George Muthoot | 51,456,021 | 26.56 |

| 3. | Thomas Muthoot | 51,456,053 | 26.56 |

| 4. | Preethi John Muthoot | 12,913,704 | 6.67 |

| 5. | Nina George | 12,913,704 | 6.67 |

| 6. | Remmy Thomas | 12,913,704 | 6.67 |

| 7. | Muthoot Kuries (India) Private Limited | 119,050 | 0.06 |

| 8. | Muthoot Exim Private Ltimited | 476,200 | 0.25 |

| Total | 193,705,560 | 100 |

Muthoot Microfin Limited IPO Offer for Sale Details:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 69.08% | 54.46% |

| Others | 30.92% | 45.54% |

Source: RHP, EWL Research

| S. No. | Name of the Selling Shareholder | Aggregate amount of Offer

for Sale (₹ crore)

|

|

| Promoter Selling Shareholders | |||

| 1. | Thomas John Muthoot | Up to 700.00 | |

| 2. | Thomas Muthoot | Up to 700.00 | |

| 3. | Thomas George Muthoot | Up to 700.00 | |

| 4. | Preethi John Muthoot | Up to 300.00 | |

| 5. | Remmy Thomas | Up to 300.00 | |

| 6. | Nina George | Up to 300.00 | |

| Investor Selling Shareholder | |||

| 1. | GPC | Up to 1000.00 | |

Muthoot Microfin Limited IPO Strengths:

-

Muthoot Microfin Limited serves rural markets with high growth potential in the microfinance segment, and have maintained a track record of financial performance and operational efficiency through consistently high rates of customer acquisition and retention and expansion into underpenetrated areas.

-

Muthoot Microfin Limited’s relationship with the Muthoot Pappachan Group provides it with brand recall and significant marketing and operational benefits.

-

Muthoot Microfin Limited has implemented well-defined key risk management policies which primarily focus on addressing credit risk, operational risk and financial risk. Its robust risk management framework, customer selection methodologies and regular end use and payment monitoring have resulted in healthy portfolio quality indicators such as high collection efficiency, stable PAR and low rates of gross NPAs and net NPAs.

-

Muthoot Microfin Limited has a streamlined operating model with effective use of technology which includes increasing digital penetration, reducing risks associated with cash transactions, improving risk management and underwriting processes, increasing operational efficiency, improving customer analytics and simplifying sourcing.

-

Muthoot Microfin Limited has a well-diversified funding profile that underpins its liquiditymanagement system, credit rating and brand equity. The company received an upgraded credit rating of A+/Stable by CRISIL on October 19, 2022, which was reaffirmed on January 19, 2023. The company has historically secured, and seek to continue to secure, cost effective funding through a variety of sources, including public sector banks, private sector banks, foreign banks, other non-banking financial institutions, developmental financial institutions, public investors etc

-

MML’s relationship with the Muthoot Pappachan Group provides it with brand recall and significant marketing and operational benefits.

-

The co. serves rural markets with high growth potential in the microfinance segment, and has maintained a track record of financial performance and operational efficiency through consistently high rates of customer acquisition and retention and expansion into underpenetrated areas.

-

Its robust risk management framework, customer selection methodologies and regular end use and payment monitoring have resulted in healthy portfolio quality indicators such as high collection efficiency, stable PAR and low rates of gross NPAs and net NPAs.

Muthoot Microfin Limited IPO Key Highlights:

-

Revenue of the co. has increased from Rs.684 Cr. in FY21 to Rs.1429 Cr. in FY23 with a strong CAGR of 27.8%; while its profits have grown from Rs.7 cr. in FY21 to Rs.164 cr. in FY23 with a huge CAGR of 185%.

-

Co’s NIM is growing and stands at 11.60% in FY23 from 8.24% in FY21.

-

Co’s Disbursements is growing rapidly; grown by 74.40% in FY23 to Rs.8105 cr. from Rs.4647 cr. in FY22.

-

The CRAR of the co. in FY23 is at 21.87%; GNPA and NNPA have improved significantly over the years and stands at 2.97% and 0.60% in FY23.

Muthoot Microfin Limited IPO Risk Factors:

-

Muthoot Microfin Limited’s customers generally have limited sources of income, savings and credit histories. As a result, the company may experience increased levels of non-performing assets and related provisions and write-offs that may adversely affect its business.

-

Muthoot Microfin Limited depends on the recognition of the “Muthoot” brand, and failure to use, maintain and enhance awareness of the brand would adversely affect its ability to retain and expand its base of customers.

-

There are several outstanding legal proceedings against Muthoot Microfin Limited, its directors, Promoters and Group Companies. An adverse outcome in any of these proceedings may adversely affect its reputation, business, financial condition, results of operations and cash flows.

-

Muthoot Microfin Limited faces the threat of cyber-fraud and cyber-attacks, such as hacking, phishing and theft of sensitive internal data or customer information and also faces the threat of a system breakdown, network outage and system failure. These may damage its reputation and adversely affect its business.

-

MML’s customers generally have limited sources of income, savings and credit histories. As a result, the co. may experience increased levels of NPAs and related provisions and write-offs that may adversely affect its business.

-

There are several outstanding legal proceedings against Muthoot Microfin Limited, its directors, Promoters and Group Companies. An adverse outcome in any of these proceedings may adversely affect its reputation and business.

Muthoot Microfin Limited IPO Outlook:

MML is one of the leading micro finance company in the South India, mainly focused on rural areas and joint-liability group funding. Company’s AUM is rapidly growing in the past three years and stands at Rs.10,877 cr. as of September 30, 2023 which has grown by 46% YoY. Also it is adding new number of customers swiftly. The company works in the rapidly growing microfinance industry which is expected to continue expanding on the back of technological advancements and focus on the low penetrated rural areas. MML is offering the P/E of 30.27x on the upper price band which seems very reasonable compared to the industry average of 94.86x. Company has huge growth potential in the Indian microfinance market. Considering the strong growth in the financials and controlled asset quality, we recommend investors to consider applying in the offering.

Motisons Jewellers IPO FAQ

Ans. Muthoot Microfin IPO is a main-board IPO of 32,989,690 equity shares of the face value of ₹10 aggregating up to ₹960.00 Crores. The issue is priced at ₹277 to ₹291 per share. The minimum order quantity is 51 Shares.

The IPO opens on December 18, 2023, and closes on December 20, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Muthoot Microfin IPO opens on December 18, 2023 and closes on December 20, 2023.

Ans. Muthoot Microfin IPO lot size is 51 Shares, and the minimum amount required is ₹14,841.

Ans. The Muthoot Microfin IPO listing date is not yet announced. The tentative date of Muthoot Microfin IPO listing is Tuesday, December 26, 2023.

Ans. The minimum lot size for this upcoming IPO is 51 shares.