Yatharth Hospital & Trauma Care Services Limited IPO Company Profile:

Yatharth Hospital & Trauma Care Services Limited is among the top 10 largest private hospitals in the National Capital Region of Delhi (“Delhi NCR”) in terms of the number of beds in Fiscal 2021. As of the date of this Draft Red Herring Prospectus, the company operates three super specialty hospitals in Delhi NCR, i.e., at Noida, Greater Noida, and Noida Extension, Uttar Pradesh. Yatharth Hospital & Trauma Care Services Limited’s Noida Extension hospital with 450 beds is one of the largest hospitals in the Noida Extension, Uttar Pradesh region. The company has recently acquired a 305-bedded multi-specialty hospital in Orchha, Madhya Pradesh near Jhansi, Uttar Pradesh (“Jhansi-Orchha”), which is one of the largest hospitals in Jhansi-Orchha-Gwalior region. With this recent acquisition, the total bed capacity of the hospitals increased to 1,405 beds as of the date of this Draft Red Herring Prospectus. In addition, the critical care program of the company comprises 318 critical care beds, as of January 31, 2022. All of the hospitals based in Delhi NCR are accredited by the NABH (National Accreditation Board for Hospitals & Healthcare Providers).

Yatharth Hospital & Trauma Care Services Limited engaged 370 doctors and offers healthcare services across several specialties and super specialties, as of January 31, 2022. For better and more focussed patient care, the company has carved out the following super specialty as Centres of Excellence (“COE”):

| · Centre of Medicine | · Centre of General Surgery | · Centre of Gastroenterology |

| · Centre of Cardiology | · Centre of Paediatrics | · Centre of Pulmonology |

| · Centre of Gynaecology | · Centre of Neurosciences | · Centre of Nephrology & Urology |

| · Centre of Orthopaedics & Spine & Rheumatology |

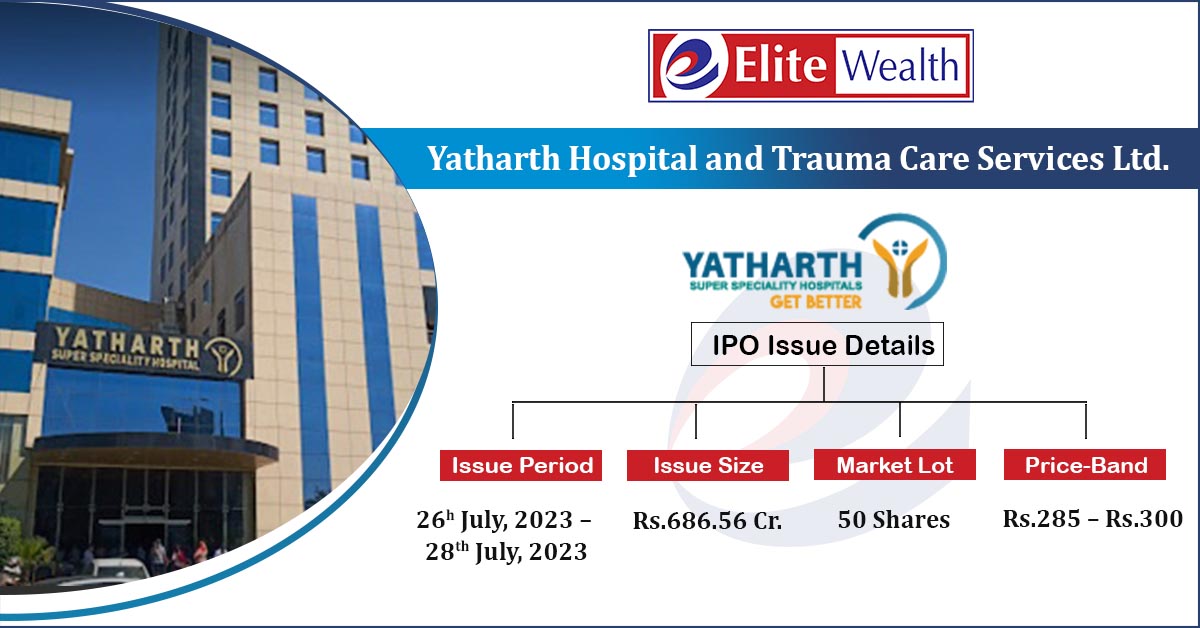

Yatharth Hospital & Trauma Care Services Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To repay borrowings

· To fund capital expenditure · To fund inorganic growth initiatives |

| Issue Size | Total issue Size – Rs.686.56 Cr.

Fresh Issue – Rs.490 Cr. Offer for Sale – Rs.196.56 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.285 – Rs.300 |

| Bid Lot | 50 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 26th July, 2023 – 28th July, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Yatharth Hospital IPO Financial Analysis:

| Particulars | 6M FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | FY-19(in cr.) | CAGR (FY-19 to FY-21) |

| Revenue from sale | 210.97 | 228.67 | 146.04 | 101.83 | 31.0% |

| Other Income | 0.86 | 0.52 | 0.14 | 0.24 | |

| Cost Of Goods Sold | 43.34 | 46.32 | 26.73 | 19.49 | |

| Employee Cost | 38.06 | 46.69 | 26.81 | 20.47 | |

| Other expenses | 65.82 | 68.66 | 54.92 | 42.43 | |

| EBITDA | 64.62 | 67.53 | 37.71 | 19.69 | 50.8% |

| EBITDA margin% | 30.63% | 29.53% | 25.82% | 19.33% | |

| Depreciation | 12.59 | 20.56 | 21.29 | 8.38 | |

| Interest | 10.91 | 18.84 | 18.91 | 6.29 | |

| PBT | 41.12 | 28.12 | -2.49 | 5.02 | 77.6% |

| Total tax | 14.15 | 8.54 | -0.44 | 1.04 | |

| PAT | 26.98 | 19.59 | -2.05 | 3.98 | 70.1% |

| PAT margin% | 12.79% | 8.57% | -1.41% | 3.91% | |

| Dep./revenue% | 5.97% | 8.99% | 14.58% | 8.23% | |

| Int./revenue% | 5.17% | 8.24% | 12.95% | 6.18% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Yatharth Hospital IPO Allotment Status

Yatharth Hospital IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Yatharth Hospital & Trauma Care Services Limited IPO Key financial and operating metrics:

| Particulars | 6M FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | FY-19(in cr.) | CAGR (FY-19 to FY-21) |

| Total bed capacity | 1100 | 1100 | 1100 | 650 | 19.2% |

| Bed Occupancy Rate (%) | 52.58% | 41.63% | 35.76% | 30.75% | 10.6% |

| Average Revenue per Occupied Bed (“ARPOB”) (₹) | 23450.85 | 21286.74 | 22277.46 | 23381.49 | -3.1% |

| Average Length of Stay (“ALOS”) | 6.16 | 5.03 | 3.45 | 3.55 | 12.3% |

| In-patient Revenue (₹ crore) | 183.41 | 206.01 | 114.70 | 81.23 | 36.4% |

| Out-patient Revenue (₹ crore) | 27.56 | 22.66 | 31.34 | 20.61 | 3.2% |

| Revenue from operations (₹ crore) | 210.97 | 228.67 | 146.04 | 101.83 | 31.0% |

Pre-Offer shareholding of the Selling Shareholders:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 91.34% | 66.33% |

| Others | 8.66% | 33.67% |

Source: RHP, EWL Research

| S. No. | Name of the Selling Shareholder | No. of Equity Shares

held |

Percentage of the pre-Offer paid

Up equity share capital (%) |

| 1. | Vimla Tyagi | 3,743,000 | 5.71% |

| 2. | Prem Narayan Tyagi | 2,021,200 | 3.09% |

| 3. | Neena Tyagi | 7,019,600 | 10.71% |

| Total | 12,783,800 | 19.51% | |

| Other Shareholders (Promoters & Promoter Group) | |||

| 6. | Ajay Kumar Tyagi | 27,021,600 | 41.24% |

| 7. | Kapil Kumar | 12,164,400 | 18.57% |

| 8. | Manju Tyagi | 11,524,200 | 17.59% |

| Total | 63,494,000 | 96.91% | |

Yatharth Hospital & Trauma Care Services Limited IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

| 1. | Vimla Tyagi | 3,743,000 Equity Shares |

| 2. | Prem Narayan Tyagi | 2,021,200 Equity Shares |

| 3. | Neena Tyagi | 787,490 Equity Shares |

Yatharth Hospital & Trauma Care Services Limited IPO Strengths:

-

Yatharth Hospital & Trauma Care Services Limited is among the top 10 largest private hospitals in Delhi NCR in terms of the number of beds in Fiscal 2021. The company also had the highest two-year CAGR in revenue growth between Fiscal 2019 and Fiscal 2021 and the highest operating margin in Fiscal 2021 among Key Hospitals in India. The company’s use of compassionate patient care, technology, and experienced medical practitioners enable it to offer its patients comprehensive patient care services with individualized attention.

-

Yatharth Hospital & Trauma Care Services Limited’s hospitals are equipped with machines and devices with sophisticated technology. The hospitals are designed to assist practitioners in providing timely, efficient, and quality healthcare. All the company’s hospitals in the Delhi NCR region are accredited by the NABH. Yatharth Hospital & Trauma Care Services Limited also has a well-equipped laboratory in all three operating hospitals for diagnostic services in haematology, biochemistry, microbiology, molecular biology, and histopathology.

-

Yatharth Hospital & Trauma Care Services Limited’s success can be partially attributed to its highly qualified medical professionals and other staff, and its ability to attract such quality professionals and, staff. As at January 31, 2022, the company’s hospitals engaged 2,530 individuals, which included 370 doctors, of which 207 were consultant doctors, 110 were resident medical officers, and 53 were visiting doctors. Yatharth Hospital & Trauma Care Services Limited’s approach of direct engagement with doctors, nursing staff, and other para-medic staff has helped it attract experienced people.

-

Yatharth Hospital & Trauma Care Services Limited has demonstrated stable operating and financial performance and growth over the past three fiscals. The growth in revenue and profitability can be credited to the strong operational efficiency, that the company achieves by streamlining its clinical and administrative functions, continually introducing process innovations, and ensuring that it maintains economies of scale.

-

The co. has two hospitals in Delhi NCR that are ranked 8th and 10th largest; Given the company’s market position and growing medical tourism YHTCSL has opportunities to expand further.

-

Its advanced infrastructure, technology, and equipment help practitioners provide timely, efficient, and quality healthcare. This has improved operational efficiency and enhanced patient experience.

-

YHTCSL is led by a highly qualified & experienced management team who ensure that the company is led by the right mix of professionals from various fields.

Yatharth Hospital & Trauma Care Services Limited IPO Risk Factors:

-

Yatharth Hospital & Trauma Care Services Limited is highly dependent on doctors, nurses, and other healthcare professionals and the business and financial performance of the company will be impacted significantly if it is unable to attract, retain or train such professionals.

-

Yatharth Hospital & Trauma Care Services Limited’s operations are concentrated in the Delhi NCR region. The company is also significantly dependent on certain specialties for a majority of its revenues. Any impact on the revenues from these hospitals or earnings from the top specialties could materially affect the business, financial condition, results of operations, and cash flows of the company.

-

Yatharth Hospital & Trauma Care Services Limited’s business depends on the strength of its brand and reputation. Failure to maintain and enhance its brand and reputation, and any negative publicity and allegations in the media against it, may materially and adversely affect the level of market recognition of, and trust in, the services, which could result in a material adverse impact on the business, financial condition, results of operations, and prospects of the company.

-

If the co. is unable to pass on cost increases to customers or receive favorable pricing from suppliers, its profitability may suffer. High fixed costs are another factor that can influence its profitability.

-

YHTCSL mainly operates in the Delhi NCR region and heavily relies on specific specialties for the majority of its revenue. Any changes in revenue from these hospitals or earnings from top specialties could significantly impact the company’s business, financial condition, results of operations, and cash flows.

Objects of the Offer:

Yatharth Hospital & Trauma Care Services Limited proposes to utilize the Net Proceeds of the Fresh Issue towards funding the following objects:

- Repayment/ prepayment, in full or part, of certain borrowings availed by the Company.

- Repayment/ prepayment, in full or part, of certain borrowings availed by the Subsidiaries, namely, AKS Medical & Research Centre Private Limited (“AKS”) and Ramraja Multispeciality Hospital & Trauma Centre Private Limited (“Ramraja”).

- Funding capital expenditure expenses of the Company for two hospitals, namely, Noida Hospital and Greater Noida Hospital

- Funding capital expenditure expenses of the Subsidiaries, AKS and Ramraja, for respective hospitals operated by them.

- Funding inorganic growth initiatives through acquisitions and other strategic initiatives.

- General corporate purposes

Yatharth Hospital & Trauma Care Services Limited IPO Prospectus:

- Yatharth Hospital & Trauma Care Services Limited IPO DRHP–

- Yatharth Hospital & Trauma Care Services Limited IPO RHP –

Registrar to the offer:

Link Intime India Private Limited

Contact Person: Shanti Gopalkrishnan

E-mail: yatharth.ipo@linkintime.co.in

Tel: +9122 4918 6200

Yatharth Hospital IPO Outlook:

YHTCSL is one of the leading hospital chain in Delhi NCR region offering a wide range of healthcare services across specialties and super specialties, supported by a highly competent team of over 609 doctors across various disciplines and specializations. Co.’s some of the super specialty centers of excellence include Centre of Medicine, Centre of General Surgery, Centre of Gastroenterology, Centre of Cardiology and Centre of Nephrology & Urology. In FY23, ARPOB stands at Rs.26,538 cr. Vs. Rs.49,668 cr. industry average Vs. Rs.21,286 cr. in FY21. India’s healthcare industry holds a prominent position, being one of the largest in terms of both employment and revenue. CRISIL’s projections indicate a strong 11.3% CAGR growth in the Indian healthcare delivery sector between FY23 and FY27. This growth is fueled by long-term structural factors, increasing affordability, strong fundamentals, and the potential impact of the Ayushman Bharat scheme. Aligning with the industry, YHTCSL is well-positioned for growth with focus on the quality care improvement and operational efficiencies. Based on FY23 earnings, YHTCSL is offering the PE of 39.16x on the upper price band against the industry average of 65.95x. And we recommend investors to apply to the offering.

Yatharth Hospital IPO FAQ

Ans. Yatharth Hospital IPO is a main-board IPO of [.] equity shares of the face value of ₹10 aggregating up to ₹[.] Crores. The issue is priced at ₹285 to ₹300 per share. The minimum order quantity is 50 Shares.

The IPO opens on Jul 26, 2023, and closes on Jul 28, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Yatharth Hospital IPO opens on Jul 26, 2023 and closes on Jul 28, 2023.

Ans. Yatharth Hospital IPO lot size is 50 Shares and the minimum order quantity is .

Ans. The Yatharth Hospital IPO listing date is not yet announced. The tentative date of Yatharth Hospital IPO listing is Monday, 7 August 2023.

Ans. The minimum lot size for this upcoming IPO is 50 shares.