Aeroflex Industries IPO Company Profile:

Aeroflex Industries Limited is a manufacturer and supplier of environmentally sound metallic flexible flow solution products to both domestic and international markets. The company’s products are used in a wide range of sectors to control the flow of all types of substances, including air, liquid, and solid. It is into metallic flexible flow solutions made of SS and has recently developed products made of bronze as well. The company’s products replace flow solutions made of rubber and polymers with flexible flow solutions made with stainless steel corrugation which are becoming a preferred solution due to their numerous advantages.

| IPO-Note | Aeroflex Industries Limited |

| Rs.102 – Rs.108 per Equity share | Recommendation: Listing Gains |

Aeroflex Industries IPO Business Offerings:

-

Product categories include braided hoses, unbraided hoses, solar hoses, gas hoses, vacuum hoses, braiding, interlock hoses, hose assemblies, exhaust connectors, exhaust gas recirculation (EGR) tubes, expansion bellows, compensators, and related end fittings.

-

A range of metallic flexible corrugated hoses with diameters starting from ¼ inch to 14 inches.

-

Stainless Steel Corrugated Flexible Hoses (with and without braiding) cater to a range of end-user industries, including steel, oil, and gas fire sprinklers, refineries aerospace & defense, fire sprinklers & fire fighting, metals & mining, solar and other flexible flow solution.

Aeroflex Industries Limited’s manufacturing facility, located at Taloja, Navi Mumbai, Maharashtra, is spread across 3,59,528 square feet of area. Its manufacturing facility, product integration capabilities, new product development capabilities, R&D, and continuous focus on product quality have been key in its ability to serve a diverse range of industries across the globe and cater to the demand of an increasing number of customers year on year. The company exports its products to more than 80 countries including Europe, USA, and others. During the ten months ended January 31, 2023, it supplied its products to 633 customers. Its customer base can be broadly classified as Distributors, Custom Fabricators, MROs, Original Equipment Manufacturers (OEMs), and companies using flexible flow solutions as part of their operations (Direct Users).

Aeroflex Industries IPO Details:

| Issue Details | |

| Objects of the issue | · To fund working capital requirements

· To pay the borrowings · To gain the listing benefits |

| Issue Size | Total issue Size – Rs.351 Cr.

Fresh Issue – Rs.162 Cr. Offer for Sale – Rs.189 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.102 – Rs.108 |

| Bid Lot | 130 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 22nd Aug, 2023 – 24th Aug, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Aeroflex Industries IPO Financial Analysis:

| Particulars | 10M of FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from Operations | 219.63 | 240.80 | 144.77 | 144.34 | 29.2% |

| Other Income | 0.00 | 0.19 | 0.06 | 0.60 | |

| Cost of Goods Sold | 141.24 | 156.06 | 93.56 | 94.80 | 28.3% |

| Employee Cost | 19.28 | 17.52 | 13.14 | 12.67 | |

| Other expenses | 17.71 | 20.53 | 15.74 | 15.11 | |

| EBITDA | 41.41 | 46.88 | 22.40 | 22.35 | 44.8% |

| EBITDA margin% | 18.85% | 19.47% | 15.47% | 15.48% | |

| Depreciation | 4.20 | 4.18 | 3.78 | 3.92 | |

| Interest | 3.78 | 6.25 | 8.94 | 11.31 | |

| Exceptional items | -2.71 | 0.41 | -1.63 | -3.57 | |

| Profit / (loss) before tax | 30.71 | 36.86 | 8.05 | 3.55 | 222.1% |

| Total tax | 8.40 | 9.36 | 2.04 | -1.14 | |

| Profit / (loss) After tax | 22.31 | 27.51 | 6.01 | 4.69 | 142.1% |

| Profit / (loss) After tax margin% | 10.16% | 11.42% | 4.15% | 3.25% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Aeroflex Industries IPO Allotment Status

Go Aeroflex Industries IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Aeroflex Industries IPO Revenue from Operations:

| Segment | 10M of FY-23 (in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | CAGR |

| Sale of products | |||||||||

| Domestic | 35.51 | 16.17% | 29.43 | 12.22% | 22.62 | 15.62% | 30.50 | 21.13% | -1.8% |

| Export | 177.56 | 80.85% | 203.56 | 84.53% | 117.12 | 80.90% | 107.88 | 74.74% | 37.4% |

| Other Operating Income | |||||||||

| Sale of Scrap | 1.85 | 0.84% | 1.58 | 0.66% | 0.83 | 0.57% | 0.62 | 0.43% | 59.9% |

| Foreign Exchange Fluctuation | 3.37 | 1.53% | 3.24 | 1.34% | 1.92 | 1.33% | 2.39 | 1.66% | 16.4% |

| Other Operating Income | 1.33 | 0.61% | 3.00 | 1.24% | 2.30 | 1.59% | 2.96 | 2.05% | |

| Total | 219.63 | 100% | 240.80 | 100% | 144.77 | 100% | 144.34 | 100% | 29.2% |

Major Shareholders Aeroflex Industries IPO :

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 91.09% | 66.99% |

| Others | 8.91% | 33.01%

|

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1 | Sat Industries Limited | 105,377,040 | 92.18 % |

| 2 | Italica Global FZC | 7,454,830 | 6.52% |

| Total | 112,831,870 | 98.70% |

Aeroflex Industries IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

|

| 1. | Sat Industries Limited | 1,23,00,000 Equity Shares | |

| 2. | Italica Global FZC | 52,00,000 Equity Shares | |

Aeroflex Industries IPO Strengths:

-

Out of the company’s revenue from operations, 80.85%, 84.53%, 80.90%, and 74.74% were derived from exports in the ten months period ended 31st January 2023 and Fiscals ended 2022, 2021, and 2020 respectively. Over the period, it has been able to establish a significant presence in the export markets by providing specified SS flexible flow solutions across industries. To serve its export markets better and on a real-time basis, the company incorporated a wholly-owned subsidiary in the United Kingdom (UK) in the name of “Aeroflex Industries Limited” in 2019.

-

Aeroflex Industries Limited is the Primary Manufacturer of flexible flow solutions (Make-in-India, Make-For-World) with no listed peers and with an advanced manufacturing facility and R&D infrastructure. It owns 34 mechanical corrugation machines, 20 hydraulic corrugation machines, 4 interlocking machines, and 28 braiding machines.

-

The company’s manufacturing facility is certified in accordance with international standards of quality management systems, environmental management systems, and health and safety management systems. Its manufacturing facility also has an in-house Design and R&D laboratory, dedicated finished product storage area, storage area for raw materials, spares, and consumables

-

Given the critical nature of the applications, its solutions are subject to, and measured against quality standards at both the customer level as well as at the regulatory authority level governing the end-user industry and rigorous product approval systems with stringent design, engineering, and use specifications, which act as significant entry barriers for new players.

-

Aeroflex Industries Limited’s operational and functional excellence have contributed to its track record of healthy financial performance and growth. For the ten months period ended January 31, 2023, and Fiscals ended 2022, 2021, and 2020, it generated total revenue from operations of Rs. 219.62 crores, Rs. 240.8 crores, Rs. 144.77 crores, and Rs. 144.34 crores respectively.

- AIL has a global presence in over 80 countries manufacturing metallic flexible flow solutions that are essential for effective material flow across industries.

- is the Primary Manufacturer of flexible flow solutions (Make-in-India, Make-For-World) with no listed peers and with an advanced manufacturing facility and R&D infrastructure. It owns 34 mechanical corrugation machines, 20 hydraulic corrugation machines, 4 interlocking machines, and 28 braiding machines.

- The solutions face rigorous approval procedures and stringent requirements as a result of the critical applications and strict quality standards in customer and regulatory evaluations, posing significant barriers to entry for new entrants.

Aeroflex Industries IPO Key Highlights:

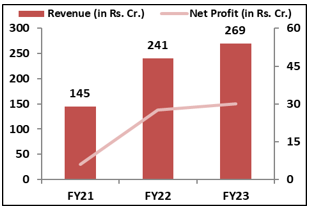

- Revenue of the co. has increased from Rs.145 Cr. in FY21 to Rs.269 Cr. in FY23 with a CAGR of 23% and the Net Profit has increased from Rs.6 Cr. to Rs.30 Cr. during the same period with a CAGR of 71%.

- Cash flow from operating activities has decreased from Rs.12.09 cr. in FY21 to Rs.3.8 cr. in FY23.

- ’s EBITDA Margin & PAT Margin stands at 20% & 11% respectively in FY23.

- As of March, 2023, ROCE and ROE ratio of the co. is 31.9% and 26.43%.

- Debt to Equity of the co. has decreased from 0.90 in FY21 to 0.39 in FY23.

Aeroflex Industries IPO Risk Factors:

-

Aeroflex Industries Limited has a single Manufacturing Facility situated in Taloja, Navi Mumbai, Maharashtra equipped with advanced equipment and semi-automated systems. Its business is dependent and will continue to depend on its single manufacturing facility and hence, the company is subjected to certain risks on that behalf. Any slowdown or shutdown in the manufacturing facility could have an adverse effect on the company’s financial condition with no immediate backup.

-

Aeroflex Industries Limited exports to the U.S.A accounted for 28.29% of its total revenue, followed by exports to the U.A.E, Spain, and Italy accounting for 6-7% of the total revenue for ten months period ended January 31, 2023. The overseas sales to customers of these countries expose the company to risks of concentration. Loss of a substantial portion of sales to any of its customers from these could have an adverse effect on its business and future business prospects.

-

The company has experienced negative cash flows from operations in the recent past which suggests the possibility of may having negative cash flows in the future. Any further negative cash flows could adversely affect the results of operations and financial condition, and the company cannot assure that its net cash flows will be positive in the future.

-

Aeroflex Industries Limited had unsecured loans totaling 5.03 crores and 4.00 crores as on January 31, 2023, and March 31, 2022, respectively which constituted 11.58% and 10.22% of the total borrowings respectively. In case the loan is recalled on demand by the lender and the company is unable to repay the outstanding amounts, it would constitute an event of default under the respective loan agreements. As a result, any such demand with respect to the loans may affect the business negatively.

-

There is an outstanding litigation (tax proceedings) involving the company’s Promoter which is currently pending before the Hon’ble High Court of Bombay. Any adverse decision in the proceeding may render its Promoter liable to penalty and/or monetary compensation and may adversely affect the business, its reputation, and the results of operations. Such proceedings could also divert management time and attention, and consume financial resources in their defense or prosecution.

- AIL’s revenue sources in FY23 were diverse, with 28% coming from the United States, 7% from the UAE, 4% from Italy, and 4% from Spain. Dependence on these markets comes with a risk, since a major decline in sales from any of these countries may negatively impact the co.’s operations and long-term prospects.

- As of FY23, co.’s top 5 raw material supplier concentration is 75% and it purchased 43.48% of the raw material from China. Any loss of these supplier may impact co.’s operations.

- AIL’s revenue sources in FY23 were diverse, with 28% coming from the United States, 7% from the UAE, 4% from Italy, and 4% from Spain. Dependence on these markets comes with a risk, since a major decline in sales from any of these countries may negatively impact the co.’s operations and long-term prospects.

- As of FY23, co.’s top 5 raw material supplier concentration is 75% and it purchased 43.48% of the raw material from China. Any loss of these supplier may impact co.’s operations.

Aeroflex Industries IPO Outlook:

AIL is a manufacturer & supplier of environment-friendly metallic flexible flow solutions to critical global industrial eco-system ranging from chemicals, petrochemicals, oil & gas, refineries to metals & mining. Its products replace flow solutions made of rubber and polymers with flexible flow solutions made with SS corrugation which are becoming a preferred solution due to their numerous advantages. The co. has 1700 product SKUs and generated ~81% of its revenue from the exports and rest from the domestic market in FY23. Two major product categories in which the co. is working are SS Flexible hoses & SS corrugated hoses; global markets for these two categories are expected to grow at a CAGR of 7.5% & 6.3% respectively from 2020 to 2026. AIL is offering the P/E of 46.3x on the upper price band which seems reasonably priced. The co. operates globally, offering flexible flow solutions across diverse industries and exhibiting robust financial growth. But it’s important to keep in mind that the OFS part won’t help the business. Additionally, with a significant portion of revenue from exports, potential geopolitical risks exist. Hence, investors are advised to apply for listing gains.

Aeroflex Industries IPO FAQ

Ans. Aeroflex Industries IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on <>.

Ans. The minimum lot size that investors can subscribe to is <> shares.

Ans. The Aeroflex Industries IPO listing date is <>.

Ans. The minimum lot size for this upcoming IPO is <> shares.