BLS E-Services Limited IPO Company Details:

BLS E-Services Limited (BLSEL) is a technology-enabled digital service provider that offers assisted e-services, e-government services at the local level in India, and business correspondence services to major Indian banks. The company has a strong network of access points that facilitate the provision of government-to-consumer (G2C) touch points, including social welfare programs, healthcare, banking, financial, educational, and utility services. Through its 97,018 BLS touchpoints and 1016 BLS Stores, BLSEL offers seamless services throughout India. The majority of these locations are found in rural, semi-urban, and isolated places with low internet penetration rates, where residents require assistance in accessing technology-enabled services. The company’s business correspondents division offers, through its subsidiaries, ZMPL and Starfin, products and services such as opening savings accounts, recurring deposit accounts, cash deposits, withdrawals, remittance, transfers, and bill collection services. The Company generates revenue from monthly commissions, Registration Fees and transaction-based commissions. In addition, it offers tickets, aided e-commerce, and point-of-sale services. Furthermore, through its touchpoints, the Company offers a range of citizen-centric services enabled by information and communication technology (“ICT”), hence facilitating the delivery of different e-governance projects of the State Governments in India. This place offers PAN and Aadhar registration, property registration, and other related services.

| IPO-Note | BLS E-Services Limited |

| Rs.129 – Rs.135 per Equity share | Recommendation: Apply for the Long Term |

BLS E-Services Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To strengthen the technology infrastructure to develop new capabilities · To fund the setting up of BLS Stores · To achieve inorganic growth through acquisitions |

| Issue Size | Total issue Size – Rs.310.91 Cr.

Fresh Issue – Rs.310.91 Cr. |

| Face value |

Rs.10 |

| Issue Price | Rs.129 – Rs.135 |

| Bid Lot | 108 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 30th Jan, 2024 – 01st Feb, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 10% of Net Issue Offer |

| Retail | 15% of Net Issue Offer |

BLS E-Services Limited IPO Strengths:

- BLSEL has an asset light business model as it operates on the franchise model where its merchants operate the BLS touchpoints, which are owned or leased by the merchants.

- The company has recently launched the BLS Sewa App, a one-stop shop for numerous services like recharges, money transfers, setting demat accounts, booking airline tickets, and much more.

BLS E-Services Limited IPO Key Highlights::

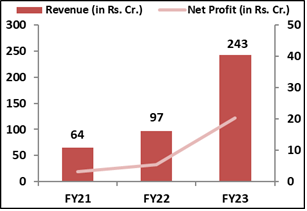

- Revenue of the co. has grown from Rs.64 Cr. in FY21 to Rs.243 Cr. in FY23 with a very strong CAGR of 55.6%; while the profit has grown with a huge CAGR of 86.2% from Rs.3 Cr. in FY21 to Rs.20 Cr. in FY23.

- Co.’s EBITDA Margin & PAT Margin stand healthy at 14.9% & 8.4% respectively in FY23.

- As of FY23, ROCE & ROE ratios are at 30.62% and 33.33% respectively.

- Company has reduced its debt over the period and its current debt to equity ratio stands at 0.07x.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check BLS E-Services Limited IPOAllotment Status

BLS E-Services Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

BLS E-Services Limited IPO Financial Performance:

BLS E-Services Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 92.28% | 68.89% |

| Others | 7.72% | 31.11% |

Source: RHP, EWL Research

BLS E-Services Limited IPO Risk Factors:

- Approximately 60% of the company’s revenue comes from a single client—a sizable PSU bank. Furthermore, there are no dependable long-term agreements between the Company and the bank.

- It provides e-governance services only in Punjab, Uttar Pradesh & West Bengal, any adverse changes in the conditions affecting these regions can impact its business.

- All the E-Governance projects are awarded to the Company’s promoter BLS International and not BLS E-Services, which is responsible for 28% of its revenue.

BLS E-Services Limited IPO Outlook:

BLSEL is offering the P/E of 60x on the upper price band, compared to 56.27x of its peer, EMudhra Limited. However the business of both company is not comparable on apple-to-apple basis. The company promotes financial inclusion by utilizing Aadhaar to facilitate banking access and money transfers. Their emphasis on innovation and security paves the path for a more promising and convenient digital future for everybody. Moreover, in alignment with the government’s Digital India initiative, BLSEL appears to have a favorable outlook. The valuation of the company looks reasonable. Hence, we recommend investors to apply in the offering with the long term perspective.

BLS E-Services Limited IPO FAQ

Ans. BLS E-Services IPO is a main-board IPO of 23,030,000 equity shares of the face value of ₹10 aggregating up to ₹310.91 Crores. The issue is priced at ₹129 to ₹135 per share. The minimum order quantity is 108 Shares.

The IPO opens on January 30, 2024, and closes on February 1, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The BLS E-Services IPO opens on January 30, 2024 and closes on February 1, 2024.

Ans. Jyoti CNC Automation IPO lot size is 108 Shares, and the minimum amount required is ₹14,580.

Ans. The BLS E-Services IPO listing date is not yet announced. The tentative date of BLS E-Services IPO listing is Tuesday, February 6, 2024.

Ans. The minimum lot size for this upcoming IPO is 108 shares.