Netweb Technologies India Limited IPO Company Details:

Netweb Technologies India Limited with fully integrated design and production skills, is a top provider of high-end computing solutions (HCS) with Indian roots. The company has owned and controlled OEM in the space of HCS providing Supercomputing systems, private cloud and HCI, data centre servers, AI systems and enterprise workstations, and HPS solutions It is one of India’s largest OEMs in terms of the number of HPC installations. Since the inception of the erstwhile sole proprietorship, one of its Promoters, Sanjay Lodha, M/s Netweb Technologies, which the company had acquired in August 2016, until February 28, 2023, the company has undertaken installations of more than 300 Supercomputing systems, 50 private cloud and HCI installations, 4,000 accelerator / GPU based AI systems and enterprise workstations and HPS solutions with throughput storage of up to 450 GB/ sec.

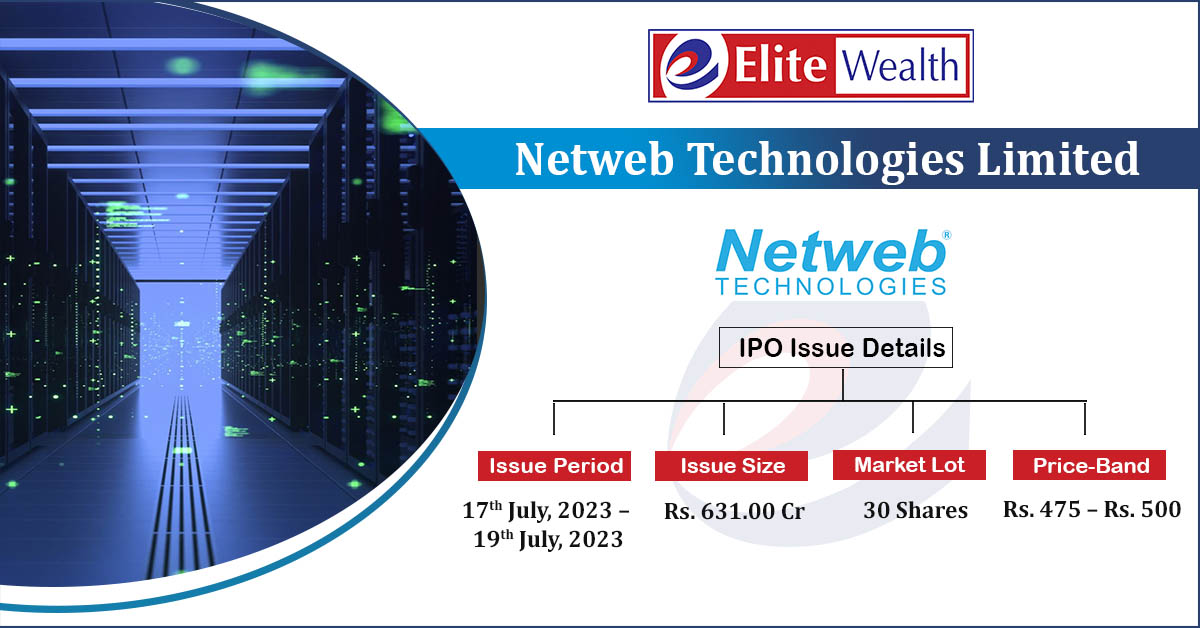

| IPO-Note | Netweb Technologies Limited |

| Rs.475 – Rs.500 per Equity share | Recommendation: Subscribe |

Netweb Technologies India Limited IPO Business Offerings:

- High-Performance Computing (HPC/ Supercomputing) systems

- Private cloud and hyper-converged infrastructure (HCI)

- AI systems and enterprise workstations

- High-Performance Storage (HPS /Enterprise Storage System) solutions

- Data centre servers, software and services for its HCS offerings.

Netweb Technologies India Limited caters to marquee customers across various end-user industries such as information technology, entertainment and media, banking, financial services and insurance (BFSI), national data centres and government entities including in the defence sector, education and research development institutions such as Indian Institute of Technology (IIT) Jammu, IIT Kanpur, Dr. Shyam Prasad Mukherjee International Institute of Information Technology, Naya Raipur (IIIT Naya Raipur), NMDC Data Centre Private Limited, Airamatrix Private Limited, Graviton Research Capital LLP, Institute of Nano Science and Technology, HL Mando Softech India Private Limited, Jawaharlal Nehru University, A.P.T. Portfolio Private Limited, Akamai India Networks Private Limited, Yotta Data Services Private Limited and Hemvati Nandan Bahuguna Garhwal University. It also caters to an Indian Government space research organisation and an R&D organisation of the Ministry of Electronics and Information Technology, Government of India which is involved in carrying out R&D in information technology and electronics

Netweb Technologies India Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To fund capital expenditure · To fund the working capital requirements · To repay borrowings |

| Issue Size | Total issue Size – Rs.631 Cr.

Fresh Issue – Rs.206 Cr. Offer for Sale – Rs.425 Cr. |

| Face value |

Rs.2 |

| Issue Price | Rs.475 – Rs.500 |

| Bid Lot | 30 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 17th July, 2023 – 19th July, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Netweb Technologies India Limited IPO Financial Analysis

| Particulars | 6M of FY-23 (in cr.) | 6M of FY-22 (in cr.) | FY-22 (in cr.) | FY-21 (in cr.) | FY-20 (in cr.) | CAGR |

| Revenue from Operations | 143.02 | 99.59 | 247.03 | 142.79 | 156.01 | 25.8% |

| Other Income | 0.26 | 0.20 | 0.91 | 1.50 | 1.22 | |

| Cost of Goods Sold | 100.85 | 75.49 | 186.46 | 106.16 | 127.43 | 21.0% |

| Employee Cost | 10.47 | 6.96 | 15.21 | 12.74 | 10.78 | |

| Other expenses | 8.94 | 3.81 | 10.77 | 9.51 | 9.73 | |

| EBITDA | 23.02 | 13.53 | 35.51 | 15.89 | 9.29 | 95.5% |

| EBITDA margin% | 16.10% | 13.59% | 14.37% | 11.13% | 5.95% | |

| Depreciation | 1.43 | 0.74 | 1.64 | 1.45 | 1.34 | |

| Interest | 1.83 | 1.77 | 3.64 | 3.33 | 2.63 | |

| Profit / (loss) before tax | 19.76 | 11.02 | 30.23 | 11.10 | 5.32 | 138.3% |

| Total tax | 5.03 | 2.83 | 7.77 | 2.87 | 1.42 | |

| Profit / (loss) After tax | 14.73 | 8.20 | 22.45 | 8.23 | 3.91 | 139.8% |

| Profit / (loss) After tax margin% | 10.30% | 8.23% | 9.09% | 5.76% | 2.50% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Netweb Technologies India Limited IPO Allotment Status

Muthoot Microfin Limited IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Netweb Technologies India Limited IPO Revenue from Operations:

| Segment | 6M of FY-23 (in cr.) | % | 6M of FY-22 (in cr.) | % | FY-22 (in cr.) | % | FY-21 (in cr.) | % | FY-20 (in cr.) | % | CAGR |

| Sale of products | 140.08 | 98% | 96.77 | 97.17% | 240.18 | 97.23% | 140.29 | 98.25% | 153.20 | 98.20% | 16.2% |

| Sale of services | 2.94 | 2% | 2.82 | 2.83% | 6.86 | 2.77% | 2.50 | 1.75% | 2.81 | 1.80% | 34.6% |

| Total | 143.02 | 100% | 99.59 | 100% | 247.03 | 100% | 142.79 | 100% | 156.01 | 100% | 51% |

Netweb Technologies India Limited IPO Financial Performance:

Netweb Technologies India Limited IPO Major Shareholders:

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1 | Sanjay Lodha | 19,715,072 | 38.71% |

| 2 | Navin Lodha | 9,857,086 | 19.36% |

| 3 | Vivek Lodha | 9,857,086 | 19.36% |

| 4 | Niraj Lodha | 9,857,086 | 19.36% |

| 5 | Ashoka Bajaj Automobiles Private Limited | 1,350,000 | 2.65% |

| Total | 50,636,330 | 99.44% |

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 97.80% | 75.45% |

| Others | 2.20% | 24.55% |

Netweb Technologies India Limited IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

|

| 1. | Sanjay Lodha | 2,860,000 Equity Shares | |

| 2. | Navin Lodha | 1,430,000 Equity Shares | |

| 3. | Vivek Lodha | 1,430,000 Equity Shares | |

| 4. | Niraj Lodha | 1,430,000 Equity Shares | |

| 5. | Ashoka Bajaj Automobiles Private Limited | 1,350,000 Equity Shares | |

Netweb Technologies India Limited IPO Strengths:

-

Netweb Technologies India Limited is one of the few players in India who can offer a full stack of products and a solution suite comprising high-performance computing solutions. It is also an Indian-origin OEM to build Supercomputing systems, private cloud and HCI, data centre servers, AI systems and enterprise workstations, and HPS solutions under the ‘Make in India’ initiative of the Government of India.

-

Netweb Technologies India Limited designs, develops, and implements its entire solutions package which helps it to engage with its customers in a more holistic manner. This enables the company to embed itself within the institutional framework of its customers and helps in customer retention and repeat business.

-

The business has made an effort to foster an innovative culture inside the organisation and to establish a strong conviction that R&D has been and will continue to be a crucial component of its expansion. It has continued to strive towards innovation in its product range and has continued to build its capabilities by continuously developing its R&D team to improve its systems design and architecture and to expand the business further.

-

Promoters of Netweb Technologies India Limited have led from the front in establishing and growing the business and operations capabilities. The company has an experienced board and strong management team led by people with significant experience in the information technology industry. Its trained and skilled engineers facilitate it in meeting the constantly evolving demands of the industry.

-

Netweb Technologies India Limited has a history of financial success and sustained expansion. Its revenue from operations has increased from ₹ 1,56.01 crores in Fiscal 2020 to ₹ 2,47.03 crores in Fiscal 2022, at a CAGR of 25.84 %. It has been able to grow both its revenue and its profit, without any external equity funding from strategic investors or private equity funds and without high leverage from lenders.

- The co. is one of the few companies in India that offers a complete range of high-performance computing (HPC) products and services, from design and development to implementation and integration.

- It has continuously worked on its R&D capabilities which has enabled it to improve its systems design and architecture and to expand its products and solutions suite.

- The technical expertise required to modify designs and change the execution of offerings is a significant barrier to entry for new players in the industry.

Netweb Technologies India Limited IPO Key Highlights:

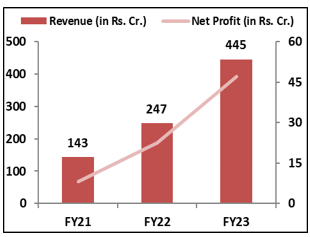

- Revenue of the co. has increased from Rs.143 Cr. in FY21 to Rs.445 Cr. in FY23 with a CAGR of 46% and the Net Profit has increased from Rs.8 Cr. to Rs.47 Cr. during the same period with a strong CAGR of 78.7%.

- ’s EBITDA Margin & PAT Margin stands at 15.9% & 10.5% respectively in FY23.

- As of March, 2023, ROCE and ROE ratio of the co. is 64.42% and 68% respectively.

- Current Debt to Equity ratio of the co. is 0.30 times which was 1.31 times in FY21.

Netweb Technologies India Limited IPO Risk Factors:

-

Netweb Technologies India Limited has entered into various non-disclosure agreements with its technology partners to collaborate on the design and innovation of products and solutions, most of which are governed by foreign laws. Any failure to comply with the terms of such agreements resulting in a breach under such agreements may have monetary implications and cause the company reputational harm.

-

The company has had negative cash flows from operating activities of ₹ (9.87) crores as on March 31, 2021, owing to the lower business operation. Any further negative cash flows could adversely affect the results of operations and financial condition, and the company cannot assure that its net cash flows will be positive in the future.

-

Netweb Technologies India Limited was required to spend ₹ .07 crores in the Fiscal 2021 in accordance with the provisions of the Companies Act, and in terms of its CSR policy. However, it was unable to meet this target and could only expend ₹ 0.2 million towards the CSR target. Accordingly, there was a shortfall of ₹ 0.49 million in its CSR expenditure in the Fiscal 2021. Any such further failure to comply with the CSR requirements in the future may attract penalties under the Companies Act.

-

There are some factual inaccuracies in some of the company’s corporate records and filings. Further, the company, in the past, has paid insufficient stamp duty on share certificates for the allotment of Equity Shares. It has also made delayed filings with the RoC and also delayed the payment of certain statutory dues. Moreover, certain payment challans in relation to the corporate filings made by the company are not traceable.

-

Netweb Technologies India Limited and one of its Promoters are currently involved in tax litigation pending at different levels of adjudication before various forums. Any adverse decision in the proceeding may render its Promoter liable to penalty and/or monetary compensation and may negatively affect the business, its reputation and results of operations. Such proceedings could also divert management time and attention, and consume financial resources in their defence or prosecution.

- A substantial amount of the co.’s revenue comes from its top 10 clients, with whom it does not have any long-term agreements. This exposes the co. to the risk of losing these top customers.

- As of March’ 23, ~72% of the co.’s revenue was generated through HCS offering, any decline in the demand of such offering may affect business performance.

- The co.’s revenue is heavily reliant on government contracts, which are awarded through a bidding process. If it is unable to win these contracts or is forced to lower its bid price, it could have a negative impact on its revenue.

Netweb Technologies India Limited IPO Outlook:

NTIL is a leading provider of high-performance computing (HPC) solutions in India. Servers, storage, software, and consulting services are a few of the HPC solutions that the co. provides. The co. caters to the needs of marquee customers including governmental organizations, educational institutions and commercial firms. Some of its products and solutions include Tyrone, Skylus, Kubyts, Verta, ParallelStor. As of March’23, co. has generated 39.19% of revenue from Supercomputing systems, 33.13% from private cloud & HCI, 7% from AI Systems, 7% from HPS solutions, 6.42% from Data centre and rest from others. In FY23, Education & Research and IT & ITES industries are the major contributor (i.e.46.69% and 24.83%) in the co.’s revenue. Indian IT Industry is anticipated to grow at a CAGR of 8.8% during FY23-29, this growth will be aided by a growing economy, the transition to 4G and 5G mobile networks, the growth of e-commerce, and the implementation of the “Make in India” and PLI Schemes. Aligning with the industry, NTIL is well-positioned for growth in the HPC market. Co. is further expanding and augmenting its product portfolio along with expansion in new geographies. Based on FY23 earnings, NTIL is offering the PE of 59.72x on the upper price band against the industry average of 79.82x. And we recommend investors to apply to the offering.

Netweb Technologies India Limited IPO Prospectus:

-

Netweb Technologies India Limited IPO DRHP- https://www.sebi.gov.in/filings/public-issues/mar-2023/netweb-technologies-india-limited-drhp_69580.html

-

Netweb Technologies India Limited IPO RHP-

Registrar to the offer:

Link Intime India Private Limited

Tel: +91 810 811 4949

E-mail: netwebtechnologies.ipo@linkintime.co.in

Investor Grievance E-mail: netwebtechnologies.ipo@linkintime.co.in

Contact Person: Shanti Gopalkrishnan

Website: www.linkintime.co.in

SEBI Registration No: INR000004058

Netweb Technologies India Limited IPO FAQ:

Ans.

Netweb Technologies India IPO is a main-board IPO of 12,620,000 equity shares of the face value of ₹2 aggregating up to ₹631.00 Crores. The issue is priced at ₹475 to ₹500 per share. The minimum order quantity is 30 Shares.

The IPO opens on Jul 17, 2023, and closes on Jul 19, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Netweb Technologies India IPO opens on Jul 17, 2023 and closes on Jul 19, 2023.

Ans. Netweb Technologies India IPO lot size is 30 Shares and the minimum order quantity is .

Ans. The Netweb Technologies India IPO listing date is not yet announced. The tentative date of Netweb Technologies India IPO listing is Thursday, 27 July 2023.

Ans. The minimum lot size for this upcoming IPO is 30 shares.