Sai Silks (Kalamandir) IPO Company Profile :

Sai Silks (Kalamandir) Limited (SSKL) is a retail textile business group that was founded in 2005 by Mr. Chalavadi Naga Kanaka Durga Prasad and Mrs. Chalavadi Jhansi Rani. The company is amongst the top 10 retailers of ethnic apparel, particularly sarees, in south India in terms of revenues and profit after tax in Fiscal 2020, 2021 and 2022. Through its four store formats, i.e., Kalamandir, VaraMahalakshmi Silks, Mandir and KLM Fashion Mall, the company offers its products to various segments of the market that include premium ethnic fashion, ethnic fashion for middle income and value-fashion, with a variety of products across different price points, thereby catering to customers across all market segments. The company leverages its store network of 54 stores as of July 31, 2023, to focus on spreading India’s vibrant culture, traditions and heritage by offering a diverse range of products which includes various types of ultra-premium and premium sarees suitable for weddings, party wear, as well as occasional and daily wear; lehengas, men’s ethnic wear, children’s ethnic wear and value fashion products comprising fusion wear and western wear for women, men and children.

| IPO-Note | Sai Silks (Kalamandir) Limited |

| Rs.210 – Rs.222 per Equity share | Recommendation: Subscribe |

Sai Silks (Kalamandir) IPO Details:

| Issue Details | |

| Objects of the issue | · Funding capital expenditure and working capital.

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.1201 Cr.

Fresh Issue – Rs.600 Cr. Offer for Sale – Rs.601 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.210 – Rs.222 |

| Bid Lot | 67 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 20th Sep, 2023 – 22nd Sep, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Sai Silks (Kalamandir) IPO Strengths:

-

The share of organized retailing in apparel has increased from 14% in Fiscal 2007 to 32% in Fiscal 2020. The evolution of the market, in its current phase, represents distinct segmentation of channels of organized retail for apparel. Today, the company offers one of the widest portfolios of saree SKUs among women’s apparel brands in India.

-

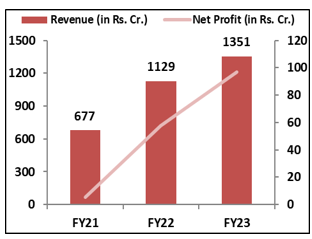

SSKL’s revenue from operations increased from ₹ 677.25 cr. in Fiscal 2021 to ₹ 1,129.32 cr. in Fiscal 2022 reflecting full recovery from the effects of COVID-19 which further increased to ₹ 1,351.47 million in Fiscal 2023.

-

The saree and others category (which includes lehengas, Indian dresses and gowns) is expected to grow at a CAGR of 19% from Fiscal 2022 to Fiscal 2027, to reach ₹ 1,248.37 billion in Fiscal 2027, and the company is planning to use the issue money to fund capital expenditure towards setting-up of 30 new stores, such expansion will further increase the company’s market share in the value-fashion brand segment and increase its profitability and revenue from operations.

Sai Silks (Kalamandir) IPO Financial Performance:

Sai Silks (Kalamandir) IPO Key Highlights:

-

SSKL reported total income/net profit for the previous three fiscal years of Rs. 679.10 crore/Rs. 5.13 crore (FY21), Rs. 1133.02 crore/Rs. 57.69 crore (FY22), and Rs. 1358.92 crore/Rs. 97.59 crore (FY23)..

-

SSKL reported RoE margins of 2.16% (FY21), 21.22% (FY22), and 27.96% (FY23), and management is optimistic about continuing these trends with the opening of new stores.

-

SSKL reported EBITDA margins of 9.21% (FY21), 11.78% (FY22), and 15.73% (FY23).

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Sai Silks IPO Allotment Status

Go Sai Silks IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Sai Silks (Kalamandir) IPO Risk Factors:

- Women’s saree sales account for a large portion of the business, making it susceptible to fluctuations in demand and shifts in customer preferences.

- The promoters of SSKL collectively pledged 31.33% of the fully diluted equity share capital to the State Bank of India.

Sai Silks (Kalamandir) IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 95.24% | 60.80% |

| Others | 4.75% | 39.20% |

Source: RHP, EWL Research

Sai Silks (Kalamandir) IPO Outlook:

Sai Silks (Kalamandir) Limited, is a retail textile business group which sells apparel with an emphasis on sarees, has emerged as one of the top 10 merchants of ethnic goods following a failed attempt at its first IPO in February 2013. It has reported solid figures for FY23, showing chances ahead with further new outlets, after suffering somewhat from COVID effect up until FY22. It appears that the issue is fully priced based on FY23 profits. P/E of the SSKL stands at 35.2x on the upper price band compared to the industry average of 98.03x; which seems cheap against listed peers. Hence we recommend Investors may subscribe and park money for medium- to long-term gains.

Sai Silks (Kalamandir) IPO FAQ

Ans. Sai Silks (Kalamandir) IPO is a main-board IPO of 54,099,027 equity shares of the face value of ₹2 aggregating up to ₹1,201.00 Crores. The issue is priced at ₹210 to ₹222 per share. The minimum order quantity is 67 Shares.

The IPO opens on September 20, 2023, and closes on September 22, 2023.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

listed on BSE, NSE.

Ans. The Sai Silks (Kalamandir) IPO opens on September 20, 2023 and closes on September 22, 2023.

Ans. Sai Silks (Kalamandir) IPO lot size is 67 Shares, and the minimum amount required is ₹14,874.

Ans. The Sai Silks (Kalamandir) IPO listing date is not yet announced. The tentative date of Sai Silks (Kalamandir) IPO listing is Wednesday, October 4, 2023.

Ans. The minimum lot size for this upcoming IPO is 67 shares.