HMA Agro Industries Limited IPO Company Profile :

HMA Agro Industries Limited is a meat processor and exporter company based in Agra. The company was founded in 2008 and has become a leading exporter of buffalo meat in India. It exports its products to more than 40 nations throughout the world. Company’s main products are Buffalo meat that has been freshly deglanded and frozen. Buffalo meat burgers, kebabs, and sausages are some other value-added goods that HMA Agro provides. The company places a high priority on food quality and safety. The Food Safety and Standards Authority of India (FSSAI) and the United States Department of Agriculture (USDA) both certify the goods of the company. The HACCP (Hazard Analysis and Critical Control Points) accreditation has also been given to the business.

| IPO-Note | HMA Agro Industries Limited |

| Rs.555 – Rs.585 per Equity share | Recommendation: Avoid |

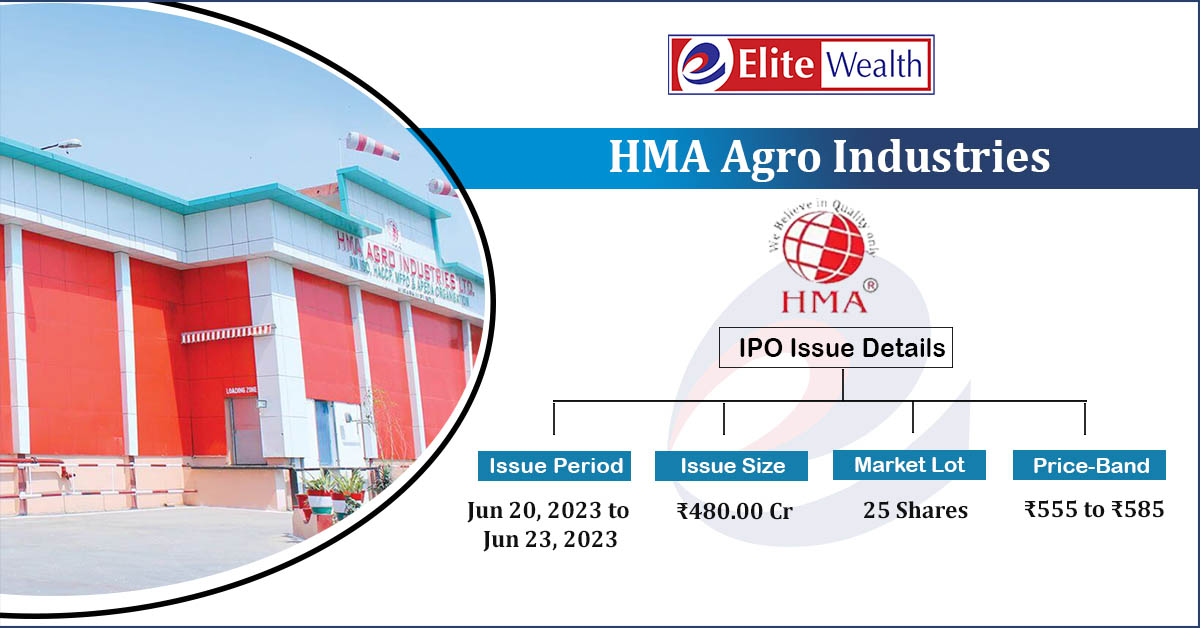

HMA Agro Industries Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To Fund working capital requirements

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.480 Cr.

Fresh Issue – Rs.150 Cr. Offer For Sale – Rs.330 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.555 – Rs.585 |

| Bid Lot | 25 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 20th June, 2023 – 23rd June, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

HMA Agro Industries Limited IPO Strengths:

- HMA Agro has one of the highest production capacities in the industry with current capacity of ~228,000 metric tonnes per annum (MTPA).

- It is among the largest exporters of buffalo meat in India and accounts for more than 10% of India’s total export of frozen buffalo meat.

- The co. is are one of the top three meat exporter companies of India exporting to more than 40 countries under the brands “Black Gold”, “Kamil” & “HMA”.

HMA Agro Industries Limited IPO Key Highlights:

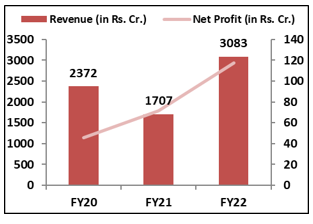

- Revenue of the co. has increased from Rs.2,372 Cr. in FY20 to Rs.3,083 Cr. in FY22 with a CAGR of 9.1%.

- Net Profit has also increased from Rs.46 Cr. in FY20 to Rs.118 Cr. in FY22 with a strong CAGR of 36.8%.

- The EBITDA Margin and PAT Margin for FY22 is at 5.70% and 3.82% respectively.

- Debt to Equity ratio of the company stands at 0.9 times as of December’22.

- As of Dec.22, ROCE and ROE ratio of the co. is at 33.39% and 27.36%.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check HMA Agro Industries Limited IPO Allotment Status

Go HMA Agro Industries Limited IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

HMA Agro Industries Limited IPO Risk Factors:

- Company’s Promoters, Directors, its Subsidiaries and other Group Companies are parties to certain legal proceedings. Any adverse decision in such proceedings may have a material adverse effect on its business.

- The co. derives significant portion of revenue from the sale of frozen Meat business, any decrease in the demand or in the production of these products may have an adverse effect on the business operations.

- The co. operates in a regulated industry and its operations generate pollutants and waste. This could lead to plant shutdowns and fines, which could impact the company’s business.

HMA Agro Industries Limited IPO Financial Performance:

HMA Agro Industries Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 100% | 71.31% |

| Others | 0% | 28.69% |

Source: RHP, EWL Research

HMA Agro Industries Limited IPO Outlook :

HMA Agro is a three star export house and a meat industry leader with 40+ years of experience. The company is expanding its product portfolio to include frozen fish products, basmati rice, poultry, and other agri products and also aim to become one of India’s most recognized food product exporters. It has four fully integrated meat processing plants at Aligarh, Mohali, Agra and Parbhani and is in the process of setting up a fifth plant. The company is also acquiring a sixth plant at Unnao, this will increase its annual processing capacity to more than 400,000 metric tons. Co. generated ~90% of its revenue from exports (of which Egypt and Vietnam are major contributor) and ~10% from India from FY20-22. Analyzing the co.’s fundamentals, its business model does not look promising as it is majorly an export driven business, co. may face significant risks due to the uncertain environments of the countries to which it exports its products. Additionally long-term outlook for India doesn’t look good for the co. as the vegetarian population of India has increased to 39% in 2019-21 compared to the previous survey conducted in 2015-16 (Acc. to National Family Health Survey). Based on FY22 earnings, HMA Agro is offering the PE of 29x on the upper price band. Company does not have any peer in the listed space. Hence, we suggest investors consider avoid subscribing to the offering.

HMA Agro Industries Limited IPO FAQ

Ans. HMA Agro Industries Limited IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The HMA Agro Industries IPO opens on Jun 20, 2023 and closes on Jun 23, 2023.

Ans. HMA Agro Industries IPO lot size is 25 Shares and the minimum order quantity is .

Ans. The HMA Agro Industries IPO listing date is not yet announced. The tentative date of HMA Agro Industries IPO listing is Tuesday, 4 July 2023.

Ans. The minimum lot size for this upcoming IPO is 25 shares.