Signature Global (India) Limited IPO Company Profile :

Signature Global (India) Limited (SGL) ) is one of the largest real estate development company in the National Capital Region of Delhi (Delhi NCR) focused on affordable and mid-segment housing in terms of units supplied (in the below ₹ 80 lakh price category) between 2020 and 2023, with a market share of 31%. Most of the Completed Projects, Ongoing Projects, and Forthcoming Projects are located in Gurugram and Sohna in Haryana, with 88..49% of the company’s Saleable Area located in this region, and almost all of the projects have been, or are being, undertaken under the Affordable Housing Policy (AHP) or the Affordable Plotted Housing Policy or the Deen Dayal Jan Awas Yojana (DDJAY –APHP). In terms of sales in Gurugram, the company. had a market share of 31% in the affordable and mid-segment, and a market share of 24% in all budget categories, in the period from 2020 to 2023.

| IPO-Note | Signature Global (India) Limited |

| Rs.366 – Rs.385 per Equity share | Recommendation: Avoid |

Signature Global (India) Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To pay borrowings · To infuse funds in the subsidiaries · To acquire land for inorganic growth · To gain listing benefits |

| Issue Size | Total issue Size – Rs.730 Cr.

Fresh Issue – Rs.603 Cr. Offer for Sale – Rs.127 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.366 – Rs.385 |

| Bid Lot | 38 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 20th Sep, 2023 – 22nd Sep, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Signature Global (India) Limited IPO Strengths:

- SGL is the largest real estate development company in Delhi NCR, with a market share of 31%, in terms of units supplied (in the below ₹ 8.00 million price category) between 2020 and the three months ended March 31, 2023.

- It has Well-established brand, strong distribution network and digital marketing capabilities translating into faster sales.

- Company is growing rapidly; its project portfolio has increased from 9.06 million square feet of Saleable Area as on March 31, 2018, to 44.65 million square feet of Saleable Area as on March 31, 2023.

Signature Global (India) Limited IPO Financial Performance:

Signature Global (India) Limited IPO Key Highlights:

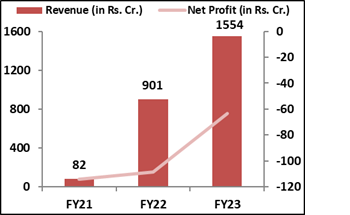

- Revenue from operations has increased from Rs.82 Cr. in FY21 to Rs.1554 Cr. in FY23 with a huge CAGR of 166.5%.

- Company has incurred losses over the years, but the losses are decreasing and has improved from loss of Rs.114 cr. in FY21 to the loss of Rs.63 cr. in FY23.

- Company’s net debt has increased from Rs.557 cr. in FY21 to Rs.1094 cr. in FY23.

- As of March, 2023, Debt to Equity ratio stands at 35.97:1 times.

- Number of completed units have increased from 102 in FY21 to 5,511 in FY23.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Signature Global (India) Limited IPO Allotment Status

Go Signature Global (India) Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Signature Global (India) Limited IPO Risk Factors:

- SGL has incurred a net loss in the past, and may not be able to achieve or maintain profitability in the future.

- The availability of developable land, particularly in Delhi NCR and Haryana, is limited, and therefore, the acquisition of new land in such areas poses substantial challenges, including being highly competitive and costly.

- Company’s business and financial performance is dependent on various GoI and state government policies supporting affordable housing; any withdrawal of such projects could adversely impact its business.

Signature Global (India) Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 78.36% | 67.28% |

| Others | 21.64% | 32.72% |

Source: RHP, EWL Research

Signature Global (India) Limited IPO Outlook:

SGL is an eminent player in residential real-estate market focused on providing affordable and mid-segment housing in the Delhi-NCR region. As of March 31, 2023, company had sold 25,089 residential units, which amounted to 88.81% of the total residential units launched in its completed and ongoing projects. Affordable and lower mid-segment housing dominated supply from 2017 to March 31, 2023, in India’s top seven cities, highlighting strong demand. Gurugram and Sohna together contributed 68% of affordable supply in Delhi NCR during this period. Company intends to align with this growth through its continuous focus on the affordable and lower mid segment housing. SGL dominates the market for affordable housing in the Delhi-NCR region, however, its history of losses has caused the IPO to be overpriced with a negative P/E. Company has large projects on the hand, and with its sale’s realization, things are expected to change soon. However, based on its financial performance so far, it is highly risky investment. Therefore, we advise to avoid the offering.

Signature Global (India) Limited IPO FAQ

Ans. Signatureglobal India IPO is a main-board IPO of 18,961,039 equity shares of the face value of ₹1 aggregating up to ₹730.00 Crores. The issue is priced at ₹366 to ₹385 per share. The minimum order quantity is 38 Shares.

The IPO opens on September 20, 2023, and closes on September 22, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

listed on BSE, NSE.

Ans. The Signature Global (India) Limited IPO opens on September 20, 2023 and closes on September 22, 2023.

Ans. Sai Silks (Kalamandir) IPO lot size is 38 Shares, and the minimum amount required is ₹14,630.

Ans. The Signature Global (India) Limited IPO listing date is not yet announced. The tentative date of Signature Global (India) Limited IPO listing is Wednesday, October 4, 2023.

Ans. The minimum lot size for this upcoming IPO is 38 shares.