Entero Healthcare Solutions IPO Company Details:

Entero Healthcare Solutions Limited (EHSL) is a distributor of healthcare products in India. The company’s technology-driven platform provides healthcare product distribution services to pharmacies, hospitals, and clinics throughout India. The company is amongst the top three healthcare products distributors in India in terms of revenue in Financial Year 2022, and reported an operating income of ₹25,220.65 million in Financial Year 2022

Benefits to healthcare product manufacturers:

-

Access to large number of pharmacies, hospitals and clinics throughout the country through a single distributor platform;

-

Availability of a nationwide healthcare products distribution platform in compliance with relevant regulations for setting up our warehouses, and logistics services;

-

Integrated systems and technologies to offer data intelligence and analytics.

-

Comprehensive end-to-end healthcare products distribution solutions combined with marketing and promotion capabilities.

In fiscal years 2021, 2022, and 2023, the company served over 39,500, 64,200, and 81,400 retail consumers. In addition, they serviced over 1,600, 2,500, and 3,400 hospital patients throughout the same time period. Entero Healthcare Solutions has agreements with over 1,900 healthcare product manufacturers, granting them access to over 64,500 product stock-keeping units as of March 31, 2023. As of March 31, 2023, the corporation has 73 warehouses in 37 cities spanning 19 states and union territories, serving approximately 81,400 pharmacies and 3,400 hospitals in 495 districts. This offers tremendous access to healthcare product producers. As of March 31, 2023, the company employed a total of 3014 workers across several divisions.

| IPO-Note | Entero Healthcare Solutions Limited |

| Rs.1195 – Rs.1258 per Equity share | Recommendation: Avoid |

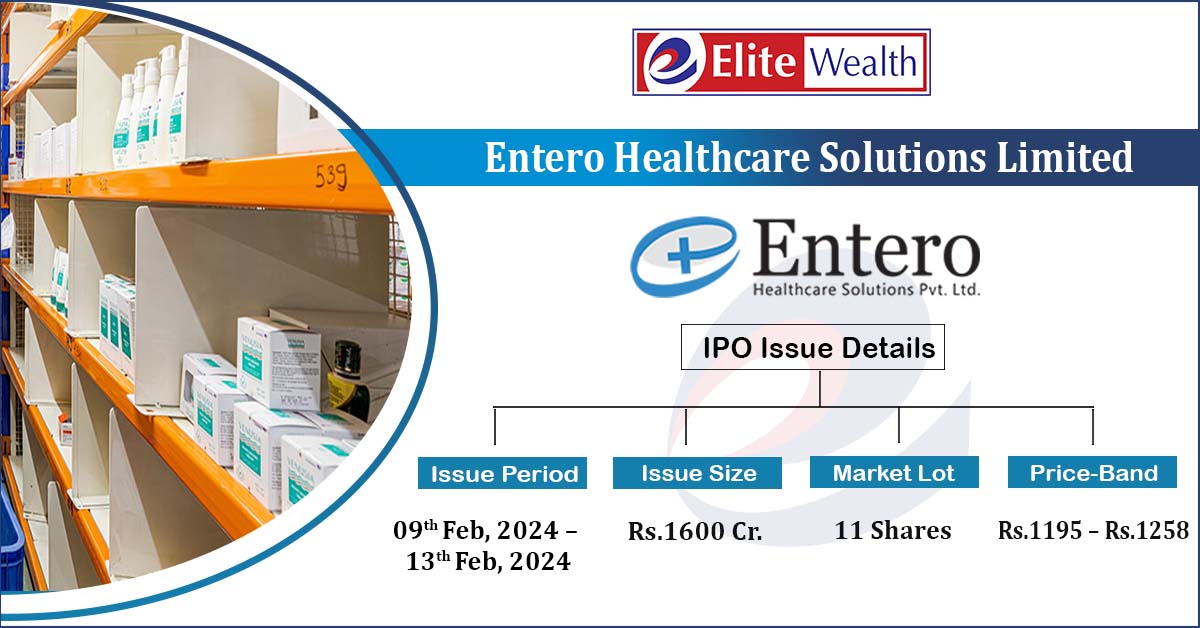

Entero Healthcare Solutions IPO Details:

| Issue Details | |

| Objects of the issue | · Repayment/prepayment of certain borrowings

· Funding of long-term working capital requirements · To gain listing benefits |

| Issue Size | Total issue Size – Rs.1600 Cr.

Fresh Issue – Rs.1000 Cr. Offer for Sale – Rs.600 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.1195 – Rs.1258 |

| Bid Lot | 11 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 09th Feb, 2024 – 13th Feb, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Entero Healthcare Solutions IPO Strengths:

- EHSL has track record of inorganic expansion and integration to grow its geographic reach, revenues and scale.

- Differentiated business model offers comprehensive and integrated commercial and supply chain solutions.

- Experienced, committed and qualified founding and professional management team with deep industry expertise and backed by healthcare focused investor. EHSL’s shareholders includes OrbiMed Asia III Mauritius Limited, a healthcare-focused fund, which has provided it continuous support through its growth in business.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Entero Healthcare Solutions IPO Allotment Status

Entero Healthcare Solutions IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Entero Healthcare Solutions IPO Risk Factors:

-

EHSL has experienced negative cash flows from operating, investing and financing activities in the past and may continue to do so in the future.

-

EHSL’s operations are subject to high working capital requirements, and have incurred substantial indebtedness. The company’s inability to maintain an optimal level of working capital or financing required may impact its operations and profitability adversely.

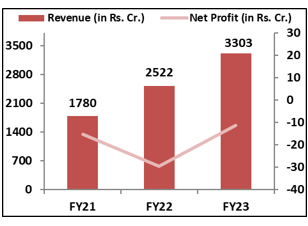

Entero Healthcare Solutions IPO Financial Performance:

Entero Healthcare Solutions IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 77.11% | 58.86% |

| Others | 22.89% | 41.14% |

Source: RHP, EWL Research

Entero Healthcare Solutions IPO Outlook:

EHSL is one of India’s most fragmented healthcare service providers, has the flexibility to grow quickly and affordably. However, The essence of the HealthTech company is one of higher risk in the first phase and reduced risk in subsequent phases, after the rollout is accomplished, making it risky. The company’s P/E ratio cannot be calculated because it has constantly suffered financial losses. The bet is on a turnaround and the future direction of the HealthTech industry. The only other listed player in this area is Medplus Health, which has a P/E ratio of 216X. we recommend investors to Avoid the offering.

Entero Healthcare Solutions IPO FAQ

Ans. Entero Healthcare Solutions IPO is a main-board IPO of 12,718,600 equity shares of the face value of ₹10 aggregating up to ₹1,600.00 Crores. The issue is priced at ₹1195 to ₹1258 per share. The minimum order quantity is 11 Shares.

The IPO opens on February 9, 2024, and closes on February 13, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Entero Healthcare Solutions IPO opens on February 9, 2024 and closes on February 13, 2024.

Ans. Entero Healthcare Solutions IPO lot size is 11 Shares, and the minimum amount required is ₹13,838.

Ans. The Entero Healthcare Solutions IPO listing date is not yet announced. The tentative date of Entero Healthcare Solutions IPO listing is Friday, February 16, 2024.

Ans. The minimum lot size for this upcoming IPO is 11 shares.