TATA Technologies IPO Company Profile:

Tata Technologies Limited (TTL) is a leading global engineering services company offering product development and digital solutions, including turnkey solutions, to global original equipment manufacturers (“OEMs”) and their tier 1. The company has deep domain expertise in the automotive industry and leverage this expertise to serve its clients in adjacent industries, such as in aerospace and transportation and construction heavy machinery (“TCHM”). The company leverages its deep manufacturing domain knowledge to deliver value-added services to its clients in support of their digital transformation initiatives including product development, manufacturing and customer experience management. The company primarily categorize its lines of business as Services, which includes providing outsourced engineering services and digital transformation services to global manufacturing clients helping them conceive, design, develop and deliver better products, and Technology Solutions, which complements its service offerings with its Products and Education businesses.

| IPO-Note | Tata Technologies Limited |

| Rs.475 – Rs.500 per Equity share | Recommendation: Subscribe |

TATA Technologies IPO Business Lines:

- Services:

TATA Technologies Limited’s primary business line is services (“Services”), which includes providing outsourced engineering services and digital transformation services to global manufacturing clients helping them conceive, design, develop, and deliver better products.

- Technology Solutions: the company complements its service offerings with its Products and Education businesses (collectively, “Technology Solutions”). Through the Products business, it resells third-party software applications, primarily product lifecycle management (“PLM”) software, and solutions, and provides value-added services such as consulting, implementation, systems integration, and support. The Education business provides “phygital” education solutions in manufacturing skills including upskilling and reskilling in relation to the latest engineering and manufacturing technologies to public sector institutions and private institutions and enterprises through curriculum development and competency center offerings through the company’s proprietary iGetIT platform.

TATA Technologies Limited’s client portfolio includes its Anchor Clients, TML and JLR, leading traditional OEMs like Airbus, McLaren, Honda, Ford, and Cooper Standard and tier 1 suppliers as well as new energy vehicle companies such as VinFast, among others such as Cabin Interiors and Engineering Solutions, ST Engineering Aerospace.

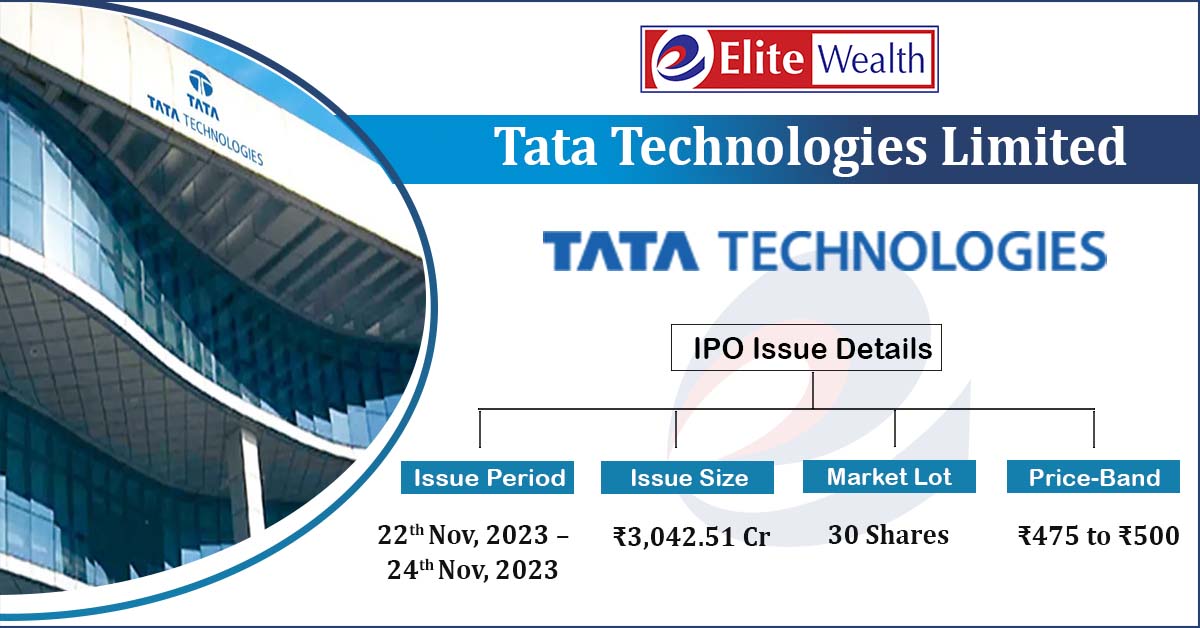

TATA Technologies IPO Details:

| Issue Details | |

| Objects of the issue | · To gain listing benefits

· Carry out the Offer for Sale |

| Issue Size | Total issue Size – Rs. 3,042.51 Cr.

Offer for Sale – Rs. 3,042.51 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.475– Rs.500 |

| Bid Lot | 30 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 22nd Nov, 2023 – 24thNov, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

TATA Technologies IPO Financial Analysis:

| Particulars | 9M of FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from Operations | 3011.79 | 3529.58 | 2380.91 | 2852.06 | 11.2% |

| Other Income | 40.50 | 48.80 | 44.83 | 44.91 | |

| Purchase for technology solutions | 340.39 | 688.54 | 338.30 | 367.92 | 36.8% |

| Outsourcing and consultancy charges | 393.25 | 399.80 | 241.44 | 304.57 | |

| Employee Cost | 1394.69 | 1512.69 | 1216.00 | 1418.54 | |

| Other expenses | 305.18 | 282.88 | 199.47 | 290.57 | |

| EBITDA | 618.79 | 694.46 | 430.54 | 515.36 | 16.1% |

| EBITDA margin% | 20.55% | 19.68% | 18.08% | 18.07% | |

| Depreciation | 69.53 | 85.71 | 92.20 | 99.15 | |

| Interest | 13.45 | 21.90 | 17.66 | 15.64 | |

| Exceptional Items | 0.00 | 0.00 | 5.42 | 8.58 | |

| Profit / (loss) before tax | 535.80 | 586.86 | 315.27 | 391.99 | 22.4% |

| Total tax | 128.34 | 149.87 | 76.09 | 140.42 | |

| Profit / (loss) After-tax | 407.47 | 436.99 | 239.17 | 251.57 | 31.8% |

| Profit / (loss) After-tax margin% | 13.53% | 12.38% | 10.05% | 8.82% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check TATA Technologies IPO Allotment Status

Go TATA Technologies IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

TATA Technologies IPO Revenue from Operations:

| Segment | 9M of FY-23(in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | CAGR |

| Sale of services | 2558.05 | 84.93% | 2654.84 | 75.22% | 1917.74 | 80.55% | 2324.08 | 81.49% | 6.9% |

| Sale of technology solutions | 453.43 | 15.06% | 873.61 | 24.75% | 463.16 | 19.45% | 506.52 | 17.76% | 31.3% |

| Other operating revenues | 0.31 | 0.01% | 1.13 | 0.03% | 0.01 | 0.00% | 21.46 | 0.75% | -77.1% |

| Total | 3011.79 | 100.00% | 3529.58 | 100.00% | 2380.91 | 100.00% | 2852.06 | 100.00% | 11.2% |

Major Shareholders of TATA Technologies IPO:

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1 | Tata Motors Limited | 303,006,000 | 51.71% |

| 2 | Alpha TC Holdings Pte. Ltd | 29,445,010 | 18.95% |

| 3 | Tata Capital Growth Fund I | 14,722,500 | 9.95% |

| 4 | Tata Motors Finance Limited | 8,119,920 | 6.37% |

| 5 | Zedra Corporate Services (Guernsey) Limited | 5,766,720 | 4.60% |

| 6 | Patrick Raymon McGoldrick | 5,000,000 | 2.05% |

| Total | 366,060,150 | 93.63% |

TATA Technologies IPO Offer for Sale Details:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 66.79% | 55.39% |

| Others | 33.21% | 44.61% |

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

|

| 1. | Tata Motors Limited | 81,133,706 Equity Shares | |

| 2. | Alpha TC Holdings Pte. Ltd. | 9,716,853 Equity Shares | |

| 3. | Tata Capital Growth Fund I | 4,858,425 Equity Shares | |

TATA Technologies IPO Strengths:

-

-

TATA Technologies Limited’s automotive domain expertise and deep understanding of client requirements underpin the approach it takes to helping its clients leverage digital technologies to optimize the manner in which they conceive, develop, manufacture, sell, and service new products.

-

TATA Technologies Limited’s long-standing partnership with its Anchor Clients, including the relationship with JLR since 2010, provides it with opportunities to cultivate skills and refine its value proposition for the automotive sector. Specific offerings such as its full vehicle proposition and lightweight structures have been incubated and developed with TML and JLR.

-

TATA Technologies Limited’s sizeable portfolio of automotive services provides cross-selling opportunities into the TCHM and aerospace sectors. For example, its turnkey machine development capabilities for TCHM have been derived from its full vehicle proposition and its expertise in automotive tooling design has underpinned its proposition for the aerospace maintenance, repair and operations (“MRO”) sector.

-

TATA Technologies Limited has built expertise in integration across PLM, ERP and MES solutions by developing proprietary integration accelerators. The company also has experience deploying Industry 4.0 at scale with the ability to identify and deploy emerging technologies, tools and solutions to transform the manufacturing operations of its clients.

-

TATA Technologies Limited’s proprietary platforms provide it with a strategic competitive advantage, creating strong barriers to entry and help in cost competitiveness, faster deployment, scalability, de-risking, improving program management and driving operational logistics more efficiently

-

TATA Technologies Limited has a diversified global presence across Asia Pacific, Europe and North America and partner with many of the largest manufacturing enterprises in the world. As of December 31, 2022, its clients are comprised of more than 35 traditional automotive OEMs and tier 1 suppliers and more than 12 new energy vehicle companies

-

The combination of Anchor Clients, traditional OEMs and new energy vehicle companies provide a balanced mix of stability and growth, with revenue stability and further growth opportunities from Anchor Clients and traditional OEMs and significant growth opportunities with new energy vehicle companies.

-

TATA Technologies Limited has a global workforce of over 11,081 employees serving multiple global clients from 18 global delivery centers in Asia Pacific, Europe and North America, as of December 31, 2022. The company’s globally distributed execution model ensures balance between onshore client proximity and offshore efficiency.

-

TATA Technologies Limited benefits from the strong track record, reputation and experience of its Promoter, TML, which is part of the Tata Group. The Tata Group is one of the leading business conglomerates in India, with a heritage of over 100 years, comprising of more than 28 equity listed companies across multiple verticals such as technology, steel and automotives

-

TATA Technologies Limited’s partnerships in India have recently extended beyond its iGetIT offering to the development of an entire “phygital” (physical and digital) proposition. The company has been engaged by various State Governments in India for upgradation of their ITIs and universities for upskilling and as a result, the company has been able to build strong capabilities and a presence in the educational sector.

-

TTL leverages its deep manufacturing domain knowledge to deliver value-added services to its clients in support of their digital transformation initiatives including product development, manufacturing and customer experience management.

-

The ER&D spend outsourced to third-party service providers reached $105 billion to $110 billion in 2022 and is anticipated to grow at a 11-13% compound annual growth rate (“CAGR”) between 2022 and 2026.

-

TTL’s capability of integrating the mechanical engineering aspect of product development with digital engineering, embedded solutions, and software allows it to provide end-to-end solutions to its clients for EV development, manufacturing and after-sales services. With an increased regulatory focus on sustainability and changing consumer preferences, electrification is expected to be the primary focus for the automotive industry.

-

TATA Technologies IPO Risk Factors:

- TATA Technologies Limited’s revenues are highly dependent on clients concentrated in the automotive segment. An economic slowdown or factors affecting this segment may have an adverse effect on its business, financial condition and results of operations.

- TATA Technologies Limited expects a significant amount of future revenue to come from new energy vehicle companies, many of whom may be startup companies. Uncertainties about their funding plans, future product roadmaps, ability to manage growth, creditworthiness and ownership changes may adversely affect its business, financial condition and results of operations.

- TATA Technologies Limited’s success depends in large part upon the strength of its skilled engineering professionals and management team. If it fail to attract, retain, train and optimally utilize these personnel, its business may be unable to grow and its revenue and profitability could decline. Further, increases in wages and other employee benefit expenses for such personnel could prevent it from sustaining its competitive advantage.

- TATA Technologies Limited has recently expanded its offerings in the Education business and if it is unable to achieve the anticipated returns in such new growth areas, it could have a material adverse effect on the business, results of operations and financial condition.

- Intense competition in the market for engineering services could affect the pricing and have a material adverse effect on the company’s business, financial condition and results of operations.

- TTL’s revenues are heavily reliant on clients in the automobile industry. A slowing economy or other factors influencing this area might harm its business.

- TTL continue to obtain a significant percentage of its revenues from its top five customers. If any or all of the top five clients experience a drop in their business, the company’s revenues may suffer.

TATA Technologies IPO Key Highlights:

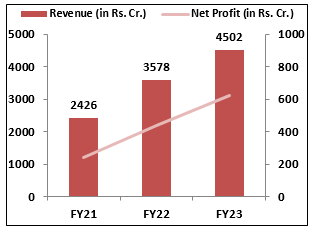

- TTL reported total income/net profit of Rs. 2425.74 cr. / Rs. 239.17 cr. (FY21), Rs. 3578.38 cr. / Rs. 437.00 cr. (FY22), and Rs. 4501.93 cr. / Rs. 624.04 cr. (FY23) on a consolidated basis. It achieved a net profit of Rs. 351.90 cr. on a total income of Rs. 2587.42 cr. in the H1 of FY24, ending September 30, 2023.

- PAT margins of 10.05% (FY21), 12.38% (FY22), 14.14% (FY23), and 13.93% (H1-FY24) have been reported by the company.

- TTL has recorded an average EPS of Rs. 12.26 and an average RoNW of 18.68% during the previous three fiscal years.

TATA Technologies IPO Outlook:

Tata Technologies Limited (TTL) is a pure-play manufacturing focused ER&D company, primarily focused on the automotive industry and is currently engaged with seven out of the top 10 automotive ER&D spenders and five out of the 10 prominent new energy ER&D spenders in 2022 (Source: Zinnov Report). For automotive ER&D services, TTL is ranked first among India service providers and third globally among rated service providers by Zinnov, It has also increased its top and bottom lines in the reported periods. The major issue with the IPO is the value of the share which is reasonably priced, which reflects the “Tata” legacy at the PE ratio of 32.50X when compared to 59.78X of its peer hence we suggest Investors shouldn’t give up this investing opportunity for medium to long-term gains.

TATA Technologies IPO FAQ

Ans. Tata Technologies IPO is a main-board IPO of 60,850,278 equity shares of the face value of ₹2 aggregating up to ₹3,042.51 Crores. The issue is priced at ₹475 to ₹500 per share. The minimum order quantity is 30 Shares.

The IPO opens on November 22, 2023, and closes on November 24, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Tata Technologies IPO opens on November 22, 2023 and closes on November 24, 2023.

Ans. Tata Technologies IPO lot size is 30 Shares, and the minimum amount required is ₹15,000.

Ans. The Tata Technologies IPO listing date is not yet announced. The tentative date of Tata Technologies IPO listing is Tuesday, December 5, 2023.

Ans. The minimum lot size for this upcoming IPO is 30 shares.