Apeejay Surrendra Park Hotels IPO Company Details:

Apeejay Surrendra Park Hotels Limited (ASPHL) is the 8th biggest hotel company in India based on asset ownership. The company has owned and operated hotels for more than 50 years, giving it extensive experience in the hospitality industry. Currently, it runs thirty luxury hotels around India, including ones in Bangalore, Mumbai, Hyderabad, Chennai, Kolkata, New Delhi, and other important cities. The Park Group owns the rights to various luxury brands, including THE PARK, THE PARK Collection, Zone by The Park, Zone Connect by The Park, and Stop by Zone. Additionally, the company has made a name for itself in the retail food and beverage sector with its retail brand, Flurys. Also, it runs 81 bars, nightclubs, and restaurants that provide a variety of cross-selling opportunities. The company has created iconic brands as part of its food, beverage, and entertainment offerings, which include Zen, Someplace Else, Tantra, Roxy, iBar, The Leather Bar, Pasha, Aqua, Zen, Lotus, Fire, 601, The Bridge and its spa and wellness offering, “Aura”.

| IPO-Note | Apeejay Surrendra Park Hotels Limited |

| Rs.147 – Rs.155 per Equity share | Recommendation: Apply |

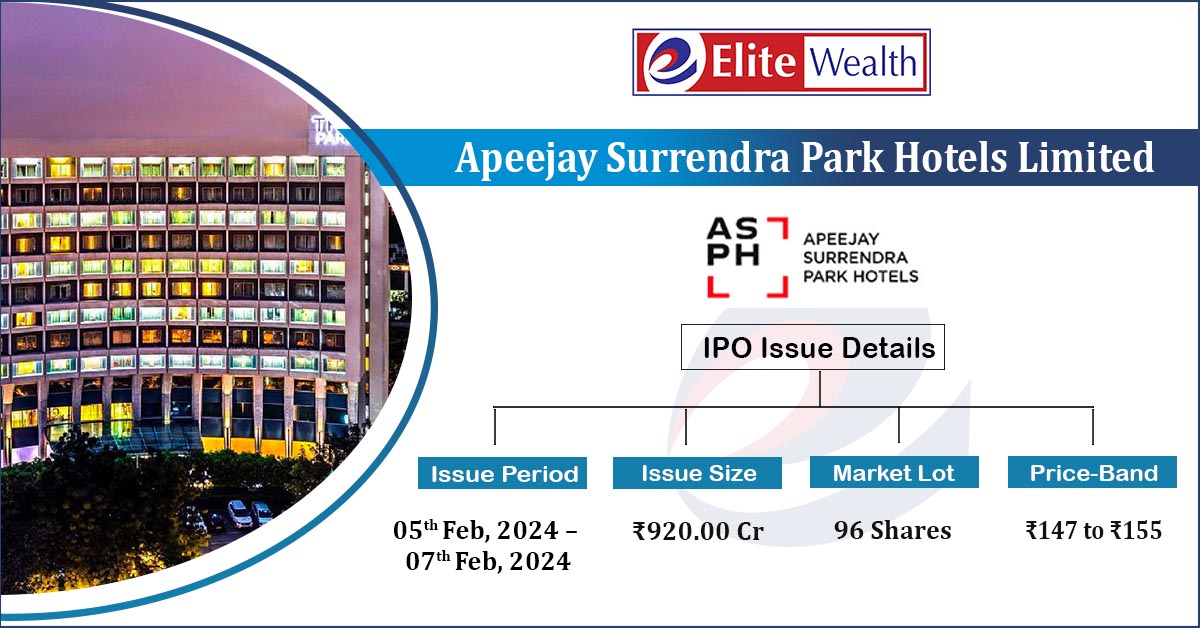

Apeejay Surrendra Park Hotels IPO Details:

| Issue Details | |

| Objects of the issue | · To pay the borrowings

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.920 Cr.

Fresh Issue – Rs.600 Cr. Offer for Sale – 320 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.147 – Rs.155 |

| Bid Lot | 96 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 05th Feb, 2024 – 07th Feb, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 10% of Net Issue Offer |

| Retail | 15% of Net Issue Offer |

Apeejay Surrendra Park Hotels IPO Strengths:

-

ASPHL has well diversified business segments which helps it to minimize the risk of a particular business segment and enables to generate steady returns and avoid being negatively impacted by the hotel industry’s cyclicality.

-

It is present throughout India, mostly in the major cities which makes it feasible for the Company to benefit from the nation’s thriving economy.

-

The company has high occupancy rates which and has been well maintained over the years.

Apeejay Surrendra Park Hotels IPO Key Highlights:

-

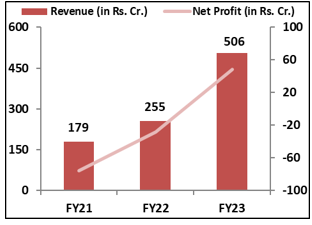

Revenue of the co. has grown from Rs.179 Cr. in FY21 to Rs.506 Cr. in FY23 with a very strong CAGR of 41.5%; while in terms of profit Co. posted a profit of Rs.48 Cr. in FY23 after suffering a net loss of Rs.28 Cr. in FY22 and Rs.76 Cr. in FY21.

-

Co’s EBITDA Margin & PAT Margin stand healthy at 35% & 9.5% respectively in FY23.

-

As of FY23, Average Room Rent & Average Occupancy of the Co. stand strong at Rs.6,070 & 91.77%.

-

The debt to equity ratio is at 1x as of 30th September 2023.

Apeejay Surrendra Park Hotels IPO Risk Factors:

-

Approximately 80% of the total room revenue comes from corporate accounts and from leisure customers. Changes in these traveler’s preferences could severely impact company’s financials.

-

ASPHL has delayed its debt repayment in the past by as many as 88 days and has breached covenants as set by the lender. In case of any breach of covenants or delay in repayment of facilities in the future, could adversely affect the business.

-

The Company’s fund-based limits and term loans were downgraded by ICRA in FY22. Such downgrades may result in a considerable rise in company’s interest cost and can impact its financials.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Apeejay Surrendra Park Hotels IPOAllotment Status

Apeejay Surrendra Park Hotels IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Apeejay Surrendra Park Hotels IPO Financial Performance:

Apeejay Surrendra Park Hotels IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 94.18% | 67.42% |

| Others | 5.82% | 32.58% |

Source: RHP, EWL Research

Apeejay Surrendra Park Hotels IPO Outlook:

ASPHL has well diversified Pan India portfolio of Hotels, restaurants and bars strategically located across metros and emerging cities. The business has been able to turn around and become profitable with strong occupancy rates after Covid. Considering the predicted double-digit demand increase in India’s tourism sector from FY24 to FY27, the company’s future commercial prospects seem bright. The demand for rooms is likely to outpace the supply during this time, which puts the company in a favorable position in the market. Furthermore, the company’s bottom line would benefit from debt reduction using IPO proceeds. The valuation is fairly priced when compared to its peers; hence, we recommend investors to apply in the offering.

Credo Brands Marketing IPO FAQ

Ans. Apeejay Surrendra Park IPO is a main-board IPO of [.] equity shares of the face value of ₹1 aggregating up to ₹920.00 Crores. The issue is priced at ₹147 to ₹155 per share. The minimum order quantity is 96 Shares.

The IPO opens on February 5, 2024, and closes on February 7, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Apeejay Surrendra Park IPO opens on February 5, 2024 and closes on February 7, 2024.

Ans. Apeejay Surrendra Park IPO lot size is 96 Shares, and the minimum amount required is ₹14,880.

Ans. The Apeejay Surrendra Park IPO listing date is not yet announced. The tentative date of Apeejay Surrendra Park IPO listing is Monday, February 12, 2024.

Ans. The minimum lot size for this upcoming IPO is 96 shares.