What is SIP?

SIP or Systematic Investment Plan is a plan through which a person can invest a small amount in a mutual fund at regular intervals (monthly/quarterly).

Building wealth requires financial discipline and a long-term horizon for investing. SIPs not only encourage disciplined investing, but also make it possible to accumulate wealth with small but regular contributions. Further, it also gives the advantage of rupee cost averaging and the flexibility of choosing your own amount and frequency, making it an ideal investment option for any investor.

How does it work?

A SIP is a flexible and easy investment plan. Your money is auto-debited from your bank account and invested into a specific mutual fund scheme.You are allocated certain number of units based on the ongoing market rate (called NAV or net asset value) for the day.

Types of SIP

Systematic Investment Plans (SIPs) are of 4 types and a short description of each of these is given below:

- Top-up SIP: This SIP type allows you to increase your investment amount periodically. This also means that you can make the most of your SIP investment by contributing to well-performing mutual fund schemes at certain intervals. You can increase your investment amount when your income increases.

- Flexible SIP: This SIP type allows you to increase as well as decrease your investment amount as per the cash flow you have. This way you can skip one or more payments when you face cash crunch due to any reason. Likewise, you can make a bigger contribution to your SIP account when you receive a bonus or an additional income.

- Perpetual SIP: SIP investments are, generally, for a fixed period of 1 year, 3 years, or 5 years. A SIP is referred to as Perpetual SIP if you do not mention the end date in the mandate date. This SIP types allows you to redeem your funds whenever required or, particularly, when you have achieved your financial goals. However, it is advisable to set an end date for your SIP contribution so as to build a disciplined, goal-based investment.

- Trigger SIP: This SIP type is ideal for investors with limited knowledge of the financial market. You are allowed to set NAV, index level, SIP start date or event, etc. Since this SIP type encourages speculation, it is not desirable or much recommended.

For Any Query Regarding Mutual Fund Investment Click here

For Any Query Regarding Online Mutual Fund click here

How do you Open Mutual Funds Account with Elite Wealth?

Download Mutual Funds Account Form

Systematic Investing in a Mutual Fund is the answer to preventing the pitfalls of equity investment and still enjoying the high returns.

To illustrate, a small amount of Rs 1000 invested every month at an interest rate of 10% for 25 years would give you Rs 13.4 Lakh! That means your investment of just Rs 3 Lakh would have grown four times over!

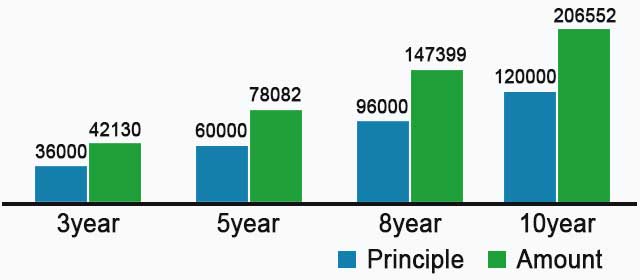

Here is a graph that represents the same for a time period of 10 years.

SIP Benefits:

Small investment

![]()

SIPs can be started with as little as ₹500 each month. SIPs provide flexibility in choosing the amount you want to invest and you can choose your frequency as monthly or quarterly.

Achieve your goals

![]()

SIPs makes it easy to achieve long-term financial goals as your investments are broken down into smaller, less daunting, regular investments.

No need to time the market

![]()

SIPs also offer freedom from being on the constant look out for opportunities to time the market. Over the long-term, the ups and downs of the market get evened out.

Financial discipline

![]()

financial discipline making you invest a fixed amount consistently at regular intervals. By starting early, even with a small amount, you can build a sizeable corpus to achieve your financial goals.