Mutual Fund

Mutual fund is a most viable investment options through which fund pooled in from various investors and this fund invested in equities, bonds, money market instruments and other securities with the help of well qualified & professional fund managers.

Type of Mutual Funds

In order to make money by investing in mutual funds, it is important to know the types of Mutual Fund Investment. There is a wide range of mutual funds in India that are categorized on the basis of Investment Objective, Asset class & Structure.

Mutual Fund Based on Asset Class:

- Equity Fund

- Equity Linked Saving Scheme – ELSS

- Debt Fund

- Hybrid or Balanced Fund

- Liquid or Money Market Fund

- Arbitrage funds

- Index Fund

- Sector fund

Mutual Fund Based on Structure:

- Open-Ended Fund

- Close-Ended Fund

Mutual Fund Based on Investment Objective:

- Growth Fund

- Income Fund

- Liquid Fund

Why Should Invest in Mutual Fund

Investment in mutual funds is the best way of creating wealth in the long-term as well as short term through Lumpsum and Systematic Investment Plan (SIP) with minimum investment amount of Rs 500. Investors can get the benefit of rupee cost averaging, compounding, and disciplined investing, and can beat the volatility of the stock markets.

Benefits of Mutual Fund Investment

Professional management

Qualified professionals manage your money,but they are not alone. They have a research team that continuously analyses the performance and prospects of companies. Fund managers are in a better position to manage your investments and get higher returns.

Diversification

Diversification lowers your risk of loss by spreading your money across various industries and geographic regions. It is a rare occasion when all stocks decline at the same time and in the same proportion.

Affordability

As a small investor, you may find that it is not possible to buy shares of larger corporations. Mutual funds generally buy and sell securities in large volumes which allow investors to benefit from lower trading costs. You can invest with a minimum of Rs.500 in a Systematic Investment Plan.

Transparency

The performance of a mutual fund is reviewed by various publications and rating agencies, making it easy for investors to compare funds. An investor is provided with regular updates, for example daily NAVs, as well as information on the fund’s holdings and the fund manager’s strategy.

More choice

Mutual funds offer a variety of schemes that will suit your needs over a lifetime. When you enter a new stage in your life, all you need to do is sit down with your financial advisor who will help you to rearrange your portfolio to suit your altered lifestyle.

Rupee-cost averaging

with rupee-cost averaging, you invest a specific rupee amount at regular intervals regardless of the investment’s unit price. As a result, your money buys more units when the price is low and fewer units when the price is high, which can mean a lower average cost per unit over time.

How to Choose Best MF Schemes for your portfolio

To choose your Best MF Scheme you should know about the factors, which are given below:

- Identify Your Goal

- Know about Fund House

- Fund Performance

- Fund Manager

- Risk Appetite

- Investment Horizon

- Scheme Asset Size

- Expense Ratio

Online Mutual Fund Platform

Elite Wealth Ltd. facilitates an Online Mutual Fund Platform where you can invest and manage your portfolio with us. You can buy / sell funds of all the AMCs, like ICICI Mutual Fund, Birla Sun Life Mutual Fund, IDFC Mutual Fund, and many more.

How to Invest Online Mutual Fund with Elite Wealth

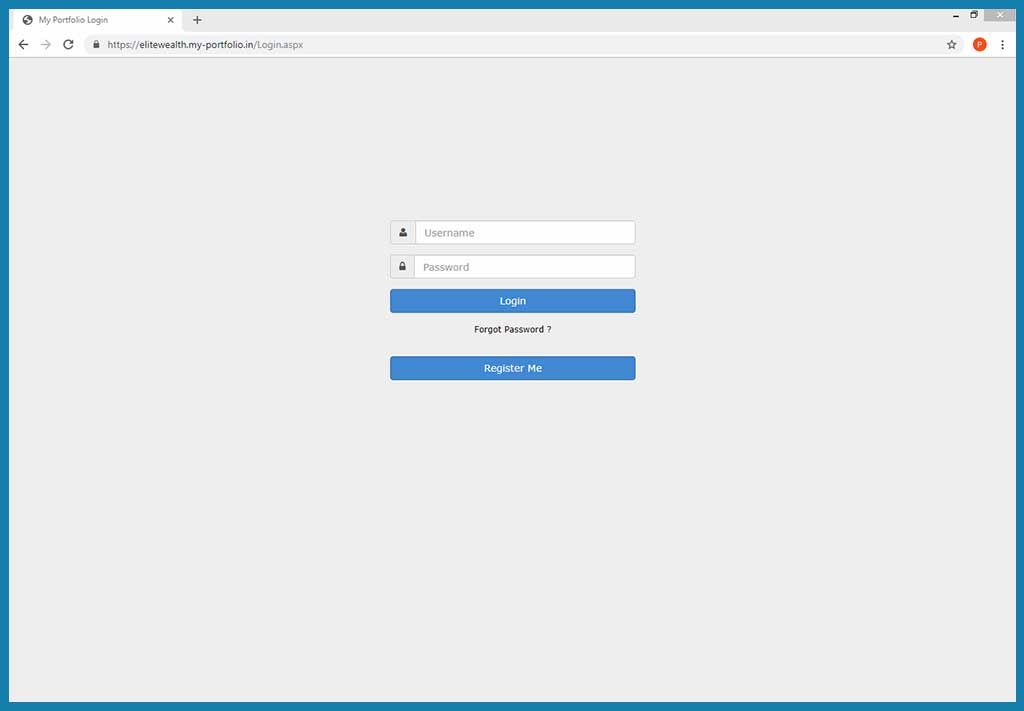

Go to our website & press MF Login as shown below:

Enter your user id and password which you received on your mobile and email id registered with us at the time of registration for our online platform & press Login.

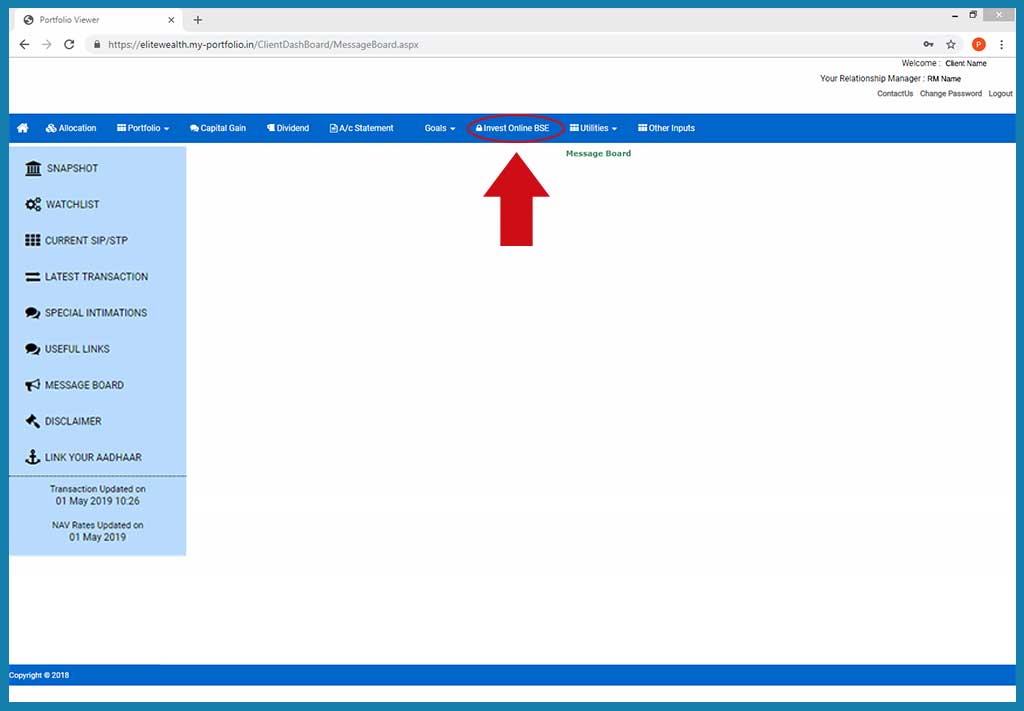

After login you will see client dashboard. Now click on “Invest Online BSE” Tab as shown below:

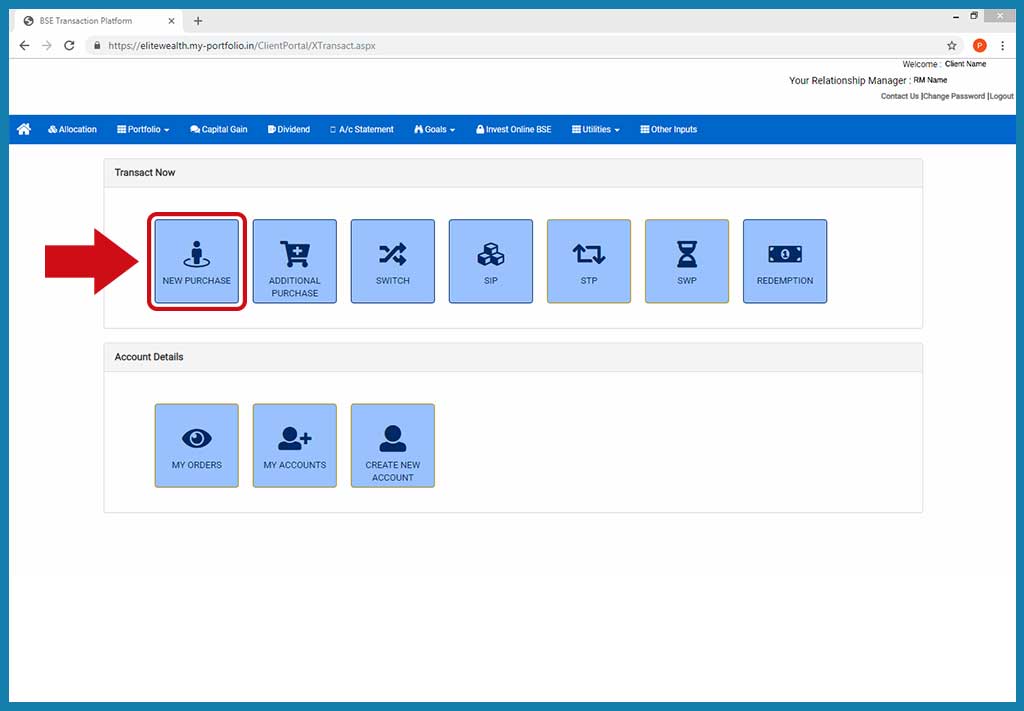

& then click on NEW PURCHASE

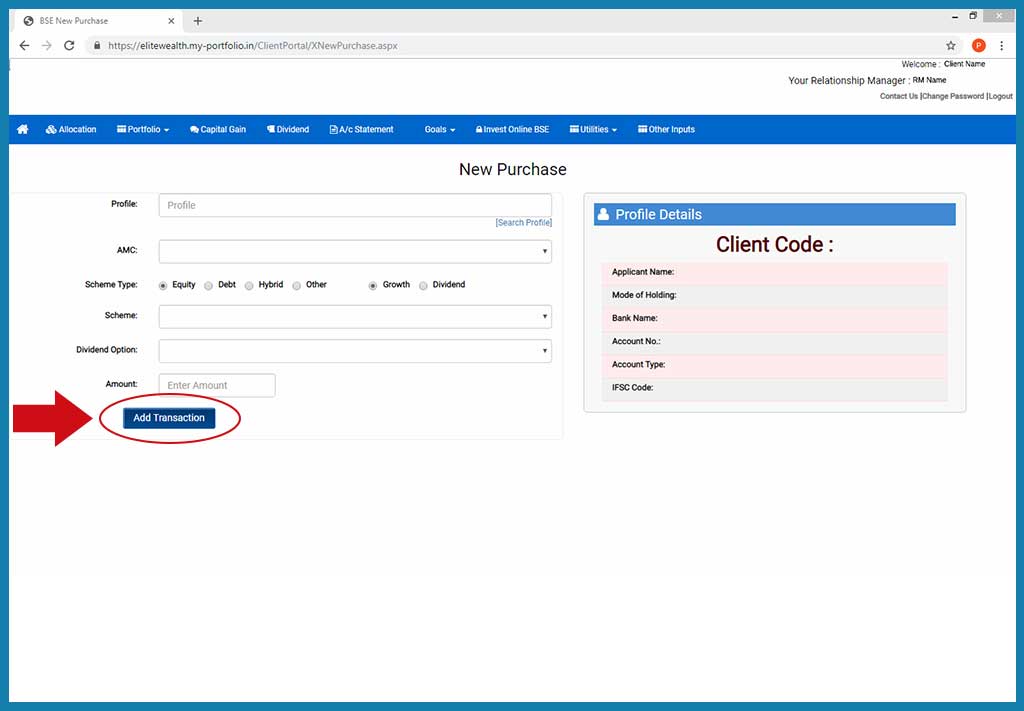

Now fill the details like AMC, scheme type, scheme name, amount you want to invest etc then click on add transaction.

It will take you to your bank account payment portal that is registered with us. Now choose online payment mode and make payment and confirm your order. After purchasing units, you will receive confirmation on your mobile and email id registered with us.

List of AMC To Invest in Online Mutual Fund

- Axis Mutual Fund

- Birla Mutual Fund

- BNP Paribas Mutual Fund

- Canara Rebeco Mutual Fund

- Deutsche Mutual Fund

- DSP BlackRock Mutual Fund

- Edelweiss Mutual Fund

- Franklin. Temp. Mutual Fund

- HDFC Mutual Fund

- ICICI Mutual Fund

- IDBI Mutual Fund

- IDFC Mutual Fund

- Kotak Mutual Fund

- L&T Mutual Fund

- Mirae Asset Mutual Fund

For Any Query Regarding Mutual Fund Investment Click here

For Any Query Regarding Online Mutual Fund click here

To Need An Assistance, Submit your details below:

You can also call us on 011-42445800 / 9650901058 from 9:00 a.m. to 6:00 p.m. Further, you can also mail to us on contact@elitewealth.in