Mutual Fund

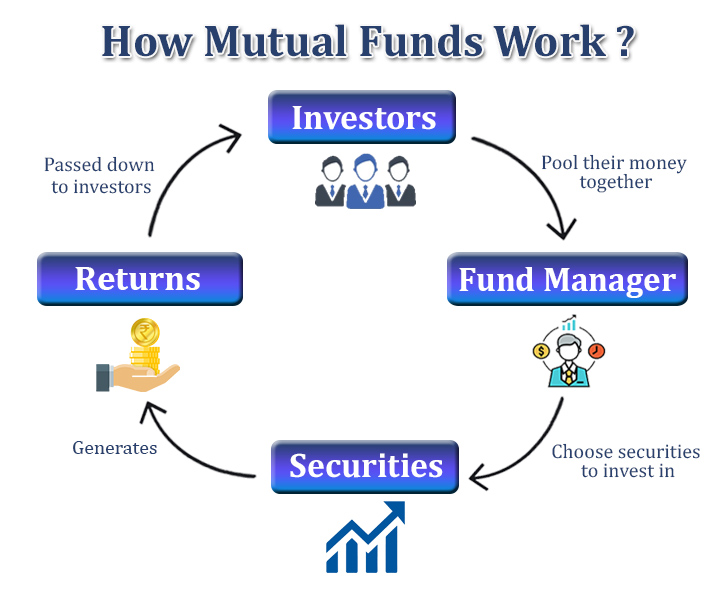

Mutual fund is a most viable investment options through which fund pooled in from various investors and this fund invested in equities, bonds, money market instruments and other securities with the help of well qualified & professional fund managers.

Investment Ideas For You

Need An Assistance:

INVEST ANY TIME ANY WHERE WITH ELITE KUBER APP!

| Date | Mutual Fund Market News |

|

4/27/2024 12:00:00 AM |

Axis MF Announces IDCW & Monthly Income Distribution cum Capital Withdrawal (IDCW) under its schemes |

|

4/27/2024 12:00:00 AM |

Mahindra Manulife Mutual Fund Announces change in fund manager |

|

4/26/2024 12:00:00 AM |

Baroda BNP Paribas Mutual Fund Announces IDCW Income Distribution cum Capital Withdrawal (IDCW) under its schemes |

|

4/25/2024 12:00:00 AM |

Motilal Oswal Mutual Fund Announces Appointment of Chief Investment Officer |

|

4/25/2024 12:00:00 AM |

TATA MF Announces change in fund managers under its schemes |

|

4/25/2024 12:00:00 AM |

Motilal Oswal Mutual Fund Announces Appointment of Managing Director (MD) and Chief Executive Officer (CEO) |

|

4/25/2024 12:00:00 AM |

Bandhan Mutual Fund Announces Income Distribution cum Capital Withdrawal (IDCW) under its scheme |

|

4/25/2024 12:00:00 AM |

Motial Oswal MF Announces Income Distribution cum Capital Withdrawal (IDCW) under its scheme |

|

4/24/2024 12:00:00 AM |

ICICI Prudential MF Announces Income Distribution cum Capital Withdrawal (IDCW) |

|

4/24/2024 12:00:00 AM |

Invesco Mutual Fund Announces Income Distribution cum Capital Withdrawal (IDCW) under One scheme |

Types of Mutual Funds

In order to make money by investing in mutual funds, it is important to know the types of Mutual Fund Investment. There is a wide range of mutual funds in India that are categorized on the basis of Investment Objective, Asset class & Structure.

- Equity Funds: These funds primarily invest in stocks and can be actively or passively managed. The highs and lows are determined by the performance of the market. While they offer potentially high returns, they also come with relatively higher risks.

- Debt Funds: These funds invest in fixed-income securities, including bonds, securities, and treasury bills, among others – these have a fixed interest rate and maturity period. These offer regular income and growth. The growth might not be at par with equity funds, but there’s a steady income flow.

- Hybrid Funds: These invest in a mix of bonds and stocks and offer the best of both worlds – equity and debt. The ratio can differ; it can be variable or fixed. This works well for investors who want to earn good returns but also want a safety net (that the debt component provides).

Here’s a look at the mutual funds:

- Open-Ended Funds: These funds can issue an unlimited number of units to the investor. Also, there’s no restriction on the time period – an investor can thus invest based on their convenience and exit when they like the current NAV.

- Closed-Ended Funds: The unit capital of closed-ended funds is fixed, and they sell a specific number of units. Unlike in open-ended funds, investors cannot buy the units of a closed-ended fund after its NFO period is over. These funds have a certain maturity tenure. Like any other mutual fund, a closed-ended fund has a professional manager overseeing the portfolio and actively buying and selling holding assets.

- Interval Funds: These funds take in traits of both open-ended and closed-ended funds. They can only be exited at certain intervals decided by the fund house; they remain closed for the remaining period. No transactions are allowed for a fixed period of time – your money is not locked-in for longer periods unlike in the case of closed-ended funds.

- Sector Funds: These invest in one particular sector. The risk is highest since these funds invest only in specific sectors, but they also potentially deliver great returns. In this case, it is important to stay aware of sector-related trends.

- Funds of Funds: A Fund of funds is a type of mutual fund which invests in other mutual funds or investment avenues. It is basically an investment strategy that pools in money and invests in other investment funds instead of investing directly in stocks or bonds or other assets.

- Actively managed funds: An actively managed fund is a fund in which a fund manager takes decisions on which stock to buy, when to buy it and when to sell it. The aim here is to deliver market-beating returns.

- Passively managed funds: A passively managed fund, by contrast, simply follows a market index to decide which stocks and their corresponding ratio it should have in its portfolio. There is no regular buying and selling happens and changes in the portfolio are done only when there are changes in the index.

Benefits

Funds are managed by qualified fund managers

Save up to Rs.1.5 lakh under section 80C

Start SIP with small amount as INR 500

Invest a basket of stock/debt instruments

Investments can be liquidated in 24 hours

Transactions are completely online

Online Mutual Funds FAQ’s

Ans. Yes, Step given below:

- Visit our website elitewealth.in

- Click on login platform and then click on MF login

- Enter your USERNAME & PASSWORD and watch your investment

Ans. If you forgot your passwords then please follow the given below instruction

Through Mobile App

- Download the Elite Kuber App

Play Store Link: https://play.google.com/store/apps/details?id=com.iw.elitekuberwealth&hl=en

App Store Link: https://apps.apple.com/in/app/elite-kuber/id1472743005

- Click on forgot password and enter you User Id and click on Ok

- Your password will be sent to your registered Email ID.

Through Website

- Visit our website elitewealth.in

- Click on login platform and then click on MF login

- Click on forgot password and enter you User name/Pan and Registered email address click on Submit

Your password will be sent to your registered Email ID.

Ans. Elite Wealth Limited online mutual fund platform offers the following benefits:

- No Paper work

- Online Buy / Sell of Mutual Funds

- No need to worry about Account Statements

- Your systematic investment plan (SIP) can be altered as per your convenience or done at the click of a button

- Integrate your banking account with your mutual fund account ensures seamless transactions with instant confirmation.

- Research to help you make the right decision.

- Regularly review and update your portfolios.

- Switch your Investments between Mutual Funds schemes.

Ans. All mutual fund investors who get registered with Elite Online MF can use our mobile app. Individuals, HUF and Corporate Body can participate in Elite Online MF subject to completing the KYC procedure. In case of a minor, the guardian would have to be KYC compliant.

Ans. Following feature available in kuber app

- New Purchase

- Additional Purchase

- Redemption

- Switch

- Online SIP Registration

- Online STP Registration

Q.8. I am the new Investor. How can I start mutual fund investment with Elite Wealth Limited online?

Ans. Registration step given below:

- First you need to check your KYC , If KYC completed then follow the next steps

- Download Elite Kuber App

Play Store: https://play.google.com/store/apps/details?id=com.iw.elitekuberwealth&hl=en

App Store: https://apps.apple.com/in/app/elite-kuber/id1472743005

- Click on sign up and fill all the details according to requirement

* Required Documents for uploading during Process

-

- Cancelled cheque

- Signature

* If KYC not completed so please complete KYC registration first then start online mf account opening process

Ans. Investors have a choice of holding units either in Physical form or in Demat.

Ans. Please follow the instructions

-

-

- Login to our website in. The below screen will show you. Click on login Platforms-> MF Login.

- Now you will see the below screen. Enter into Elite Online MF platform by login using your user id and password, which you received on your email id, registered with us at the time of registration for our online platform.

- After login, you will see our Elite Online MF platform home page. Now you can make any transactions in our online platform.

-

Ans. Please follow the instruction

-

-

- Firstly download the Elite Kuber App

-

Play Store: https://play.google.com/store/apps/details?id=com.iw.elitekuberwealth&hl=en

App Store: https://apps.apple.com/in/app/elite-kuber/id1472743005

-

-

- Login by entering User name and Passwords which you received on your email id registered with us at the time of registration for our online platform.

- After login you will see our home page where a basket icon available

-

Click on basket and add you transaction according to your requirement

Ans. Please follow the instructions

-

-

- Firstly login into our website www.elitewealth.in follow the instruction of Question no 10 After login into Elite Mutual Fund Online Platform, click on “Invest Online BSE” tab on home page. You will reach on the below screen.

-

- Then click on NEW PURCHASE. You will see the following screen

-

- Now fill the details like AMC, scheme type, scheme name, amount you want to invest etc then click on add transaction. Payment link will be sending on your registered mail. Now choose online payment mode and make payment and confirm your order. After purchasing units, you will receive confirmation on your mobile and email id registered with us.

-

Ans. Please follow the instructions

-

-

- Firstly login into mobile app follow the instruction Question No. 11, After login into mobile app click on basket which is available on right top corner

- Click on “Add Scheme” then you will see all scheme available on screen

- Select Scheme according to your requirement and add to cart

- Then click on Order Now , select Lumpsum

- Fill all the details as per the requirement and click on order now

- You will get the confirmation on your registered mail address

-

Ans. ‘Fresh’ purchase indicates the purchase Orders that are placed for the selected scheme for the very first time. ‘Additional’ purchases mean any incremental purchase of units of the same scheme, which is already available in your portfolio.

Ans. Please follow the instructions

-

-

- Firstly login into our website www.elitewealth.in follow the instruction of Question no 10. After login into Elite Mutual Fund Online Platform, click on “Invest Online BSE” tab on home page. You will reach on the below screen.

- Then click on Additional Purchase, you will see the following screen

- Fill the details like AMC, scheme type, scheme name, amount you want to invest etc then click on add transaction. Payment link will be sending on your registered mail

-

Ans. Please follow the instructions

-

-

- Firstly login into Elite Kuber app

- Then click on your investment which you shown on screen

- Then you will see all the scheme where you have invested

- Click on that scheme which you wants to redeem then you will find the many option like additional purchase, sip, switch, stp, redeem

- Click on Additional Purchase and enter the amount and swipe to transaction

- Then you will get a link on your registered mail for Payment.

-

After confirmation you will allotted the new unit in your current scheme

Ans. Yes, You can cancel or modify the mutual order by 12 pm on the same trading day.

Ans. Please follow the instructions

-

-

- Firstly login into Elite Kuber app

- Then click on your investment which you shown on screen

- Then you will see all the scheme where you have invested

- Click on that scheme which you wants to redeem then you will find the many option like additional purchase, sip, switch, stp, redeem

- Click on Redeem and enter the amount or unit and swipe to transaction

- Then you will get a link on your registered mail for redemption confirm.

- After confirmation you will get your amount within 3 business days in your linked bank account

-

Ans. The credit of redemption proceeds into your bank account within 3 business days after redemption confirmation

Ans. Please follows the instruction

-

-

- If you want to invest in SIP first login into our Online MF platform by your User Id and Password then click on Invest Online BSE

-

- then click on SIP, the following page will show you

-

- Fill your details like AMC name, scheme type, scheme name, start date etc

- If you wants to pay first amount on same then select yes under the tab <Generate first order today

- Then click on order. Hence your SIP is registered and confirmation and payment link email is sent on your registered email address.

- Complete the payment

-

Ans. Please follow the instructions

-

-

- Firstly login into mobile app follow the instruction Question No. 13, After login into mobile app click on basket which is available on right top corner

- Click on “Add Scheme” then you will see all scheme available on screen

- Select Scheme according to your requirement and add to cart

- Then click on Order Now , and select SIP

- Fill all the details as per the requirement and click on order now

- You will get the confirmation on your registered mail address

-

Ans. No, you do not require a DEMAT account.

Q23. Can NRI eligible for online mutual fund facility? If yes then how can an NRI use this facility?

Ans. Yes. The process is the same as for resident individuals. However, instead of a savings bank account, NRI’s will require an NRE/NRO bank account.

Ans. Once you place an order, you must check the email received from the exchange with subject “Order Authentication”. Once you authenticate, then the Order is finally submitted. Please note, the registrar Cams/Karvy will process the transaction subject to their own checks

Ans. There are no usage charges taken from the investor for using online platforms

Ans. No, mutual fund investments are the subject to market risk. Past performance does not guarantee future return. Investors must assess their risk profile before investing.

Ans. No, your money is transferred to the exchange and then onward to AMC( Asset Management Company). At no point is your money transferred to our organization.

Ans. After login into mobile app you can see your wealth manager details under the < contact information section

Ans. Yes, we have financial tools on our mobile app for calculating your future goals

Ans. After login you will see a option < PORTFOLIO in bottom , click on portfolio then your total investment will show on screen

Then click on your total investment then you will find the all invested scheme on screen

Ans. Maximum three are permitted.

Ans. Just click on “A/c Statement” in our mutual fund online platform, you can see your all transaction. You can also see your dividend report, capital gain, your portfolio etc.

Ans. Yes, You are permitted to nominate a minor. However, if you nominate a minor, do provide the name and address of the minor’s guardian in the nomination request.

Ans. Please follow the instruction

-

-

- For switching your portfolio from one scheme to another within the same AMC, you may login on our Elite Online MF platform using your User Id and Password. On the home page, click the tab “INVEST ONLINE BSE”. It will open the below window:-

- Now click on SWITCH, the below window will be opened:-

- Select respective information and click on the “ORDER” tab. After clicking order tab, for order confirmation you will receive a pop-up confirming the request along with order no. Further, you will receive second level of authentication on your registered email id in which you will be requested to further confirm for final execution of the order.

-

SIP Investment

SIP Investment GOI Bonds Online Investment

GOI Bonds Online Investment Tax Saving Scheme

Tax Saving Scheme Mutual Funds

Mutual Funds Sovereign Gold Bond

Sovereign Gold Bond

Professionally Managed

Professionally Managed Tax Saving

Tax Saving Affordability

Affordability Diversification

Diversification Liquidity

Liquidity Convenience

Convenience