Mutual Fund Investments FAQ’s

Ans. Mutual funds are one of the most popular investment options these days. A fund manager, who is a finance professional, manages the pooled investment. The fund manager purchases securities such as stocks and bonds that are in line with the investment mandate.

Ans. A Systematic Investment Plan or SIP is a smart and hassle free mode for investing money in mutual funds. SIP allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.) A SIP helps you inculcate the habit of saving and building wealth for the future.

When should I start investing in Mutual Funds?

There is a beautiful Chinese proverb, “The best time to plant a tree was 20 years ago. The second best time is now.”

There is no reason why one should delay one’s investments, except, of course, when there is no money to invest. Within that, it is always better to use Mutual Funds than to do-it-oneself.

There is no minimum age when one can start investing. The moment one starts earning and saving, one can start investing in Mutual Funds. In fact, even kids can open their investment accounts with Mutual Funds out of the money they receive once in a while in form of gifts during their birthdays or festivals. Similarly, there is no upper age for investing in Mutual Funds.

Do Mutual Funds invest only in stocks?

Do you visualize roller-coasters or toy trains first when you think of an amusement park? Probably the former. These rides are usually the biggest attractions in such parks which create a certain perception about amusement parks. ‘Mutual funds’ too carry a similar perception that they invest only in stocks and hence are risky. There are many types of Mutual Funds meant for the varying investment needs of people. Some investors want high returns which only stocks can deliver. Such investors can invest in Equity Mutual Funds which are among the best long-term investment options available for achieving such objectives. But these Mutual Funds have risk of higher volatility because of their exposure to stocks of various companies.

There are other types of Mutual Funds that do not invest in equity but in bonds issued by banks, companies, government bodies and money market instruments (bank CDs, T-bills, Commercial Papers,) which have lower risk but also offer lower returns compared to equity funds.

To know more with respect to various types of categories and the schemes refer to the query no 9 On page no …..

Ans. ELSS is a type of diversified equity mutual fund which is qualified for tax exemption under section 80C of the Income Tax Act and offers the twin advantage of capital appreciation and tax benefits. It comes with a lock-in period of three years.

Ans. The idea of SIP is to avoid timing the market and should be started at any given state of the market. Be it very high or very low. The purpose of SIP is to avoid timing the markets and get into the habit of investing with a purpose.

Ans. Some investors prefer a scheme that is available at lower NAV compared to the one available at higher NAV. Investors may please note that in case of mutual fund schemes, lower or higher NAVs of similar type of schemes of different mutual funds have no relevance. On the other hand, investors should choose a scheme based on its merit considering performance track record of the mutual fund, service standards, professional management, etc.

Ans. You can invest in mutual funds in a paperless and hassle-free manner with Elite Wealth Ltd. Follow these simple steps to start your investment journey right away:

Step 1: Download & Log on to Elite Kuber App and create an investment account

Step 2: Enter all the requested details

Step 3: Get your e-KYC done, the whole process can be completed in 5 minutes

Step 4: Invest in the right mutual fund

Ans.

- Domestic funds: Domestic fund houses launch funds, which mobilize savings of the nationals within the country.

- Offshore Funds: Offshore funds can invest in securities of foreign companies, after requisite permission from RBI. The objective behind launching offshore funds is to attract foreign capital for investment in the country of the issuing company.

Ans.

- Growth Plan: Under the Growth Plan, the investor realizes only the capital appreciation on the investment (by an increase in NAV) and does not get any income in the form of dividend.

- Income Plan: Under the Income Plan, the investor realizes income in the form of dividend. However his NAV will fall to the extent of the dividend.

- Dividend Re-investment Plan: Here the dividend accrued on mutual funds is automatically re-invested in purchasing additional units in open-ended funds. In most cases mutual funds offer the investor an option of collecting dividends or re-investing the same.

- Systematic Investment Plan (SIP): Here the investor is given the option of preparing a pre-determined number of post-dated cheques in favour of the fund. He will get units on the date of the cheque at the existing NAV. For instance, if on 25th March, he has given a post-dated cheque for June 25th, he will get units on 25th June at existing NAV.

- Systematic Withdrawal Plan: As opposed to the Systematic Investment Plan, the Systematic Withdrawal Plan allows the investor the facility to withdraw a pre-determined amount/units from his fund at a pre-determined interval. The investor’s units will be redeemed at the existing NAV as on that day.

- Retirement Pension Plan: Some schemes are linked with retirement pension. Individuals participate in these plans for themselves and corporate for their employees.

Ans. Investors are exposed to reduced investment risk due to portfolio diversification, economies of scale in transaction cost and professional management.

- Limited Risk: Investors are exposed to reduced investment risk due to portfolio diversification, economies of scale in transaction cost and professional management.

- Diversified investment: Small investors can participate in larger basket of securities and share the benefits of efficiently managed portfolio by experts, and are freed from maintaining records of company share certificates, and tracking tax rules. Mutual fund investments are less risky due to portfolio diversification, which is possible mainly due to large funds available at their disposal. Small investors can never spread their risks across such a wide portfolio, as can mutual funds.

- Freedom from tracking investments: Investors do not have to track their investments regularly, as the tracking is done by experts who buy and sell securities for them. Investors are only required to track the performance of the mutual fund.

- Professional management: Mutual funds are run by professionals, with experience in portfolio management. Analysts employed by mutual funds analyze data and information available in a manner that cannot be matched by the lay investor.

Tax benefits: Income tax benefits are granted to investors in mutual funds, making it more tax efficient as compared to other comparable investment avenues.

Ans. It is desirable that different schemes launched by a Mutual Fund are clearly distinct in terms of asset allocation, investment strategy etc. Further, there is a need to bring in uniformity in the characteristics of similar type of schemes launched by different Mutual Funds. This would ensure that an investor of Mutual Funds is able to evaluate the different options available, before taking an informed decision to invest in a scheme.

In order to bring the desired uniformity in the practice, across Mutual Funds and to standardize the scheme categories and characteristics of each category, the Mutual Fund Advisory Committee (MFAC) has decided to categorize the MF schemes as given below:

The Schemes would be broadly classified in the following groups:

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution Oriented Schemes

- Other Schemes

The details of the scheme categories under each of the aforesaid groups along with their characteristics and uniform description are given below:

- Equity Fund Categories:

| Sr.

No. |

Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

| 1 | Multi Cap Fund | Minimum investment in equity & equity related instruments- 65% of total assets | Multi Cap Fund- An open ended equity scheme investing across large cap, mid cap,

small cap stocks |

| 2 | Large Cap Fund | Minimum investment in equity & equity related instruments of large cap companies- 80% of total assets | Large Cap Fund- An open ended equity scheme predominantly investing in

large cap stocks |

| 3 | Large & Mid Cap Fund | Minimum investment in equity & equity related instruments of large cap companies- 35% of total assets Minimum investment in equity & equity related instruments of mid

cap stocks- 35% of total assets |

Large & Mid Cap Fund- An open ended equity scheme investing in both large cap and mid cap stocks |

| 4 | Mid Cap Fund | Minimum investment in equity &

equity related instruments of mid cap companies- 65% of total assets |

Mid Cap Fund- An open ended

equity scheme predominantly investing in mid cap stocks |

| 5 | Small cap Fund | Minimum investment in equity & equity related instruments of small cap companies- 65% of total assets | Small Cap Fund- An open ended equity scheme predominantly investing in

small cap stocks |

| 6 | Dividend Yield Fund | Scheme should predominantly invest in dividend yielding stocks. Minimum investment in equity- 65% of total assets | An open ended equity scheme predominantly investing in dividend yielding stocks |

| 7 | Value Fund* | Scheme should follow a value investment strategy.

Minimum investment in equity & equity related instruments – 65% of total assets |

An open ended equity scheme following a value investment strategy |

| Contra Fund* | Scheme should follow a contrarian investment strategy.

Minimum investment in equity & equity related instruments – 65% of total assets |

An open ended equity scheme following contrarian investment strategy | |

| 8 | Focused Fund | A scheme focused on the number of stocks (maximum 30)

Minimum investment in equity & equity related instruments – 65% of total assets |

An open ended equity scheme investing in maximum 30 stocks (mention where the scheme intends to focus, viz. multi cap, large cap, mid cap,

small cap) |

| 9 | Sectoral/ Thematic | Minimum investment in equity & equity related instruments of a particular sector/ particular theme- 80% of total assets | An open ended equity scheme investing in sector (mention the sector)/

An open ended equity scheme following theme (mention the theme) |

| 10 | ELSS | Minimum investment in equity & equity related instruments – 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005

notified by Ministry of Finance) |

An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit |

* Mutual Funds will be permitted to offer either Value fund or Contra fund.

- Debt Fund Categories:

| Sr.

No. |

Category of

Schemes |

Scheme Characteristics | Type of scheme (uniform

description of scheme) |

| 1 | Overnight Fund** | Investment in overnight securities

having maturity of 1 day |

An open ended debt scheme

investing in overnight securities |

| 2 | Liquid Fund $ ** | Investment in Debt and money

market securities with maturity of upto 91 days only |

An open ended liquid scheme |

| 3 | Ultra Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 months – 6 months | An open ended ultra-short term debt scheme investing in instruments with Macaulay duration between 3 months and 6 months (please refer to page

no. )# |

| 4 | Low Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months- 12 months | An open ended low duration debt scheme investing in instruments with Macaulay duration between 6 months and

12 months (please refer to page no. )# |

| 5 | Money Market Fund | Investment in Money Market instruments having maturity upto 1

year |

An open ended debt scheme investing in money market

instruments |

| 6 | Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 1 year – 3 years | An open ended short term debt scheme investing in instruments with Macaulay duration between 1 year and 3 years (please refer to page

no. )# |

| 7 | Medium Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 years – 4 years | An open ended medium term debt scheme investing in

instruments with Macaulay duration between 3 years and 4 years (please refer to page no. )# |

| 8 | Medium to Long Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 4 – 7 years | An open ended medium term debt scheme investing in instruments with Macaulay duration between 4 years and 7 years (please refer to page

no. )# |

| 9 | Long Duration Fund | Investment in Debt & Money Market Instruments such that the Macaulay duration of the portfolio is greater than 7 years | An open ended debt scheme investing in instruments with Macaulay duration greater than 7 years (please refer to page

no. )# |

| 10 | Dynamic Bond | Investment across duration | An open ended dynamic debt scheme investing across

duration |

| 11 | Corporate Bond Fund | Minimum investment in corporate

bonds- 80% of total assets (only in highest rated instruments) |

An open ended debt scheme

predominantly investing in highest rated corporate bonds |

| 12 | Credit Risk Fund^ | Minimum investment in corporate bonds- 65% of total assets (investment in below highest rated

instruments) |

An open ended debt scheme investing in below highest rated corporate bonds |

| 13 | Banking and PSU Fund | Minimum investment in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions- 80% of total assets | An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public

Financial Institutions |

| 14 | Gilt Fund | Minimum investment in Gsecs- 80% of total assets (across maturity) | An open ended debt scheme investing in government

securities across maturity |

| 15 | Gilt Fund with 10 year constant duration | Minimum investment in Gsecs- 80% of total assets such that the Macaulay duration of the portfolio is

equal to 10 years |

An open ended debt scheme investing in government securities having a constant

maturity of 10 years |

| 16 | Floater Fund | Minimum investment in floating rate instruments- 65% of total assets | An open ended debt scheme

predominantly investing in floating rate instruments |

**Provisions of SEBI Circular No SEBI/IMD/DF/19/2010 dated November 26, 2010 shall be followed for Uniform cut-off timings for applicability of Net Asset Value in respect of Liquid Fund and Overnight Fund.

$ All provisions mentioned in SEBI circular SEBI/IMD/CIR No.13/150975/09 dated January 19, 2009 in respect of liquid schemes shall be applicable

# Please refer to the page number of the Offer Document on which the concept of Macaulay’s Duration has been explained

^ Words/ phrases that highlight/ emphasize only the return aspect of the scheme shall not be used in the name of the scheme (for instance Credit Opportunities Fund, High Yield Fund, Credit Advantage etc.)

- Hybrid Schemes:

| Sr.

No. |

Category of

Schemes |

Scheme Characteristics | Type of scheme (uniform

description of scheme) |

| 1 | Conservative Hybrid Fund | Investment in equity & equity related instruments- between 10% and 25% of total assets;

Investment in Debt instruments- between 75% and 90% of total assets |

An open ended hybrid scheme investing predominantly in debt instruments |

| 2 | Balanced Hybrid Fund @ | Equity & Equity related instruments- between 40% and 60% of total assets;

Debt instruments- between 40% and 60% of total assets No Arbitrage would be permitted in this scheme |

An open ended balanced scheme investing in equity and debt instruments |

| Aggressive Hybrid Fund @ | Equity & Equity related instruments- between 65% and 80% of total assets;

Debt instruments- between 20% 35% of total assets |

An open ended hybrid scheme investing predominantly in equity and equity related instruments | |

| 3 | Dynamic Asset Allocation or Balanced

Advantage |

Investment in equity/ debt that is managed dynamically | An open ended dynamic asset allocation fund |

| 4 | Multi Asset Allocation ## | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three

asset classes |

An open ended scheme investing in , , (mention the three different asset

classes) |

| 5 | Arbitrage Fund | Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments-

65% of total assets |

An open ended scheme investing in arbitrage opportunities |

| 6 | Equity Savings | Minimum investment in equity & equity related instruments- 65% of total assets and minimum investment in debt- 10% of total assets

Minimum hedged & unhedged to be stated in the SID. Asset Allocation under defensive considerations may also be stated in the Offer Document |

An open ended scheme investing in equity, arbitrage and debt |

@ Mutual Funds will be permitted to offer either an Aggressive Hybrid fund or Balanced fund

## Foreign securities will not be treated as a separate asset class

- Solution Oriented Schemes:

| Sr.

No |

Category of

Schemes |

Scheme Characteristics | Type of scheme (uniform

description of scheme) |

| 1 | Retirement Fund | Scheme having a lock-in for at least

5 years or till retirement age whichever is earlier |

An open ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is

earlier) |

| 2 | Children’s Fund | Scheme having a lock-in for at least 5 years or till the child attains age of majority whichever is earlier | An open ended fund for investment for children having a lock-in for at least 5 years or till the child attains age of

majority (whichever is earlier) |

- Other Schemes:

Sr. No

Category of Schemes

Scheme Characteristics Type of scheme (uniform description of scheme)

1 Index Funds/ ETFs Minimum investment in securities of a particular index (which is being replicated/ tracked)- 95% of total assets

An open ended scheme replicating/ tracking _ index 2 FoFs (Overseas/ Domestic) Minimum investment in the underlying fund- 95% of total assets An open ended fund of fund scheme investing in fund (mention the underlying fund)

What are the taxation rules and implications in Mutual Funds?

Mutual Fund investments are subject to capital gains tax. It’s paid on the profit we make while redeeming / selling our Mutual Fund holdings (units). The gain is the difference in Net Asset Value (NAV) of scheme on the date of sale and date of purchase (Selling Price-Purchase Price). Capital gains tax is further classified depending on period of holding. For equity funds (funds with equity exposure > =65%), holding period of one year or more is considered long-term and subjected to Long-Term Capital Gains (LTCG) tax.

LTCG tax of 10% is applicable on equity funds if the cumulative capital gain in a financial year exceeds INR 1 lakh. Profits on holdings of less than a year are subject to 15% Short-Term Capital Gains (STCG) tax in equity funds.

Long-term is defined as holding period of 3 years or more in case of non-equity funds (debt funds) and 20% LTCG tax is applicable on such holdings with indexation i.e. purchase price is adjusted upwards for inflation, while computing capital gains. Profits on holdings of less than 3 years are subject to STCG tax, which is the highest income tax slab individuals fall into.

What is NACH and objectives of NACH?

National Payments Corporation of India (incorporated in December 2008 and the Certificate of Commencement of Business was issued in April 2009) has implemented the National Automated Clearing House (NACH), a web based solution for Banks, Financial Institutions, Corporates and Government to facilitate interbank, high volume, electronic transactions which are repetitive and periodic in nature.

NACH is a centralized system, launched with an aim to:

- consolidate multiple ECS systems running across the country.

- leverage on distribution footprint and technology to provide a modern, robust platform to handle large volumes of repetitive payments.

- provide a single set of rules (operating and business), open standards and best industry practices for electronic transactions which are common across all the Participants, Service Providers and Users etc. and removes local barriers/inhibitors.

support the financial inclusion measures initiated by Government, Government Agencies and Banks by providing support to Aadhaar based transactions and Mobile based ACH transactions

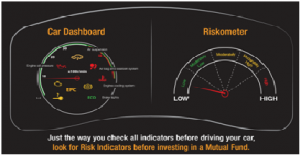

What are the indicators of risk in a Mutual Fund Scheme

Picking up the right Mutual Fund scheme to invest your hard-earned money is the most crucial aspect of investing. While investors often go by scheme category and top performing schemes in the category, they ignore risk indicators for these schemes. When you are comparing schemes to choose from, don’t miss out comparing their riskiness. While there are many risk indicators like Standard Deviation, Beta and Sharpe Ratio provided in the factsheet of every scheme, product label is the most basic thing to look for. The riskometer in the label shows the risk level of the fund.

How do Mutual Funds help manage risk?

In Mutual Fund, typically portfolio holds many securities, thus offering “diversification”. In fact, diversification is one of the biggest benefits of investing in a Mutual Fund. It ensures that the dip in price (price risk) or company specific risk of one or even a few securities does not affect portfolio performance alarmingly.

Another important risk to bear in mind is Liquidity Risk. Mutual Funds by regulation and structure, offer tremendous liquidity. Portfolios are designed to offer an investor, ease of investing and redemption.

What are the Scheme Related Documents? What information do these documents provide?

There are 3 important documents: Key Information Memorandum (KIM), Scheme Information Document (SID) and Statement of Additional Information (SAI).

The SID has information like:

- All Fundamental Attributes like Investment Objective and Policies, Asset Allocation Pattern, Fees and Liquidity Provisions.

- Fund Management Team details

- All Risk Factors in the schemeas well as risk mitigation mechanisms.

- Scheme details like load, plans and options, past performance, benchmark.

- General Unit holder information.

- Other details like list of AMC branches, Investor Service Centres, Official Points of Acceptance.

The SAI has information like:

- The constitution of the Mutual Fund – Sponsors, Asset Management Company and Trustees.

- All information on key personnel of the AMC and associates such as Registrars, Custodians, Bankers, Auditors and Legal Counsel.

- All Financial and Legal issues.

The concise version of SID is the KIM, that is attached with the application form. As the name suggests, it contains all the Key Information that an investor must know before investing in the scheme. The KIM must be made available with every application form.

How to choose a fund basis your risk appetite

Mutual Funds are market-linked products that carry various kinds of risks and their returns are not guaranteed. Choosing the right mutual fund involves not only looking at its investment objective, return potential but also an evaluation of its riskiness. Since every investor has a unique personality including risk preference, the choice of mutual funds will be unique to each investor. Apart from risk preference, every investor will have a certain goal in mind that would be unique in its value and time horizon. Hence choosing the right mutual fund requires one to evaluate various funds along with the risk-return-time horizon metric.

What is KYC Process?

KYC is an acronym for “Know Your Customer” and is a term used for Customer Identification Process as a part of Account Opening process with any financial entity. KYC establishes an investor’s identity & address through relevant supporting documents such as prescribed photo id (e.g., PAN card, Aadhar card) and address proof and In-Person Verification (IPV). KYC compliance is mandatory under the Prevention of Money Laundering Act, 2002 and Rules framed there under, read with the SEBI Master Circular on Anti Money Laundering (AML) Standards/ Combating the Financing of Terrorism (CFT) /Obligations of Securities Market Intermediaries.

What kind of returns should one expect from Mutual Funds?

There is not one product called Mutual Fund, there are many types of different Mutual Funds. The investment returns from the different categories could vary and then there are certain fund categories that exhibit higher level of uncertainty in performance

An investor would be advised to focus on the characteristic nature of the fund and match the same with one’s own requirements or connect to a wealth manager who can help in building a portfolio based on financial goals.

Can Mutual Funds help create wealth?

Business and commerce allows us to create wealth by investing our money with those who are on the path to creating wealth. We can be investors in businesses of entrepreneurs, by investing in stocks of various companies. As the entrepreneurs and the managers run their businesses efficiently and profitably, the shareholders get the benefits. In this regard, Mutual Fund are a great way to build wealth.

Can minors invest in Mutual Funds?

Anyone under the age of 18 (minor) can invest in Mutual Funds, with the help of parents/legal guardians until the age of 18. The minor must be the sole account holder represented by the parent/guardian. Joint holding is not allowed in a minor’s Mutual Fund folio.

Do Indian Mutual Funds invest only in India?

While most Indian Mutual Funds invest only in India, there are quite a few schemes that invest in overseas securities. There are in fact two ways for a scheme to get such exposure to foreign securities. Schemes may either buy such securities listed or traded in overseas exchanges, or they may invest in other overseas Mutual Fund schemes that have such securities in their portfolio after obtaining separate SEBI approval for investment in foreign securities. Either way, the scheme has foreign flavour in the portfolio.

Can NRIs invest in Mutual Funds in India?

Yes, Non Resident Indians (NRI) and Persons of Indian Origin (PIO) can invest in Indian Mutual Funds on a full repatriation as well as non-repatriation basis. However, NRIs would have to comply with all regulatory requirements such as completion of KYC before investing. It should however be noted that a few countries such as US and Canada have restricted investments by NRIs in Mutual Funds without relevant disclosures.