About Scheme: This strategy identifies Large & Mid cap stocks with strong momentum in Cross Sectional, Absolute, Revenue, and Earnings Momentum. By focusing on the top 250 companies by market capitalization, the fund optimizes the portfolio and mitigates risks using derivatives and hedging during market volatility.

Fund Overview

Investment Objective

The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly Large Cap and Mid Cap equity and equity-related securities.

There is no assurance that the investment objective of the scheme will be achieved.

| Key Highlights |

|---|

| Cross-sectional momentum is the core criterion for stock selection which identifies and invests in top-performing large-cap stocks with consistent price strength, outperforming their sector and indices. |

| Absolute momentum assesses the directional trend of stocks or the market, regardless of relative performance. If the trend turns negative, the fund employs tactical measures, including derivatives and hedging, to reduce net equity exposure and protect against drawdowns. |

| Revenue momentum focuses on companies with strong top-line growth, highlighting those with consistent sales increases that precede earnings growth. This approach ensures the portfolio includes growth stocks that can sustain market leadership and capture long-term value creation. |

| Earnings momentum identifies companies with rapid growth in profitability at the PBT (Profit Before Tax) and PAT (Profit After Tax) levels, reflecting their ability to translate operational efficiency and revenue growth into shareholder value. |

(source: samcomf.com)

|

NFO Period

|

June 05, 2025 to June 19, 2025

|

|

Type of scheme

|

An open-ended equity scheme predominantly investing in large cap and mid cap stocks

|

|

Plans

|

|

|

Benchmark Index

|

Nifty Large Midcap 250 TRI

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

|

(source: samcomf.com)

Samco Large & Mid Cap Fund NFO Details:

| Mutual Fund | Samco Mutual Fund |

| Scheme Name | Samco Large & Mid Cap Fund |

| Objective of Scheme | The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly Large Cap and Mid Cap equity and equity-related securities. There is no assurance that the investment objective of the scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Large & Mid Cap Fund |

| New Fund Launch Date | 05-Jun-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 19-Jun-2025 |

| Indicate Load Seperately | Entry Load: Not Applicable Exit Load: 10% of units can be redeemed at any time without an exit load. Any redemption in excess of 10% of units will incur 1% exit load in the first 12 months. No exit load, if redeemed after 12 months from the date of allotment of unit. |

| Minimum Subscription Amount | Rs. 5,000 and in multiples of Rs. 1/- thereafter |

| For Further Details Please Visit Website | https://www.samcomf.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: samcomf.com)

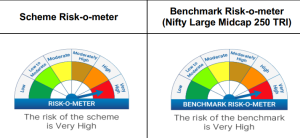

Samco Large & Mid Cap Fund NFO Riskometer:

(source: samcomf.com)

Frequently asked questions

Large Cap companies are the 1st-100th company in terms of market capitalization. Mid Cap companies are the 101st-250th company in terms of market capitalization. Large and Mid-Cap Funds are those equity-oriented mutual funds that invest primarily in a mix of large and mid-cap companies.

SAMCO Large & Mid Cap Fund uses a cutting-edge momentum-based strategy with SAMCO’s proprietary C.A.R.E. Momentum system to deliver superior risk-adjusted returns. It identifies large & mid cap stocks with strong momentum in Cross Sectional, Absolute, Revenue, and Earnings Momentum. By focusing on the top 250 companies by market capitalization, the fund optimizes the portfolio and mitigates risks using derivatives and hedging during market volatility.

The minimum investment amount for lumpsum is Rs.5,000 and in multiples of ₹1/- thereafter and for Systematic Investment Plan (SIP) it is Rs. 500 and in multiples of ₹1/- thereafter.

There is no entry load applicable. 10% of units can be redeemed at any time without an exit load. Any redemption in excess of 10% of units will incur 1% exit load in the first 12 months. No exit load, if redeemed after 12 months from the date of allotment of unit.