NIFTY:

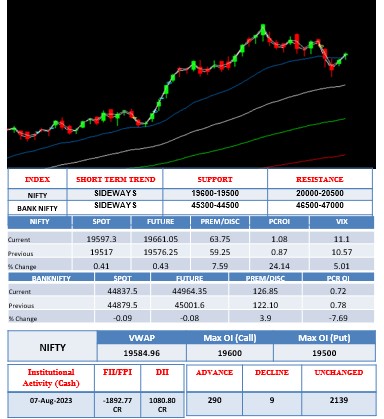

The NIFTY opened at 19576.85 with a gap up of 59 points. Initially, the index moved lower but quickly found support and started moving sideways, after recording its intraday low at 19524.80. The index started a rally in the afternoon and went above 19600. However, prices have found strong resistance there and then again formed a range that lasted till the end. The NIFTY recorded its intraday high at 19620.45 and finally closed at 19597.30 near its day’s highs with a gain of 80.30 points or 0.41% up. PHARMA and IT outperformed and closed with a gain of over 1% followed by REALTY and AUTO. MEDIA, BANK, and METAL under performed and closed with minor losses. The short-term trend is sideways now but the bias is bullish. The NIFTY closed higher for the second consecutive trading day but moved very narrowly for the past two days. We may see a sharp move here soon.

BANK NIFTY:

The BANK NIFTY opened at 44993.70 with a gap up of 135 points. The index initially moved lower, filled the gap, and then found support around 44800. Prices bounced up but could not move much higher and faced resistance around 45000. The index kept on swinging within these two levels for the whole day, recorded its intraday low at 44773.85 and its intraday high at 45011.35. Prices finally closed at 44833 with a loss of just 25 points PSU BANK has underperformed today, saw a sharp down move, and ended with a loss of 0.60% PVT BANK outperformed, saw a mild upside rally. and ended with a gain of just 0.09%. Within the index, in terms of points, ICICI BANK contributed the highest on the upside while SBIN contributed the lowest. BANK NIFTY moved very narrowly today and closed almost on a flat note. The short-term trend is sideways now as the index has stopped moving down for the past two days.

TECHNICAL PICKS

| COMPANY NAME | CMP | B/S | RATIONALE |

| CONCOR | 699.00 | BUY | The stock is about to give a breakout on the intraday and the daily chart. The stock can be bought above 700.50 with a stop loss of 691.55 and a target of 715.85. |

| BRITANNIA | 4659.75 | SELL | The stock has given a breakdown on the intraday as well as the daily chart. The stock can be sold below 4621.55 with a stop loss of 4673.30 and a target of 4517.50. |

DERIVATIVE PICKS

| Stock Name | Strike Price | Buy/Sell | CMP | Initiation | Stop Loss | Target | Remarks |

| AXIS BANK | 950 CE | BUY | 20.30 | CMP | 19 | 22.90 | BREAKOUT |

| Long Buildup | Short Buildup | |||||||||

| Stocks | Price | Price% | OI % | OI | Stocks | Price | Price% | OI % | OI | |

| RECLTD.23.08 Aug | 210.05 | 6.3 | 1.28 | 77264000 | ABFRL.23.08 Aug | 200.3 | -5.03 | 13 | 32232200 | |

| DIVISLAB.23.08 Aug | 3908.3 | 4.48 | 9.08 | 2879800 | BALKRISIND.23.08 Aug | 2384 | -4.16 | 3.45 | 2079600 | |

| PFC.23.08 Aug | 267.8 | 3.3 | 3.82 | 49556600 | INDIACEM.23.08 Aug | 216.85 | -4.07 | 15.01 | 23420400 | |

| BIOCON.23.08 Aug | 263.85 | 3.27 | 4.92 | 33085000 | DELTACORP.23.08 Aug | 183 | -2.69 | 15.61 | 12443200 | |

| AUROPHARMA.23.08 Aug | 873.7 | 3.17 | 2.07 | 13968900 | CUMMINSIND.23.08 Aug | 1753.1 | -2.26 | 11.15 | 5166000 | |

| Short Covering | Long Unwinding | |||||||||

| Stocks | Price | Price% | OI % | OI | Stocks | Price | Price% | OI % | OI | |

| M&M.23.08 Aug | 1534.05 | 4.19 | -6.12 | 18144000 | GNFC.23.08 Aug | 562.05 | -4.81 | -5.37 | 7605000 | |

| LICHSGFIN.23.08 Aug | 443.75 | 3.29 | -2.53 | 23640000 | HINDCOPPER.23.08 Aug | 149.1 | -3.06 | -2.59 | 25678500 | |

| GUJGASLTD.23.08 Aug | 461.05 | 3.24 | -2.5 | 8238750 | BRITANNIA.23.08 Aug | 4679.8 | -2.85 | -0.32 | 2076600 | |

| METROPOLIS.23.08 Aug | 1405.5 | 2.91 | -7.73 | 1634000 | MRF.23.08 Aug | 109052.3 | -2.65 | -6.45 | 48120 | |

| HDFCAMC.23.08 Aug | 2453.35 | 2.19 | -2.77 | 2741700 | BHEL.23.08 Aug | 96.95 | -2.07 | -1.37 | 113568000 | |

Top Delivery Percentage

| Stocks | Price | %Chg | Total Qty | Delivery | Del % | % Change | ||||

| Sectors | Price | Change % | Quantity | |||||||

| Gujgasltd | 461.7 | 2.4 | 1452392 | 2899209 | 78.66 | Nifty50 | 19597.3 | 0.41 | 36740586 | |

| Jk Cement Limited | 3242.4 | 1.03 | 62643 | 138636 | 76.89 | Niftybank | 44837.5 | -0.09 | 16029405 | |

| Hindustan Unilever Ltd | 2569.2 | 0.91 | 803823 | 990939 | 72.9 | Nifty it | 30779.25 | 1.13 | 784657 | |

| Godrej Cons Products Ltd | 1030.7 | 1.29 | 1298516 | 418199 | 69.95 | India Vix | 11.1 | 5.01 | 651697559 | |

| Petronet Lng Limited | 226.5 | 1.07 | 1164287 | 1512087 | 69.1 | Nifty Fmcg | 52072.5 | 0.04 | 402400 | |

| Alkem | 4131.85 | 0.8 | 145189 | 205131 | 68.83 | Nifty Pharma | 15479.25 | 1.56 | 46655446 | |

| Shriram Finance Limited | 1854.8 | 0.97 | 985237 | 729276 | 66.84 | Nifty Realty | 542.3 | 0.58 | 1328795537 | |

| Sbi Life Insurance Compa | 1302.55 | 2.73 | 1719680 | 1066162 | 66.26 | Nifty Auto | 15390.9 | 0.41 | 46734671 | |

| Tata Consumer Products l | 837.8 | 0.36 | 1106208 | 577837 | 65.1 | Nifty Metal | 6622.15 | -0.01 | 108440943 | |

| Ultratech Cement Limited | 8175.45 | 0.21 | 195297 | 161438 | 65.08 | Nifty Financial Services | 20022.6 | 0.17 | 5582957 | |

Upcoming Economic Data

| Domestic International | |

| INR: M3 Money Supply on 09th August, 2023

INR: Interest Rate Decision on 10th August, 2023 |

USD: EIA Short-Term Energy Outlook on 08th August, 2023

USD: CPI (YoY) (Jul) on 10th August, 2023 |

News Updates

-

India’s benchmark stock indices advanced for the second straight day on Monday, as healthcare and telecommunication sectors advanced, while power and utilities stocks declined. The S&P BSE Sensex closed 232.23 points higher, or 0.35%, at 65,953.48, while the NSE Nifty 50 ended 80.30 points higher, or 0.41%, at 19,597.30

-

Reliance Industries Goes Slow On Non-Core Investments As Net Debt Hits $9 Billion The company’s standalone net debt rose to Rs 72,897 crore as of March from Rs 12,328 crore a year earlier.

-

Max Healthcare Institute Ltd on Monday reported a 27 per cent rise in its profit after tax (PAT) in the quarter that ended on June 30 to Rs 291 crore as compared to Rs 229 crore in the same quarter last year. As compared to Rs 320 crore in the quarter that ended on March 31, the PAT was down 9 per cent. The company’s gross revenue during the quarter was up 17 per cent to its highest-ever figures of Rs 1,719 crore as compared to Rs 1,473 crore in the June quarter of 2022. Sequentially, the revenue was up 5 per cent from Rs 1,637 crore.

Source: Economic Times, Indian Express, Business Today, Livemint, Business Standard, Bloomberg Quint

Board Meetings

| Company Name | Purpose | Meeting Date | Company Name | Purpose | Meeting Date |

| ADFFOODS | Quarterly Results | 07-Aug-23 | ENTRINT | Quarterly Results | 07-Aug-23 |

| ADROITINFO | Quarterly Results | 07-Aug-23 | EUROLED | Quarterly Results | 07-Aug-23 |

| ASIANENE | Quarterly Results | 07-Aug-23 | EVERTEX | Quarterly Results | 07-Aug-23 |

| ASTAR | Quarterly Results | 07-Aug-23 | FOODSIN | General;Quarterly Results | 07-Aug-23 |

| BALMLAWRIE | General;Quarterly Results | 07-Aug-23 | GEECEE | Quarterly Results | 07-Aug-23 |

| BANCOINDIA | A.G.M.;Quarterly Results | 07-Aug-23 | GHCLTEXTIL | Quarterly Results | 07-Aug-23 |

| BAYERCROP | Quarterly Results | 07-Aug-23 | GICHSGFIN | A.G.M.;General;Quarterly Results | 07-Aug-23 |

| BAZELINTER | Quarterly Results | 07-Aug-23 | GLAND | Quarterly Results | 07-Aug-23 |

| BGWTATO | Quarterly Results | 07-Aug-23 | GODREJCP | Quarterly Results | 07-Aug-23 |

| CAPPIPES | Quarterly Results | 07-Aug-23 | GOKEX | Quarterly Results | 07-Aug-23 |

| DAL | Quarterly Results | 07-Aug-23 | HILTON | Quarterly Results | 07-Aug-23 |

| DEVHARI | Quarterly Results | 07-Aug-23 | HLEGLAS | Quarterly Results | 07-Aug-23 |

| DUGARHOU | A.G.M.;General | 07-Aug-23 | ICIL | Quarterly Results | 07-Aug-23 |

| DYNAVSN | A.G.M.;Quarterly Results | 07-Aug-23 | INDIAGLYCO | Quarterly Results | 07-Aug-23 |

| EIHAHOTELS | Quarterly Results | 07-Aug-23 | INDIGOPNTS | Quarterly Results | 07-Aug-23 |

| EMAMIREAL | Quarterly Results | 07-Aug-23 | INDPRUD | Quarterly Results | 07-Aug-23 |

Corporate Action

| Company Name | Ex-Date | Purpose | Company Name | Ex-Date | Purpose |

| GABRIEL | 07-Aug-23 | Final Dividend – Rs. – 1.6500 | DAAWAT | 09-Aug-23 | Interim Dividend – Rs. – 0.5000 |

| KARURVYSYA | 07-Aug-23 | Dividend – Rs. – 2.0000 | ICICIBANK | 09-Aug-23 | Final Dividend – Rs. – 8.0000 |

| NATFIT | 07-Aug-23 | Dividend – Rs. – 1.5000 | MSUMI | 09-Aug-23 | Final Dividend – Rs. – 0.6500 |

| NAVNETEDUL | 07-Aug-23 | Final Dividend – Rs. – 2.6000 | SMLT | 09-Aug-23 | Final Dividend – Rs. – 1.0000 |

| PRISMMEDI | 07-Aug-23 | E.G.M. | WSTCSTPAPR | 09-Aug-23 | Final Dividend – Rs. – 10.0000 |

| RITES | 07-Aug-23 | Interim Dividend – Rs. – 3.7500 | ZPPOLYSA | 09-Aug-23 | E.G.M. |

| SAKSOFT | 07-Aug-23 | Final Dividend – Rs. – 0.3500 | MANINFRA | 10-Aug-23 | Interim Dividend – Rs. – 0.3600 |

| STL | 07-Aug-23 | Final Dividend – Rs. – 0.2000 | ADSL | 10-Aug-23 | Final Dividend – Rs. – 1.2500 |

| ARCHITORG | 08-Aug-23 | Final Dividend – Rs. – 0.5000 | ALKEM | 10-Aug-23 | Final Dividend – Rs. – 10.0000 |

| CASTROLIND | 08-Aug-23 | Interim Dividend – Rs. – 3.0000 | AVL | 10-Aug-23 | Final Dividend – Rs. – 7.5000 |

| POWERGRID | 08-Aug-23 | Final Dividend – Rs. – 4.7500 | GOACARBON | 10-Aug-23 | Dividend – Rs. – 17.5000 |

| RPEL | 08-Aug-23 | Bonus issue 1:1 | IRBINVIT | 10-Aug-23 | Income Distribution (InvIT) |

| SHALBY | 08-Aug-23 | Final Dividend – Rs. – 1.2000 | JSWISPL | 10-Aug-23 | Amalgamation |

| STLTECH | 08-Aug-23 | Final Dividend – Rs. – 1.0000 | JUBLINGREA | 10-Aug-23 | Final Dividend – Rs. – 2.5000 |

| TANAA | 08-Aug-23 | Interim Dividend – Rs. – 2.5000 | JUBLPHARMA | 10-Aug-23 | Final Dividend – Rs. – 5.0000 |

| WESTLIFE | 08-Aug-23 | Interim Dividend – Rs. – 3.4500 | LINDEINDIA | 10-Aug-23 | Final Dividend – Rs. – 4.5000 |

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulation