National Highways Infra Trust (“NHIT”) is a registered infrastructure investment trust under the InvIT Regulations. NHIT currently has a right to toll, operate and maintain a portfolio of five Initial Toll Roads in the Indian states of Gujarat, Rajasthan, Telangana, and Karnataka, and intends to toll, operate and maintain a portfolio of three Target Toll Roads in the Indian states of, Telangana, Maharashtra, Uttar Pradesh and Madhya Pradesh under the Toll Operate Transfer (“TOT”) model conceived by NHAI. These Toll Roads are operated and maintained under concessions granted by the NHAI. The Initial Toll Roads comprise five stretches spanning a total length of approximately 389 km and the Target Toll Roads comprise three stretches spanning a total length of approximately 246 km.

National Highways Infra Trust (“NHIT”) is coming out with a public issue of secured, rated, listed, redeemable non-convertible debentures of the face value of Rs.1,000 each, (“NCDs”), (comprising three separately transferable and redeemable principal parts (“STRPP”, as detailed hereinafter) namely 1 STRPP A of the face value of Rs. 300/-, 1 STRPP B of the face value of Rs. 300/- and 1 STRPP C of the face value of Rs. 400/-, for an amount up to Rs. 750 crores (“base issue size”) with an option to retain oversubscription up to Rs. 750 crores (“green shoe option”) aggregating to an amount of up to Rs. 1500 crores (hereinafter referred to as the “issue”). the issue will be of up to 15,000,000 NCDs (consisting of 15,000,000 STRPP A, 15,000,000 STRPP B, and 15,000,000 STRPP C). the three STRPPs will be of different face value, and different maturity and shall be redeemable (i) at par; and (ii) in a staggered manner.

National Highways Infra Trust NCD Details

| Issue opens: | Monday, October 17, 2022 | ||||

| Issue closes: | Monday, November 7, 2022 | ||||

| Allotment: | First Come First Serve Basis | ||||

| Base Issue Size: | ₹ 750 Crore | ||||

| Green Issue Option: | ₹ 750 Crore | ||||

| Total Issue Size: | ₹ 1500 Crore | ||||

| Face Value: | ₹ 1,000/- per NCD consisting of 1 (one) STRPP A with face value of.₹ 300, 1 (one) STRPP B with face value of.₹ 300 and 1 (one) STRPP C with face value of.₹ 400 | ||||

| Nature of Instrument: | Secured, Rated, Listed, Redeemable, Non-Convertible Debentures | ||||

| Minimum Application: | ₹ 10,000 (i.e. 10 NCDs comprising of 10 STRPP A, 10 STRPP B, 10 STRPP C) | ||||

| Listing: | The NCDs are proposed to be listed on BSE & NSE | ||||

| Credit Rating | ‘CARE AAA/Stable’ by CARE Ratings Limited and ‘IND AAA/Stable’ by India Ratings and Research Private Limited | ||||

| Tranche-III Issue Size | Base Issue size of ₹ 100 Crore with an option to retain oversubscription up to ₹ 700 Crore aggregating up to ₹ 800 crore

Being the Tranche-III Issue size. |

||||

| Depositories | NSDL and CDSL | ||||

| Put and Call Option | Not Applicable | ||||

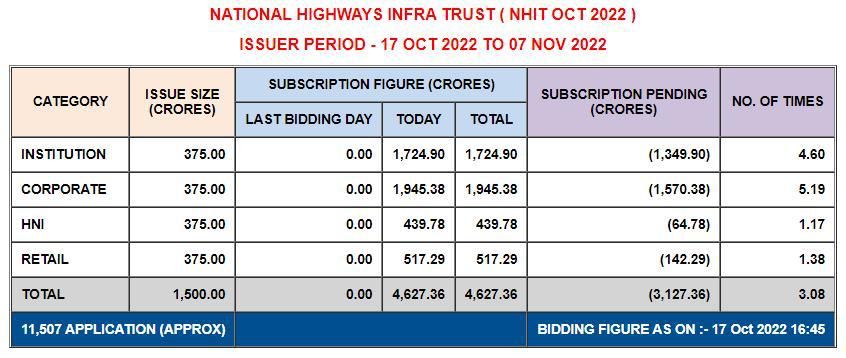

| Category | I – Institutional (“QIB”) | II – Non-Institutional (“Corporates”) | II – High Net worth

Individual (“HNI”) (Amount aggregating to above ₹ 10 lakh) |

II – Retail Individual (“Retail”) (Amount aggregating up to and including ₹ 10 lakh) | |

| Category Allocation of the overall Issue Size | 25% | 25% | 25% | 25% | |

Specific Terms of the Prospectus:

The terms of the NCDs offered under the Issue are as follows:

| Series | I | ||

| Frequency of Interest Payment | Semi-Annual | ||

| STRPP with Different ISIN | STRPP A | STRPP B | STRPP C |

| Tenor | 13 Years | 18 Years | 25 Years |

| Face value per STRPP (₹) | ₹ 300 | ₹ 300 | ₹ 400 |

| Aggregating to ₹ 1,000 (i.e. 1 NCD) | |||

| Coupon (% )for NCD Holders in Category I, Category II, Category III & Category IV | 7.90% p.a. | 7.90% p.a. | 7.90% p.a. |

| Effective Yield (%) | 8.05% | 8.05% | 8.05% |

| Redemption Date/ Redemption Schedule | Staggered Redemption by Face Value for each respective STRPP | ||

| Amount (₹ / NCD) on Redemption

Day/ Maturity for NCD Holders in Category I, II, III & IV |

Six (6) annual payments of ₹ 50 each, starting from 8th Anniversary* until Maturity | Six (6) annual payments of ₹ 50 each starting from 13th Anniversary* until Maturity | Eight (8) annual payments of ₹ 50 each starting from 18th Anniversary until* Maturity |

Strengths of the company:

-

The existing five projects under round-1 commenced toll collections from December 16, 2021, and reported a toll collection of ₹139.42 crores during FY22 with an average daily toll collection (ADTC) of ₹1.32 crore, which remained in line with the envisaged levels. During Q1FY23, the NHIT reported a healthy toll collection of ₹142.48 crore with an ADTC of ₹1.57 crore. The additional three assets under round-2 have been transferred under the InVIT and are expected to contribute to toll collections from October 2022 onwards.

-

The surplus cash flows after meeting the operational expenses of all the project highways will be available to the InvIT coupled with a long tenor of loan availed, translating into healthy debt coverage in the projected period

-

The NHIT holds the entire shareholding in the project assets through its 100% subsidiary, i.e., the NHIPPL, which has entered into a 30-year CA with the NHAI for O&M of these assets on a TOT basis, which provides long-term revenue visibility.

Risk factors:

-

Lower-than-envisaged toll collections in the underlying SPVs, adversely impacting the combined debt service coverage ratio (DSCR) below 1.50x on a sustained basis may affect the credit rating.

-

Increase in the O&M and MM expenses, which may adversely impact the profitability and cash accruals in the future.

-

Any adverse change in the capital structure, leading to a debt-to-enterprise value higher than 49% may act as a negative factor for the financials of the company.

Conclusion:

With the rise of interest rates in the economy, debenture public issues are obligated to offer attractive yields to their investors. This Issue by National Highways Infra Trust (“NHIT”) offers yields of 8.05% p.a., which is a bit in line with the debt market trends, especially with the instruments of the same credit rating. The credit rating offered to this NCD is ‘CARE AAA/Stable’ by CARE Ratings Limited and ‘IND AAA/Stable’ by India Ratings and Research Private Limited, Issuers with this rating are considered to offer the highest degree of safety regarding timely servicing of financial obligations. Such issuers carry the lowest credit risk*. Hence, investors may invest for a regular income as per the coupon rate offered. Since Demat is mandatory for investing in this particular NCD from NHIT, the investor must open a Demat account with a trusted broker like Elite Wealth.