In the current economic scenario, the buzz is in the market that India may replicate the bull market like Japan which was the biggest rally ever seen in the history of stock markets globally. These days we are listening to a lot of analyst and their statements about this but we have to understand the scenario, capabilities of both the nations and efforts by their central government, then only we can make a view that whether India can emulate that kind of performance or not.

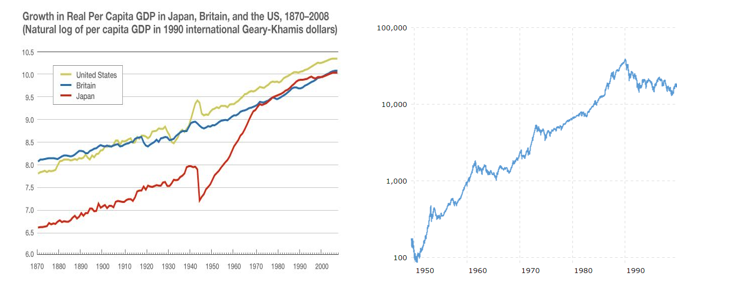

In Japan by 1956, real per capita GDP had overtaken the pre-war 1940 level. In 1973, Japan’s per capita GDP was 95% of that of Britain and 69% of that of the United States, That was the last year of the so-called rapid-growth era, but the Japanese economy continued to expand at a comparatively brisk rate for almost two more decades, and as we take in view of the Japanese stock market it showed a massive bull run for approximately for half a century, as shown in the figure below.

GDP Comparison Historic performance of Japan’s

Stock market

The basic growth factor that drove the rapid growth of the Japanese economy was the “backwardness” of the Japanese economy relative to the world’s advanced industrial economies. For Japan, this signified a high potential for rapid growth through the adoption of those advanced technologies. As a latecomer to modernization, Japan was able to avoid some of the trial and error, seeking market share rather than quick profit was another powerful strategy. The same is reflected in the charts of the Japanese stock market.

The chief reason for acceleration was the relocation of resources, especially labor from the relatively low-productive agricultural sector to the non-agricultural sector, which enjoyed higher productivity and per capita income overall. Japan’s labor force contributed notably to economic growth, because of its availability and literacy, and also because of its reasonable wage demands. The highly skilled and educated labor force, extraordinary savings rates and accompanying levels of investment, and the growth of Japan’s labor force were major factors in the acceleration of productivity.

So the two major factors that drove the rapid growth of the Japanese economy were;

- Quick adoption of advanced technologies.

- Japan’s labor force. Because of its availability and literacy, and also because of its reasonable wage demands of the highly skilled and educated labor force.

Using these methods japan was able to grow exponentially in these years making more wealth for its people than one could imagine, it was said that the Japanese economy could soon overtake the US economy but the dream was shattered once the BOJ (Bank of Japan) started increasing their interest rate, and by the end of the year 1989, it marked the top of the Japanese stock market.

Can India emulate the Japanese “Miracle”?

The main reason for Japan’s rapid growth was the inflow of great foreign investment along with the latest technology which helped it grow exponentially despite the losses during World War II. A similar kind of economic slowdown occurred worldwide during covid times despite it Indian economy was able to recover exponentially with the evident increase in foreign investment. The FDI inflow in India was at its highest ever at USD 81.97 billion in 2020-21. Among the global investors, the government said, these trends in India’s FDI are an endorsement of its status as a preferred investment destination. The government reviews all the FDI policies on an ongoing basis and makes significant changes on time to time basis to make sure that India remains an investor-friendly destination. India’s FDI policy is transparent and liberal Most of the sectors are open to FDI under the automatic route. To further liberalize and simplify FDI policy for providing ease of doing business and attract investments, reforms have been undertaken recently across sectors such as Coal Mining, Contract Manufacturing, Digital Media, Single Brand Retail Trading, Civil Aviation, Defence, Insurance, and Telecom.

The top recipient sector of FDI Equity inflow during FY 2021-22 was Computer Software and Hardware. It emerged on top with around 25 percent share followed by the Services Sector (12 percent) and Automobile Industry (12 percent) respectively, as per the media portal.

Although foreign institutional investors or FIIs have pulled out more money from the Indian markets in the first five months of 2022 giving us a glimpse into how severe the selloff is. Higher crude prices, rising inflation, tightening monetary policy, etc. are the main reason for their sell-off. Despite all this Sensex and nifty both didn’t have any major impact on the same, this is majorly because, in today’s market, it is not only FIIs that influence markets. The share of retail, high net worth individuals (HNI), and domestic mutual funds have also increased since the last year. In FY21, we have seen approximately 1.4 crore new Demat accounts opened. Meanwhile, our monthly SIP run rate of Rs 12000 crores approx. which is helping cushion against any major FII pull-out.

Another reason for Japan’s economic development was the relocation of labor from the relatively low-productivity agricultural sector to the non-agricultural sector, which enjoyed higher productivity and per capita income overall. As per the demographic analysis of India, it has immense human resources that are well-educated, young, and fluent in English, and labor is also cheap but restrictions on foreign investment, lack of measures to promote private industry, and import of cheap manufactured goods all contributed to the lack of substantial growth in the manufacturing sector. The manufacturing sector tends to be labor intensive, hence the renewed emphasis on manufacturing through programs like ‘Make in India’ will serve to correct this anomaly and raise employment in proportion to the growth in GDP. A major outcome of covid-19 is likely the shift in the global supply chain away from China to other economies. Nearly 70% of the survey participants have said that India could benefit from this move and they expect a fair share of manufacturing to shift from China to India in the near future.

More such schemes introduced by the government for the development of the economy are;

| · PLIScheme | · Digital India Mission |

| · Gati Shakti | · Ayushman Bharat |

| · Dedicated Freight Corridor | · Start-up India, Stand-up India |

| · Skill India Mission | · Housing For All Scheme |

| · Pradhan Mantri Mudra Yojana (PMMY) | · GST |

Conclusion:

“Japanese miracle” is what tells us that, well-designed systems and institutions have an important role to play in promoting the efficient allocation of resources and stimulating new growth and it can be said that India is heading on the path of the same growth which can be seen from the various efforts put on by the government to increase the manufacturing in India under “Made In India” scheme. Many countries are seeing India as an alternative for manufacturing products, many analysts believe that India could benefit from the gradual shift from china to India which may happen in the future, The China+1 strategy has gained momentum over the last few years due to rising labor and regulatory costs in China, global companies look to diversify their single country risk by adding India as a +1 to China making India attractive for the investors. Focusing on greater self-reliance in manufacturing and a shift in global supply chains may also necessitate pick up in capex, with the increase of HNI along with deep pockets of domestic institutions, acting as a cushion against the FII sell-off if it does happen, are the few factors that have perhaps increased the confidence of investors in the Indian stock market and this may move towards Japan like bull run in the future.