ITI Mutual Fund was established in 2018 to offer investment solutions to investors for wealth generation over the long-term. It offers thoughtful and investor-centric investment solutions backed by a highly experienced team of researchers and investment managers. With a team of equity and credit researchers, as well as investment managers, ITI AMC runs a unique investment philosophy and strategies that are well-positioned to generate returns in the long-run. Being the latest entrant allows the AMC to offer products that can help investors benefit from the evolving economy. The promoter of the AMC is the Investment Trust of India Ltd. The Mutual Fund has around 29 branches in India with more than 196 employees.

ITI Mutual Fund is coming up with ITI Flexi Cap Fund, an NFO scheme with an investment objective to generate long-term capital appreciation from a diversified portfolio that dynamically invests in equity and equity-related securities of companies across various market capitalizations. However, there can be no assurance that the scheme’s investment objective will be realized. The scheme opens on the 27th of January, 2023, and closes on the 10th of February, 2023.

ITI Flexi Cap Fund (NFO) details:

| Mutual Fund: | ITI Mutual Fund |

| Scheme Name: | ITI Flexi Cap Fund |

| Objective of Scheme: | The investment objective of the scheme is to generate long-term capital appreciation from a diversified portfolio that dynamically invests in equity and equity-related securities of companies across various market capitalizations. However, there can be no assurance that the scheme’s investment objective would be achieved. |

| Scheme Type: | An open-ended dynamic equity |

| Scheme Category: | Dynamic equity scheme investing across large-cap, mid-cap, small-cap stocks |

| New Fund Launch Date: | 27th January, 2023 |

| New Fund Offer Closure Date: | 10th February, 2023 |

| Fund Managers: | Mr. Dhimant Shah and Mr. Rohan Korde |

| Minimum Investment | · SIP: Rs. 500/- and in multiples of Re.1/- thereafter

· Lumpsum: Rs. 5,000/- and in multiples of Re. 1/- thereafter · Additional Purchase: Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Exit Load: | · 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units;

· Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units. Inter scheme Switch: At the applicable exit loads in the respective schemes. |

Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity Related Instruments across market capitalization | 65% | 100% | High |

| Listed Preference Shares | 0% | 10% | Medium to High |

| Debt and Money Market Instruments | 0% | 35% | Low to Medium |

| Units issued by REITs & InvITs | 0% | 10% | Medium to High |

ITI Flexi Cap Fund (NFO) Conclusion:

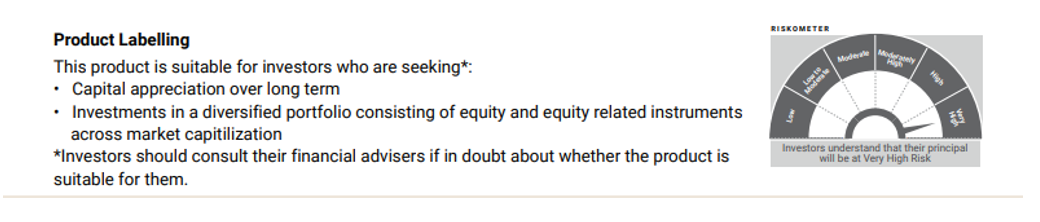

ITI Flexi Cap Fund has the potential to offer Tactical allocation bets within market cap segments depending upon market scenarios, big companies give stability to the portfolio, the Mid-cap segment has higher exposure to emerging and high growth sectors, and within the Small-cap, bottom-up stock selection is vital. However, investing in mutual funds is susceptible to market risk. Therefore, this product is suitable for New Investors looking for exposure across market caps with one fund, a Suitable option for long-term wealth creation as can adapt to different market cycles, Investors looking for diversification & reducing risks pertaining to a single market cap, and Investors looking to build a core Equity Portfolio. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.