Diwali Samvat 2079 Recommendations

| Company | Sector | CMP/Accumulate (Rs.) | Target (Rs.) | Upside (%) | Time Horizon |

| Berger Paints | Paints | 615 | 740 | 20 | 12 months |

| HDFC Bank | Bank | 1400 | 1650 | 18 | 12 months |

| Maruti Suzuki | Automobile | 8200 – 8400 | 9800 | 17 | 12 months |

| Relaxo | Footwear | 975 | 1220 | 25 | 12 months |

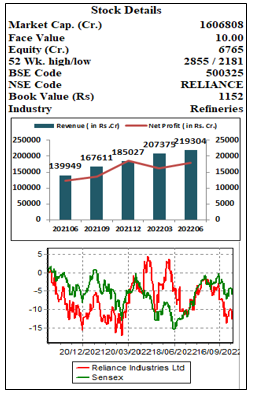

| Reliance Industries | Refineries | 2400 | 3120 | 30 | 12 months |

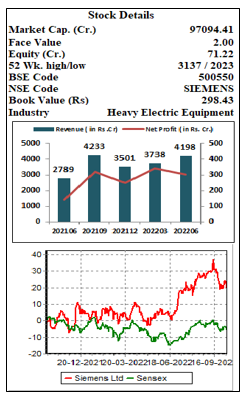

| Siemens India | Electrical Equipment | 2740 | 3200 | 17 | 12 months |

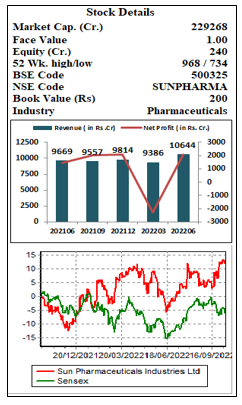

| Sun Pharmaceuticals | Pharmaceuticals | 970 | 1200 | 24 | 12 months |

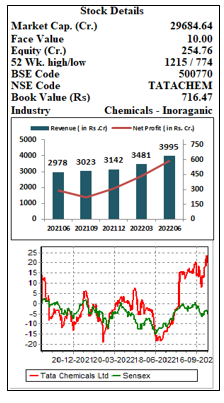

| Tata Chemicals | Chemicals | 1150 | 1380 | 20 | 12 months |

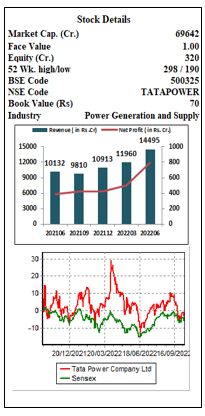

| Tata Power | Power | 215 | 280 | 30 | 12 months |

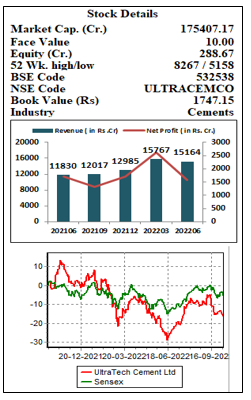

| Ultratech Cement | Cements | 6185 | 7425 | 20 | 12 months |

Diwali Samvat 2078 Performance

| Company | Recommended Price | Target | Status | High + Dividend | High Date | Gains from High* |

| Bharti Airtel | 691 | 950 | Position Closed | 819.75 | 04-Oct-22 | 19% |

| Larsen & Toubro | 1790 | 2130 | Target Almost Hit | 2100.55 | 18-Jan-22 | 17% |

| ONGC | 161 | 210 | Target Almost Hit | 205.45 | 08-Mar-22 | 28% |

| State Bank of India | 513 | 650 | Position Closed | 585.60 | 15-Sep-22 | 14% |

| Cipla | 906 | 1160 | Target Almost Hit | 1155.40 | 06-Oct-22 | 28% |

| Sona BLW Precision | 642 | 810 | Target Achieved | 841.44 | 14-Dec-21 | 31% |

| Tata Power | 225 | 310 | Target Almost Hit | 299.80 | 07-Apr-22 | 33% |

| Axis Bank | 831 | 1050 | Position Closed | 867.90 | 25-Oct-21 | 4% |

| Easy Trip Planners | 475 | 580 | Target Achieved | 955 | 24-May-22 | 101% |

| ICICI Securities | 752 | 918 | Target Achieved | 920.05 | 13-Oct-21 | 22% |

*High + Dividend

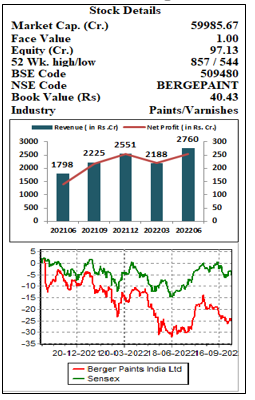

Berger paints India Ltd.(CMP – Rs. 615 Target – Rs. 740)

Berger paints India Ltd. (BPIL) is the second largest paint manufacturer in India and one of the top five paint companies in Asia. It is headquartered at Kolkata, with 16 strategically located manufacturing units across India (including the subsidiaries), 2 in Nepal, 1 each in Poland and Russia and about 162 stock points. The company also has an international presence in 4 countries (Nepal, Bangladesh, Poland and Russia). It has countrywide large distribution network of 50,000+ dealers. BPIL is acclaimed as a game changer in the sector with a vibrant portfolio of paints and tailor-made customer services in every paint segment.

Key Highlights:

-

The revenue growth of the company is strong led by the improved demand in decorative and industrial paints. Company has maintained its market share over a longer period of time.

-

On a three-year basis, revenue grew at a CAGR of 17% led by volume CAGR of 14% during the same period.

-

The company has seen good growth both in terms of volume and value in terms of automotive sales. Demand for industrial paints is rising with revival of auto industry.

-

Increased focus on the `water proofing & building chemical’ category will continue to drive revenue growth for BPIL.

Outlook:

BPIL is a well-known brand in the decorative paints segment. The decorative and industrial business is looking good as the overall economy’s outlook is positive. The operating margins of the company is improving gradually and is at 15.3% in the Q1FY23. The TTM EPS of the company is at Rs. 9.7. Company is currently delivering the ROCE & ROE of 25.7% and 22.8% respectively. Hence, we recommend to buy the stock for the target price of Rs. 740 with the time horizon of 12 months.

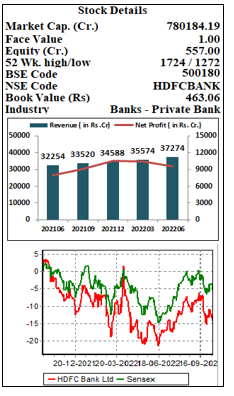

HDFC Bank Ltd.(CMP – Rs.1400 Target – Rs.1650)

HDFC Bank Ltd. is one of India’s leading private banks with banking network of 6,378 branches and 18,620

ATM’s in 3,203 cities/towns. It offers a wide range of commercial and transactional banking services and treasury products to wholesale and retail customers. The bank has three key business segments: Wholesale Banking Services, Retail Banking Services and Treasury. The services offered by the bank include Personal Accounts & Deposits, Loans, Cards, Forex, Investments & Insurance.

Key Highlights:

-

The bank has touched an incremental market share in Term Deposits (TDs) of 42% in FY18, 21.5% in FY20 and 26.1% in FY22. In Q1FY23 bank added Rs 600 billion in TDs and due to forthcoming merger, the focus is to garner more TDs.

-

The total deposits of the bank is continuously rising and is at 16.73 lakh crores while total advances is at whopping 14.8 lakh crores at the end of September 2022 quarter.

-

The Asset Quality of the company is best among its peers which highlights HDFCB’s strong underwriting capabilities. On the standalone basis NIM is at 4.1% while Gross NPA and Net NPA is at 1.23% and 0.33% at the end of September quarter.

Outlook:

HDFC Bank’s sound fundamentals, extensive distribution network, and agile operations enables it to be at the top among its peers. The financials of the bank are continuously increasing and the merger with HDFC Ltd. to further strengthen its leadership position. Its aggressive branch expansion plan will drive growth; management has maintained its guidance of adding 1000-2000 branches per annum. The Commercial and Rural Banking would be the key growth enabler given the vast untapped opportunity. On the performance front, HDFC bank shows EPS at TTM of Rs. 71.6 and at the current price of Rs. 1400 it is trading at 20x. We recommend to buy the stock for the target price of Rs. 1650 with the time horizon of 12 months.

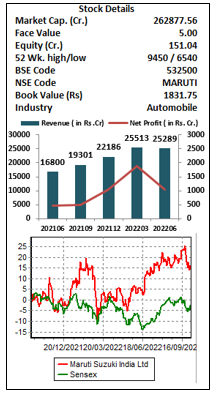

Maruti Suzuki India Ltd. (Accumulate – Rs. 8200-8400 Target – Rs. 9800)

Maruti Suzuki India Ltd. (MSIL) is the leading car manufacturer of passenger vehicle segment in India and one of the largest automobile seller with 39.88% market share as of September 2022. The Company has two state-of-the-art manufacturing facilities, located in Gurugram and Manesar in Haryana, capable of producing 2.25 million units per annum.

Key Highlights:

-

MSIL has multiple SUVs in the launch pipeline over the next 18 months and its more active new product launch calendar should help it regain market share.

-

The company is on the track to launch its EV segment PVs by 2025 and would benefit from the pre-developed EV infrastructure.

-

The market share of non-SUV segment is 65%, but it does not have any car in the mid – SUV segment. The company is entering mid – SUV segment to lift market share and planning to increase its total market share to 50% from current 45%.

Outlook:

MSIL is India’s largest vehicle manufacturer and supplier with almost 41 years of experience. The chip shortage may ease in the coming months, allowing the company to clear its order book rapidly. The robust pending order-booking, easing of semiconductors supply constraints and planned new launches in Mid SUV segment to drive double digit volume growth. Benefit of price hikes, stabilizing of metals prices and operating leverage to result in sharp improvement in profitability. On performance front the company’s TTM EPS is Rs. 147. We recommend to accumulate the stock at Rs. 8200 to RS. 8400 for the target of Rs. 9800 for the time horizon of 12 months.

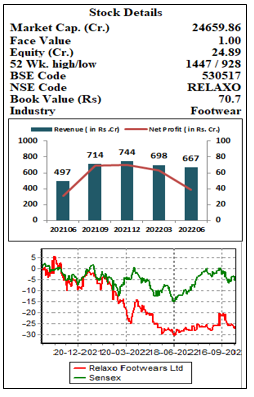

Relaxo Footwears Ltd.CMP – Rs. 975 Target – Rs. 1220

Relaxo Footwears Ltd. (RFL) is a well-known brand in the mid-range footwear segment in India. It started off with manufacturing of Hawaii slippers and subsequently diversified into manufacturing casuals, joggers, school and leather shoes. The product range of the company includes Hawai, Canvas, Dip, Bahamas, Leatherite, Joggers and Flite.

Key Highlights:

- The Rs. 960 billion Indian footwear market (FY20) is witnessing a unique transformation over the last few years. The consideration of PLI scheme of Rs.2600 crores for the footwear and leather sector will further boost the production and exports of the company.

- The company has undertaken corrective pricing actions to help revive sales volumes and to make the brands competitive with unorganized player.

- RFL has recently opened 50-100 stores which contains all the in-house brands of the company. Through this strategy, it will focus on improving the sales as well as profitability per store.

Outlook:

RFL is one of India’s most quality conscious and progressive footwear companies. A dominant player in the open footwear segment with wide distribution reach, competitive pricing, and strong brand recall, renders it an edge over the unorganized footwear market. The e-commerce channel is gaining momentum gradually and managements’ plans to grow the exports by 20-25% on the low base would contribute to the revenue growth. The TTM EPS of the company is at Rs. 9.7 at the end of Q1FY23. Hence, we recommend to buy the stock for the target price of Rs. 1220 with the time horizon of 12 months.

Reliance Industries Ltd.(CMP – Rs. 2400 Target – Rs. 3120 )

Reliance Industries Ltd. (RIL) is one of India’s biggest conglomerates with a presence in oil refining & marketing and petrochemicals, oil & gas exploration, retail, digital services and media, etc. making it a well diversified business entity. In the June quarter on a consolidated basis, O2C and oil & gas contributed 68% to revenue, while retail, and others contributed 24%, and 8%, respectively. At the EBITDA level, O2C and oil & gas contributed 56% while retail and others contributed 9.5% and 34.5%, respectively.

Key Highlights:

-

In the FY22 the high crude prices led to 56% YoY EBITDA growth in O2C business. The crude price improvement from $30/pbl to current $95/pbl, continues to drive strong growth momentum in FY23.

-

Revenue of the Retail segment grew 26% YoY in FY22 and the expansion plans through physical as well as digital platforms announced in the AGM will bring further long term growth.

-

Reliance Jio business has retained its market share and is at 36.23%. In the new energy business it recently acquired 100% stake in REC Solar, which specializes in solar panels.

Outlook:

RIL’s Retail, Telecom and New Energy can be the next growth engines over the next two-to-three years for the company. The rollout of 5G services by this Diwali will accelerate the ARPU for the Reliance Jio. The retail segment is strengthening; acquisition of several FMCG brands by the company will help to gain the market share. RIL has shown the EPS of Rs. 99.5 on TTM basis and is trading at the 24 times on the current price of 2370. Hence, we recommend to buy the stock for the target price of Rs. 3120 with the time horizon of 12 months.

Siemens Ltd. (CMP – Rs. 2740 Target Rs. 3200 )

Siemens Ltd. is a global powerhouse focusing on the areas of electrification, automation and digitalization. One of the world’s largest producers of energy-efficient, resource-saving technologies, Siemens is a leading supplier of systems for power generation and transmission as well as medical diagnosis. In infrastructure and industry solutions the company plays a pioneering role.

Key Highlights:

-

The company reported revenue growth of 49.8% YoY, driven by strong growth across key segments such as Mobility (up 185.5% YoY), Energy (up 52.3% YoY), Smart Infra (up 38.1% YoY) and Digital Industries (up 45.7% YoY) in the Q1FY23.

-

It has strong capacity utilisation across industries and expects strong traction in roads, renewables, railways, process industries, etc.

-

Siemens is aiming to target the SME segment, which will allow it to scale up, adopt new designs & components and stay competitive.

-

Siemens has recently signed a MoU with NTPC to demonstrate the feasibility for hydrogen co-firing blended with natural gas in Siemens V94.2 gas turbines installed at NTPC Faridabad gas power plant. This plays a key role in reducing the CO2 emissions.

Outlook:

Electrification, automation and digitalization are the long-term growth fields of Siemens. The penetration of automation & digitisation products and services across segments will drive long term growth for the company. The order book of the company is at the all-time high level of close to Rs. 17,000 crores. Various PLI schemes announced for the industries in which company operates will also benefit the company in the longer horizon. Siemens is delivering the EPS of Rs. 34 at the TTM basis. We recommend to buy the stock for the target price of Rs. 3200 with the time horizon of 12 months.

Sun Pharmaceutical Industries Ltd.(CMP – Rs.970 Target – Rs. 1200)

Sun Pharmaceutical Industries Ltd. (SPIL) is the fourth largest specialty generic pharmaceutical company in the world. The company also makes active pharmaceutical ingredients. In branded markets, their products are prescribed in chronic therapy areas like cardiology, psychiatry, neurology, gastroenterology, diabetology and respiratory. It generates major revenue from India (33%) and US (30%).

Key Highlights:

-

The company had Wide basket of 604 ANDAs & 67 NDAs filed and 515 ANDAs & 54 NDAs approved across multiple therapies as of June 2022.

-

Specialty R&D expense of the company was 21% of total R&D spend in the June Quarter and is likely to inch up as clinical trials goes up.

-

The branded formulations business of SPIL now contributes more than 50% to revenue. The business is exhibiting strong growth because of growth in focus markets of US and India.

-

Higher contribution from specialty & strong domestic franchise is likely to change the product mix of the company.

Outlook:

The outlook remains positive on SPIL on the back of sustained scale-up in the specialty portfolio, robust franchise building in the branded generics portfolio, and healthy ANDA pipeline awaiting approval. Company ranks no. 1 in India with 8.5% market share in generic business as of June 2022. The specialty revenue growth has been impressive at an average of 30.0% YoY over the last four quarters. The company has another four new drug application molecules undergoing trials. The TTM EPS of Sun Pharma is Rs. 16; ROE and ROCE is 14.5% and 18% respectively. Hence, we recommend to buy the stock for the target price of Rs. 1200 with the time horizon of 12 months.

Tata Chemicals Ltd. (CMP – Rs. 1150 Target – Rs. 1380)

Tata Chemicals Limited (TCL) is one of the oldest company of the Tata Group, they are the third largest soda Ash and sixth largest sodium bicarbonate producer in the world. The company has divested all its non-core business and are now scaling up the core basic and specialty chemicals business. The company operates in four divisions namely Nutritional Science, Energy Science, Agro Science and Material Science

Basic chemical forms 75% of overall revenue while the rest comes from specialty products.

Key Highlights:

-

Soda ash is a key raw material in the process of lithium – ion batteries and as the world is planning to shift from conventional vehicle to EV, demand for soda ash is going to gain pace.

-

Rallis, a subsidiary company of TCL continues to focus on launching products and reducing dependence on imported intermediates from China. The overall China+1 strategy is also boosting the sentiments.

-

Soda Ash price environment is likely to stay robust over the next 18-24 months and the demand-supply dynamics are forecasted to remain favourable until FY25-FY26.

Outlook:

TCL has been reporting solid performance consistently despite a challenging environment this adds on to the optimistic view about continued soda ash demand across geographies, which will boost the Revenue. The ongoing global soda ash shortage globally will further improve realisations through heightened pricing. The management expects the positive momentum to continue in the near to short term and aims to leverage digitalisation for further growth. TCL is trading at 19 times at the current price level of 1160; TTM EPS is at Rs. 61. We recommend to buy the stock for the target price of Rs. 1380 with the time horizon of 12 months.

Tata Power Company Ltd.(CMP – Rs. 215 Target – Rs.280 )

Tata Power Compay Ltd. (TPCL) is primarily engaged in Power Generation, Transmission and Distribution of Electricity. Together with its subsidiaries & joint entities, it has a power generation capacity of 13,750 MW of which 36% comes from clean energy sources. It also has product portfolio in next Generation Power Solutions including Solar Rooftop, EV Charging infrastructure, Home Automation and Microgrids.

Key Highlights:

-

The company reported strong start to FY2023 with 103% YoY growth in PAT at Rs. 795 crore, supported by higher integrated Coastal Gujarat Power Ltd. plus coal profit and strong growth in Renewable Energy business.

-

It has robust order book worth of Rs. 14,600 crores as on 30th June 2022.

-

TPCL with its subsidiaries, is a pioneer in the EV Charging space and owns an expansive network of over 600 public chargers in 120+ cities and it had recently signed a MoU with National Real Estate Development Council to install up to 5,000 EV charging points across Maharashtra.

Outlook:

Tata Power is expanding its business portfolio across renewables, transmission and distribution, as well as customer centric businesses of Solar Rooftops, Solar Pumps, and Micro grids, EV charging, Energy Services (ESCO), Home Automation and Floating Solar. The company’s focus to shift from a B2G to B2C model would drive robust earnings growth over the next 4-5 years. Higher imported coal prices to lead to improved profitability from the company’s Indonesian mines. The company’s renewables and distribution business makes it the best private player in the sector. Currently Tata Power is trading at the PE of 32x and BV of 3x at the current price of Rs. 215 on TTM basis. Hence, we recommend to buy the stock for the target price of Rs. 280 with the time horizon of 12 months.

UltraTech Cement Ltd.(CMP – Rs.6185 Target – Rs.7425 )

UltraTech Cement Ltd. (UTCL) is the largest manufacturer of grey cement, ready-mix concrete (RMC) and white cement in India with a consolidated capacity of 119.95 Million Tonnes Per Annum (MTPA) of grey cement. It is the only company in the world to have a capacity of over 100 million tonnes in a single country, outside of China. The company has extensive distribution network with over 30,000+ Dealers, 64,000+ Retailers and 3,000+ stores across India.

Key Highlights:

-

The recently announced expansion plan of 22.6 million tonnes per annum and expected capacity of 153.85 mtpa by FY25 is robust.

-

The financials of the company remains strong; Q1FY23 revenue of the company increased by 28% YoY to Rs. 15,164 crores, with consolidated volume increasing by 22% YoY.

-

The EBITDA margin of the company is at 22% at the end of Q1FY23 which is the highest among its peers.

-

The company expected to benefit from declining pet coke and diesel prices, the impact of which would be visible in the coming results.

Outlook:

UTCL, the leading company in the cement industry offers strong growth momentum because of its capacity utilization and better cost management. Company is structurally improving its cost structure by increasing its green power usage. The management of the company expects demand to grow at 8% CAGR in next 5 years and demand outlook stay positive on the back of increased government spending and positive outlook on real estate industry. On the performance front, the TTM EPS of the stock is at Rs. 250 and it trades at the PE of 24.7 at the current price level of Rs. 6200. Hence, we recommend to buy the stock for the target price of Rs. 7425 with the time horizon of 12 months.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL