Medi Assist Healthcare Services IPO Company Details:

Medi Assist Healthcare Services Limited (MAHSL) is the third-party administrator services such as customer service and network management to insurance companies through its wholly owned subsidiaries. The company serves more than 35 insurance companies both nationally and internationally with its services. In the retail health insurance business, MAHSL held a 14.83% market share as of FY22, while in the group health insurance market, its share was 41.71%. In FY23, company managed health insurance premiums for both group and retail customers totaling Rs. 14,574.65 Cr. It offers hospitalization, call center, billing, and claim processing services in the UK, Australia, Singapore, and other countries through its overseas subsidiaries operating under the name Mayfair Group. As of FY23, company has managed over 28% of India’s entire group health insurance market comprising over Rs.12,818 cr. worth of group health insurance premiums. The company act as a facilitator between insurance companies, insurance policy holders, government and has a pan-India network comprising 18,754 hospitals across 1069 cities and 31 states (including union territories). It also covers over 141 countries globally.

| IPO-Note | Medi Assist Healthcare Services Limited |

| Rs.397 – Rs.418 per Equity share | Recommendation: Aggressive investors may apply |

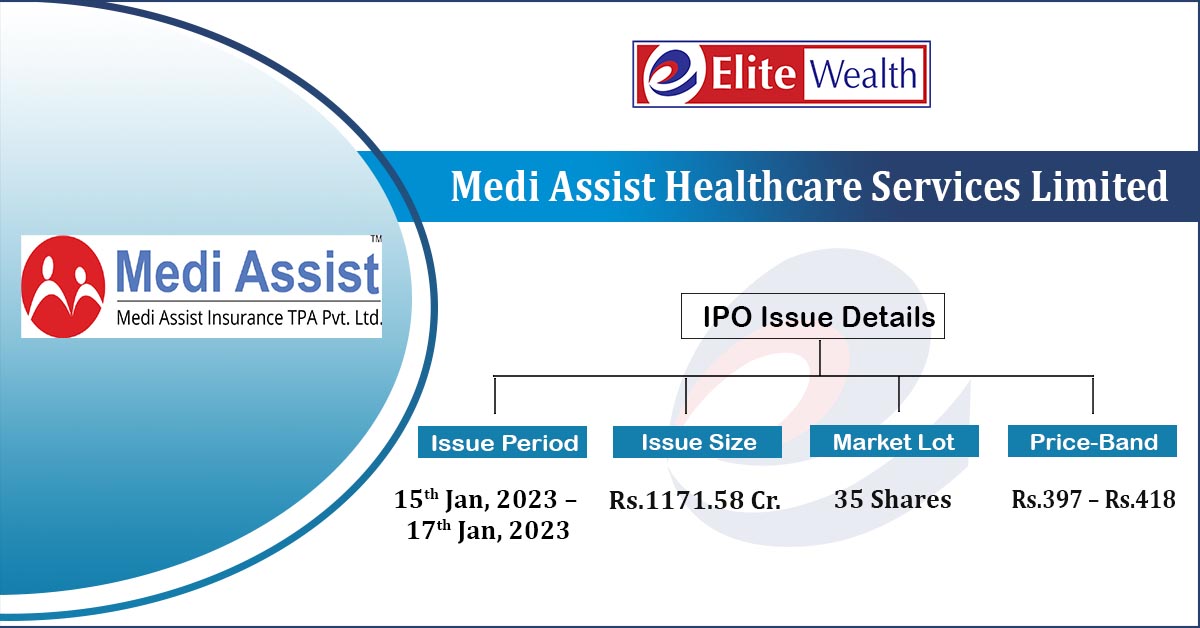

Medi Assist Healthcare Services IPO Details:

| Issue Details | |

| Objects of the issue | · To gain listing benefits |

| Issue Size | Total issue Size – Rs.1171.58 Cr.

Offer for Sale – Rs.1171.58 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.397 – Rs.418 |

| Bid Lot | 35 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 15th Jan, 2024 – 17th Jan, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Medi Assist Healthcare Services IPO Strengths:

-

MAHSL and its subsidiary hold 30.03% market share while in retail insurance policies, they hold a 6.98% share.

-

The Company has a pan-India network of 18,754 hospitals across 1069 cities and 31 states.

-

Building synergies amongst various subsidiaries and successfully acquiring businesses, the company has successfully integrated under its group.

-

Company has longstanding relationship with majority of its customers.

Medi Assist Healthcare Services IPO Key Highlights:

-

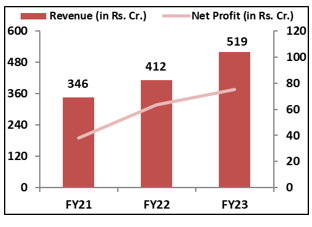

Revenue of the co. has grown from Rs.346 Cr. in FY21 to Rs.519 Cr. in FY23 with a CAGR of 14.5%; while the profit has grown with a strong CAGR of 25.6% from 38 Cr. in FY21 to 75 Cr. in FY23.

-

Co ’s EBITDA Margin & PAT Margin stand healthy at 23% & 18.7% respectively in FY23.

-

As of FY23, ROCE & ROE ratios are at 24.95% and 19.63% respectively.

-

Company has no debt.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Medi Assist Healthcare Services IPO Allotment Status

Medi Assist Healthcare Services IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Medi Assist Healthcare Services IPO Risk Factors:

-

MAHSL generated 81.54% of its revenue from its top 5 clients as of FY23, Significant dependence for the revenue on these clients may impact its financials in future.

-

Company’s business is significantly dependent on the IT and the BFSI segment which contributed to 46% and 21% respectively.

-

There are certain legal and regulatory proceedings against the Promoters, Dr. Vikram Jit Singh Chhatwal, Bessemer India Capital Holdings II Ltd and Medimatter Health under the provisions of the Companies Act 2013, and which are currently outstanding before the National Company Law Tribunal. Any unfavorable outcome in the matter could impact the business of the company.

Medi Assist Healthcare Services IPO Financial Performance:

Medi Assist Healthcare Services IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 77.14% | 36.44% |

| Others | 22.86% | 63.56% |

Medi Assist Healthcare Services IPO Outlook:

MAHSL, is India’s leading player in health benefits administration business with strong presence in India as well as abroad. Company is focusing on maintaining its leadership position among group health insurance segment and continue to pursue inorganic growth opportunities. With rising awareness among public, healthcare & insurance business is expected to grow and expand further which will help the company to grow. MAHL’s strong operational and financial performance demonstrates its considerable market presence and partnerships with leading insurance companies. However, there are potential risks including revenue dependency on premium growth and vulnerability to technology-related risks. The company is offering the P/E of 38x on the upper price band which appears slightly overpriced. Hence, we recommend only aggressive investors to apply in the IPO.

Jyoti CNC Automation IPO FAQ

Ans. Medi Assist Healthcare IPO is a main-board IPO of 28,028,168 equity shares of the face value of ₹5 aggregating up to ₹1,171.58 Crores. The issue is priced at ₹397 to ₹418 per share. The minimum order quantity is 35 Shares.

The IPO opens on January 15, 2024, and closes on January 17, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Medi Assist Healthcare IPO opens on January 15, 2024 and closes on January 17, 2024.

Ans. Medi Assist Healthcare IPO lot size is 35 Shares, and the minimum amount required is ₹14,630.

Ans. The Medi Assist Healthcare IPO listing date is not yet announced. The tentative date of Medi Assist Healthcare IPO listing is Monday, January 22, 2024.

Ans. The minimum lot size for this upcoming IPO is 35 shares.