Infosys (INFY) is a global leader in next-generation digital services and consulting. Over 300,000 people of the company work to amplify human potential and create the next opportunity for people, businesses and communities. The company enables clients in more than 56 countries to navigate their digital transformation. With over four decades of experience in managing the systems and workings of global enterprises, it expertly steers clients, as they navigate their digital transformation powered by the cloud. The company enables them with an AI-powered core, empower the business with agile digital at scale and drive continuous improvement with always-on learning through the transfer of digital skills, expertise, and ideas from our innovation ecosystem.

| Result Analysis: Infosys Limited (CMP: Rs.1495.00) | Result Update: Q3FY24 |

| Stock Details | |

| Market Cap. (Cr.) | 620492 |

| Equity (Cr.) | 2069.00 |

| Face Value | 5 |

| 52 Wk. high/low | 1620 / 1215 |

| BSE Code | 500209 |

| NSE Code | INFY |

| Book Value (Rs) | 170.49 |

| Sector | IT-Software |

| Key Ratios | |

| Debt-equity: | 0.1 |

| ROCE (%): | 44.36 |

| ROE (%): | 36.42 |

| EPS TTM: | 58.77 |

| P/BV: | 8.77 |

| P/E TTM: | 25.44 |

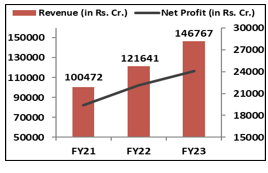

Financial Performance:

Shareholding Pattern:

| Particulars (In %) | Q2FY24 | Q1FY24 |

| Promoters Group | 13.29 | 13.29 |

| FIIs | 30.90 | 30.79 |

| DIIs | 31.63 | 31.01 |

| Public | 23.33 | 24.04 |

| Others | 0.85 | 0.87

|

Result Highlights:

-

The revenue from operations and net profit decreased on a QoQ basis by ~0.4% and 1.6% respectively.

-

Infosys McCamish Systems, a wholly-owned subsidiary of the company witnessed a cyber-security incident during the quarter resulting in the non-availability of certain applications and systems. The loss in revenue along with costs to remediate the same was $30 million (~₹250 crore).

-

During the quarter, the operating margin decreased by 70 bps on a QoQ basis. The company benefitted by 50 bps through cost optimization, efficiency and higher utilisation, ~10 bps due to exchange rate fluctuations. However, the same was offset by 70 bps due to higher salary on account of wage hikes and one-time impact of 60 bps due to the McCamish incident.

-

Among segments the growth on a YoY basis in cc terms for the Manufacturing was 10.6%, Life Sciences 6.3%, and Others 7%. Retail and Energy, Utilities, Resources & Services (EURS) were flat at 0.4% and 0.3%, respectively. However, Communication, Financial Services and Hi-tech saw a decline of 8%, 5.9% and 5.1%, respectively.

-

Across geographies, ROW witnessed growth of 7.8%, followed by Europe growing by 5%. However, North America and India de-grew by 4.9% and 1%, respectively, on a YoY basis in cc terms.

-

In Q3 FY24, it closed 23 large deals with total contract value (TCV) of $3.2 billion, of which 71% were net new deals. The TCV during Q3 FY23 was $3.3 billion. Out of these large deals, ~1 was regarded as mega deal.

-

The company on a QoQ basis saw gross reduction by 7 clients in the $1 million+ band taking the total to 944, 4 clients in the $10 million+ band taking the total to 308. However, it added 2 clients in the $50 million+ band to reach 82 and 1 client in the $100 million+ band to reach 40.

-

The company had a net reduction sequentially of 6,101 employees during the quarter, taking the total to 3,22,663 employees as on 31st December 2023, along with this the company has trained over 1,00,000 employees in Generative AI to boost its AI led projects.

-

The company has entered into an agreement to acquire 100% of InSemi Technology Services Private Limited on 11th January 2024. It is a semi-conductor design service company based in India.

Outlook:

Infosys posted muted Q3FY24 results, the results of the company reflect the seasonality impact of Q3 generally being slower due to higher furloughs and holiday periods. The discretionary spending environment continued to remain sluggish. Despite that, they continue to see healthy traction towards their margin expansion program. The company has guided for a revenue growth of 1.5%-2% from the previous guidance of 1%-2.5% in cc terms for FY24. Further, they guided operating margins to be in the range of 20%-22%. The management remains optimistic regarding the deal pipeline going ahead despite weak discretionary spending budget spends. Hence we recommend to buy for the target of 1,880.

Results:

| Particulars (In Rs. Cr.) | Q3FY24 | Q2FY24 | Q3FY23 | QoQ% | YoY% |

| Revenue from Operations | 38,821 | 38,994 | 38,318 | -0.4% | 1.3% |

| Other Income | 789 | 632 | 769 | 24.8% | 2.6% |

| Total Income | 39,610 | 39,626 | 39,087 | 0.0% | 1.3% |

| Employee Benefit Expenses | 20,651 | 20,796 | 20,272 | -0.7% | 1.9% |

| Employee benefit Expenses as % of Sales | 53.2% | 53.3% | 52.9% | -10 bps | 30 bps |

| Cost of Equipment, Software licences & Others | 7,292 | 6,848 | 6,829 | 6.5% | 6.8% |

| Depreciation & Amortisation Expense | 1,176 | 1,166 | 1,125 | 0.9% | 4.5% |

| Other Expenses | 1,741 | 1,910 | 1,850 | -8.8% | -5.9% |

| EBIT | 7,961 | 8,274 | 8,242 | -3.8% | -3.4% |

| EBIT Margin (%) | 20.5% | 21.2% | 21.5% | -70 bps | -100 bps |

| PAT | 6,113 | 6,215 | 6,586 | -1.6% | -7.2% |

| PAT Margin (%) | 15.7% | 15.9% | 17.2% | -20 bps | -150 bps |

| EPS (In Rs.) | 14.76 | 15.01 | 15.72 | -1.7% | -6.1% |

| Segment Revenue (In Rs. Cr.) | Q3FY24 | Revenue % | Q2FY24 | QoQ% | Q3FY23 | YoY% |

| Financial Services | 10,783 | 27.8% | 10,705 | 0.7% | 11,235 | -4.0% |

| Retail | 5,649 | 14.6% | 5,913 | -4.5% | 5,480 | 3.1% |

| Communication | 4,421 | 11.4% | 4,463 | -0.9% | 4,710 | -6.1% |

| Energy, Utilities, Resources, and Services | 5,121 | 13.2% | 4,957 | 3.3% | 4,957 | 3.3% |

| Manufacturing | 5,786 | 14.9% | 5,574 | 3.8% | 5,099 | 13.5% |

| Hi-Tech | 2,985 | 7.7% | 3,053 | -2.2% | 3,095 | -3.6% |

| Life Sciences | 2,954 | 7.6% | 3,050 | -3.1% | 2,695 | 9.6% |

| All other segments | 1,122 | 2.9% | 1,279 | -12.3% | 1,047 | 7.2% |

| Total | 38,821 | 100.0% | 38,994 | -0.4% | 38,318 | 1.3% |

| Geography Revenue % | Q3FY24 | Q2FY24 | Q3FY23 | YoY Growth (%) | |

| Reported | CC | ||||

| North America | 59.0% | 61.1% | 62.0% | -4.7% | -4.9% |

| Europe | 28.2% | 26.5% | 25.8% | 9.2% | 5.0% |

| Rest of the World | 10.4% | 9.6% | 9.8% | 7.1% | 7.8% |

| India | 2.4% | 2.8% | 2.4% | -1.9% | -1.0%

|

Management Commentary:

Commenting on the December quarter results, Salil Parekh, CEO and MD said, “Our performance in Q3 was resilient. Large deal wins were strong at $3.2 billion, with 71% of this as net new, reflecting the relevance and strength of our portfolio of offerings ranging from generative AI, digital and cloud to cost, efficiency and automation. Our clients are leveraging our Topaz generative AI capabilities and our Cobalt cloud capabilities to create long-term value for their businesses.”

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.